Subscribe to wiki

Share wiki

Bookmark

LUMINT

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

LUMINT

LUMINT is a project developed by the Neural Trust Foundation that integrates blockchain technology with artificial intelligence (AI) to create a participant reward system and a suite of AI-driven asset management services. The project aims to build a blockchain-based financial ecosystem designed for long-term value and stability. [1] [2]

Overview

The LUMINT project was initiated by the Neural Trust Foundation, described as a joint venture between artificial intelligence companies in the United States and Korea. The project proposes a hybrid model that combines elements of decentralized finance (DeFi) with AI-powered asset management. It was designed to address common challenges in the cryptocurrency market, such as the high energy consumption of Proof-of-Work (PoW) mining, the complexities of some Proof-of-Stake (PoS) models, market volatility, and the perceived lack of practical utility for many digital assets. [2]

LUMINT's core strategy is centered on creating long-term value by implementing a structure intended to increase token scarcity over time. This is pursued through a combination of a node-based staking system, AI-driven services that generate demand for the native token, and deflationary mechanisms. The project's stated vision is to establish a global, blockchain-based financial ecosystem. This is planned to be achieved through listings on major cryptocurrency exchanges and the continuous development of its infrastructure, with plans for subsequent second and third projects to expand its scope. The project began its public presence in August 2025. [3] [4]

Products

Lumint Node Staking Framework (LNSF)

The LNSF is a decentralized reward system where participants can purchase and operate nodes to support the network. Node operators contribute to the ecosystem's security and scalability and receive daily token rewards in return. This system is presented as a resource-efficient alternative to traditional mining, designed to lower the barrier to entry for network participation. [1] [4]

AI-Powered Services Platform

This is a suite of applications and tools that use AI to provide data analysis, trading signals, and portfolio management services for the cryptocurrency market. The platform is intended to serve as the core utility driver for the LUMINT token. [2]

- Intelligent Investment Signals/Alerts: This service uses deep learning to analyze on-chain data, exchange activity, and liquidity flows to generate trading signals. It is designed to detect market anomalies, such as large "whale" movements, and provide automated buy or sell alerts.

- AI Automated Trading/Portfolio Management: An application that executes automated trading strategies based on real-time market data. It also provides recommendations for portfolio rebalancing by analyzing both on-chain and off-chain data sources.

- AI-Based Crypto Trend Report Service: This service utilizes generative AI to produce market trend reports. It analyzes data points including transaction volumes, active user numbers, and capital flows between centralized and decentralized exchanges.

- Personalized Alerts/Forecasts: A feature that delivers customized notifications and risk alerts to users based on their specific wallet holdings, tokens of interest, and observed trading patterns.

Key Features

- Smart Mining System: An algorithmic mechanism that dynamically adjusts the daily mining output based on the token's market price. The system is designed to decrease rewards during periods of significant price increase to prevent market oversaturation and increase rewards during price declines to support the ecosystem.

- AI-Linked DeFi: A portion of user rewards and platform fees are allocated to funds managed by proprietary AI investment algorithms. The profits generated from these AI-managed funds are then redistributed to staking participants, creating a potential additional source of yield.

- Deflationary Tokenomics: The project includes an automatic token burn mechanism. A percentage of LUMINT tokens are permanently removed from circulation during specific on-chain activities, such as wallet transfers, withdrawals, and payments within the ecosystem, with the goal of increasing token scarcity over time.

Use Cases

- Earning rewards through the purchase and operation of a node within the Lumint Node Staking Framework (LNSF).

- Gaining exclusive access to the platform's AI-powered investment, trading, and market analysis applications.

- Paying for subscriptions to premium services, such as advanced analytics, trend reports, and intelligent investment signals.

- Staking tokens to receive higher tiers of service or additional rewards within the ecosystem.

- Participating in community activities, such as sharing AI-driven trading strategies.

- Serving as a medium of exchange within future gaming and entertainment services planned for integration into the ecosystem. [1] [2]

Architecture

LUMINT operates on a hybrid architecture that merges DeFi principles with AI-driven asset management. The project's native token, LUMINT, is a BEP-20 token on the BNB Smart Chain. The technical architecture is composed of several interconnected systems. [4] [3]

- LUMINT Node Staking Framework (LNSF): This is the foundational reward distribution system. It operates on a dual-reward structure that provides automated daily allocations and performance-based incentives. According to the project's documentation, all initial token distribution occurs through this framework.

- Smart Distribution Engine: Described as the "brain" of the ecosystem, this engine implements the dynamic supply control mechanism. It uses real-time data on market price, circulating supply, and the number of participants to adjust token distribution algorithmically. It is also designed to detect and penalize abusive behaviors that attempt to exploit the reward system.

- AI-Based Cryptocurrency Data Analysis Platform: This is the technological backbone for LUMINT's product offerings. The platform is built to collect, process, and analyze large volumes of data, including on-chain transactions, exchange order books, and alternative data such as social media sentiment.

- Autonomous Burn Logic: A feature embedded within the project's smart contracts that automatically executes the token burn protocol during specified transactions. This ensures the deflationary mechanism is enforced transparently and consistently on-chain.

Tokenomics

The native utility token of the LUMINT ecosystem is $LUMINT. It is a BEP-20 token on the BNB Smart Chain with a total supply of 3 billion. [4]

Allocation

- Ecosystem (35%): Reserved for node staking rewards, marketing, user incentives, and initial exchange liquidity. Approximately 94% of this allocation is locked, with a monthly vesting schedule of 10,000,000 tokens over 100 months, beginning three months after the first exchange listing.

- Investors and Project Funding (35%): Allocated for early-stage system development, marketing, and operational costs. This portion follows the same 100-month vesting schedule as the Ecosystem fund.

