Y2K Finance

Y2K Finance는 Arbitrum 체인에서 운영되는 DeFi 플랫폼으로, 사용자에게 이국적인 페깅된 자산의 디페깅에 대해 투기하거나 헤지할 수 있는 기회를 제공합니다. 이 암호화폐 기반 구조화 상품은 사용자가 고정된 가치에서 벗어날 수 있는 자산을 보호하거나 이익을 얻을 수 있는 독특한 방법을 제공합니다. [1][2]

개요

Y2K Finance는 2022년 8월 26일에 Arbitrum 네트워크에서 공식적으로 출시되었습니다. 스테이블코인 및 토큰 래퍼와 관련된 위험을 사고 팔 수 있는 마켓플레이스를 제공합니다. 사용자는 프리미엄을 지불하여 가능한 디페깅 이벤트로부터 자신을 보호하거나 위험을 판매하여 투기적 포지션을 취할 수 있습니다. 더 높은 위험 옵션이 더 큰 보상을 제공하는 다양한 수준의 위험 중에서 선택할 수 있습니다. [3][4]

플랫폼은 각 에포크가 한 달 동안 지속되는 에포크를 통해 운영되며, 위험 볼트에 예치된 자금은 각 에포크가 끝날 때까지 잠깁니다. 자금이 잠기면 예치자의 담보 및 보상의 일부에 대해 거래할 수 있는 반 fungible 토큰으로 표시됩니다. Y2K는 또한 추가 유동성 옵션과 청산 이벤트에서 발생하는 수익에 대한 노출을 제공하는 "Wildfire" 및 "Tsunami"라는 두 가지 추가 제품을 보유하고 있습니다. 이 플랫폼은 DAI, USDC 및 wBTC를 포함한 다양한 자산에 대한 지원과 함께 Arbitrum에서 처음 출시되었습니다. [3][4]

Earthquake

Earthquake는 기존의 재해 채권(CAT)에 대한 새로운 접근 방식을 도입하는 금융 상품으로, 사용자에게 다양한 페깅된 자산과 관련된 변동성 위험을 헤지, 투기 및 인수할 수 있는 플랫폼을 제공합니다. 지진이나 허리케인과 같은 미리 결정된 재해 위험이 발생할 경우 지급되는 기존 CAT 채권과 달리 Earthquake는 스테이블코인, 유동성 래퍼 및 기타 DeFi 파생 상품에 대한 디페깅 이벤트에 중점을 둡니다. 이 플랫폼을 통해 사용자는 ETH 담보를 헤지 볼트에 예치하고 Y2K 토큰을 받아 이러한 자산의 변동성으로부터 자신을 보호할 수 있습니다. 이 플랫폼은 Chainlink 오라클을 활용하여 페깅된 자산 가격을 모니터링하고 디페깅 이벤트 발생 시 5%의 수수료를 부과합니다. [5][14]

위험 볼트

Earthquake는 사용자가 ETH를 위험 볼트에 예치하여 디페깅 위험 시장에 참여할 수 있는 플랫폼을 제공합니다. ETH를 위험 볼트에 예치함으로써 사용자는 디페깅 보험의 인수자 역할을 하며 헤지 볼트 예치금에서 징수된 프리미엄의 비례 배분된 몫을 받을 자격이 있습니다. 반 fungible ERC-1155 토큰은 위험 볼트에 예치할 때 발행되며, 이는 예치 증빙 역할을 하며 Wildfire 출시 후 거래할 수 있습니다. 볼트가 디페깅되지 않은 경우 위험 볼트 예치자는 헤지 볼트 예치금의 비례 배분된 몫을 받게 됩니다. 볼트가 디페깅된 경우 위험 볼트 예치자는 헤지 볼트 예치금의 비례 배분된 몫을 받을 뿐만 아니라 원금도 헤지 볼트 예치자에게 이전됩니다. [6][7]

