Subscribe to wiki

Share wiki

Bookmark

Arc

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Arc

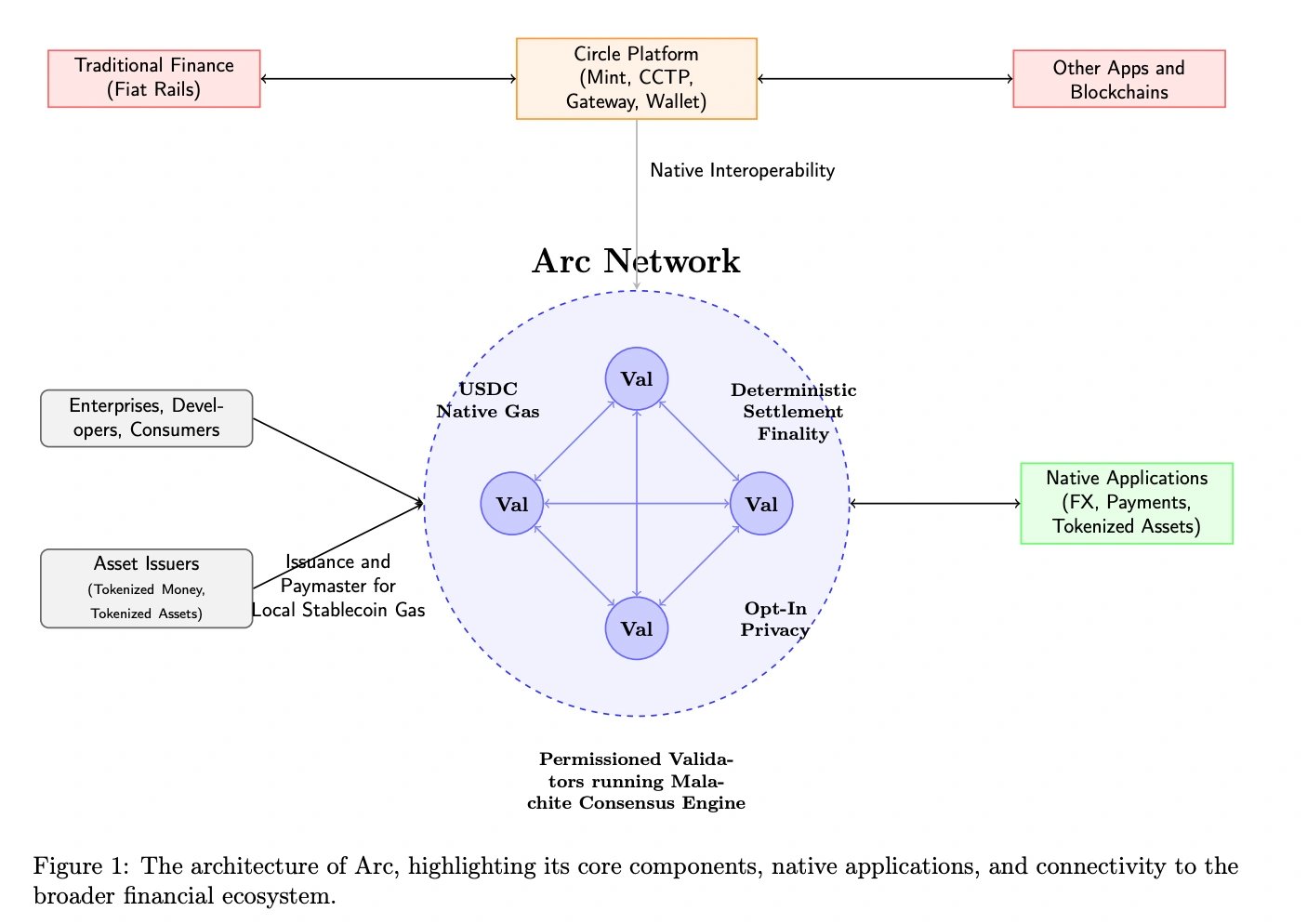

Arc is a purpose-built, EVM-compatible Layer-1 blockchain designed specifically for stablecoin-based finance. It features USDC as native gas, deterministic settlement finality, opt-in privacy, and a stable transaction fee architecture. Optimized for stablecoin-native use cases, such as global payments, FX, and capital markets, Arc serves as a foundational settlement layer for programmable money on the internet. [1] [3]

