Subscribe to wiki

Share wiki

Bookmark

Slippage

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Slippage

Slippage or Crypto Slippage is the amount of money lost or gained as a result of market fluctuations while executing an order. It is the difference between the expected price of a trade and the actual price at which the trade is executed.[1]

Slippage occurs particularly in situations where there is high volatility, low liquidity, or rapid price movements. Slippage can affect both buying and selling transactions.[12]

Slippage Tolerance

Slippage tolerance is the acceptable range within which a trader is comfortable with the trade being executed. Generally, the higher the slippage tolerance, the greater the risk of losses due to slippage.

For instance, if a trader sets a slippage tolerance of 1%, it means they are willing to accept a price deviation of up to 1% from their expected price. At that moment, the cryptocurrency’s price may begin to move against the trader before the trade is completed. As a result, the trader may receive a lower price than anticipated, resulting in large losses.

The consideration of choosing the appropriate level of slippage tolerance depends on factors such as market conditions and trading strategies. When markets are volatile, trades may require a higher degree of slippage tolerance to be executed quickly and efficiently. Alternatively, during less volatile times, it may be possible to set lower levels of slippage tolerance which could result in more favorable executions.[11]

Calculation

Slippage

Slippage can be calculated by taking the difference between the current market price and the executed trade price.

Slippage = Current Market Price – Executed Trade Price.

For example, if a buy order for 1 Bitcoin at $10,000 is placed and it is filled at $9,800, then,

Slippage = 10,000-9,800 = $200. In this case, a lower price is received than expected due to slippage.[9]

Slippage Percentage

Slippage percentage can also be calculated by dividing the current market price and the executed trade price by dividing it by the current market price.

Slippage Percentage = (Current Market Price – Executed Trade Price) / Current Market Price.

For instance, from the above-mentioned case, it would be,

Slippage percentage = 200/10,000 = 2%. This means that a lower price is received than expected due to slippage amounting to 2%.[10]

Types

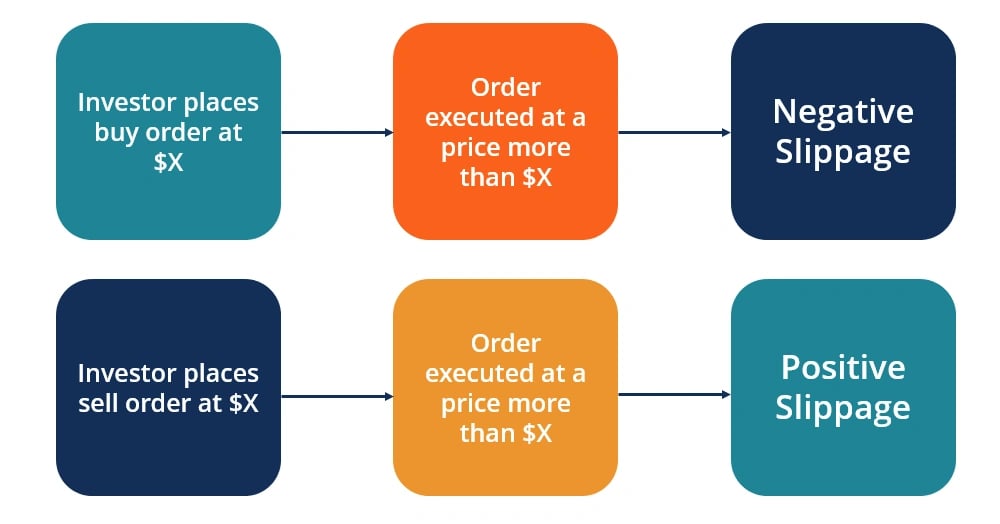

Positive Slippage

Positive Slippage, also called 'price improvement,' occurs when the trade is executed at a better price than the expected price. This can happen in situations of high volatility, where prices move rapidly in favor between the time the user places the order and the time it gets executed.

Negative Slippage

Negative slippage occurs when the trade is executed at a less favorable price than the expected price. It occurs when market conditions change quickly, leading to a discrepancy between the expected and actual prices.[13]

Causes

Market Volatility

Cryptocurrencies are known for their high levels of volatility, which can lead to significant price fluctuations in short periods. This volatility can result in substantial slippage, especially when markets are moving rapidly.

For instance, high volatility in the BTC market incurs a fast price shift caused by high-frequency trades before the order gets filled. This results in the bid/ask prices changing to $20,000.5/$20,001. The order is then filled at $20,001, incurring an extra cost of $1 per BTC for a total of $100 negative slippage on the 100 BTC order.[3]

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without causing substantial price changes. Many cryptocurrencies, especially altcoins, can have lower liquidity compared to more established assets, i.e., there might be fewer buyers and sellers at specific price levels, making it more challenging to execute trades without slippage, particularly for larger orders.

For instance, if a large market buy order of 100 BTC for $20,000 per BTC is placed on an exchange with low liquidity. Some of the orders will have to be matched with sell orders above $20,000 to be 100% executed. Like,

- 50 BTC is matched with a sell order at $20,000;

- 25 BTC is matched with a sell order at $20,001;

- 25 BTC is matched with a sell order at $20,002.

Then, the average price will be $20,000.75, which is higher than the original order amount ($20,000), with a negative slippage of $0.75.[2]

News and Events

Major news releases, announcements, or events can trigger swift and unexpected price movements. Traders often react to these events in real time, causing order imbalances and disruptions in the normal trading process. As a result, the execution price may differ significantly from the expected price.

Exchange Delays and Latency

The speed at which a trade is executed is crucial in the fast-paced cryptocurrency markets. Delays or latency between the time an order is placed and the time it's executed can contribute to slippage, especially during periods of intense market activity.[14]

Managing or Reducing Slippage

Using Limit Orders

Using limit orders instead of market orders can help mitigate slippage. A limit order allows the user to set the maximum price one is willing to pay or the minimum price one is willing to accept. There's a chance that a limit order might not be executed if the market doesn't reach the specified price.[4][7]

Monitoring Market Conditions

Conducting thorough market analysis and staying updated with relevant news to anticipate potential price movements. Being aware of upcoming events and news releases can help to make more informed trading decisions.[7]

Diversifying Trading Times

Markets are typically more liquid during overlapping trading hours of major financial centers. Since liquidity can vary between different cryptocurrency exchanges, trading on exchanges with higher trading volumes, during a high market liquidity period and more participants can be considered to reduce the risk of slippage.[5][7]

Trade Size

Large trade sizes can increase the likelihood of slippage, especially in illiquid markets. By breaking down larger orders into smaller ones, traders can potentially reduce the impact of slippage on individual trades.[7]

Algorithmic Trading Strategies (ATS) like Volume Participation (VP) and Time-Weighted Average Price (TWAP) can be used to help efficiently execute the orders and avoid slippage.[6]

Paying Higher Gas Fee

To reduce the problem of slippage on a decentralized exchange, a trader could speed up the rate at which their transaction is processed. They could choose to pay a higher transaction fee (gas fee) in order for their transaction to be pushed further forward in the queue.[14]

Trading on a Layer 2-based DEXs

When a layer 1 blockchain network gets congested, it slows down the trades and exacerbates the risk of slippage. Thus, traders could opt to use a layer 2-based DEX, which could mean faster transactions, less risk of slippage, and lower gas fees. A trader could use an exchange like QuickSwap, which is built on Polygon.[14]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)