Subscribe to wiki

Share wiki

Bookmark

Uniswap (DEX)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Uniswap (DEX)

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain, enabling peer-to-peer trading of digital assets through automated market makers. Its native governance token, UNI, empowers users to participate in decision-making and earn rewards for providing liquidity to the platform. [2]

Overview

Uniswap, founded on November 2, 2018 by Hayden Adams, operates with a permissionless design, allowing open access to anyone without selective restrictions. Uniswap employs smart contracts, acting as an automated market maker, facilitating the trading of various digital assets via liquidity pools that automatically rebalance after each trade, ensuring efficient and secure asset swaps. Users can participate in Uniswap in several ways, including creating new markets, swapping assets in existing markets, providing liquidity to earn rewards in the platform's native token, UNI, and participating in platform governance through voting. Uniswap's open-source nature allows anyone to copy its code and create their own decentralized exchanges, and it supports ERC-20 tokens and compatible infrastructure. [2][16][17]Uniswap v2 operates on Arbitrum, Polygon, Optimism, Base, Binance Smart Chain, and Avalanche. Users can swap tokens and provide liquidity across these supported chains through the Uniswap interface.[18]

UNI

UNI is an ERC-20 token that serves as the governance token for Uniswap. Launched in September 2020, UNI was distributed through an airdrop to users who engaged with the protocol by participating in token swaps or providing liquidity.

