订阅 wiki

Share wiki

Bookmark

RedStone Oracles

0%

RedStone Oracles

RedStone 是一个模块化的预言机,专门为借贷市场提供收益型抵押品,尤其是 LST 和 LRT。它在 50 多个链和所有 Rollup 上提供 gas 优化的数据馈送。受到 Morpho、Venus、ether.fi 等的信任 [1]。

概述

RedStone 通过其可定制的模型(撰写本文时有 3 种模型:RedStone Core、Redstone Classic 和 Redstone X)解决了 Oracle 与协议的兼容性问题[2],从而简化了流程。RedStone 提供跨多个 EVM Ethereum, Optimism, Manta 或 Blast,非 EVM 生态系统,rollup 和各种 appchain 的价格信息[3]。这使得 RedStone 成为 Rollup-as-a-Service 提供商以及 Eigenlayer AVS 的理想合作伙伴。与大多数 Oracle 采用的典型方法不同,RedStone Core 不会定期持续地将数据上传到区块链上。相反,它的方法是将数据存储在 Arweave 上,从而显著降低了 gas 成本。 对于使用 RedStone 的开发人员,每种产品都有全面的文档,并辅以补充资源。这些资源包括数据提供商指南、RedStone 操作程序的解释、展示网络采用和扩展的指标,以及阐明集成过程的分步教程。

RedStone 模块化设计

RedStone 的模块化预言机系统突出了其灵活性,独立的组件使其能够轻松进行调整、更改和添加。这与具有互连基础设施的传统预言机形成对比,简化了升级和适应过程,包括与新区块链的集成。模块化意味着:

- 提供其他地方无法获得的数据源:RedStone 专门提供为借贷市场量身定制的生息抵押品,特别关注 LST 和 LRT 等资产。引入新兴资产的价格源需要创新的价格发现方法,例如基于滑点的加权。我们的模块化定价引擎不断改进,以确保最高的准确性和相关性。

- 可在任何地方部署:我们的价格源与所有链无缝集成,无论是 EVM 还是非 EVM 生态系统、rollup 还是各种 appchain。这种多功能性使 RedStone 成为 Rollup-as-a-Service 提供商和 Eigenlayer AVS 的合作伙伴。与 RedStone 集成可以从一开始就在具有预言机功能的新链上快速部署。

- 支持所有 DeFi dApp:RedStone 支持各种 DeFi 应用程序,提供灵活的数据消费选项。选择经典(推送)模型,以便跨各种资产进行频繁的数据更新,或者选择核心(拉取)模型,以便使用最广泛的预言机接口。无论具体要求如何,RedStone 都提供量身定制的解决方案来满足每个人的需求。

根据协议需求,RedStone 可以通过不同的方式集成。在 2024 年第一季度,有 3 种模型可用:

RedStone Core (Pull)

将所有必要数据包含在单个交易中,包括其注入和附加到初始用户交易,提供了一种有效的方法来绕过与生成大量必须按顺序等待处理的交易相关的复杂性。当交易由于大量先前的交易而持续时间延长时,这尤其有利。它还有助于降低交易在多个层上重复处理时产生的成本[4]。

RedStone Classic (Push)

RedStone Classic 是一个与 Chainlink 兼容的接口。它建立在核心模型之上,有效地将数据分发给中继器,然后在需要时将数据上链。它被认为是一种更高效、可扩展的选择,数据被推送到链上。这种方法确保 RedStone 优化数据处理,提供平衡有效的解决方案。所提出的模型在协议在私有网络或具有低 gas 费用的网络上运行时最有用[4]。

RedStone X

RedStone X 基于 GMX V2 架构设计,引入了一种延迟执行模式,提供了一种验证数据完整性的机制,确保数据不会被潜在的恶意行为者篡改。当所有验证检查成功通过时,将向用户提供正确的值。如果检查失败,订单将被暂时锁定,理想情况下会有一个通知机制,以防止恶意行为者进一步尝试。不正确的数据可能会影响应用程序的运行。

生态系统

数据源

RedStone的数据源包括中心化交易所(CEX)(例如币安、Coinbase),去中心化交易所(DEX)(例如Uniswap、Curve)和广泛的市场聚合器(例如Coingecko、Kaiko)。这些数据源已集成,其中超过50个经过专门策划,以适应各个价格馈送[5]。

