위키 구독하기

Share wiki

Bookmark

Vanguard (VWA)

0%

Vanguard (VWA)

**Vanguard (VWA)**는 2025년 10월에 솔라나 블록체인에서 시작된 암호화폐 프로젝트입니다. 이 프로젝트는 여러 플랫폼에서 상충되는 정체성을 보입니다. 공식 웹사이트와 소셜 미디어에서는 실물 자산(RWA)을 토큰화하기 위한 플랫폼으로 설명하는 반면, 타사 데이터 집계업체는 이를 밈코인으로 분류합니다. [1] [2]

개요

Vanguard는 솔라나 네트워크에서 운영되며 2025년 10월 초에 등장했습니다. 이 프로젝트의 공개적인 정체성은 두 가지 뚜렷하고 모순적인 이야기로 특징지어집니다. 공식 웹사이트에 따르면 Vanguard의 임무는 고가치 실물 자산을 토큰화하여 전통적인 금융과 블록체인 기술을 연결하는 것입니다. 이 프로젝트는 특히 금, 은, 보석을 주요 대상으로 지정하여 유동성을 높이고 디지털 토큰으로 더 광범위한 투자자가 접근할 수 있도록 하는 것을 목표로 합니다. 이러한 포지셔닝은 암호화폐 산업의 실물 자산(RWA) 부문 내에 위치하며, 물리적 세계의 유형 및 무형 자산에 대한 온체인 표현을 만드는 데 중점을 둡니다. 웹사이트에는 프로젝트의 비전이 "귀중한 실물 자산을 접근 가능한 디지털 투자로 전환"하는 것이라고 명시되어 있습니다. [1]

반대로, Bitget Wallet과 같은 암호화폐 데이터 플랫폼의 정보는 Vanguard (VWA)를 밈 코인으로 설명합니다. 이 설명은 프로젝트를 "월스트리트의 선봉 전사"로 규정하고 마케팅에서 "갑옷을 입고 돌격하는 기사"와 "픽셀 스타일의 '불타는 칼날'" 테마를 사용합니다. 이 설명은 커뮤니티 참여, 소셜 미디어 트렌드 및 기본 유틸리티 또는 기술보다는 투기적 거래에서 가치를 얻는 암호화폐인 밈 코인의 문화와 일치합니다. 이 프로젝트의 정체성 버전에는 시장 붕괴 가능성에 대한 투자자에게 직접적인 경고도 포함되어 있으며, 이는 고위험 밈 코인 공간에서 일반적인 특징입니다. 이러한 상충되는 묘사는 프로젝트의 진정한 목적과 장기 목표에 대한 모호성을 만듭니다. [2]

프로젝트의 공식 자료는 전 세계 금 시장(22조 8천억 달러)과 연간 고급 시계 시장(750억 달러)을 예로 들어 총 23조 달러 이상의 시장을 목표로 하고 있다고 주장합니다. 이러한 주장에도 불구하고 프로젝트의 공식 채널에는 자산 보관, 검증 및 감사를 위한 운영 모델을 명확히 하는 백서 또는 기술 사양과 같은 자세한 문서가 부족합니다. 이는 합법적인 RWA 프로토콜에 중요한 구성 요소입니다. 토큰은 Jupiter와 같은 솔라나 기반 탈중앙화 거래소에서 거래할 수 있으며 Phantom과 같은 지갑과 호환됩니다. [1]

역사

Vanguard의 공개적인 존재는 2025년 10월에 확립되었습니다. 프로젝트의 공식 X (이전 Twitter) 계정인 @vanguardrwa는 이 달에 생성되었습니다. [3] 타사 플랫폼의 데이터에 따르면 VWA 토큰은 2025년 10월 1일경에 출시되었습니다. Bitget Wallet의 2025년 10월 6일 항목에는 프로젝트가 "5일 전에 설립"되었다고 언급되어 10월 초 출시를 뒷받침합니다. [2]

기술

Vanguard는 디지털 자산 거래 및 전송에 유용한 높은 거래 속도와 낮은 수수료로 선택된 솔라나 블록체인을 기반으로 구축되었습니다. 프로젝트의 공식 웹사이트는 RWA 내러티브와 관련된 몇 가지 주요 기술 기능과 목표를 간략하게 설명합니다. [1]

프로젝트에서 설명하는 주요 기능은 다음과 같습니다.

- 귀중한 자산 집중: 이 프로토콜은 특히 금, 은, 보석에 대한 초기 강조와 함께 고가치 실물 자산의 토큰화를 위해 설계되었습니다.

- 접근성: 개인이 토큰화된 실물 자산에 투자하는 프로세스를 단순화하여 기존 진입 장벽을 제거하는 것을 목표로 합니다.

- 유동성 증가: Vanguard는 실물 자산을 온체인 토큰으로 표현함으로써 전통적으로 유동성이 낮은 자산의 가치를 잠금 해제하여 즉시 전 세계적으로 거래할 수 있도록 하는 것을 목표로 합니다.

