위키 구독하기

Share wiki

Bookmark

Jupiter

0%

Jupiter

Jupiter는 탈중앙화 거래소이자 솔라나 블록체인 상의 유동성 애그리게이터입니다. 경쟁력 있는 거래 가격, 다양한 거래 옵션, 그리고 네이티브 토큰인 JUP를 통한 커뮤니티 거버넌스를 제공합니다. Meow는 Jupiter의 설립자입니다. [1]

개요

Jupiter는 2022년에 출시된 탈중앙화 거래소 및 유동성 애그리게이터입니다. 여러 DEX 및 AMM의 유동성을 솔라나에서 통합하여 이러한 시장을 연결함으로써 경쟁력 있는 가격을 제공합니다. 토큰 스왑 외에도 Jupiter는 "지정가 주문" 거래, 탈중앙화 영구 및 선물 거래, 달러 비용 평균화(DCA) 전략을 지원합니다. 또한 솔라나와 다른 블록체인 간의 자산 전송을 위한 자체 브리지를 제공합니다. 처음에는 토큰 스왑에 집중했지만 Jupiter는 영구 선물 거래를 포함하도록 확장되었으며 중앙 집중식 스테이블코인과 관련된 위험을 완화하기 위해 탈중앙화 스테이블코인을 도입할 계획입니다. 거버넌스는 기본 토큰인 JUP를 통해 촉진되며, 이를 통해 커뮤니티는 DeFi의 탈중앙화 원칙에 부합하는 유동성 계획 및 생태계 프로젝트와 같은 결정에 투표할 수 있습니다. [2]

특징

지정가 주문

Jupiter Limit Order는 솔라나에서 지정가 주문을 간소화하여 다양한 토큰 쌍을 제공하고 솔라나 생태계 전반에서 사용 가능한 유동성을 활용합니다. 전통적인 주문장 시스템과 달리 키퍼를 사용하여 온체인 토큰 가격을 모니터링하고 유동성이 존재할 때 주문을 실행합니다. 주문은 지정된 가격 제한을 기준으로 실행되며, 키퍼는 유동성을 지속적으로 모니터링하고 시장 가격이 일치할 때 주문을 이행합니다. 사용자는 주문 만료 시간을 설정하여 미체결 주문이 자동으로 취소되고 환불되도록 할 수 있습니다. 이 접근 방식은 슬리피지를 최소화하고 변동성이 큰 기간 동안 거래 실패 위험을 제거합니다. Jupiter Limit Order는 사용자 경험, 단순성, 유연성 및 솔라나 전반의 광범위한 유동성을 우선시하며, 키퍼가 주문을 실행하여 사용자가 플랫폼 수수료를 제외한 견적 가격을 받도록 보장합니다. [3]

Jupiter DCA

Jupiter DCA는 달러 비용 평균화 솔루션을 제공하여 사용자가 설정된 기간 동안 일정한 간격으로 SPL 토큰을 자동 구매 또는 판매할 수 있도록 합니다. 일시불로 최고점에 가까워질 위험을 감수하는 대신, DCA는 투자를 시간 경과에 따라 분산시켜 전체 비용을 평준화하고 잠재적 손실을 줄이면서 장기적인 수익성을 향상시킵니다. 이 전략은 자본을 고정된 간격으로 더 작은 주문으로 나누어 시간이 지남에 따라 점진적으로 자산을 축적하는 데 효과적이며, 이 프로세스는 Jupiter의 DCA 기능에 의해 자동화됩니다. [4]