Redstone Oracle节点

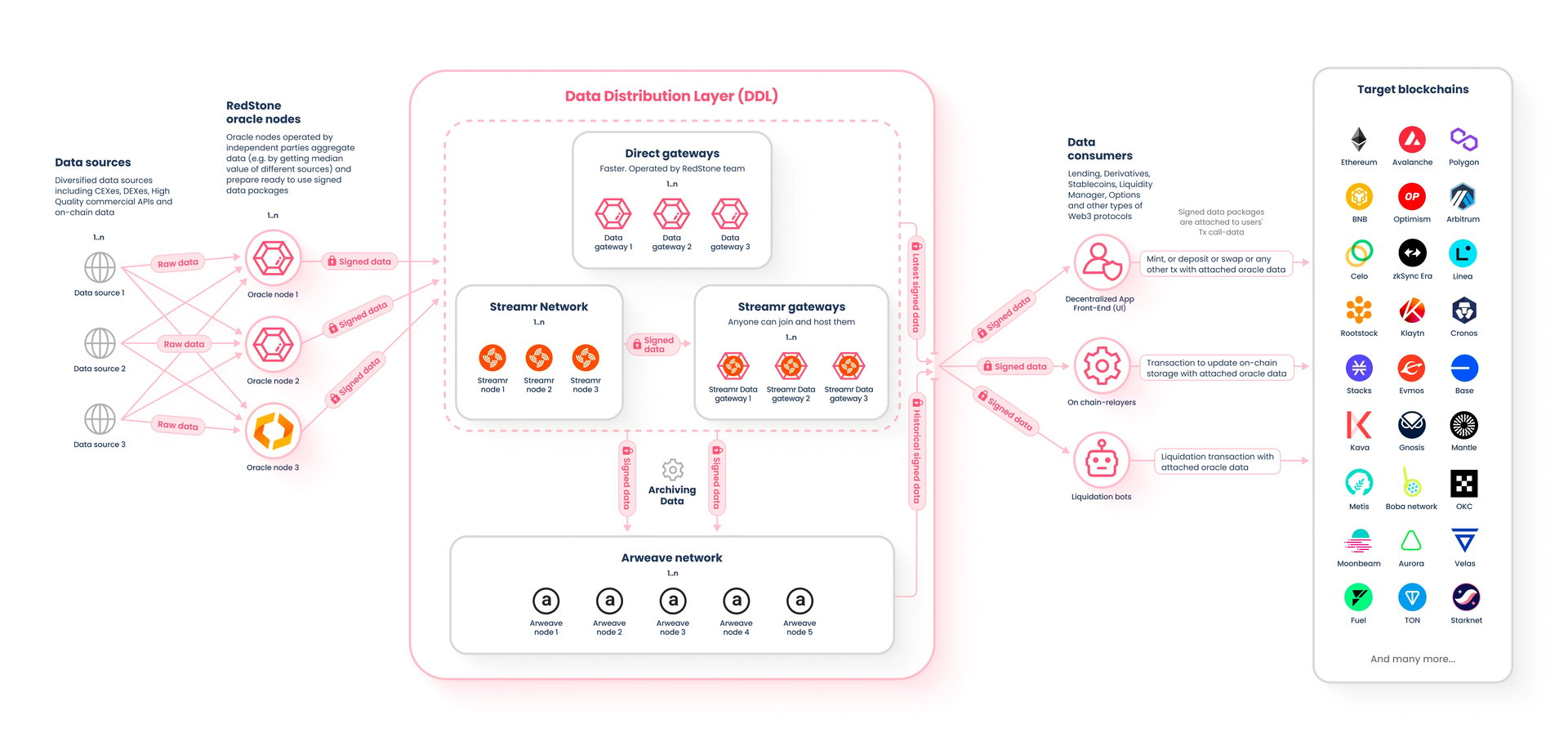

该系统利用Oracle节点进行链下数据聚合、处理和签名到分布式数据层(DDL)。聚合方法(如中位数、成交量加权平均价格(VWAP)或流动性加权平均价格(LWAP))是可配置的,尽管RedStone默认传递中位数。目前,RedStone在主网上运行所有五个Oracle节点,但理论上,它们可以是独立的运营商[6]。

数据分发层 (DDL)

RedStone 的策略超越了其内部结构,旨在解决去中心化应用程序 (dApps) 如何利用其数据。通过其数据分发层 (DDL),称为“去中心化云”,预言机安全有效地将价格数据链下存储。这种设计允许多种链上的不同消费方式,满足各种 dApp 及其需求[7]。

数据存储

鉴于缓存层中数据的短期存储,去中心化存储对于存档历史数据至关重要。Arweave 是一个专门用于数据存储的区块链,通过保存存档的价格馈送数据,确保数据提供商的责任性[7]。

Relayers

Relayer使用预先确定的标准,如心跳或价格偏差阈值,将数据推送到链上。可以为每个价格馈送配置Relayer。但是,RedStone在主网上只使用白名单上的Relayer。

数据聚合

Redstone Oracle 数据收集过程从链上和链下来源获取信息。这包括 DEX(Curve 池、Uniswap 池、Balancer 池等)、CEX(币安、Bitget、Coinbase、OKX、Kraken 等)、预言机提供商(Chainlink、Band 协议、DIA)、社交图谱(Lens)和聚合器(如 CoinmarketCap、Coingecko、Kaiko)。RedStone 已经集成了 162 个数据源。