- 솔라나 생태계 통합: 이 프로젝트는 솔라나 생태계 내에서 RWA 부문의 성장에 기여하는 것으로 자리매김합니다.

이러한 명시된 목표에도 불구하고 프로젝트의 공개 자료에는 중요한 기술 세부 정보가 부족합니다. 자산 보관 메커니즘, 기본 실물 자산의 존재 및 가치를 확인하는 프로세스, 토큰이 완전히 지원되는지 확인하기 위한 감사 절차 또는 물리적 담보에 대한 토큰 발행 및 상환 프로토콜에 대한 정보는 제공되지 않습니다. 이 프로젝트는 백서를 게시하지 않았거나 GitHub 계정과 같은 공개 코드 저장소에 대한 링크를 제공하지 않았습니다. [1]

토큰노믹스

Vanguard 프로젝트의 기본 토큰은 VWA입니다. 솔라나 네트워크의 토큰입니다. 2025년 10월 6일 현재 토큰노믹스 데이터는 타사 플랫폼에서 보고되었습니다. [2]

- 티커: VWA

- 블록체인: 솔라나

- 계약 주소:

GJvLcMvQwznh1gAonWnqbqdSRrNCQmVzhfsZVvQdtM4b - 총 공급량: 999,990,000 VWA

- 최대 공급량: 1,000,000,000 VWA

- 유통 공급량: 999,990,000 VWA

- 보유자: 6,550명 (2025년 10월 6일 기준)

- 시가 총액: 약 745만 달러 (2025년 10월 6일 기준)

2025년 10월 초의 데이터는 상당한 거래 활동을 나타내며, 24시간 온체인 거래 수는 11,677개의 구매 주소와 2,519개의 판매 주소를 보여줍니다. [2]

