订阅 wiki

Share wiki

Bookmark

Bunni

0%

Bunni

Bunni 是一个旨在激励 Uniswap v3 流动性提供的流动性引擎。它包含两个关键组件:一个将 Uniswap 流动性头寸转换为可替代的 ERC-20 代币的协议,以及一个用于鼓励 Bunni 流动性的 vetokenomics 系统。 [1]

2025 年 10 月 23 日,Bunni 团队通过 X(前身为 Twitter)宣布永久关闭,此前该团队遭受了一次重大安全漏洞,导致大约 840 万美元从其 智能合约 中被盗。 [17]

概述

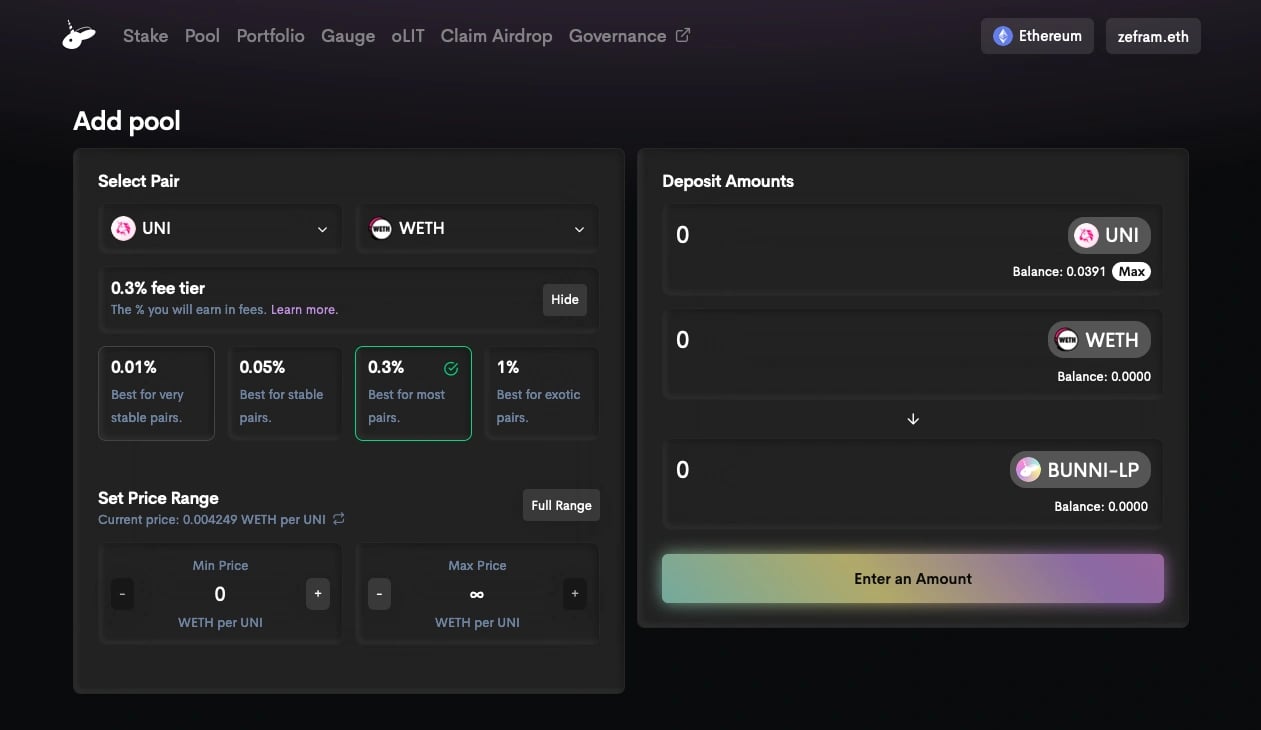

Bunni 由 Timeless Finance 创建,Timeless Finance 也是收益市场协议 Timeless 背后的团队。Bunni 的功能围绕其 Uniswap 包装器展开,该包装器是一个将 Uniswap 头寸表示为 ERC-20 代币 的合约,而不是使用 非同质化代币 (NFT)。这种方法旨在提供更高的 gas 效率,因为共享相同价格范围和池的 流动性提供者 (LP) 可以持有相同的 ERC-20 代币,从而降低总体 gas 成本。此外,这旨在促进与现有金融应用程序的轻松组合,因为这些应用程序通常是为代币而不是 NFT 定制的。 [2][3][13][14]

