Peapods

Peapods is a decentralized on-chain protocol that aims to facilitate volatility farming without relying on oracles or external price feeds. It seeks to introduce the concept of 'Volatility Farming' to utilize market fluctuations within the DeFi space.[1][2]

Overview

Peapods, established in 2023, is a decentralized protocol that aims to enable volatility farming without relying on oracles or external price feeds. It seeks to provide users with the ability to earn yield on liquid assets by utilizing crypto market volatility. Users can wrap liquid assets into ERC-20 tokens called "Pods" (pTKN), which are fully backed by the underlying assets (TKN) and can be unwrapped as needed.

The protocol generates revenue through arbitrage opportunities between TKN and pTKN prices, with fees distributed to pTKN holders, liquidity providers, and PEAS holders.[1][2][3][4]

Products

Pods

Pods in the Peapods protocol are vaults that aim to wrap assets into an ERC-20 token, pTKN, which can be unwrapped to access the underlying assets. Each Pod has a liquidity pool that earns revenue, ensuring pTKN remains liquid. Price differences between pTKN and TKN provide arbitrage opportunities. Pods are backed 1:1 by the assets and operate in a decentralized manner, allowing users to potentially earn fees as liquidity providers.[2][5]

Revenue

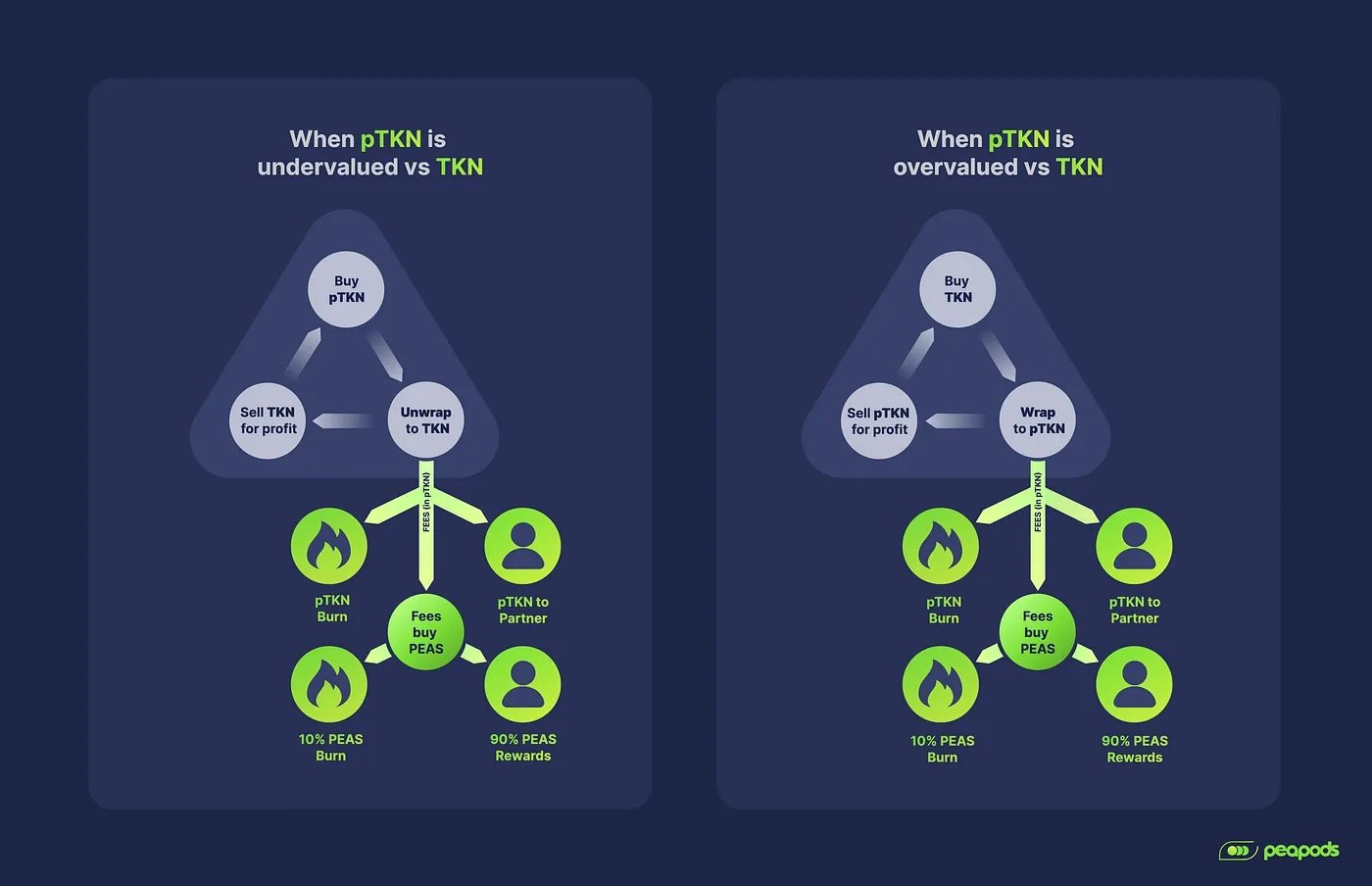

Peapods aims to generate revenue from transaction fees and pTKN trading, supporting yield generation. Up to 50% of this revenue is allocated as pTKN, with a portion potentially distributed to Pod creators, and the rest burned to manage token supply. The remaining revenue is converted to PEAS, with 90% distributed to liquidity providers and 10% burned to promote stability.