所有可用的数据源都显示在 RedStone 仪表板上,并带有可靠性指标,如“价格不正确”、“获取失败”、“成功率”和“稳定性报告”[6]。

链下

链下数据聚合涉及独立节点提供商从各种数据源收集数据。这些节点使用中位数、时间加权平均价格 (TWAP)、最后加权平均价格 (LWAP) 或自定义计算(例如,使用滑点而不是交易量来计算 wstETH 价格)等方法聚合收集到的数据。数据经过聚合和处理后,由节点运营商签名,以确保其质量和完整性。

链上

链上聚合和验证发生在将此数据引入区块链时,确保其有效性,并准备好供智能合约和最终用户使用。

使用案例

Venus 集成

Venus 协议于 2020 年在 BNB 链 上启动,集成了 RedStone Oracles 以增强其 Oracle 基础设施。此举旨在提高冗余性和安全性,防范黑天鹅事件。Venus 融合了稳定币铸造和算法货币市场,总锁定价值高达 17 亿美元[9]。

在 Venus 因 Oracle 故障而遭受损失后,与 RedStone Oracles 的集成应运而生,突显了依赖单一 Oracle 提供商的风险[8]。

RedStone 的实施涉及与 Venus 开发团队的技术讨论,最终采用了 RedStone 的经典模型。选择此模型是因为它与 Venus 现有的 Oracle 接口兼容,无需进行重大代码更改。RedStone Classic 的主要功能包括可定制的更新参数、数据源和聚合方法的透明性以及完整的基础设施支持。

在治理论坛投票后,集成得以巩固,从而在 BNB 链上为 Venus 设置了链上中继器。

DeltaPrime

DeltaPrime 是一个在 Avalanche 网络上促进低抵押贷款的平台,RedStone Oracles 的合作关系超越了 2022 年在 Avalanche 主网上的初始集成。一个关键挑战是确保对多样化资产组合进行准确估值,以维持金融稳定,而传统 Oracle 模型的局限性使这项任务变得复杂[10]。

RedStone 通过为各种资产提供链下、及时的更新来解决这个问题,从而在不产生不必要的 gas 成本的情况下提高安全性和灵活性。它包括其他 Oracle 未涵盖的 LP 和质押代币。这种方法不仅具有成本效益,而且还扩展了 DeFi 策略的可能性,并在更广泛的资产上获得更高的收益。

DeltaPrime 和 RedStone 之间正在进行的合作关系有望进一步发展,计划扩大资产定价范围,可能包括现实世界资产 (RWA)。此次合作旨在通过为用户提供先进的投资管理工具,巩固 DeltaPrime 作为 DeFi 领域关键参与者的地位。

StakeWise

StakeWise 是一个质押协议,充当质押者和节点运营商之间的中间人,需要一个可靠的 Oracle 将流动性质押代币 (osETH) 与 DeFi 协议连接起来。RedStone Oracles 通过提供必要的、可靠的数据来促进这一点,从而扩大 osETH 的效用并增加对其在各种应用程序中的使用的信任。这种集成降低了与数据不准确或操纵相关的风险。由于 RedStone 的 osETH/ETH 价格馈送,osETH 可以包含在 Gravita、Morpho Blue 和 Enzyme 等平台中。

StakeWise 的 Kirill Kutakov 指出,由于 Chainlink 的高流动性需求,对 Oracle 的近乎完全依赖已经转变为一个更加多样化的生态系统,RedStone 等提供商提供可访问的、高质量的价格馈送。这种多样化有助于协议更轻松地获得必要的价格数据。

RedStone 的实施采用了一种价格发现机制,该机制从 osETH 交易的三个最具流动性的 DEXes 中获取数据:Balancer (osETH-WETH)、Uniswap V3 (osETH-USDC) 和 Curve (osETH-rETH)。还设置了一个流动性监控服务,以适应代币部署的转移并阻止价格操纵。该解决方案包括数据提供商节点、中继器节点和监控服务的综合基础设施,确保可靠的 osETH 价格数据馈送[11]。

融资

2021年7月,RedStone完成了pre-seed轮融资,获得了52.5万美元的投资。该轮融资由Maven 11 Capital领投,私募SAFT风格轮次的主要投资者包括Arweave、Collider Ventures等。随后,在2022年8月,RedStone进入种子轮融资阶段,成功筹集了700万美元[12]。该轮融资由Lemniscap、Blockchain Capital、Maven11、Coinbase Ventures和其他顶级Web3基金领投。2023年5月,RedStone宣布进行独家天使轮融资。从Stani Kulechov(Aave公司创始人兼CEO)、Sandeep Nailwal(Polygon联合创始人)和其他知名人士处筹集了未公开的金额。

团队 & 顾问[14]

- Jakub - 创始人, CEO

- Marcin - 联合创始人, COO

- Alex - 联合创始人, 首席开发

- Matt - 业务拓展负责人

发现错误了吗?