Bunni 的原生代币,即流动性激励代币 (LIT),在激励流动性方面发挥了核心作用。该平台的 vetokenomics 系统受到 Curve 的启发,利用 Balancer LP 代币来锁定选票以获得 veLIT,从而为 LP 提供高达 5 倍的最大提升。Bunni 还采用看涨期权代币作为 LIT 的奖励,使协议能够积累现金储备,而不受市场条件的影响,并为忠实持有者提供以折扣价购买 LIT 的机会。Bunni 将这两个主要系统结合在一起,试图为 去中心化交易所 (DEX) 空间中的流动性激励提供一个高效且有吸引力的解决方案。 [2][4]

代币经济学

LIT(流动性激励代币)

LIT(流动性激励代币)是 Bunni 的原生代币,用作激励流动性提供的工具。 [5]

LIT 分配

LIT 的总供应量为 10 亿个,其分配结构如下:[6]

- 社区 (72%): 此分配涉及各种分配,包括 45% 用于 4 年减半计划的计量器,11% 保留在协议金库中用于赠款和审计等目的,10% 通过流动性引导池 (LBP) 出售,以及 5% 通过质押池在 4 年内分配给 veMPH 持有者。

- 团队 (25%): 此分配将在 4 年内归属。

- 投资者 (3%): 这些收益将直接用于协议金库,有 6 个月的悬崖期,然后是 1 年的归属期。

- 空投 (1%): 1% 的 空投,其中 0.25% 给早期 Timeless & Bunni 用户,0.75% 给活跃的 Uniswap v3 LP。

oLIT(LIT 的看涨期权代币)

oLIT 是 LIT 的看涨期权代币,允许持有者以折扣价购买 LIT,且没有到期日。截至 2023 年 12 月,折扣为 50%,但需进行治理调整。Bunni 流动性提供者收到 oLIT 作为参与的激励。要获得 oLIT,用户需要在 Bunni 上提供流动性并在计量器中 质押。oLIT 使用户可以通过访问 Bunni 网站上的 oLIT 页面以折扣价获得 LIT。这种机制允许忠实持有者以降低的成本购买 LIT。 [7]

veLIT(投票托管 LIT)