Arbitrage revenue provides pTKN holders with yield through token burns, which gradually reduce supply, impacting future unwrap values. After any optional pTKN burn, the tokens are used to acquire PEAS for LP rewards, with 10% allocated for burning.[2]

Green Arrow Pods

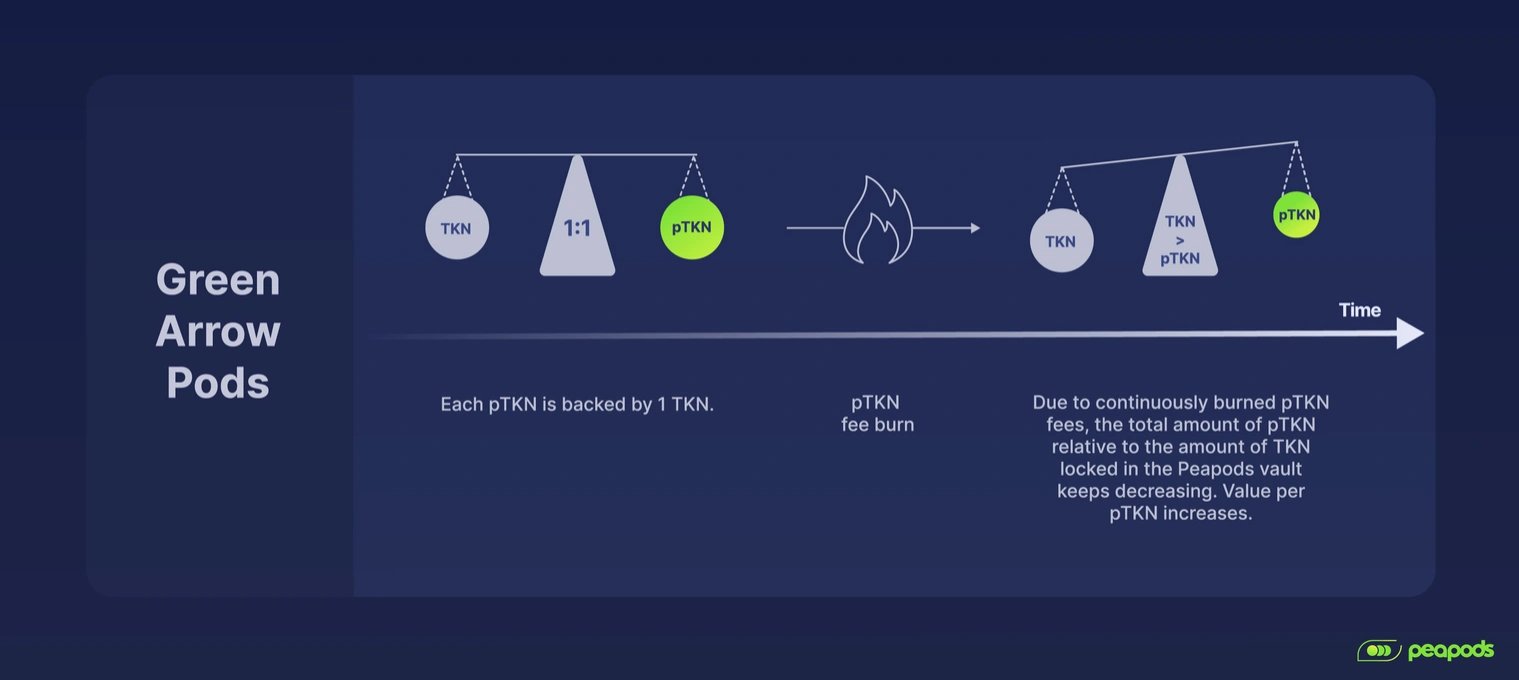

Green Arrow Pods enhance the original Legacy Pods in the Peapods protocol by incorporating a burn fee option that aims to reduce the supply of Pod tokens (pTKN) and increase their backing beyond the initial 1:1 ratio with TKN.

Creators can establish a burn fee percentage, which may raise the TKN backing per pTKN as fees are burned. Pod holders can unwrap their pTKN at any time to claim a share of the underlying TKN.[6]

pOHM

pOHM is a Green Arrow Pod backed by OHM, which utilizes the "Range Bound Stability" (RBS) model to adjust its supply based on market demand. This approach aims to maintain a dynamic price range while providing liquidity providers with greater volatility compared to pegged stablecoins like DAI.

pOHM aims to appreciate against OHM through (un)wrap fees and increased volatility from multiple asset pairings, allowing for greater exposure and reduced impermanent loss.[7]

Tokenomics

Peapods Token ($PEAS)

PEAS is a deflationary rewards token that aims to provide yield to staked liquidity providers (LPs) through volatility and arbitrage. It is fully circulating, with no emissions or reserved rewards, which contributes to net buy pressure.

PEAS is evolving beyond its initial role as a rewards token to incorporate additional utilities.[8][2]

Allocation

The total supply of PEAS is 10,000,000 tokens, allocated as follows:

- 44% (4,400,000) aims to support a Uniswap 1% V3 PEAS/DAI position with a market cap of $100,000 to $300,000.

- 44% (4,400,000) aims to support a Uniswap 1% V3 PEAS/DAI position with a market cap from $100,000 to infinity.

- 12% (1,200,000) is designated for the team, distributed among six members and fully vested.[8]