위키 구독하기

Share wiki

Bookmark

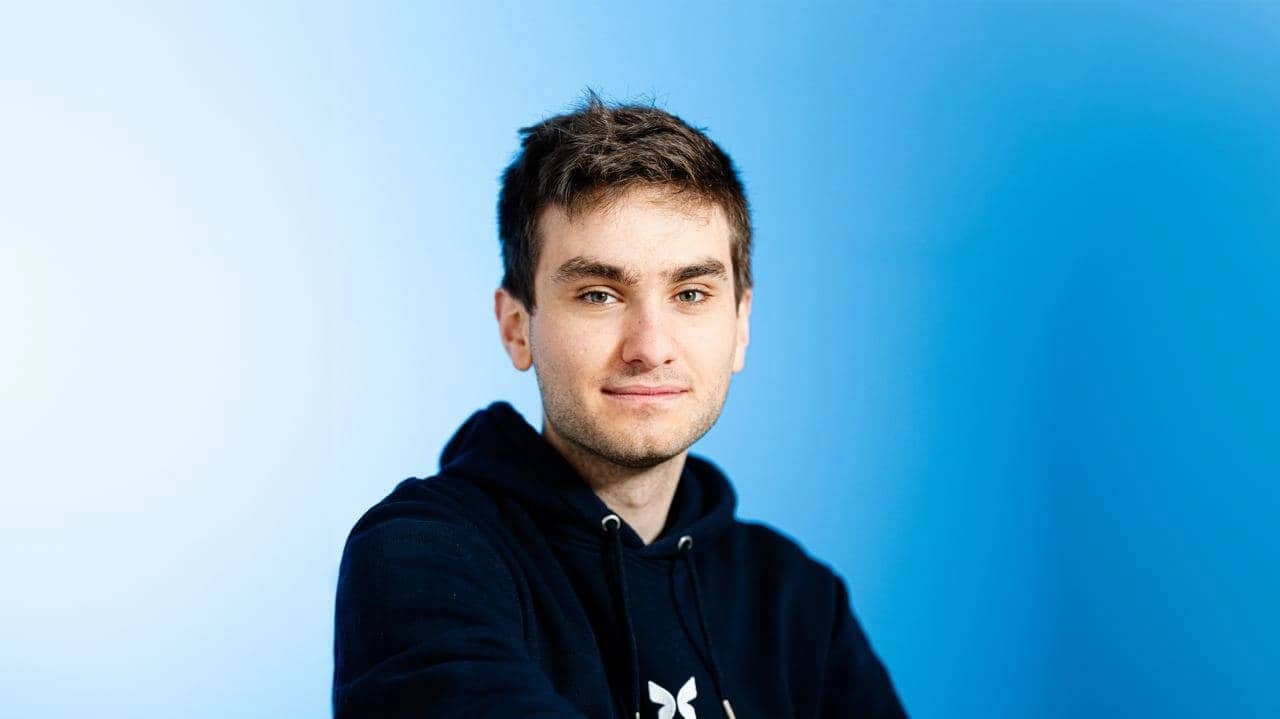

Paul Frambot

0%

Paul Frambot

**폴 프람봇(Paul Frambot)**은 탈중앙화 대출 프로토콜 개발에 주력하는 회사인 Morpho Labs의 CEO이자 공동 창립자입니다. 그는 탈중앙화 금융(DeFi) 대출 시장 내에서 자본 효율성을 개선하기 위해 2021년에 Morpho Labs를 공동 창립했습니다. [1] [2]

교육

프람봇은 2022년에 파리 공과대학에서 병렬 및 분산 시스템과 블록체인 석사 학위를 받았습니다. [4] [2]

경력

프람봇은 Morpho Labs의 CEO이자 공동 창립자입니다. 그는 파리 공과대학에서 석사 과정을 밟는 동안 2021년에 회사를 공동 창립했습니다. Morpho Labs는 탈중앙화 대출에서 자본 효율성을 향상시키도록 설계된 Morpho 프로토콜을 개발하고 성장시키는 책임을 맡고 있습니다.

프람봇의 지휘 아래 Morpho는 Andreessen Horowitz(a16z) 및 Variant와 같은 투자자로부터 1,800만 달러의 자금 조달을 포함하여 자금을 확보했습니다. 이 프로토콜은 상당한 규모를 달성하여 수십억 달러 규모의 대출 플랫폼이 되었습니다. 주요 개발 사항은 안전하고 효율적으로 설계된 탈중앙화 대출을 위한 간단하고 독립적이며 유연한 기본 레이어인 Morpho Blue입니다. [1] [2] [5]

인터뷰

머니 마켓

Bell Curve 팟캐스트에서 프람봇은 고정 금리 차입 및 대출을 도입하는 DeFi 플랫폼인 Morpho V2에 대해 논의했습니다. 그는 V2가 고정 금리에만 집중하는 것이 아니라 문제를 해결하고 V1을 개선하는 것을 목표로 한다고 설명했습니다. 그는 V2의 의도 기반 모델을 강조하여 시장 참여자가 위험과 가격을 동적으로 관리할 수 있도록 하여 예측 가능한 조건을 추구하는 전통적인 금융 사용자를 유치할 수 있다고 강조했습니다. 토론에서는 시장 수요, 볼트, 유동성 파편화 및 큐레이터를 위한 위험 관리와 같은 과제를 다루었습니다. [6]

