위키 구독하기

Share wiki

Bookmark

UNI

0%

UNI

UNI 토큰은 ERC-20 거버넌스 토큰으로, 탈중앙화 오픈 소스 거래소 유니스왑에서 발행합니다. UNI는 2020년 9월에 출시되었으며 토큰을 스왑하거나 유동성을 제공하여 프로토콜과 상호 작용한 사용자에게 에어드롭되었습니다.

UNI 거버넌스 토큰의 출시는 총 토큰 공급량의 15%를 2020년 9월 1일 이전에 유니스왑 플랫폼을 사용한 모든 사람이 청구할 수 있도록 한 가장 주목할 만한 DeFi 에어드롭 중 하나였습니다. 각 사용자는 출시 당시 1,344달러 상당의 400 UNI를 받았습니다. [3] [2]

토큰 에어드롭

2020년 9월 16일, 유니스왑은 UNI를 플랫폼의 거버넌스 토큰으로 소개했습니다. UNI 토큰 에어드롭은 탈중앙화 금융 (DeFi) 세계에서 중요한 사건이었습니다. 에어드롭은 유니스왑 프로토콜에 의해 수행되었습니다.

1억 5천만 UNI, 즉 토큰 공급량의 15%가 프로토콜의 초기 채택자인 2020년 9월 1일 이전에 플랫폼과 상호 작용한 250,000개 이상의 주소에서 사용할 수 있게 되었습니다. 에어드롭 중에 뉴스가 입소문이 나면서 13,000명의 유니스왑 사용자가 출시 후 처음 3시간 이내에 당시 1,344달러 상당의 400개의 무료 UNI를 청구했습니다.

신세틱스 설립자 카인 워윅은 이 움직임을 “갤럭시 브레인 움직임”이라고 부르며 에어드롭이 “우리가 본 최고의 토큰 배포”라고 덧붙였습니다.

터키 카디르 하스 대학교의 “암호화폐 입문” 수업에 등록한 학생들은 유니스왑의 UNI 토큰 배포의 예상치 못한 승자가 되었습니다. 수업 강사 중 한 명인 이스마일 하키 폴라트는 코인텔레그래프 터키에 수업 프로젝트의 일환으로 유니스왑에서 토큰을 상장하고 스왑하는 데 참여한 모든 학생이 400 UNI를 받았다고 말했습니다. 터키 현지 통화로 환산하면 약 12,000리라, 즉 약 1,570달러로 일부 학생들의 연간 교육비의 거의 절반을 차지합니다.

UNI는 출시 당일 12개 이상의 거래소에 상장되었으며, 바이낸스는 90분 이내에 토큰을 상장한 최초의 거래소 중 하나였습니다. 이로 인해 거래량이 19억 달러에 달했습니다. UNI 에어드롭은 사용자가 DeFi 커뮤니티에 참여할 수 있는 방법이었습니다. UNI 토큰을 보유함으로써 사용자는 유니스왑 프로토콜 개발에 기여할 수 있습니다. [1] [3] [4] [11] [12] [13]

토큰노믹스

UNI의 총 공급량은 10억 개입니다. 유니스왑은 4년에 걸쳐 이러한 토큰을 출시한 다음 네트워크 참여를 장려하기 위해 2%의 영구적인 인플레이션율을 구현할 것입니다. [7]