Jupiter Bridge

Jupiter는 DEX 애그리게이터와 유사하게 브리지 애그리게이터 역할을 합니다. 지원되는 브리지에서 데이터를 수집하여 사용자가 브리지 거래에 사용할 수 있는 경로, 경로 세부 정보 및 현재 상태를 기반으로 제안된 경로를 제공합니다. 사용자는 선호하는 경로를 선택하고 선택한 브리지로 리디렉션되어 거래를 완료합니다. 지원되는 브리지 시설에는 Mayan Finance와 Debridge가 있습니다. 또한 Jupiter는 Wormhole을 지원하여 블록체인 네트워크 간의 통신을 가능하게 하는 네트워크 간 메시징 프로토콜을 활용하여 자산 브리징을 지원합니다. Jupiter의 Wormhole 기반 브리지는 현재 Ethereum과 Solana 블록체인 간의 자산 브리징을 용이하게 합니다. [5]

Perpetuals

Jupiter는 사용자가 최대 100배 레버리지로 롱 또는 숏 포지션을 취할 수 있도록 하는 분산형 영구 계약 거래 플랫폼을 제공합니다. 사용자는 트레이더 또는 유동성 공급자로 참여할 수 있으며, 유동성 공급자는 영구 계약 볼트에 자산을 고정하고 트레이더의 자금 사용으로 수익을 얻습니다. 현재 영구 계약 볼트는 WBTC, USDT, USDC, SOL 및 ETH의 5가지 자산을 지원합니다. 트레이더는 담보를 약정하고 담보 및 선택한 레버리지 배율을 기준으로 볼트에서 자금에 액세스합니다. 이 플랫폼은 중앙 집중식 파생 상품 거래 플랫폼과 유사하게 작동하며, 유동성 공급자가 제공하는 레버리지 자금을 통해 제로 가격 영향, 슬리피지 및 LP 풀 유동성 및 오라클을 통한 깊은 유동성을 보장하고, Pyth 네트워크의 오라클을 사용하여 가격 피드를 제공합니다. [5]

LFG 런치패드

2024년 1월 23일, Meow는 X에 게시물을 통해 솔라나 프로젝트 런치패드인 LFG 출시를 발표했습니다. LFG는 인센티브나 가격 발견 시스템 없이 커뮤니티 지원을 강조하며 새로운 프로젝트가 시장에 진입하는 것을 돕는 것을 목표로 합니다. Jupiter DAO는 커뮤니티 투표를 통해 프로젝트를 승인하여 런치패드를 감독합니다. 승인된 프로젝트는 맞춤형 런치 풀, 구성 가능한 유동성 풀 및 봇 네트워크 액세스를 포함하여 Jupiter로부터 기술 지원을 받습니다. LFG에 대한 Jupiter의 목표는 구매자를 과장 광고, FOMO 및 러그 풀로부터 보호하면서 성공적인 프로젝트 출시를 육성하는 것입니다. [5][6]

생태계

Jupiter DAO

Jupiter DAO는 Jupiter 생태계 내의 핵심적인 거버넌스 기구로서, 커뮤니티 참여를 촉진하고, 이니셔티브를 실행하며, 암호화폐 세계에서 플랫폼의 영향력을 강화하기 위한 전략적 목표를 설정하는 데 중점을 둡니다. 투명한 거버넌스, 광범위한 유동성, 다양한 토큰 보유자 기반을 특징으로 하는 이 DAO는 분산형 거래 플랫폼으로서의 Jupiter의 위상을 활용하여 광범위하게 운영됩니다. [7]

Jupiter 외에도 DAO는 분산형 생태계 내에서 성장을 촉진하고, 커뮤니티 주도 이니셔티브를 지원하며, 생태계 전반의 의사 결정 과정에 참여하기 위해 노력합니다. 상당한 예산을 갖춘 DAO는 Jupiter가 최고의 인재를 유치하고 플랫폼의 장기적인 성공에 기여하는 프로젝트를 실행할 수 있도록 합니다. Active Staking Rewards와 같은 이니셔티브를 통해 DAO는 적극적인 참여를 장려하여 Jupiter 생태계의 지속 가능성과 활력을 보장합니다. [7]