헤지 볼트

페깅된 자산의 변동성에 대해 헤지하려는 사용자는 ETH를 헤지 볼트에 예치하여 그렇게 할 수 있습니다. ETH를 헤지 볼트에 예치함으로써 사용자는 보험 계약자 역할을 하며 디페깅 이벤트 발생 시 위험 볼트 예치금의 비례 배분된 몫을 받을 자격이 있습니다. 반 fungible ERC-1155 토큰은 헤지 볼트에 예치할 때 발행되며, 이는 예치 증빙 역할을 하며 Wildfire 출시 후 거래할 수 있습니다. 볼트가 디페깅되지 않은 경우 헤지 볼트 예치자는 지불된 프리미엄을 위험 볼트 예치자에게 이전합니다. 볼트가 디페깅된 경우 헤지 볼트 예치자는 지불된 프리미엄을 위험 볼트 예치자에게 이전하고 위험 볼트 예치금의 비례 배분된 몫을 받습니다. [6][7]

스트라이크 가격

Earthquake는 Chainlink 오라클을 사용하여 USDC, USDT, DAI, FRAX 및 MIM을 포함한 지원되는 페깅된 자산의 가격을 모니터링합니다. Chainlink 오라클이 주어진 볼트의 스트라이크 가격에 도달했음을 나타내면 에포크가 종료되고 볼트가 닫히므로 위험 볼트 예치금이 헤지 볼트로 이전됩니다. 프로토콜은 디페깅 이벤트 발생 시 헤지 볼트 예치금의 5%와 위험 볼트 예치금의 5%의 수수료를 징수합니다. 페그가 유지되면 수수료가 부과되지 않습니다. [7][8]

Tsunami

Tsunami는 담보부 채무 증권(CDO) 제품의 개발 및 관리에 중점을 둔 플랫폼입니다. CDO는 자산을 뒷받침하기 위해 부채를 사용하는 금융 상품으로, 많은 부채 보유자가 기초 자산의 소유자 역할도 합니다. Tsunami는 여러 소스의 부채를 중앙 호스트 유동성 풀로 풀링하여 CDO에 대한 고유한 접근 방식을 활용합니다. 이 풀링은 부채 포지션을 집계하는 메커니즘을 생성하며 CDO Non-Fungible Tokens(NFT)로 표시됩니다. [9]

이 플랫폼은 CDO NFT에 유동성을 제공하는 사용자에게 청산 봇에 대한 독점적인 액세스를 제공합니다. 레버리지 포지션이 청산되는 경우 청산 프로세스에서 생성된 수익은 이러한 사용자에게 전달되어 이미 받고 있는 수익에 추가됩니다. 또한 Tsunami는 전담 대출 인수자를 고용하여 대출 포지션을 모니터링하고 촉진하며, y2kTOKENS의 ETH는 청산 시 담보가 110% 이상으로 유지되도록 하는 안전 장치 역할을 합니다. 청산 이벤트에서 발생하는 수익 가능성과 결합된 CDO에 대한 플랫폼의 접근 방식은 사용자가 제공자로부터 직접 대출하는 대신 Y2K에서 대출하도록 유도합니다. [9]

Wildfire

Wildfire는 사용자가 온체인 RFQ 주문장을 통해 실시간으로 포지션에 진입하고 종료할 수 있도록 하는 Earthquakes 토큰화된 볼트 위에 구축된 보조 시장 플랫폼입니다. 트랜잭션은 0x 프로토콜 계약을 사용하여 처리되고 거래는 테이커의 서명된 트랜잭션을 사용하여 이루어집니다. Wildfire는 풍부한 유동성을 제공하고 반 fungible 토큰의 빠른 가격 재조정을 허용하여 트레이더가 포지션을 잠그지 않고도 디페깅 심리에 대해 투기할 수 있도록 합니다. 이 플랫폼은 보험 시장에서 위험을 관리하고 유동성을 제공하는 데 더 큰 유연성과 옵션을 제공하여 트레이더와 예치자가 에포크 시간 외에 포지션을 헤지하거나 인수할 수 있도록 합니다. [4][14][15]