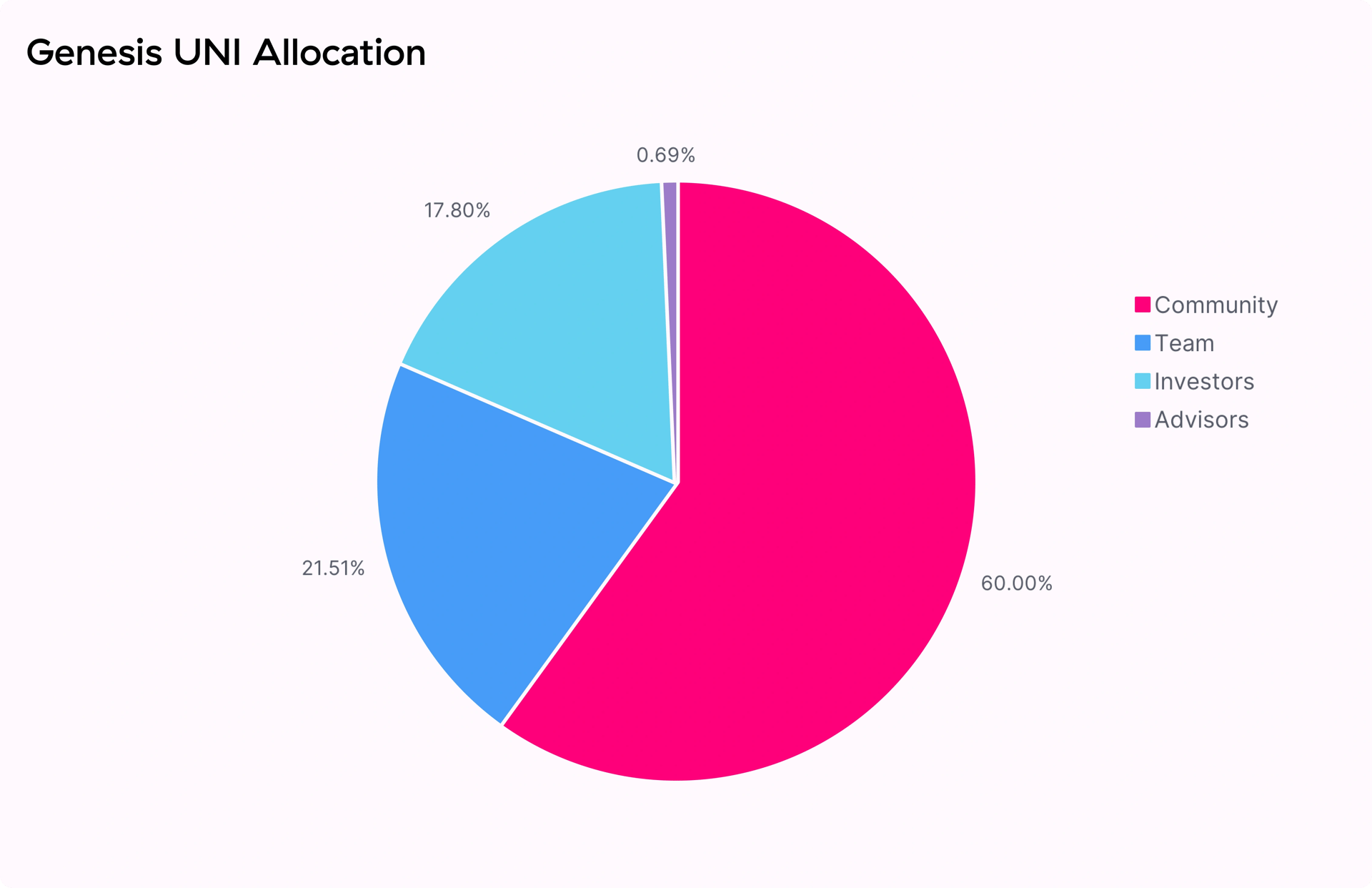

UNI Allocation

1 billion UNI were minted during genesis and will become readily available over four years. The tokens will be allocated as follows:

- 60% (600,000,000 UNI) - Uniswap community members.

- 21.266% (212,660,000 UNI) - team members and future employees with 4-year vesting.

- 18.044% (180,440,000 UNI) - investors with 4-year vesting.

- 0.69% (6,900,000 UNI) - advisors with 4-year vesting.[5]

Liquidity Mining

A liquidity mining program for the token went live on September 18, 2020, and ran until November 17, 2020. Throughout this period, the pools "ETH/USDT", "ETH/USDC", "ETH/DAI", and "ETH/WBTC" were given liquidity mining incentives liquidity mining. 5,000,000 UNI was allocated per pool in proportions equal to liquidity. This brought roughly 83,333 UNI per pool per day to Liquidity Providers (LPs), or 13.5 UNI per pool per block, in a 14s block time.[6]

Timelock

The Timelock contract can modify system parameters, logic, and contracts in a ‘time-delayed, opt-out’ upgrade pattern. Timelock has a hard-coded minimum delay of 2 days, which is the least amount of notice possible for a governance action. Each proposed action will be published at a minimum of 2 days in the future from the time of announcement. Major upgrades, such as changing the risk system, may have up to a 30-day delay. Timelock is controlled by the governance module; pending and completed governance actions can be monitored on the Timelock Dashboard.

Uniswap Grant Program

On December 3, 2020, Jesse Walden and Ken Ng proposed creating the Uniswap Grant Program. The purpose of the Uniswap Grant Program would be to provide resources that would help grow Uniswap's ecosystem. By rewarding developers with incentives, bounties, and infrastructure support, the funding and committee would aid in maintaining Uniswap and helping it grow.

The proposal includes a quarterly budget of $750,000, with the budget and caps to be assessed every six months.

The proposal also includes the creation of a committee of six members to dispense the grants, where 1 of them leads and the other 5 reviews. The proposed members are,

- Program Lead: Ken Ng

- Reviewer: Jesse Walden

- Reviewer: Monet Supply

- Reviewer: Robert Leshner

- Reviewer: Kain Warwick

- Reviewer: TBD. Potentially a member of the Uniswap team.