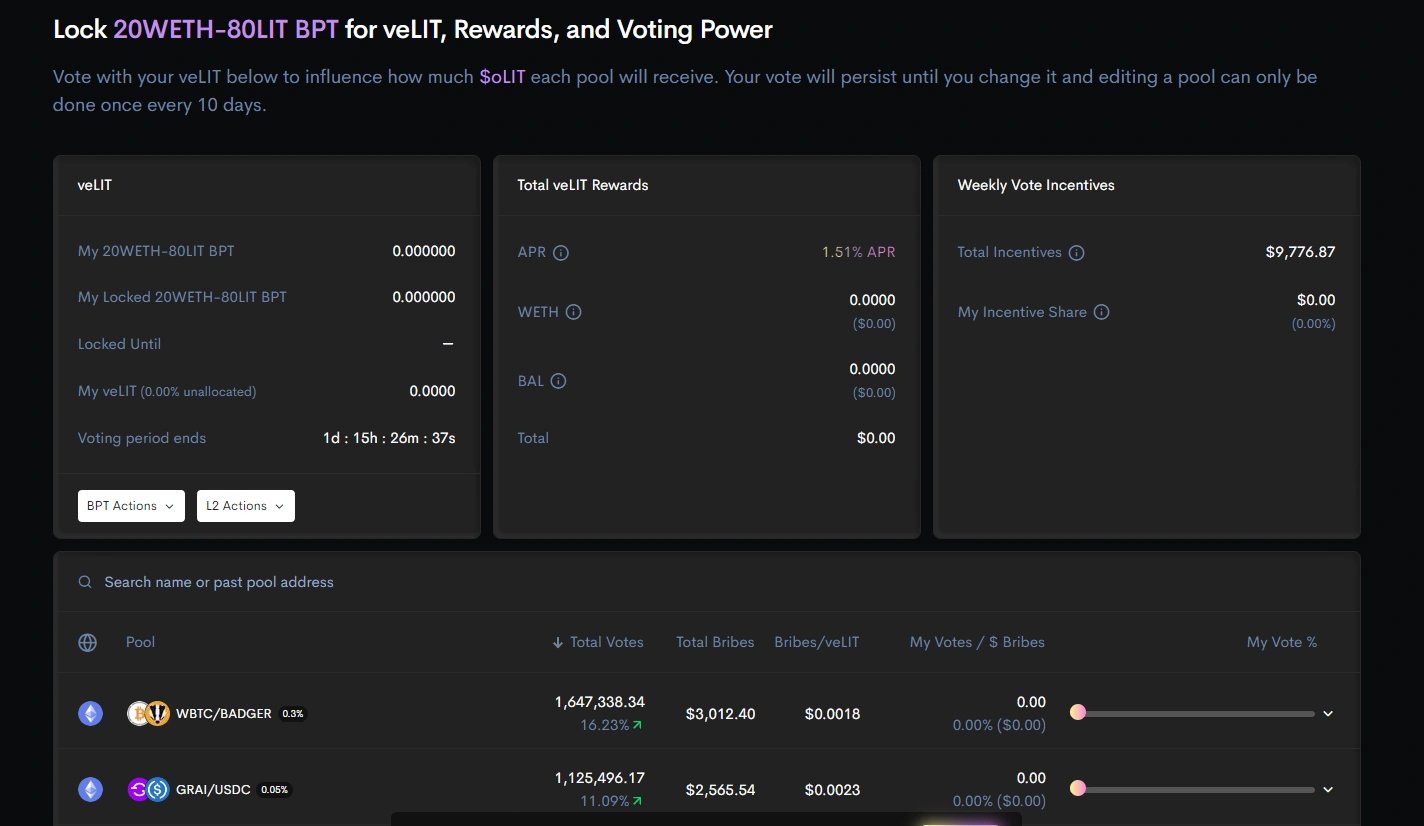

veLIT 用作治理提案和计量器权重决策的投票工具,遵循受 Curve 的 veCRV 启发的模型。要获得 veLIT,用户需要锁定 Balancer 80LIT-20WETH LP 代币。锁定的持续时间会影响获得的 veLIT,并且 veLIT 余额会随着时间的推移而减少。veLIT 在多个方面提供实用性,包括治理投票、计量器权重决策、提高计量器奖励、获得投票奖励以及分享协议的收入。 [8]

计量器

与 Curve 计量器类似,Bunni 计量器用于分配 oLIT 激励。LP 可以将他们的 LP 代币质押在计量器中以获得 oLIT 奖励和这些计量器。要从计量器中获得 oLIT 奖励,用户需要向具有关联计量器的 Bunni 池提供流动性,将他们的 LP 代币质押在计量器中,并从计量器合约中领取奖励。持有 veLIT 还可以提高从计量器中获得的奖励。持有的 veLIT 越多,奖励就越高(达到一定限制)。 [9]

提升

提升是 LIT 代币经济学的一个组成部分,它通过增加 oLIT 奖励来奖励持有 veLIT 的 LP。Bunni 的模型通过将最大提升从 2.5 倍提高到 5 倍来增强这种提升机制,从而使 veLIT 所有权更具吸引力和影响力。获得的提升量不仅取决于一个人的 veLIT 余额,还取决于同一计量器中其他人的 veLIT 余额。提升是一个相对概念,LP 在其中竞争奖励份额。 [10]

