订阅 wiki

Share wiki

Bookmark

Tigris Trade

0%

Tigris Trade

Tigris 是一个去中心化的合成杠杆交易平台,可在 Arbitrum、Meter 和 Polygon 网络上进行交易。它使个人可以直接从他们的数字钱包交易加密货币、外汇和大宗商品。 [1]

概述

Tigris 作为一个合成杠杆交易平台运营,其特点是采用链下 oracle 系统获取价格数据,确保即时交易结算,且不影响安全性。Tigris 以其低费用和快速执行而闻名,对交易开仓和平仓收取 0.1% 的透明费用结构,该费用结构只能通过 DAO 投票进行更改。虽然适用可变资金费用,但它们不会影响利益相关者的收入分成,而是由持有活跃仓位的交易者直接支付和接收。此外,Tigris 还提供高级交易功能,如部分平仓和未平仓头寸的保证金调整,交易针对抵押品池执行。 [1]

历史

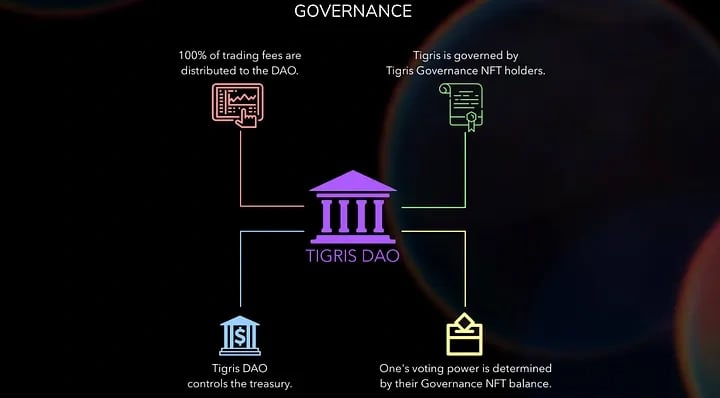

当 Tigris 于 2022 年 9 月推出时,该平台使用了一种治理 NFT 模型。治理 NFT 持有者是 Tigris Trade DAO 的主要利益相关者,并获得 Tigris Trade 产生的收入分成。当时,DAO 决定平均分配收入,一半分配给利益相关者,剩余部分作为 DAI 存入 Stablecoin Vault 中用作抵押品,旨在提高交易规模和杠杆上限。DAO 保留了调整收入分配的灵活性,可能会增加分配给治理 NFT 持有者的部分,前提是金库中存在充足的 流动性。 [2][3]

特点

Oracle 架构

Tigris Trade 采用 oracle 基础设施,该基础设施结合了 oracle 和 keeper 以实现无缝操作。Oracle 从 Pythnet 检索链下价格数据,使用附加信息对其进行增强,并在将数据传输到 keeper 之前对其进行签名。用户通过与 UI 的 HTTPS 交互向 keeper 提交订单,从而实现即时链上执行和结算。Oracle 节点连接到 Pythnet 价格馈送,直接向 Tigris 用户提供资产价格和相关数据以进行市价单交易。此数据包括资产价格、价差、时间戳、节点地址、市场状态和 Oracle 签名。当用户发起交易时,此数据和签名将合并到交易输入参数中,从而确保链上验证。这为交易者提供了可靠的价格,没有 滑点,因为资产价格在交易发起时被锁定。此外,订单执行是即时的,只需要一笔交易,从而简化了平台运营。平台的速度取决于 区块链 的速度。 [4]

