Subscribe to wiki

Share wiki

Bookmark

Flash Swap

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Flash Swap

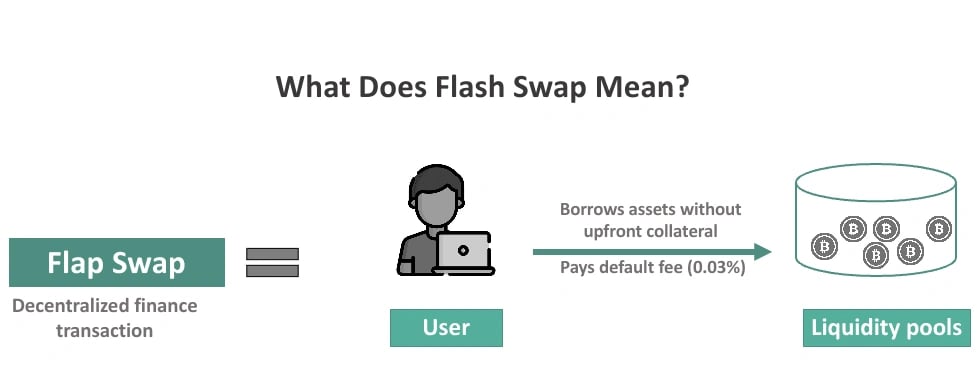

Flash swap is a decentralized finance (DeFi) transaction that allows users borrow assets from a liquidity pool, execute a series of actions with the assets, and return the assets to the pool in the same transaction. The entire transaction must be completed successfully, or the borrowed assets will be lost.[1]

Overview

Flash Swap is a decentralized contract functionality that allows users to borrow assets from the liquidity pool and repay them to the same pool at a default fee with the purpose of enabling instant borrowing and repayment of these assets via smart contracts. Flash swaps enable instant token swaps between different assets without the need for traditional trading pairs. It renders profits in the absence of collateral risk, and also allows for arbitrage opportunities by taking advantage of price disparities between different decentralized finance (DeFi) platforms.[2]

Flash swaps are typically used for arbitrage, which is the practice of buying an asset in one market and selling it in another market for a profit. A user could use a flash swap to borrow ETH from a liquidity pool on Uniswap, and then sell the ETH on another exchange for a higher price. Following the sale, the user would then be obligated to repay the borrowed amount within the same transaction block.[3]

Flash swaps can be used to amplify the potential profits of a trade, but also the potential losses. Flash swaps are primarily used for liquidity provision and risk management. Liquidity providers can utilize flash swaps to quickly swap out one asset for another in order to rebalance their portfolio or hedge against potential losses. This flexibility enables them to optimize their positions and maximize returns. [3][4]

How Flash Swap Works

Flash swaps work by using a smart contract. The smart contract specifies the assets that are being borrowed, the actions that are being performed with those assets, and the conditions that must be met for the transaction to be successful. The smart contract is executed in a single transaction. To utilize a flash swap, the user needs to:

- Find a DeFi protocol that supports flash swaps.

- Connect their wallet to the DeFi protocol.

- Create a flash swap transaction.

- Specify the assets to borrow, the actions to perform with those assets, and the conditions for the transaction's success.

- Submit the flash swap transaction.

This process allows participants to access liquidity and execute desired actions seamlessly within the DeFi ecosystem. If the transaction fails, the borrowed assets are not returned to the liquidity pool.[4][1]

Benefits of Flash Swap

Flash swaps offer several notable benefits within the decentralized finance (DeFi) ecosystem:

No Collateral Requirement

One of the most significant advantages of flash swaps is that they do not require users to provide collateral upfront. This means traders can access liquidity without tying up their assets in a collateralized position. This feature enhances capital efficiency and allows traders to unlock the full potential of their holdings.

Arbitrage Opportunities

Flash swaps are often used to exploit arbitrage opportunities in the DeFi space. Traders can swiftly take advantage of price differences across different platforms or tokens without needing to hold the assets they are trading. This enables them to profit from market inefficiencies in real time.

Reduced Risk

Flash swaps are designed for near-instant execution, typically within a single transaction block. This reduces the exposure to market volatility and price fluctuations, as the entire transaction occurs within a brief timeframe.

Liquidity Provision

Flash swaps also benefit liquidity providers. Users who supply assets to flash swap pools earn fees, making it an attractive option for those looking to earn passive income by providing liquidity to the DeFi ecosystem.

Efficiency and Speed

Flash swaps are incredibly fast and efficient because of their simultaneous execution mechanism. This makes them a preferred choice for traders who want to execute transactions quickly.

Innovative Finance

Flash swaps represent an innovative financial tool that showcases the capabilities of smart contracts and blockchain technology. They have expanded the possibilities of DeFi by offering new ways to access liquidity and conduct complex financial operations.

Accessibility

Flash swaps are accessible to a wide range of users, from individual traders to institutions. This inclusivity democratizes access to financial markets and opportunities, leveling the playing field for participants.

Market Efficiency

By enabling traders to take advantage of price discrepancies and inefficiencies in the market, flash swaps contribute to overall market efficiency, helping to align prices across different platforms and reducing arbitrage opportunities over time. [5][6][1]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)