- Team (15%): For core team members. This allocation vests at a rate of 4,500,000 tokens per month over 100 months, starting three months after the first exchange listing.

- Partners (10%): For technology and service partners. This vests at a rate of 3,000,000 tokens per month over 100 months, following the same schedule.

- Advisors (5%): For external advisors. This vests at a rate of 1,500,000 tokens per month over 100 months, also following the same schedule. [2]

Token Utilities

- Access to Services: The token is required to access the project's suite of AI-powered services for trading, analysis, and portfolio management.

- Payment Medium: It serves as the primary means of payment for premium reports, advanced analytics, and other subscription-based features.

- Staking and Rewards: Tokens can be staked to gain access to enhanced benefits and higher reward tiers within the ecosystem. LUMINT tokens are also distributed as rewards to participants who operate nodes.

- Future Utility: The token is planned to be used as a medium of exchange in future gaming and entertainment applications integrated into the ecosystem.

- Community Engagement: Token-based participation in sharing trading strategies or results encourages activity, holding, and circulation of LUMINT. [2]

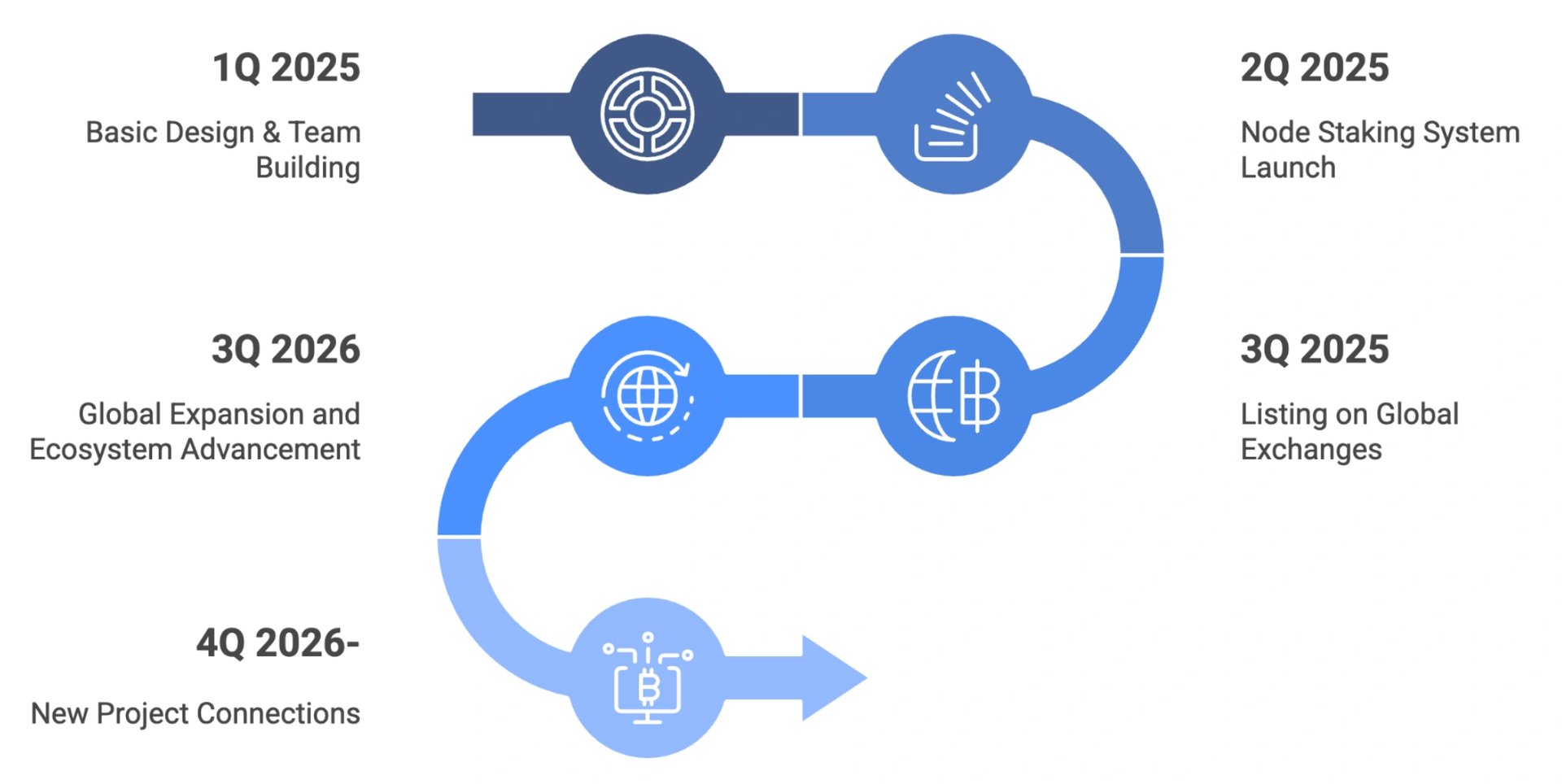

Roadmap

- Phase 1 (Q1 2025): Establish foundational design and team structure, including the white paper, tokenomics review, and node architecture.

- Phase 2 (Q2 2025): Launch the node staking system and validate the 900-day reward algorithm.

- Phase 3 (Q3 2025): Achieve the first listing on a global exchange and officially launch the LNSF system.

- Phase 4 (up to Q3 2026): Expand global partnerships, integrate AI services into the ecosystem, and connect with gaming and entertainment platforms.

- Phase 5 (Q4 2026 onward): Introduce additional coins or benefits for early participants and broaden the range of AI service applications. [2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)