Overview

Arc is positioned as a foundational layer for an internet-based financial system centered around stablecoins. The project's premise is that while stablecoins have demonstrated the potential for digital money, a dedicated infrastructure is needed to support their widespread adoption in enterprise and consumer finance.

The blockchain is designed to be open and programmable, providing a platform for developers and businesses to build financial products and services. It seeks to combine the predictability and trust required by traditional financial institutions with the speed and global reach of a public ledger. [1]

The platform is offered by Circle Technology Services, LLC, a subsidiary of Circle Internet Group, Inc., a key entity behind the USD Coin (USDC) stablecoin. Arc's architecture is purpose-built to address common challenges in blockchain-based finance, such as volatile transaction costs, slow settlement times, and a lack of privacy for sensitive financial data. By focusing on these areas, Arc aims to become a core infrastructure for stablecoin payments, foreign exchange (FX), and capital markets. [1]

History

Arc was publicly announced in August 2025. The project's official social media presence on X (formerly Twitter) was established in the same month, with an introductory post on August 12, 2025, outlining its vision as a Layer-1 blockchain for stablecoin finance. [2]

Following the public launch, the project began accepting applications for early access to its private testnet, inviting developers and businesses to begin exploring the network's capabilities. [1]

Consensus and Finality

The network is powered by a consensus engine named Malachite. This engine is engineered for high performance and is designed to provide deterministic, sub-second transaction finality. This rapid settlement capability is critical for serving demanding, enterprise-grade applications where transaction certainty and speed are paramount. Instant finality ensures that once a transaction is confirmed on the network, it is irreversible, mirroring the settlement assurances of traditional financial systems. [1]

Native Gas Token

A distinctive feature of the Arc blockchain is its use of USDC as the native token for paying transaction (gas) fees. By denominating gas fees in a dollar-pegged stablecoin, the network aims to provide predictable and stable transaction costs. This approach shields users and applications from the price volatility commonly associated with the native cryptocurrencies of other blockchains, making financial planning and cost management more straightforward for businesses operating on the network. [1]

Compliant Privacy Features

Arc integrates native privacy tools that allow for optional confidentiality. This "opt-in" privacy model enables users and businesses to selectively shield sensitive financial information on the blockchain. The feature is designed to be compliant, allowing entities to maintain data privacy while still adhering to relevant regulatory and reporting obligations. This balance is intended to make the platform suitable for institutions that must protect confidential customer or transaction data. [1]

Integrated FX Engine

The blockchain includes a built-in foreign exchange (FX) engine designed for institutional use. This feature operates as an on-chain Request for Quote (RFQ) system, facilitating price discovery and peer-to-peer (PvP) settlement for stablecoin-to-stablecoin currency pairs. The engine is designed to operate 24/7, providing a trusted and efficient environment for on-chain FX transactions without relying on external venues. [1]

Use Cases

Arc is purpose-built to serve as the underlying infrastructure for a new generation of financial applications built with stablecoins. The platform's features are tailored to support several key areas:

- Payments: The network's low, predictable transaction costs and fast finality are designed to facilitate stablecoin payments at scale, from micropayments to large corporate treasury transfers.

- Foreign Exchange (FX): The native FX engine provides a decentralized venue for 24/7 currency exchange between different stablecoins, enabling more efficient cross-border transactions and liquidity management.

- Capital Markets: Arc aims to provide a robust platform for the issuance and trading of tokenized real-world assets (RWAs) and other digital securities, where stability and compliance are essential.

These use cases are supported by the platform's core design principles of stability, performance, and predictability. [1]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)