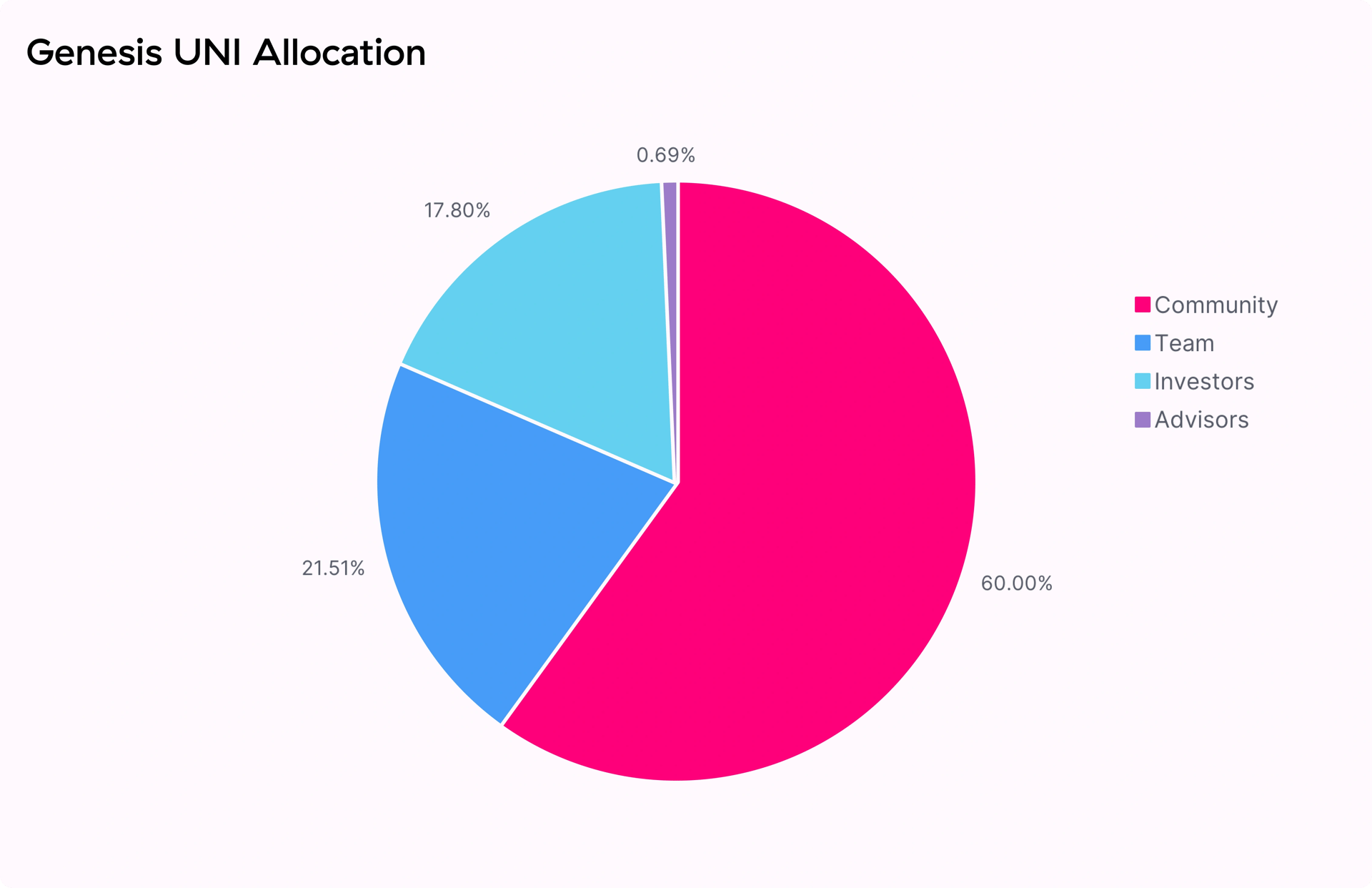

UNI 토큰의 초기 4년 배포는 다음과 같습니다.

- 커뮤니티 구성원에게 60%, 즉 6억 UNI

- 팀원 및 향후 직원에 4년 베스팅으로 21.51%, 즉 215,101,000 UNI

- 투자자에게 4년 베스팅으로 17.8%, 즉 178,000,000 UNI

- 고문에게 4년 베스팅으로 0.69%, 즉 6,900,000 UNI [4]

할당된 UNI의 15%는 2020년 9월 1일 00:00 UTC에 종료되는 스냅샷을 기준으로 과거 유동성 공급자, 사용자 및 SOCKS 상환자/보유자가 청구했으며, 여기에는 성공하지 못한 거래를 제출한 사용자도 포함됩니다. 각 사용자는 출시 당시 1,344달러 상당의 400 UNI를 받았습니다.

- 모든 49,192명의 과거 유동성 공급자에게 비례 배분 4.91664% (49,166,400 UNI)

- 모든 251,534개의 과거 사용자 주소에 균등하게 분할 10.06136% (100,613,600 UNI)

- 220명의 SOCKS 보유자/상환자에게 0.022% (220,000)

UNI는 아래 일정에 따라 지속적으로 거버넌스 재무부에 귀속됩니다. 거버넌스는 2020년 10월 18일 00:00 UTC부터 귀속된 UNI에 액세스할 수 있습니다.

| 연도 | 커뮤니티 재무부 | 배포 % || ---- | ------------------ | -------------- || 1년차 | 172,000,000 UNI | 40% || 2년차 | 129,000,000 UNI | 30% || 3년차 | 86,000,000 UNI | 20% || 4년차 | 43,000,000 UNI | 10% |

팀, 투자자 및 고문 UNI 할당은 동일한 일정으로 토큰이 잠깁니다. [4] [7]

유동성 채굴

UNI의 커뮤니티 배포의 일부는 유동성 채굴을 통해 이루어집니다. 이 방법은 아래 나열된 유니스왑 풀에 유동성을 제공하는 사람들에게 UNI를 배포하는 것을 포함합니다.