Evolution of Uniswap

Uniswap v2

Uniswap v2, launched on March 23, 2020, is a decentralized marketplace for pooled, automated liquidity provision on the Ethereum blockchain, Uniswap v2 offers a trustless platform for converting ERC-20 tokens. Unlike Uniswap v1, which primarily involved liquidity pools between ETH and a single ERC-20 token, Uniswap v2 introduces the concept of ERC-20/ERC-20 pairs, enabling any ERC-20 token to be pooled directly with any other ERC-20 token. [10]

ERC20/ERC20 Pairs

In Uniswap v2, any ERC-20 token can be paired directly with any other ERC20 token, enhancing liquidity providers' flexibility. Although Wrapped Ether (WETH) is used instead of native ETH in the core contracts, users can still utilize ETH through external helper contracts. [10]

Price Oracles

Uniswap v2 introduces highly decentralized and manipulation-resistant on-chain price feeds through time-weighted average prices (TWAPs). These price feeds are essential for various decentralized financial applications, such as derivatives, lending, margin trading, and prediction markets. [10]

Flash Swaps

Uniswap v2 facilitates flash swaps, allowing users to withdraw ERC-20 tokens from Uniswap without upfront costs and execute arbitrary code. By the end of the transaction, users must either pay for the withdrawn tokens, return them, or a combination of both, enabling unique use cases, such as arbitrage without upfront capital. [10]

Core/Helper Architecture

Uniswap v2 adopts a core/helper architecture, where core smart contracts focus on securing liquidity in pools, while external helper contracts handle logic related to trader security or ease-of-use. This design improves flexibility and modularity for developers building on top of Uniswap. [10]

Protocol Charge Mechanism

In pursuit of self-sustainability, Uniswap v2 introduces a protocol charge mechanism. At launch, this mechanism defaults to 0, and the liquidity provider fee is set at 0.30%. If activated, the protocol charge becomes 0.05%, and the liquidity provider fee changes to 0.25%. The protocol charge is hardcoded into the decentralized core contracts and can be enabled or adjusted through a future decentralized governance process. [10][11]

Uniswap v3

Uniswap v3, launched on March 23, 2021, aims to make an improvement in automated market makers (AMMs). A central concept of Uniswap v3 is "concentrated liquidity," which introduces the ability to limit liquidity within specific price ranges instead of uniformly distributing it across the entire price spectrum. This approach aims to improve capital efficiency and optimize trading within targeted price intervals. [12]

Concentrated Liquidity

Uniswap v3 introduces the concept of concentrated liquidity, allowing liquidity to be bounded within custom price ranges. Earlier versions distributed liquidity uniformly along the x * y = k price curve, covering the entire price range (0, ∞). However, Uniswap v3 enables liquidity providers (LPs) to create positions within specific price ranges, acting as constant product pools with larger virtual reserves. [12][13]

Multiple Fee Tiers

Unlike previous versions with a fixed 0.30% fee, Uniswap v3 introduces multiple fee tiers for each trading pair. LPs can choose from three fee tiers: 0.05%, 0.30%, and 1.00%. This flexibility allows LPs to adjust their margins based on the expected volatility of the pair, resulting in a more balanced and efficient fee structure. [12][13]

Advanced Oracles

Uniswap v3 upgrades its time-weighted average price (TWAP) oracle, removing the need for users to track previous accumulator values externally. It also employs a geometric mean price oracle that tracks the sum of log prices, offering enhanced precision and accuracy in price calculations. [12][13]

Liquidity Providers' Flexibility

LPs can create multiple positions on different price ranges, approximating any desired distribution of liquidity on the price space. This approach allows the market to allocate liquidity effectively, and rational LPs can optimize their capital costs by concentrating liquidity around the current price. [12][13]

Uniswap v4

Uniswap v4, announced on June 13, 2023, is the latest iteration of the Uniswap Protocol. Building on the achievements of Uniswap v3, which processed over $1.5 trillion in trading volume, Uniswap v4 aims to introduce new possibilities for liquidity creation and token trading on the blockchain. [14]