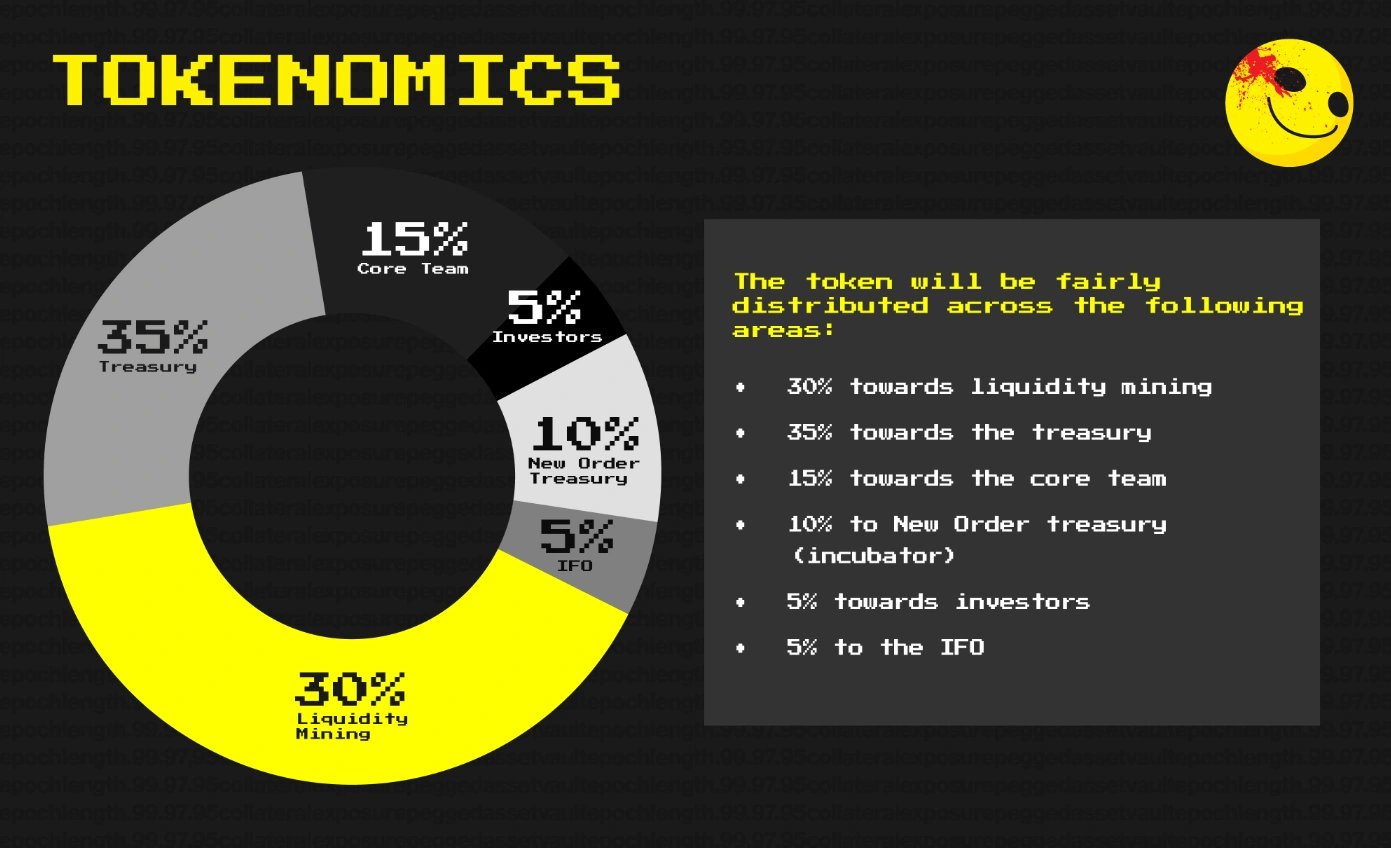

토큰노믹스

Y2K Finance 생태계 내의 토큰은 다음과 같이 배포됩니다. [10]

