EGLD

EGLD (eGold) 是 MultiversX 区块链生态系统中的原生数字货币,用于促进交易、代币管理和智能合约部署。 [1]

概述

EGLD 于 2019 年 7 月 2 日通过 首次代币发行 (ICO) 推出,在发行当天筹集了 515 万美元。作为 MultiversX 网络的原生代币,EGLD 在区块链经济中具有多种用途。 [1][2]

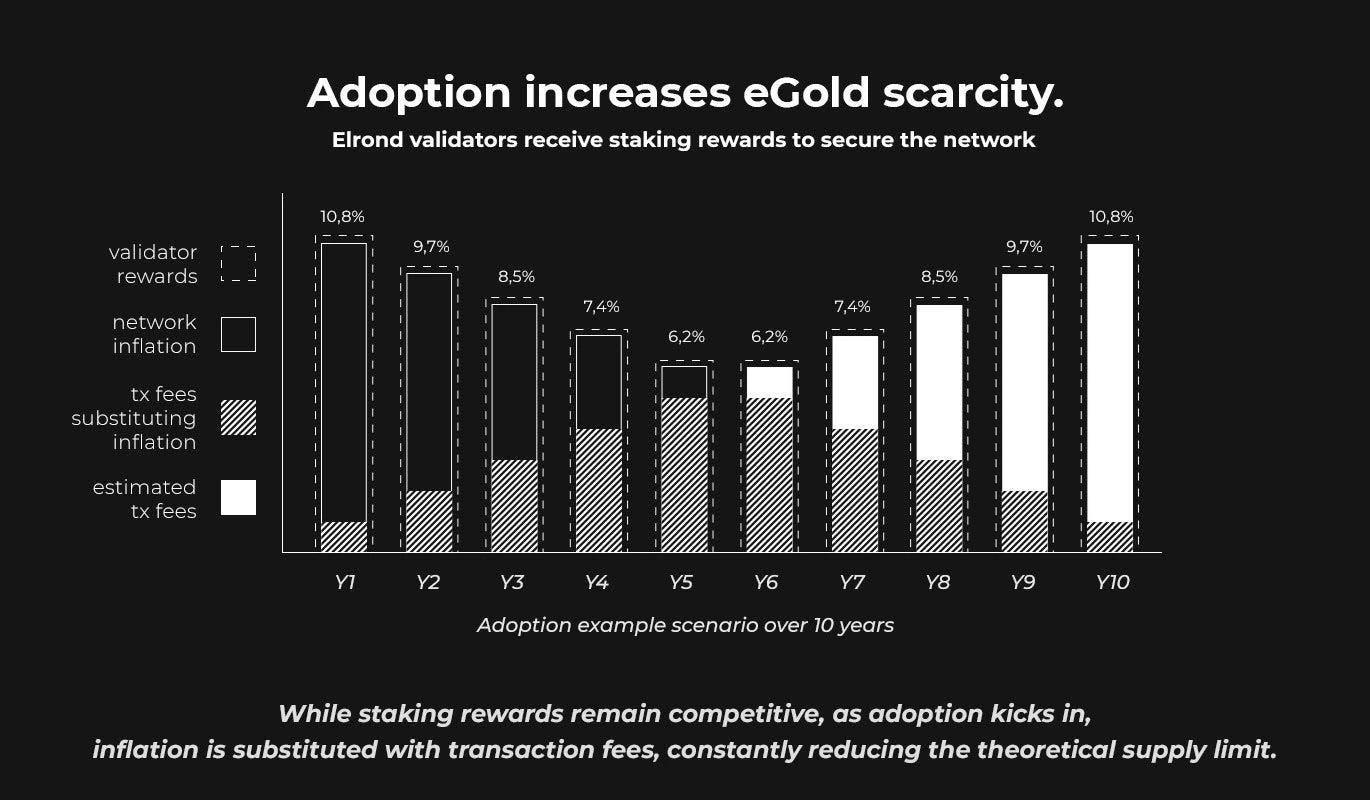

EGLD 促进各种操作,包括价值和资产转移、代币创建和管理以及 智能合约 部署。验证者是保护网络并为共识做出贡献的互联网计算机,他们因其对网络安全和共识的贡献而获得 EGLD 奖励。这种数字经济围绕 EGLD 代币的实用性和功能展开,从而促进其在 MultiversX 生态系统中的采用和集成。 [1][3]

质押

质押 是 eGold (EGLD) 生态系统不可或缺的一部分,它为参与者提供了为网络安全做出贡献并获得奖励的机会。通过质押他们的 EGLD 代币,用户可以积极参与 MultiversX 区块链的共识机制,从而确保网络的完整性和稳定性。 [3]

当个人质押他们的 EGLD 时,他们实际上是将他们的代币委托给验证者,验证者负责验证交易、保护网络和维护共识。验证者在网络运营中发挥着至关重要的作用,并且根据其声誉、表现和质押规模进行选择。 [3]