Customizable Liquidity with Hooks

A core focus of Uniswap v4 is to enable flexibility and customization for liquidity providers through the introduction of "hooks." These hooks are external contracts that execute specific logic at key points in a pool's lifecycle, allowing developers to innovate and create custom Automated Market Maker (AMM) pools. With hooks, pools can be designed to natively support dynamic fees, incorporate onchain limit orders, implement a time-weighted average market maker (TWAMM) to manage large orders over time, and much more. [14][15]

Action Hooks

Action hooks are specified when creating a pool and implement custom logic that the pool calls during execution. Uniswap v4 supports eight hook callbacks, allowing for gas-efficient and expressive control of desired callbacks. [14][15]

Hook-Managed Fees

Uniswap v4 allows fees on swapping and liquidity withdrawal. Swap fees can be static or dynamically managed by a hook contract, which can allocate a percentage of the fees to itself. Withdrawal fees are set using hook contracts, with the collected fees directed to the respective hook contract. Hook contracts have the flexibility to allocate fees as needed, such as to liquidity providers, swappers, or other parties. The pool's fee settings are determined by immutable flags set during pool creation, including static or dynamic fees and permissions for hooks to take fees. [14][15]

Efficient Singleton Architecture

Uniswap v4 adopts an efficient "singleton" contract architecture, which centralizes all pools within a single smart contract. This architectural change significantly reduces gas costs for pool creation and multi-pool swaps. The introduction of "flash accounting" further enhances efficiency by transferring assets only on net balances, resulting in gas savings during trades that span multiple pools. [14][15]

Native ETH Support

Uniswap v4 brings back support for native ETH in trading pairs, eliminating the need for users to wrap ETH into an ERC-20 token (WETH) before trading on the Uniswap Protocol. This improvement results in reduced gas costs for ETH users. [14][15]

Governance and License

The Uniswap community will govern Uniswap v4, just like previous versions, ensuring transparency and open decision-making. The protocol's code will be released under a Business Source License 1.1, which initially limits commercial usage but will convert to a GPL license after four years. Uniswap Governance and Uniswap Labs can grant exceptions to the license. [14][15]

UniswapX

UniswapX, the permissionless and open-source trading protocol, was introduced on July 17, 2023, as an extension of the Uniswap Protocol. Its primary goal is to enhance onchain trading and self-custody swapping. By aggregating liquidity sources and employing a Dutch auction-based model, UniswapX aims to offer users better prices by ensuring competitive pricing through the involvement of a network of third-party fillers. This eliminates the need for manual integration and ongoing maintenance efforts. Additionally, UniswapX enables gas-free swapping by allowing swappers to sign offchain orders that are then submitted onchain by fillers who bear the gas costs, making transactions more cost-efficient and eliminating costs for failed swaps. [8][9]

Moreover, UniswapX addresses the issue of Maximal Extractable Value (MEV) by returning potential gains from arbitrage transactions back to swappers, thereby improving the overall price efficiency of swaps. The protocol also mitigates other forms of MEV by preventing sandwich attacks and incentivizing fillers to use private transaction relays when routing orders to onchain liquidity venues. In the future, UniswapX plans to expand its capabilities to include gas-free cross-chain swaps, enabling seamless trading between different blockchain networks. This will provide users with increased flexibility and convenience when transacting across chains. Built on the principles of security, self-custody, and community, UniswapX offers an immutable smart contract that cannot be modified or paused by any party, ensuring trust and decentralization. [8][9]