Y2K 토큰

Y2K 토큰은 Y2K 생태계의 유틸리티 토큰으로, Earthquake 및 Wildfire라는 두 가지 주력 제품의 거버넌스 토큰 역할을 합니다. $Y2K는 Y2K : wETH Balancer Pool에서 거래할 수 있으며 거버넌스를 통해 생태계의 중요한 매개변수를 결정하는 데 사용됩니다. [11]

vIY2K 토큰

vIY2K는 80Y2K:20wETH Balancer Pool에서 Y2K를 잠가 얻은 잠긴 토큰입니다. vIY2K 보유자는 거버넌스 권한이 증가하고 Y2K 생태계에서 생성된 프로토콜 수수료의 50%를 받을 자격이 있습니다. 잠금 기간은 16주 또는 32주가 될 수 있으며, 더 오래 잠그는 사람은 더 많은 프로토콜 수수료와 거버넌스 권한을 받습니다. vIY2K는 양도할 수 없으며 IFO에 참여하거나 Balancer 풀에서 유동성을 제공하거나 Balancer 풀에서 Y2K를 구매하여 얻을 수 있습니다. [12]

볼트 토큰

Y2K 볼트 토큰은 ERC-1155이며 예치자의 볼트 소유권의 비례 배분된 몫을 나타냅니다. 자산, 유형 및 에포크별로 구분되며 Bond 개시 및 vlY2K 출시까지 양도할 수 없습니다. Y2K 토큰은 볼트 예치자에게 보상으로 발행됩니다. Y2K 배출 방향은 게이지 시스템을 통해 결정되며, 유동성 마이닝 배출 방향의 일부는 스냅샷 투표를 통해 이루어지며, 여기서 vlY2K 로커는 배출을 할당할 시장을 지정할 수 있습니다. 이러한 배출 할당의 분산화는 배출을 중심으로 뇌물 시장이 발전할 가능성을 만듭니다. [13]

Y2K 채권

2023년 1월 31일, Y2K는 Bond Protocol과 함께 $Y2K 채권 시장을 출시했습니다. [16] $YSK 채권은 프로토콜 소유 유동성(PoL)을 늘리는 동시에 $Y2K 토큰에 대한 새로운 시장을 도입할 것입니다. [17]

토큰 채권은 사용자가 특정 암호화폐 자산을 할인된 가격으로 기본 토큰으로 교환할 수 있는 개념입니다. 그 대가로 사용자는 며칠에 걸쳐 할인된 자산을 받습니다. $Y2K 채권은 또한 사용자에게 할인된 가격으로 $Y2K를 구매할 수 있는 방법을 제공하여 Y2K 재정을 늘릴 수 있습니다. $USDC 예치금만 처음에는 지원되며 사용자는 Y2K Finance 또는 Bond Protocol 프런트엔드에 예치하여 참여할 수 있습니다. [17]

Y2K V2

2023년 5월 1일, Y2K V2는 Carousel을 사용한 개선된 UX, 새로운 수익원, Open Builder Platform 및 확장된 유연성을 포함한 추가 기능과 함께 플랫폼에서 라이브로 전환되었습니다. 이 기능은 Earthquake를 보다 효율적인 제품으로 만드는 것을 목표로 합니다. Carousel 덕분에 예치, 롤오버 및 보상 획득을 더 잘 탐색할 수 있으며 $vlY2K 보유자는 새로운 정보 세금에서 추가 수수료를 얻습니다. 프로토콜은 Earthquake를 자체 제품에 구축할 수 있으며 Y2K는 Earthquake 위에 자체 사내 제품을 구축하기 시작할 수 있습니다. [18]

Y2K는 또한 사용자가 V2 플랫폼에서 시장을 적절하게 이해하고 상호 작용할 수 있도록 4단계 사용자 가이드[19]를 출시했습니다. [18][19]