质押 EGLD 不仅为用户提供了赚取奖励的机会,而且还能够积极参与网络治理。EGLD 持有者有权对重要的协议升级、参数更改和其他治理提案进行投票。这种民主过程允许参与者对 MultiversX 区块链的开发和方向发表意见。 [3]

取消质押

取消质押 EGLD 允许用户在锁定期到期后检索其质押的代币。取消质押过程通常涉及等待期,在此期间,代币会逐渐释放回质押者的钱包。此等待期可确保网络安全并防止恶意行为。 [4]

绑定

除了 质押 之外,用户还可以选择绑定他们的 EGLD 代币。绑定涉及更长的锁定期,通常由对网络有长期承诺的用户选择。绑定的代币有助于网络的整体安全性,并为共识算法提供稳定性。有一个 10 天的解绑期,之后节点可以检索质押的数量。 [4]

代币经济学

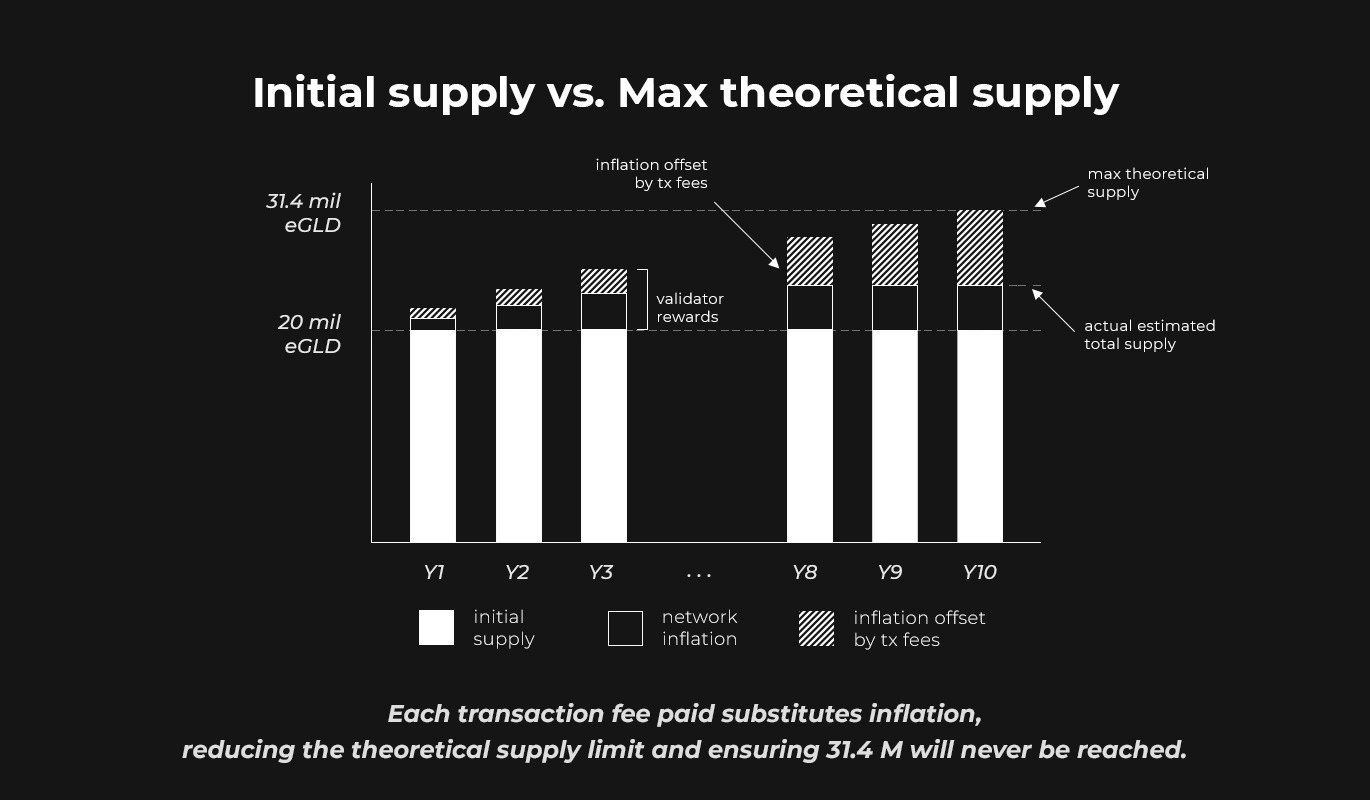

EGLD 的理论最大供应量为 31,415,926 个代币。在 MultiversX 区块链的引导阶段,最初铸造了 20,000,000 个 EGLD 代币。在 10 年的时间里,额外的 EGLD 代币逐渐进入流通,直到达到最大限制。 [5]