订阅 wiki

Share wiki

Bookmark

DeFAI

0%

DeFAI

**DeFAI(去中心化金融人工智能)**代表了去中心化金融领域中人工智能和区块链技术的融合,创建由在区块链网络上运行的人工智能代理驱动的自主金融系统。[2] [1]

概述

DeFAI,是去中心化金融人工智能的缩写,是一种新兴的技术范式,它将人工智能与去中心化金融(DeFi)协议相结合。这种集成旨在通过结合人工智能驱动的决策、自动化和优化来增强传统DeFi系统的能力。这个新兴术语包括人工智能代理和人工智能集成代币,但主要强调通过自主交易代理、抽象框架和人工智能增强的去中心化应用程序(dApps)来实现链上流程的自动化。[1] [2]

DeFAI背后的核心概念涉及在区块链网络上部署自主人工智能代理,这些代理无需人工干预即可执行复杂的金融操作。这些人工智能代理可以分析市场数据、执行交易、管理风险和优化收益策略,同时保持区块链系统的去中心化和无需信任的特性。通过消除中介并自动化决策过程,DeFAI旨在降低成本、最大限度地减少人为错误并提高金融服务的可访问性。[1] [2] [3]

DeFAI代理的核心功能

DeFAI代理配备了多项功能,旨在通过简化资产管理和决策来增强[去中心化金融(DeFi)](https://iq.wiki/wiki/defi)体验。

- 多链投资组合聚合 DeFAI代理将用户在不同区块链上的资产聚合到一个仪表板中,从而可以轻松跟踪和管理分布在多个平台上的资产。

- 人工智能驱动的推荐和自主投资 该代理根据人工智能对链上和链下数据的分析,提供个性化的投资建议,这些建议是根据用户的风险偏好量身定制的。它还提供自主投资(即将推出),这将执行策略以优化投资组合的表现。

- 全面的启动板情报 DeFAI代理提供来自多个启动板的项目的详细分析,通过对代币经济学、项目团队和表现的数据驱动洞察,帮助用户评估新的投资机会。

- 定制新闻和智能警报 该代理提供有关市场趋势、价格变化以及与用户投资组合相关的新闻的实时通知和个性化更新,帮助他们随时了解情况并及时对发展做出反应。

- 泰坦金库:社区驱动的利润 DeFAI代理通过泰坦金库将社区治理与人工智能驱动的策略相结合,用户可以在其中质押代币以影响投资决策并分享金库产生的利润。[1]

DeFAI在应用程序中的应用

DeFAI生态系统迅速发展,导致加密货币领域内涌现出多个创新应用程序。这些应用程序利用人工智能来增强[去中心化金融(DeFi)](https://iq.wiki/wiki/defi)的各个方面。

- Griffain:人工智能驱动的收益优化 Griffain利用机器学习来优化投资组合管理,提供实时区块链数据分析和自动化收益优化策略。

- Orbit:跨链情报 Orbit提供与200多个区块链协议的集成,利用人工智能来增强市场分析并有效地管理跨链流动性。

- Neur:Solana的DeFAI先驱 Neur专注于Solana特定的人工智能策略,提供开源开发工具和高性能交易能力。[4]