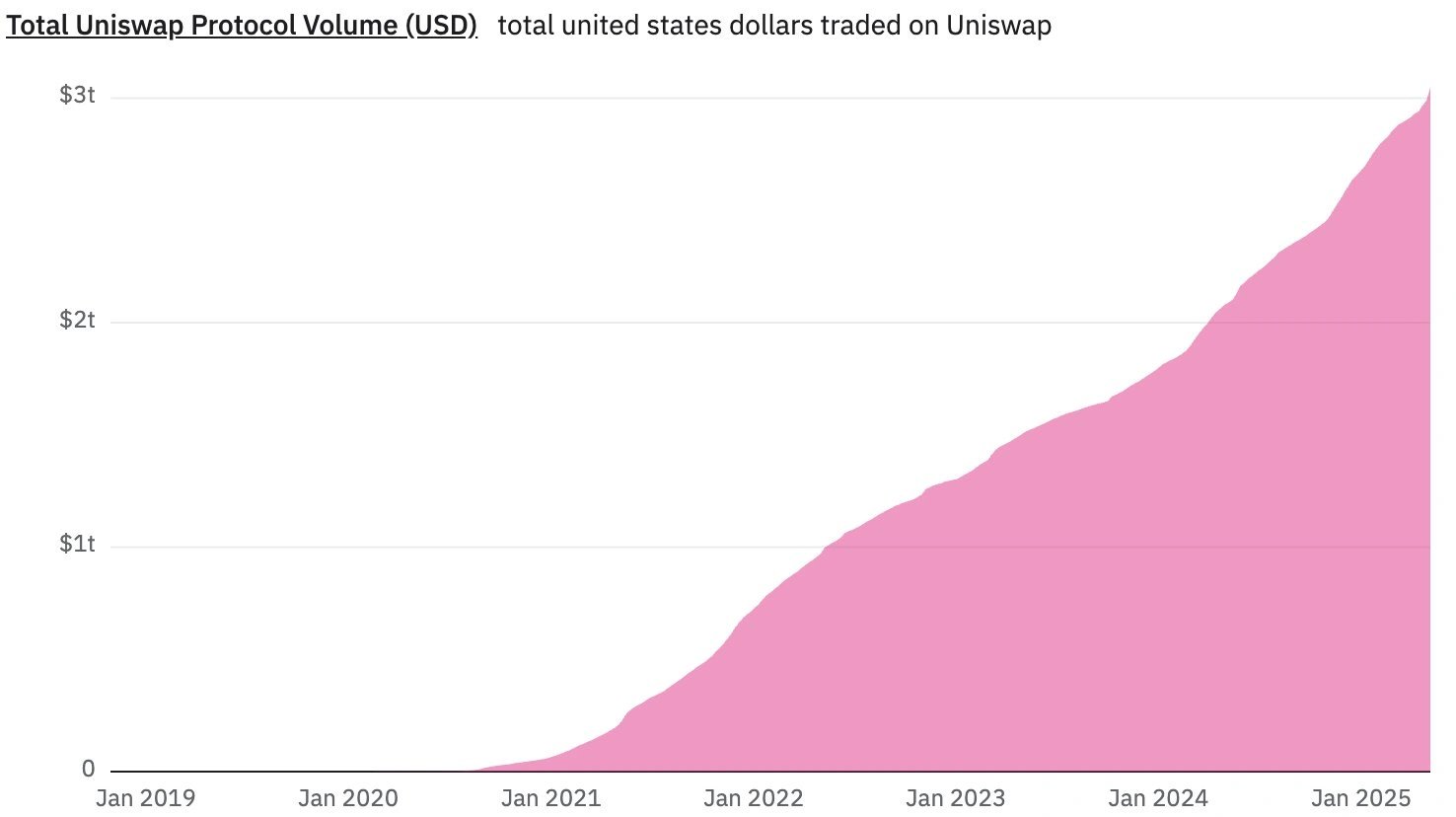

First DEX to Surpass $3 Trillion Milestone

On May 12, 2025, Uniswap became the first DEX to reach $3 Trillion in total trading volume marking a significant milestone. [19]

This milestone was announced by Uniswap founder Hayden Adams, showcasing the platform’s growing role in the DeFi ecosystem. [19]

"Uniswap is the first DEX to $3T volume 🦄

Bet its the first to 10

Grateful to everyone who swapped along the way as we decentralize the global finance system 🌐" - he tweeted [20]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)