ENA

ENA 是 Ethena 的原生治理代币,用于通过基于委员会的系统影响协议决策。代币持有者任命和轮换委员会成员,这些成员负责监督协议的各个运营方面。 [1]

概述

ENA 主要用作 Ethena 协议的治理代币,允许持有者通过投票影响关键决策。这种影响力通过选举专门委员会的成员来行使,包括风险委员会。最初六个月任期的风险委员会包括 Gauntlet、Block Analitica、Steakhouse、Blockworks Research、LlamaRisk 和 Ethena Labs Research 等实体。治理结构旨在允许 ENA 持有者将日常决策委托给专家利益相关者,同时保持透明度。ENA 持有者还参与与 ENA 代币经济学、Ethereal 等生态系统项目以及战略举措相关的提案,例如将 SOL 作为 USDe 支持资产以及选择 储备 基金 RWA 分配。

通过与 Symbiotic 的合作,已集成 Restaking 功能,以提高 ENA 的实用性。Restaked ENA 有助于利用 LayerZero 的基于 DVN 的消息传递系统来保护跨链 USDe 传输。此基础设施旨在支持 Ethena 网络中即将推出的应用程序,将 restaked ENA 模块整合到平台的金融架构中。 [1]

治理

Ethena 采用一种治理结构,该结构将大多数协议决策委托给专门委员会,而不是仅仅依靠所有 ENA 代币持有者的直接投票。这些委员会在定义的范围内运作,ENA 持有者主要通过轮换任命委员会成员来参与。

这种基于委员会的模式旨在适应协议的链下依赖性,并旨在平衡高效决策与透明度和外部监督。虽然完全链上治理是不切实际的,但该结构允许经验丰富的利益相关者管理日常治理,而 ENA 持有者保留对更广泛的治理方向和委员会任命的影响。治理讨论在专门的论坛上进行,投票在 Snapshot 上进行。 [2]

sENA

Staked ENA (sENA) 是为锁定的 ENA 发行的流动收据代币。它旨在具有可组合性,并可在各种 DeFi 协议中使用。sENA 持有者获得奖励,最初包括来自第 2 季 空投 分配的未认领代币。这种奖励机制旨在激励与 Ethena 的长期增长保持一致的用户。

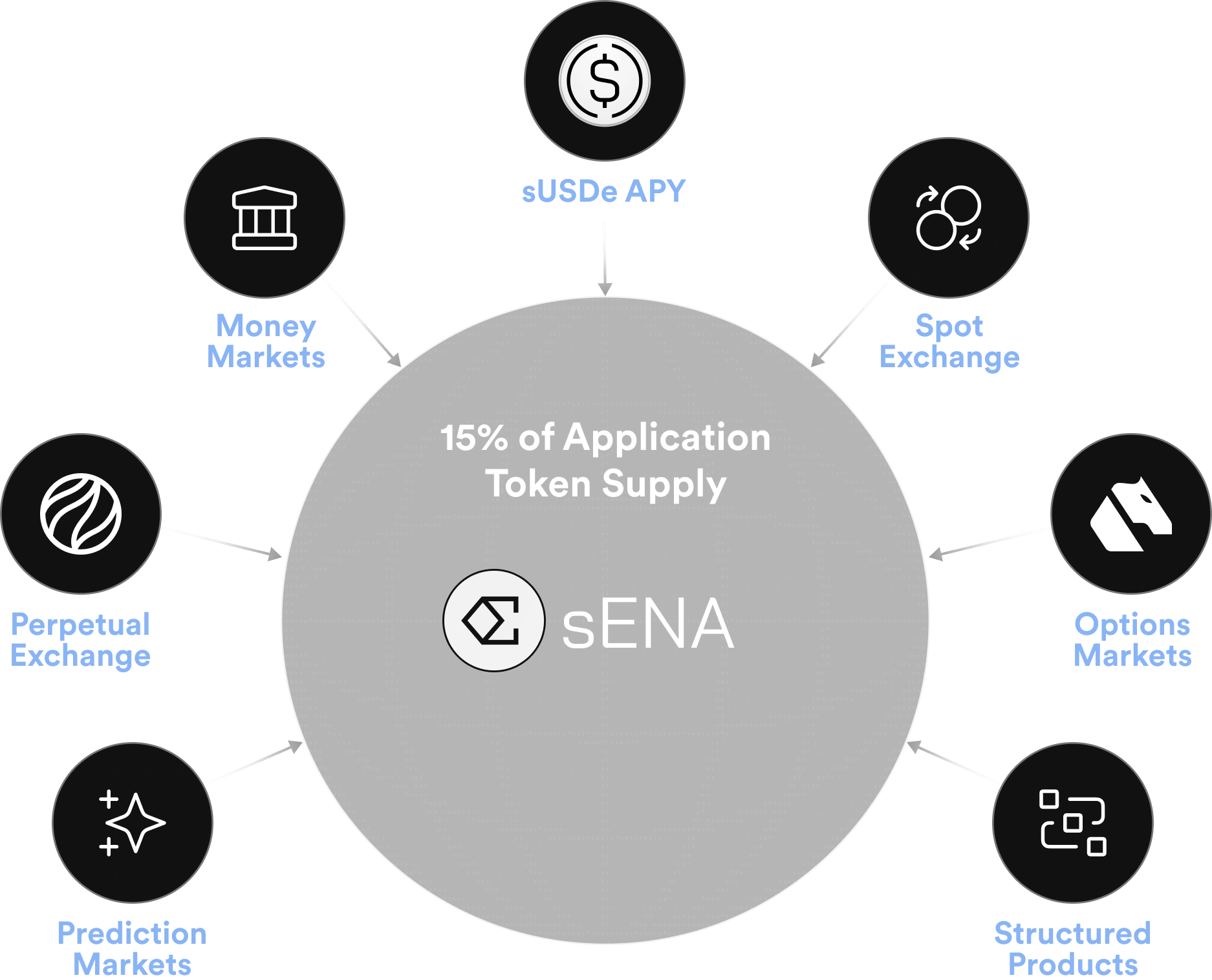

此外,sENA 从生态系统项目中获得奖励。例如,Ethereal 团队已承诺将其未来潜在代币供应量的 15% 分配给 sENA 持有者。sENA 代币的结构旨在以一种模型中累积价值,在该模型中,生态系统应用程序为其基于 sENA 的 空投 保留其代币供应量的一部分。 [1]

代币经济学

ENA 代币的总供应量为 150 亿个代币。总供应量的分配如下: [3] [4]

- 核心贡献者:30%

- 生态系统开发:28%

- 投资者:25%

- 基金会:15%

- 币安 Launchpad:2%