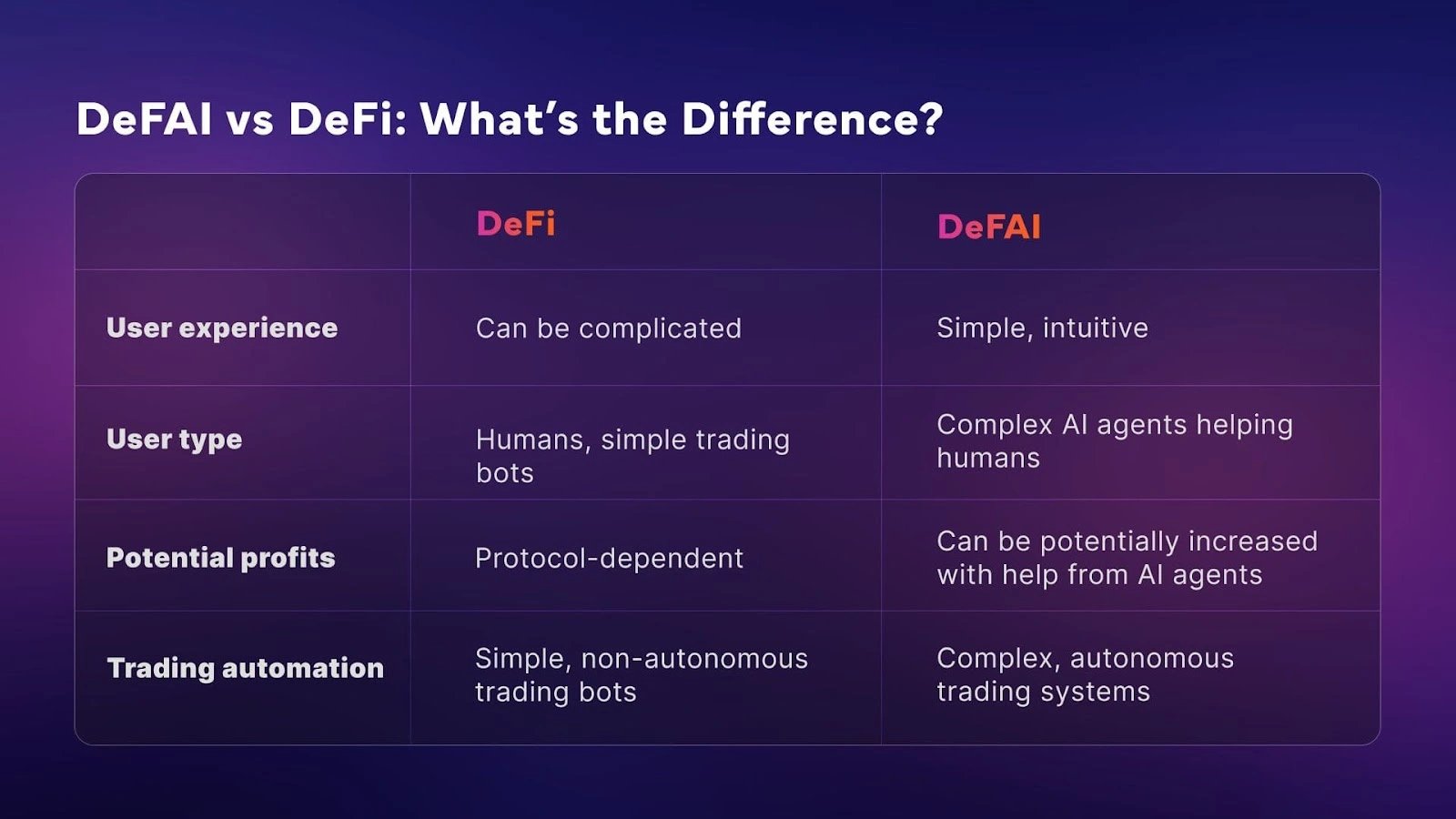

DeFAI与DeFi:有什么区别?

DeFAI通过结合自主人工智能代理来处理复杂的金融操作,代表了传统DeFi的演变。与传统的DeFi系统(用户必须手动管理策略和决策)不同,DeFAI将这些任务委托给能够随着时间推移学习和适应的智能代理。

虽然DeFi中存在诸如交易机器人之类的基本自动化工具,但它们通常遵循静态规则,并且无法从过去的表现中改进。相比之下,DeFAI系统集成了机器学习,允许代理根据实时数据改进其策略。[5]

用例和应用

DeFAI技术正在跨各个金融领域应用,为自动化和智能金融服务创造了新的可能性:

自动化交易和投资

人工智能代理可以分析市场数据、识别模式并在多个DeFi协议中跨执行交易,而无需人工干预。这些代理可以实施复杂的交易策略、重新平衡投资组合并针对特定的风险回报概况进行优化。一些系统甚至允许用户根据其财务目标和风险承受能力自定义人工智能行为。[1]

收益优化

DeFAI系统可以自动将资本分配到各种产生收益的协议中,以最大限度地提高回报。人工智能代理持续监控不同平台上的利率、流动性挖矿奖励和风险因素,转移资金以优化收益,同时管理风险敞口。[1]

风险管理

人工智能驱动的风险评估工具可以评估不同DeFi协议和资产的安全性、流动性和波动性风险。这些系统可以帮助用户了解潜在的漏洞并相应地调整其敞口。一些DeFAI平台还提供自动保险机制,以防止智能合约故障或其他技术风险。[1]

个性化金融服务

DeFAI能够创建根据个人用户需求量身定制的个性化金融产品。人工智能代理可以分析用户行为、财务历史和偏好,以推荐合适的DeFi服务,从借贷到保险和储蓄产品。[1]

技术架构

DeFAI系统的技术基础通常包括:

链上组件

链下组件

优势与风险

DeFAI通过集成人工智能,为去中心化金融(DeFi)体验带来了显著的改进,但也带来了一些独特的挑战。

- 可访问性:人工智能代理旨在通过提供引导式界面和上下文解释来简化用户与DeFi平台的交互,从而使该领域对于非技术用户更易于接近。

- 自动化:智能代理可以持续执行策略、监控市场和执行任务,从而减少人工工作量,并使用户能够更有效地管理投资组合。

- 跨链功能:DeFAI系统通常支持多个区块链协议,从而简化了互操作性并降低了跨不同网络管理资产的复杂性。

- 对自动化的依赖:仅依赖人工智能代理可能会降低用户对底层流程的了解。人工智能决策中的错误配置或错误可能会导致意外的结果,从而强调了偶尔进行用户监督的必要性。

- 资源使用量增加:人工智能处理和区块链交互的结合可能需要更多的计算能力,从而引发对能源消耗和环境影响的潜在担忧。[5] [6]

未来展望

DeFAI领域仍处于发展的早期阶段,具有巨大的增长和创新潜力。随着区块链技术变得更具可扩展性,人工智能模型变得更加复杂,DeFAI系统可能会变得越来越强大和普及。未来的发展可能包括:

发现错误了吗?