유틸리티

UNI 보유자는 해당 법률 및 규정을 준수하여 거버넌스 결정이 이루어지도록 할 책임이 있습니다. 그들의 초점은 유니스왑의 미래를 형성할 수 있는 일련의 프로토콜 대표를 투표하고 수수료를 징수할 특정 토큰 풀을 투표하는 데 있습니다. [4]

2023년에 유니스왑 팀은 “수수료 전환” 제안을 투표에 부칠 계획입니다. 유니스왑 커뮤니티는 탈중앙화 암호화폐 거래소의 일부 풀에서 “수수료 전환”을 시범 운영할지 여부에 대해 투표할 예정입니다. 이 제안은 유니스왑이 선택된 유동성 풀에서 매개변수를 테스트할 수 있는 기회를 제공합니다. 여기에는 DAI-ETH의 0.05%, ETH-USDT의 0.3%, USDC-ETH의 1%가 포함됩니다. 선택된 풀의 해당 비율에 10%의 수수료가 적용됩니다. 이는 코드에서 허용하는 최소값입니다. 유니스왑의 기본 스마트 계약은 배포되는 순간 변경할 수 없었습니다. 수수료 전환을 켜도 프로토콜을 사용하여 직접 스왑하는 사용자에게는 영향을 미치지 않지만 현재 유동성 공급자에게 지급되는 금액의 일부를 유지합니다.[25][26][27]

UNI 토큰에 대한 비탈릭 부테린

2021년 5월, 이더리움 창시자 비탈릭 부테린은 유니스왑의 UNI 토큰이 ETH/USD에 대한 오라클 가격 토큰이 되어 DeFi 생태계가 공정 가치를 ‘시가 평가’할 수 있도록 하여 스마트 계약 실행을 위한 보다 강력한 메커니즘을 제공할 수 있도록 하는 제안을 했습니다. 그는 가격 오라클이 오거와 유사한 방식으로 모델링되어야 한다고 말했습니다. [15]

부테린은 ‘알고리즘 스테이블코인’의 채택 증가로 인해 발생한 필요성과 ETH/USD의 오라클 가격의 필요성을 강조했습니다. 그의 제안에서 부테린은 다음과 같이 말했습니다.

"저는 유니스왑과 UNI 토큰이 개입하여 (예: Augur 또는 UMA 디자인을 모델로 하여) 견고하고 조작하고 공격하는 데 매우 비용이 많이 드는 가격 데이터를 제공하는 데 특화된 오라클을 제공할 것을 권장합니다." [16]

유니스왑은 아직 비탈릭의 제안을 투표에 부치지 않았습니다. 그러나 유니스왑의 설립자이자 CEO인 헤이든 애덤스는 트위터에서 이에 대한 관심을 표명했습니다.

👀 @VitalikButerin의 @Uniswap 거버넌스 / UNI가 디파이에 대한 오라클 서비스를 제공하기 위한 제안. 👂사람들이 어떻게 생각하는지 궁금합니다!! [20]

유니스왑 재단

유니스왑 재단을 설립하자는 제안은 2022년 8월 4일에 유니스왑 커뮤니티 구성원에 의해 이루어졌으며 2022년 8월 17일부터 8월 23일까지 투표에 부쳐졌습니다. 이 제안은 승인을 받으려면 약 4천만 표가 필요했으며 8천 8백만 표 이상을 받았으며 UNI 토큰 보유자의 총 투표수의 99% 이상을 받았습니다.

데빈 월시와 켄 응은 초기 아이디어를 제출하고 “어젯밤 유니스왑 재단을 설립하자는 우리의 제안이 최종 투표를 통과했습니다!”라고 트윗했습니다. 월시와 응은 모두 유니스왑 커뮤니티 구성원이며 전 유니스왑 랩 임원입니다. [17][ [18] [19]](#cite-id-t6j4bakwww)

유니스왑 재단은 마찰을 제거하고 야심차고 영향력 있는 프로젝트에 대한 보조금을 활성화하여 유니스왑 생태계의 거버넌스를 개선하기 위해 노력할 것입니다.

- 유니스왑 거버넌스 포럼에 제출된 제안서에 따르면.

이 제안은 커뮤니티로부터 엇갈린 피드백을 받았으며, 많은 사람들이 재단의 유니스왑 생태계를 지원하고 확장하려는 계획을 칭찬하는 반면, 다른 사람들은 7,400만 달러의 비용에 눈살을 찌푸렸습니다.

유니스왑 CEO인 헤이든 애덤스는 트윗에서 이 계획에 긍정적으로 반응했습니다.

“생태계의 강점은 성공을 향해 구축하고 노력하는 각 추가 팀과 함께 성장합니다. Imo, 이것이 통과된 후 재단은 프로토콜이 생존할 뿐만 아니라 번성하는 미래를 향해 노력하는 또 다른 팀이 될 것입니다!” [21]

2022년 8월 23일, 이 제안은 총 투표수의 8,600만 표 또는 99%가 찬성하고 770표가 반대하여 최종 투표를 통과했습니다. 데빈 월시는 트윗에서 발표했습니다.

어젯밤 유니스왑 재단을 설립하자는 우리의 제안이 최종 투표를 통과했습니다! 우리는 이미 최우선 과제에 착수했습니다. UF 팀에 합류할 재능 있고 가치관이 일치하는 후보자 인터뷰 UGP 확장 (다음 달에 Grants Wave 9 발표를 기대하십시오) 거버넌스 활성화 (곧 포럼 토론을 기대하십시오.[22][23][24]

잘못된 내용이 있나요?