Jupiter Start

Jupiter Start는 새로운 프로젝트에 대한 인지도를 높이고 생태계 내에서 투명성과 신뢰를 보장하기 위한 이니셔티브입니다. 유망한 프로젝트를 강조하고 사기나 편향된 지지를 피하는 균형을 유지함으로써 Jupiter Start는 사용자 경험을 향상시키고 안전하고 분산된 거래를 장려하고자 합니다. 1년에 걸쳐 진행되는 이 이니셔티브는 커뮤니티 협력을 통해 새로운 프로젝트를 검증하고 커뮤니티 소개, 교육, 상장 전, 런치패드(예정), 아틀라스(예정)의 5가지 구성 요소를 통해 선보일 예정입니다. [8]

- Jupiter 커뮤니티 소개를 통해 Jupiter 커뮤니티 구성원은 Solana 생태계 내에서 새로운 프로젝트와 토큰을 발견할 수 있습니다. 각 소개는 약 1주일 동안 진행되며, 이 기간 동안 특집 프로젝트는 Jupiter의 Discord 포럼에서 개념, 토큰 경제 및 소유권 분배와 같은 세부 정보를 공유합니다. 커뮤니티 구성원은 이러한 프로젝트를 검증, 이해 및 토론하는 데 참여합니다. 반응이 긍정적이고 우려 사항이 발생하지 않으면 추가 홍보에는 Jupiter 홈페이지에 트윗하고 특집으로 게재하는 것이 포함될 수 있습니다. 또한 시간이 지남에 따라 전문 지식과 사려 깊은 참여를 보여주는 커뮤니티 구성원은 보상과 인정을 받을 수 있습니다. [8]

- Jupiter 교육은 Jupiter의 자격을 갖춘 트레이더와 사용자에게 Solana 생태계 내의 주목할 만한 프로젝트에 대한 통찰력을 제공하도록 설계되었습니다. 특집 프로젝트와 Jupiter 웹사이트의 전용 섹션이 소셜 미디어에서 강조 표시됩니다. 자격을 갖춘 사용자와 트레이더는 교육 자료에 참여하고 지정된 온체인 작업을 완료하여 포인트 또는 토큰을 얻을 수 있습니다. 이 이니셔티브는 유망한 새로운 온체인 프로젝트에 대한 정보를 사용자에게 제공하는 지속 가능한 메커니즘을 만들고 이러한 프로젝트에 대한 인식과 참여를 촉진하는 것을 목표로 합니다. 선택 과정은 매우 선택적이고 맞춤화되며 커뮤니티 투표에 따라 커뮤니티 및 생태계 지원이 명확한 프로젝트를 기반으로 선택됩니다. [8]

- Jupiter 상장 전은 Jupiter 플랫폼에서 새로운 토큰의 안전한 거래를 용이하게 하여 사용자가 토큰 선택기에서 이러한 토큰에 더 빨리 액세스하고 지정가 주문을 설정하거나 달러 비용 평균(DCA)을 수행할 수 있도록 합니다. 이러한 새로운 토큰의 초기 유동성이 부족하기 때문에 사용자는 인식을 보장하기 위해 여러 UI 알림과 프롬프트를 받게 됩니다. 사기 토큰을 방지하거나 지정된 Discord 포럼에서 검증을 받으려면 프로젝트가 생태계 내에서 잘 알려져 있어야 합니다. 오해의 소지가 있는 이름을 가진 토큰이나 엄격한 목록과 겹치는 토큰은 승인되지 않으며 신뢰성과 같은 주관적인 요소가 고려됩니다. 필요한 경우 반복적인 개선이 이루어집니다. [8]

Jupiter Mobile

Jupiter Mobile은 Jupiter Exchange의 모바일 애플리케이션으로, 사용자가 스마트폰에서 직접 Solana 기반 토큰을 거래할 수 있도록 합니다. iOS에서 처음 출시되었으며 Android 지원이 예정되어 있으며, 이 앱은 플랫폼 수수료가 없고, 통합된 법정화폐 온-램프(Apple Pay 및 신용카드 지원 포함)를 제공하며, 간소화된 원탭 스왑을 제공합니다. 또한 슬리피지, 우선 수수료 및 트랜잭션 재시도를 자동으로 관리하는 자동 모드가 포함되어 있습니다. 추가 기능으로는 실시간 DEX 차트, Solana 생태계 전반의 토큰 스왑, SOL 및 USDC와 같은 주요 자산에 대한 지갑 기능, 더 넓은 Jupiter 플랫폼을 통한 거버넌스 및 스테이킹 액세스가 있습니다. [9]