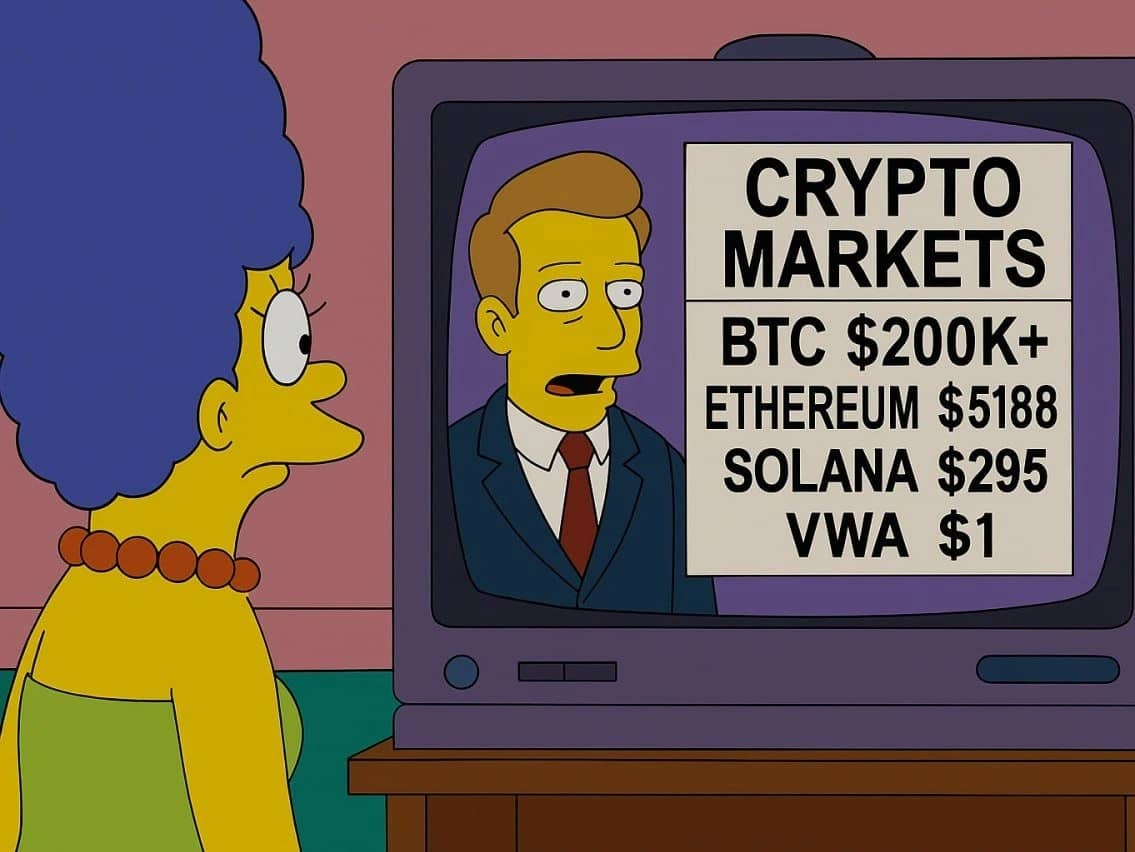

심슨 예측

2025년 10월에 VWA 토큰이 11월 22일에 애니메이션 TV 쇼 심슨 가족의 다가오는 에피소드에 등장할 것이라는 소문이 돌기 시작했습니다. 암호화폐 뉴스 매체에서 "가짜 소문" 및 "가짜 뉴스"로 묘사한 이 주장은 증거를 제시하지 않고 소셜 미디어에서 날짜를 홍보한 VWA 프로젝트 팀에 의해 촉발되었습니다. 심슨 가족과 같이 세계적으로 인정받는 쇼가 수많은 위험 신호가 있는 1천만 달러 미만의 새로운 시장 캡 프로젝트를 특징으로 할 가능성이 낮기 때문에 주장의 타당성에 대한 광범위한 회의론이 제기되었습니다. 이는 2020년 에피소드와 같이 비트코인 가격 옆에 무한대 기호가 있는 뉴스 티커가 등장한 쇼와 암호화폐 커뮤니티가 연결을 맺은 역사를 따릅니다. [4]

상충되는 정보 및 확인되지 않은 주장

Vanguard (VWA)에 대해 사용 가능한 공개 정보는 주로 핵심 정체성, 기관 지원 및 토큰 배포와 관련된 중요한 모순과 확인되지 않은 마케팅 주장으로 표시됩니다. 이러한 문제는 업계 관찰자들이 "위험 신호"로 강조했습니다. [4]

프로젝트 정체성

프로젝트가 정의되는 방식에 근본적인 불일치가 있습니다.

- 실물 자산(RWA) 프로젝트: 공식 웹사이트와 X 프로필은 Vanguard를 귀금속과 보석을 토큰화하는 데 중점을 둔 진지한 금융 기술 프로젝트로 제시합니다. 태그라인은 "토큰화된 실물 자산의 미래"입니다. [1] [3]

- 밈코인: Bitget Wallet과 같은 타사 플랫폼은 VWA를 밈 코인으로 분류합니다. 이 플랫폼에 대한 설명은 투기적이고 주제적인 언어를 사용하여 "월스트리트의 선봉 전사"라고 언급하고 RWA 토큰화에 대한 언급은 없습니다. [2]

기관 지원 주장

이 프로젝트는 주요 기관 지원에 대한 두 가지 다른 근거 없는 주장과 관련이 있습니다.

- Ripple: 공식

@vanguardrwaX 계정의 약력에는 프로젝트가 "@Ripple의 지원을 받습니다."라고 명시되어 있습니다. 이 주장은 블록체인 및 디지털 결제 분야의 저명한 회사인 Ripple의 파트너십, 투자 또는 공식적인 보증을 시사합니다. 2025년 10월 초 현재 Ripple은 VWA 프로젝트와의 연결을 확인하지 않았습니다. [3] [4] - S&P 500 ETF: Bitget Wallet에 대한 설명은 프로젝트가 "유명한 S&P 500 ETF의 지원을 받습니다."라고 주장합니다. 밈 코인은 기존 금융 의미에서 주요 주식 시장 지수 펀드의 직접적인 지원을 받을 수 없으므로 이 주장은 매우 이례적이며 비유적일 가능성이 높습니다. 이는 확인 가능한 금융 계약보다는 "월스트리트" 마케팅 테마의 일부로 보입니다. [2]

추가 위험 신호

다른 여러 문제가 투자자와 분석가들 사이에서 우려를 제기했습니다.

- 익명의 팀: 이 프로젝트는 익명으로 유지되는 팀에 의해 시작되었으며, 이는 책임감을 줄이기 때문에 암호화폐 공간에서 일반적인 위험 신호입니다. [4]

- 확인되지 않은 통합: Ripple 주장 외에도 VWA를 홍보하는 영향력 있는 사람들은 SWIFT 은행 시스템과 통합된다고 제안했습니다. 이 주장도 공식 출처에서 확인되지 않았습니다. [4]

- 사칭 우려: 프로젝트 이름은 9조 3천억 달러의 자산 관리 회사인 Vanguard와 자신을 연관시키려는 시도로 보입니다. 실제 Vanguard는 VWA 암호화폐 프로젝트에 대한 지원 또는 연결을 발표하지 않았습니다. [4]

- 중앙 집중식 토큰 공급: 2025년 10월 Bubblemaps의 온체인 분석에 따르면 60개 이상의 연결된 지갑이 총 VWA 공급량의 약 87%를 제어합니다. 이 높은 토큰 집중은 주요 보유자가 토큰을 대량으로 판매하고 가격을 폭락시킬 수 있는 "러그 풀"에 프로젝트가 매우 취약하게 만들기 때문에 중요한 위험 요소로 간주됩니다. [4]

잘못된 내용이 있나요?