위키 구독하기

Share wiki

Bookmark

USDD

0%

USDD

USDD(탈중앙화 USD)는 스테이블코인이자 디지털 자산으로, TRON DAO가 2022년 5월 5일에 BNB 체인, 이더리움 및 TRON에서 출시했습니다. [1][2][3][4]

역사

공개 서한

TRON의 창립자인 H.E. 저스틴 선은 2022년 4월 21일 트위터에 올린 공개 서한[5]에서 탈중앙화 USD 스테이블코인인 USDD 출시를 발표했습니다. 공개 서한에서 USDD는 완전한 탈중앙화와 가격 안정성을 보장하기 위해 중앙 기관에 대한 의존을 종식시키는 스테이블코인 시대 3.0을 가져올 것으로 설명되었습니다. [6][7]

시대 1.0은 최초의 스테이블코인 중 하나인 USDT로 대표되는 스테이블코인 개발의 초기 단계를 의미하며, 이는 Omni Layer를 사용하여 비트코인 네트워크에서 생성되었습니다. 그러나 비트코인 네트워크에서의 구현으로 인해 시대 1.0은 낮은 처리량과 같은 문제에 직면하여 USDT 전송 속도가 느려졌습니다. 또한 거래 수수료가 비교적 높았고 중앙 기관이 USDT를 뒷받침하는 미국 달러 준비금을 관리했습니다. [7]

시대 2.0은 선의 공개 서한[5]에서 "TRON 기반 USDT 2.0 시대"라고 언급되며, 트랜잭션을 처리하기 위해 TRON 네트워크의 독립적인 탈중앙화 레이어를 활용합니다. 이러한 발전은 처리량 증가로 인해 더 빠른 전송과 처리 수수료 감소를 가능하게 합니다. 그러나 준비금과 수탁은 계속 중앙 집중화되어 있다는 점에 유의해야 합니다. [7]

시대 3.0에서는 온체인 알고리즘을 사용하여 변동성을 관리하는 탈중앙화 알고리즘 스테이블코인에 중점을 둡니다. 이 접근 방식은 완전한 탈중앙화를 달성한 스테이블코인에 대한 접근 권한을 개인에게 제공하는 것을 목표로 합니다. [6][7]

출시

2022년 5월 5일, USDD는 TRON DAO에 의해 1억 개의 초기 공급량으로 출시되었습니다.[8] BitTorrent(BTCC)의 크로스 체인 프로토콜을 통해 이더리움 및 BNB 체인에서 사용할 수 있게 되었습니다. 스테이블코인의 롤아웃은 USDD 메인넷 출시로 이어지는 4단계(Space, International Space Station, Moon, Mars)로 진행됩니다. [9]

USDD는 TRON DAO에서 직접 관리하는 알고리즘 스테이블코인이며 미국 달러에 1:1 비율로 고정될 예정입니다. 즉, 디지털 통화의 가치가 미국 달러의 가치에 연동됩니다.

기술

과잉 담보화

USDD는 5억 8천만 달러 상당의 TRX(TRON의 기본 암호화폐), 2억 3천 5백만 달러의 BTC 및 4억 4천 2백만 달러의 USDT로 담보화됩니다. 이 자산 바구니는 유통 중인 USDD 가치의 200% 이상을 차지합니다. 따라서 시장의 각 USDD는 가치의 두 배 이상으로 뒷받침됩니다. 이 과잉 담보화는 USDD가 USD에 디페깅되는 것을 방지하는 것을 목표로 합니다. [10]

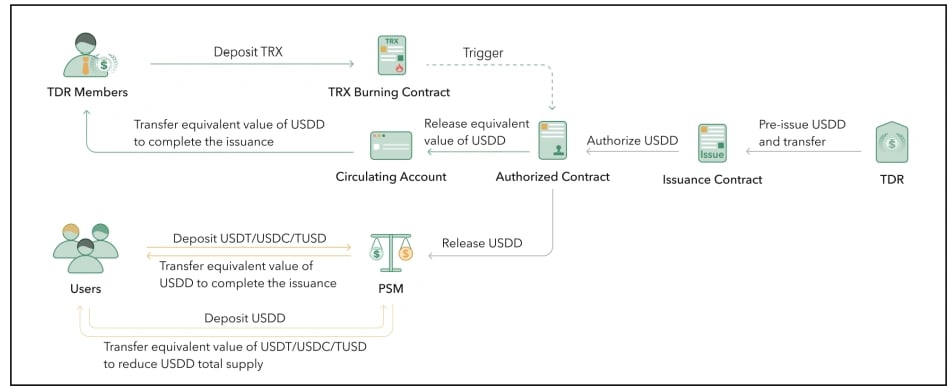

발행 및 소각 메커니즘

USDD 가격이 1 USD보다 낮으면 사용자는 1 USDD를 소각하여 1 USD 상당의 TRX를 돌려받을 수 있습니다. USDD 가격이 1 USD보다 높으면 사용자는 1 USD 상당의 TRX를 소각하여 1 USDD를 받을 수 있습니다. 이는 USDD를 USD에 1:1로 고정하기 위한 것입니다. [11][10]

페그 안정성 모듈(PSM)

USDD는 사용자가 USDD와 USDT 또는 USDC와 같은 다른 스테이블코인 간에 가격 슬리피지 없이 고정된 1:1 비율로 토큰을 교환할 수 있도록 하는 오픈 소스 소프트웨어인 "페그 안정성 모듈(PSM)"을 제공합니다. 사용자는 트랜잭션을 시작할 때 예상되는 정확한 양의 암호화폐를 받습니다. [10][11]

슈퍼 대표

슈퍼 대표는 TRON 네트워크 내에서 USDD의 가격 안정성을 유지하는 데 기여하는 27명의 TRX 토큰 보유자입니다. 그들은 특정 메커니즘을 통해 스테이블코인에 대한 높은 변동성의 영향을 완화하는 역할을 합니다. 슈퍼 대표의 선택은 가역적인 프로세스이며, 관심 있는 TRX 보유자는 해당 직위에 지원할 수 있으며 TRX 커뮤니티에서 투표합니다. [11]

USDD 스테이블코인 하락

2022년 5월 5일 초기 출시 직후 USDD 코인 가격이 0.93달러로 하락하여 투자자들 사이에서 우려를 불러일으켰습니다. TRON DAO Reserve는 스테이블코인이 높은 변동성 기간("+

- 3% 이내")을 겪는 것은 허용된다고 주장하는 일련의 트윗을 게시하여 상황을 밝혔습니다. 이 주장은 일부 암호화폐 전문가의 지지를 받았지만 다른 사람들은 회의적이었습니다. 토큰은 출시 후 며칠 동안 더 높은 변동성을 보이다가 2022년 7월 말에 안정화되었습니다. [12][11]

2022년 11월 USDD는 FTX 붕괴로 인해 다시 약간 디페깅되어 한때 0.97달러 아래로 떨어졌습니다. DeFi 프로토콜 Curve의 USDD 유동성 풀은 상당한 불균형을 보였으며 풀의 거의 80%가 USDD로 구성되었습니다. USDD를 구매하는 것보다 판매하려는 사람이 더 많았습니다. [13][11]

저스틴 선은 FTX의 샘 뱅크먼-프리드가 이끄는 암호화폐 헤지 펀드인 알라메다 리서치가 FTX의 유동성 문제를 해결하기 위해 USDD를 판매했을 가능성이 높으며 풀이 균형을 되찾았다고 트윗[14]하여 상황을 해결했습니다. [11][13]

잘못된 내용이 있나요?