JUP

Jupiter의 네이티브 토큰인 JUP는 거버넌스 토큰 역할을 하며, 커뮤니티가 유동성 및 배출 계획 승인, 제네시스 이후 토큰 민트 승인, 생태계 이니셔티브 투표와 같은 플랫폼 결정에 참여할 수 있도록 합니다. JUP 토큰의 상당 부분은 활성 사용자에게 에어드롭되어 토큰 분배에 대한 Jupiter의 커뮤니티 중심 접근 방식을 반영합니다. JUP 토큰 보유자는 기능, 업데이트 및 기타 주요 측면과 관련된 의사 결정 프로세스에 참여하여 플랫폼의 개발 및 운영에 영향을 미칠 수 있습니다. [2]

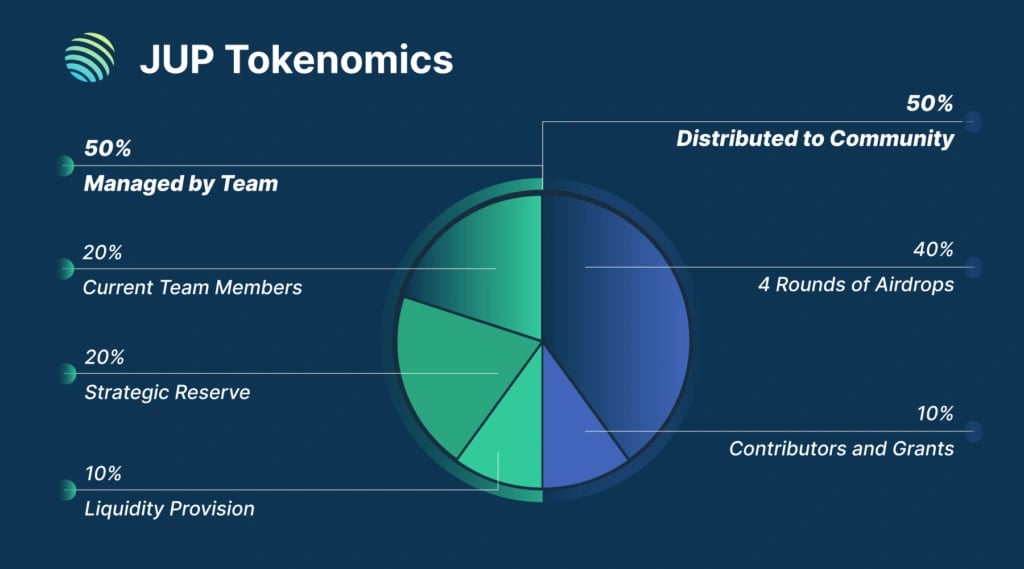

토큰노믹스

JUP 토큰의 초기 공급량은 총 100억 개이며, 생태계를 강화하고 커뮤니티 참여를 유도하기 위해 분배됩니다. 초기 공급량의 40%는 커뮤니티 에어드랍에 할당되고, 또 다른 40%는 팀 및 전략적 개발을 위해 따로 확보됩니다. 원래 토큰 판매용으로 지정되었던 나머지 20%는 유동성 공급, 커뮤니티 기여자 및 보조금으로 용도가 변경되었습니다. [2]

파트너십

Jupiter의 파트너는 다음과 같습니다.

- Wormhole

- Marinade Finance

- Orca

- Bonkswap

- Helium Network

- Bonfida

- Hello Moon

- Samoyed

- Raydium

잘못된 내용이 있나요?