FOO 模型

FOO 模型是另一种代币经济学模型,计划在未来上线,旨在进一步激励 LP 和代币持有者积极参与协议。在此模型中,没有 veLIT 的 LP 不会收到任何奖励,从而在农民和 LP 之间建立共生关系。 [11]

协议收入

费用结构

Bunni 目前对 Bunni LP 产生的交换费用收取 10% 的协议费用,治理机构有权将此费用提高到 50%。 [12]

费用收集机制

Bunni 可以通过其 LP 通过 Bunni 智能合约 提供流动性来收取费用,该合约持有所有流动性头寸。在从 Uniswap 领取交换费用后,一部分分配给协议作为费用,剩余部分分配给 LP。 [12]

协议收入的使用

截至 12 月,收取的收入将用于协议金库。veLIT 持有者收到的收入份额(包括赎回收入和协议费用)将在 2023 年 11 月 2 日根据一项治理提案从 50% 降至 25%。 [12][16]

合作伙伴关系

Bunni x Gravita 协议

2023 年 6 月 17 日,Bunni 宣布与 Gravita 协议建立战略合作伙伴关系,Gravita 协议以使用加密资产实现 铸造 GRAI(一种低波动性算法 稳定币)而闻名。此合作伙伴关系旨在为用户提供以下几个关键优势:[15]

- 收益最大化: 通过利用 Gravita 的抵押贷款和 Bunni 的流动性优化来增强用户的收益生成资产。这种双重方法允许用户从抵押品和债务中获得收益,从而提高整体收益。

- 增强的流动性和集成: Bunni 的 ERC-20 包装器简化了 Uniswap 头寸的流动性提供过程,从而为与 Gravita 集成创造了机会。

- 治理和激励: 在 Bunni 上将 LIT 与 ETH 汇集并将其锁定为 veLIT 使用户能够参与治理决策。他们有资格获得额外的奖励,包括 ETH 和 BAL。此外,他们还可以影响各自池中的收益分配。

- 增加的资本效率: Gravita 和 Bunni 的合作提高了资本效率,使用户能够探索新的策略,以实现更加多元化和高效的资本配置。

Bunni 关闭和 840 万美元的漏洞利用

2025 年 9 月初,Bunni DEX 遭受了一次重大安全漏洞,导致大约 840 万美元 从其 智能合约 中被盗,涉及 以太坊 和 UniChain 网络。该漏洞利用针对 Bunni 的自定义流动性分配函数 (LDF),利用了“逻辑级别”漏洞,该漏洞使攻击者能够操纵内部计算并使用闪电贷和舍入误差攻击提取资金。 [17]

在漏洞利用之后,Bunni 的总锁定价值 (TVL)(已飙升至数千万美元)崩溃,并且该团队于 2025 年 10 月 23 日宣布该协议将永久关闭。

在其公开声明中,该团队表示,安全重启的成本(包括审计、开发、监控和业务发展工作)将达到六到七位数,他们表示他们不再拥有这些资金。 [18]

尽管做出了关闭决定,但 Bunni 宣布用户暂时可以继续提款,并且剩余的金库资产最终将根据快照分配给 BUNNI、LIT 和 veBUNNI 代币的持有者。作为最后的行动,Bunni 团队将其版本 2 智能合约从限制性 BUSL 许可证重新许可为开源 MIT 许可证,从而允许其他开发人员在其技术的基础上进行构建。

Bunni DEX 的关闭凸显了 去中心化金融 (DeFi) 领域持续存在的挑战,在该领域,包含新颖机制的高增长协议可能会容易受到细微的合约缺陷的影响。该事件再次强调了在可持续 DeFi 设计中强大的安全架构、充足的金库储备和危机准备的重要性。 [17] [18]

发现错误了吗?