암호화폐 대출

"The Crypto Beat" 에피소드에서 프람봇은 Morpho를 Aave와 같은 플랫폼과 대조하여 Morpho는 개발자가 맞춤형 대출 상품을 구축할 수 있는 무허가 프레임워크를 제공하는 반면 Aave는 위험과 코드를 내부적으로 관리한다고 언급했습니다. 그는 Morpho에 대한 의심스러운 시장의 초기 배치를 포함하여 무허가 시장의 위험을 인정했습니다. 프람봇은 기존 DeFi 프로토콜이 인프라 솔루션으로 이동하는 추세를 언급하고 Coinbase가 앱 내에서 탈중앙화 대출 기능을 제공하기 위해 Morpho의 기술을 통합하여 사용자 신뢰를 구축하기 위해 과담보 대출 및 거래 투명성을 강조했습니다. 그는 Morpho의 초점은 다양한 금융 기회를 기술 백엔드와 연결하고 탈중앙화 금융 상품을 확장하는 것이라고 말했습니다. [7]

Morpho Blue

The Big Whale 팟캐스트에서 프람봇은 Morpho Blue에 대해 이야기하면서 공공 블록체인에서 대출 및 차입의 효율성과 접근성을 향상시키는 역할을 강조했습니다. 그는 전통적인 금융의 규제 제약 없이 최적의 매칭을 위한 탈중앙화 인프라의 이점을 강조했습니다. 프람봇은 Morpho가 애그리게이터에서 독립적인 대출 프로토콜로 진화하여 다양한 위험 프로필에 맞는 다양한 금융 상품을 가능하게 했다고 설명했습니다. 그는 프로토콜이 탈중앙화 및 사용자 제어에 중점을 두고 있으며 사용자가 자체 인프라를 구축할 수 있도록 함으로써 Aave와 같은 플랫폼과 차별화된다고 언급했습니다. 프람봇은 또한 Morpho의 비즈니스 모델과 미래 토큰 기능에 대해 언급하고 유동성 파편화 및 위험 관리에 대한 우려를 해결했습니다. [8]

Morpho Labs

Re7 Capital과의 인터뷰에서 프람봇은 DeFi의 진화와 대출 및 차입 효율성을 개선하는 데 있어 Morpho의 역할에 대해 논의했습니다. 그는 2016년에 암호화폐에 진출한 것과 Uniswap 및 Compound와 같은 플랫폼 이전의 초기 DeFi의 사용자 경험 문제에 대해 공유했습니다. 그는 2020-2022년의 많은 DeFi 혁신이 근본적인 개선보다 인센티브에 더 집중했다고 언급했습니다. 프람봇은 시장 침체 후 합리적인 접근 방식이 지속적인 혁신으로 이어질 수 있다고 제안했습니다. 그는 Compound 및 Aave와 같은 기존 플랫폼의 인프라를 활용하면서 직접 대출 기관-차용인 참여를 가능하게 함으로써 이자율을 개선하는 것을 목표로 하는 Morpho의 P2P 매칭 시스템에 대해 자세히 설명했습니다. 그는 미래의 DeFi 혁신에 대한 낙관론을 표명하고 교육과 사려 깊은 참여를 장려했습니다. [3]

프레젠테이션

Morpho

EthCC 2022에서 프람봇은 Morpho 대출 프로토콜에 대해 발표하면서 자신의 DeFi 여정을 회상했습니다. 그는 낮은 참여로 인해 비효율적인 Dharma와 같은 초기 P2P 모델을 언급하여 DeFi에서 일시적으로 벗어났습니다. 그는 2020년에 Compound가 유동성을 제공하고 풀 불균형으로 인해 넓은 금리 스프레드를 생성하여 미치는 영향에 주목했습니다. 프람봇은 유동성 풀과의 직접적인 상호 작용 없이 피어 투 피어 매칭을 용이하게 하여 더 나은 금리를 목표로 하는 보다 효율적인 프로토콜인 Morpho를 소개했습니다. 그는 특히 시장 침체 이후 DeFi에서 자본 효율성을 강조하고 Morpho를 개선된 사용자 대출 경험을 위해 복잡성과 효율성의 균형을 맞추는 하이브리드 프로토콜로 설명했습니다. [9]

패널

노변담화

Variant LP Day 2024의 노변담화에서 프람봇은 Morpho가 대출 금리 애그리게이터에서 무허가의 불변 시장 생성을 위한 탈중앙화 대출 프로토콜로 전환한 것에 대해 설명했습니다. 이러한 움직임은 오프체인 시스템에 의존하는 한계를 극복하고 사용자 제어 및 복원력을 향상시키는 것을 목표로 했습니다. 프람봇은 대출 시장 개발을 위한 개방형 프레임워크를 제공함으로써 Morpho를 거버넌스가 심한 프로토콜과 대조하고 탈중앙화 금융과 전통적인 금융을 연결하는 것에 대해 논의했습니다. 그는 자산 관리자의 관심이 증가하고 스테이블코인의 중요성이 커지고 있으며 탈중앙화 인프라가 비용 효율성, 유동성 및 혁신을 어떻게 향상시킬 수 있는지 강조했습니다. 그는 또한 초기 참가자에게 보상을 제공하고 장기적인 조정을 장려하기 위해 양도 불가능한 토큰을 사용한 Morpho의 토큰 모델에 대한 세부 정보를 제공했습니다. [10]

잘못된 내용이 있나요?