流动性金库

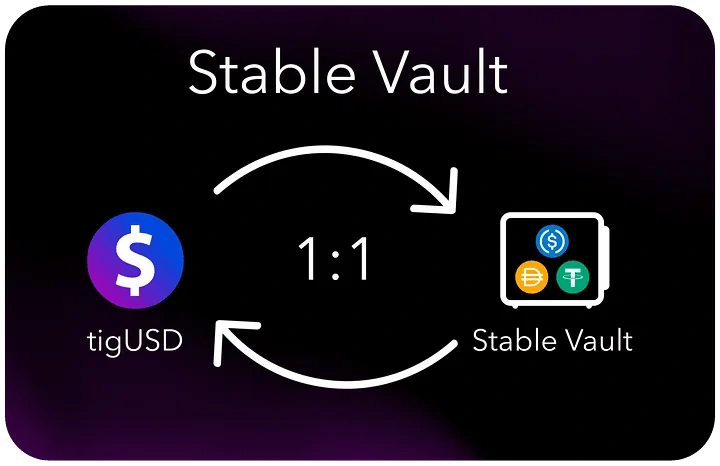

Tigris 的流动性代币 (LT) 是与代币挂钩并由其完全支持的 稳定币,确保以 1:1 的比例保持稳定的 挂钩。这些代币始终以超额抵押来维持稳定性。当在 Tigris 上发起交易时,保证金会自动放入相应的流动性金库中。平仓后,交易者会收到相应的流动性代币作为付款。流动性金库充当交易者的交易对手,负 PnL 和清算有助于其抵押,而正 PnL 则产生相反的效果。用户可以将任何可用的流动性代币与流动性金库中的原生代币相互兑换,保持 1:1 的比例。此外,用户可以将他们的原生代币兑换为 LT,并将它们质押在各自的金库中以提供流动性。质押的流动性代币可赚取一定比例的 交易费用,奖励会在将 LT 添加到现有质押时自动领取。 [5]

二元期权

二元期权使用户能够在固定期限内(从 4 分钟到 4 小时不等)推测资产的短期价格变动。如果期权以价内收盘,则支付额为抵押品的 70%;否则,整个抵押品将丢失。没有费用,但价差适用于开盘价,从而确保以保证价格即时执行交易。开立期权后,抵押品价值的 5% 分配给质押者,其中 3.5% 分配给 TIG 质押者,1.5% 分配给 tigUSD 质押者。来自亏损期权的抵押品保留在交易金库中,从而加强其抵押。 [6]

TIG

Tigris (TIG) 是协议代币,允许用户质押以获得交易费用奖励并参与治理决策。质押者获得 70% 的市价单交易费用和 63% 的限价单和止损单交易费用,剩余的 7% 用于激励机器人处理的执行。交易费用利润以 tigUSD 和 tigETH 的形式实时分配,并且可以通过 Tigris 的网站或质押合约领取。质押者仅在他们质押的链上赚取利润。TIG 作为 Omnichain Fungible Token 运行,并且可以跨 Tigris 部署的不同链进行桥接,由 LayerZero 提供支持。 [7]

代币经济学

TIG 的总供应量为 2,000,000 个代币,并具有以下分配: [7][8]

- 787,800 个代币(39.3%)用于当前的 Gov NFT 持有者,包括团队和金库 NFT(每个 NFT 1300 个 TIG)

- 700,000 个代币(35%)在 40 万个公开销售和 30 万个白名单销售中售出

- 218,300 个代币(10.915%)用于团队

- 193,900 个代币(9.695%)用于金库

- 100,000 个代币(5%)保留用于 空投

xTIG

xTIG 是交易者通过产生平台费用赚取的奖励代币。它是不可转让的,只能在 1 周的交易窗口(称为 epoch)之后领取。每天从格林威治标准时间午夜开始,Tigris 会根据交易者产生的费用在交易者之间分配 100 个 TIG。使用 WETH 作为抵押品的交易在 xTIG 计算中获得双倍权重,以鼓励使用 tigETH 流动性池。交易者可以将他们的代币声明为 xTIG,并选择立即解锁它们,但会受到 50% 的惩罚,或者等到当天结束时解锁并将它们作为 TIG 提取,或者将它们留下以赚取像质押 TIG 一样的交易费用。在总供应量 200 万个 TIG 中,10 万个代币保留用于交易量挖矿,交易奖励在 Arbitrum 上实时提供,每天 100 个 TIG,如有必要,可以进行调整。此外,xTIG 还提供添加额外奖励的选项,允许其他项目赞助 Tigris 上的交易 epoch。 [9][10]

合作伙伴关系

Arbitrum

2022 年 10 月 12 日,TigrisDAO 宣布 Tigris Trade 即将在 Arbitrum 上推出。为了支持在 Arbitrum 上的部署,引入了高级交易管理功能,并提供了另一批 Governance NFT 进行销售。目标是利用具有深度流动性的新市场,并将 Tigris Trade 带给更广泛的受众。Arbitrum Nitro 的最新推出承诺了更高的性能,为 Tigris Trade 快速、高效和实时的定价架构的闪耀奠定了基础。部署了新的智能合约,以简化用户体验并促进合作伙伴更轻松地集成 Tigris Trade 基础设施。 [11]

Pyth

2023 年 3 月 16 日,Tigris Trade 在 v2 更新中集成了 Pyth Price Feeds,为其 Oracle 基础设施提供公平且低延迟的定价。Pyth 提供的低延迟和广泛的资产覆盖范围增强了系统的可靠性和运营流畅性。 [3][12]

发现错误了吗?