Subscribe to wiki

Share wiki

Bookmark

USDC

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

USDC

USDC is an Ethereum-based stablecoin for Circle - a fintech company that provides payment and treasury infrastructure for Internet businesses. It is pegged 1:1 to the value of one USD and was launched in 2018. [24]

In November 2020, Circle partnered with Airtm and the Bolivarian Republic of Venezuela to deliver funds from the United States Department of the Treasury to Venezuelan citizens. It was the first time in U.S. history that a stablecoin would be used by the government to execute a foreign policy plan.[5]

Overview

As USDC is an ERC-20 token but pegged to Fiat currency, i.e United States dollar, it cannot be mined like Bitcoin or other minable cryptocurrencies. It is backed by the United States dollar held in reserve bank accounts. Basically, the USDC Treasury, the Centre consortium that mints USDC, collectively holds US$1.00 for every single USDC. These funds are held in a special bank account that is constantly monitored and audited. USDC tokens can be changed back to USD at any time.[8]

USDC can be purchased and traded on both centralized and decentralized exchanges such as Binance, Coinbase, Poloniex, OKX, Kucoin, Bitfinex, and Uniswap.

Tokenization Process

The process of converting US dollars into USDC tokens is referred to as tokenization. This involves three steps: first, a user sends USD to the token issuer's bank account; then, the issuer uses a USDC smart contract to generate an equivalent amount of USDC; finally, the newly created USDC is sent to the user and the equivalent USD is held in reserve. [14]

Redeeming USDC for USD is the reverse process of minting the token. The steps are as follows: first, a user requests the USDC issuer to redeem an equivalent amount of USD for their USDC tokens; then, the issuer submits a request to the USDC smart contract to exchange the tokens for USD and remove an equivalent number of tokens from circulation; finally, the issuer returns the requested amount of USD from its reserves to the user's bank account, minus any applicable fees. The user receives the net amount equivalent to the USDC tokens they had redeemed. [14]

History

USDC was developed by Centre Consortium, a US-based open-source, decentralized consumer payment network, in partnership with Circle Internet Financial and Coinbase, a leading cryptocurrency exchange.

USDC is an ERC-20 token created on Ethereum using a smart contract that can be verified by anyone on the blockchain. Coinbase announced its support for USDC on October 23, 2018, and it became the first initiative of the Centre consortium. Circle and Coinbase are the founding members of the consortium. USDC was launched on September 26, 2018, and as of October 2018, about 127 million USDC were in circulation. By the end of 2021, the number of USDC in circulation had grown to over 51 billion. Circle was founded in 2013 by Jeremy Allaire and Sean Neville. [7][9][10]

In April 2020, Coinbase deposited $1.1 million in USDC stablecoins into the pools powering two of the most popular DeFi applications on Ethereum, Uniswap, and PoolTogether. The investment came via the USDC Bootstrap Fund, which was launched in September 2019. This came after the introduction of DeFi projects such as decentralized exchanges (DEX) like dYdX, DApps like Aave, liquidity pools like Uniswap, and Wallets like Cobo Wallet, and Dexwallet that leverage USDC, which resulted in substantial growth in USDC's market cap.[11]

On November 20, 2020, Circle announced its partnership with the Bolivarian Republic of Venezuela and Airtm. The parties worked together in delivering aid to Venezuelans using USDC, as the United States Department of the Treasury has had previous issues with sending funds to Venezuelan residents as a result of Dictator Nicolás Maduro blocking this aid. In a blog post, the company stated,

Through a collaboration with the Bolivarian Republic of Venezuela, led by President-elect Juan Guaido, U.S.-based fintech innovator Airtm, and coordination and licensing with the US government, we were able to put in place an aid disbursement pipeline that leveraged the power of USDC — dollar-backed, open, internet-based digital currency payments — to bypass the controls imposed by Maduro over the domestic financial system and put millions of dollars of funds into the hands of people fighting for the health and safety of the people of Venezuela.

Funds from the U.S. Treasury flowed through a business account Airtm has with Circle. From there, USDC was sent to mobile digital wallets. Airtm had over half a million users in Venezuela alone which enabled the U.S. government to bypass the Venezuelan banking system, which was controlled by the country.

In December 2020, Circle announced a partnership with Visa that allowed businesses in its payment network to accept the USDC. In July 2021, Mastercard announced plans to test USDC as a payment method, and Stripe said in April 2022 that it would begin supporting USDC as a form of payment.[10]

As of October 2022, USDC is one of the most popular stablecoins and is ranked in the top 5 cryptocurrencies on CoinMarketCap. Since its launch in 2018, USDC has progressed well and has achieved an image of the most trustworthy stablecoin.[12]

Use Cases

As a price-stable digital asset, USDC has several use cases:

- Hedge against volatility: Investors with exposure to other cryptocurrencies can reduce their portfolios' volatility by strategically buying a stablecoin like USDC. Owning USDC during periods of significant market volatility can help to stabilize a portfolio's value.

- Pricing in fiat money: Pricing of digital assets listed on cryptocurrency exchanges in fiat money can be done using a stablecoin like USDC.

- Stable price-pegging: The price stability of USDC enables it to represent equity ownership or fund investments. USDC can also be used to represent liabilities or debt.

- Remittances: USDC can be used to send funds across borders. Recipients can store USDC without using a bank account or being concerned about price volatility.

- U.S. dollar exposure: Non-U.S. investors that wish to gain exposure to the U.S. dollar can add USDC to their cryptocurrency investment portfolios.

- Hedge against inflation: Non-U.S. investors concerned about inflation of their local currency can hold a stablecoin like USDC to help protect the value of their money.

- Global crowdfunding: Startup companies and non-profit organizations can raise money from investors and donors worldwide by soliciting digital currency. Raising funds in the form of a stablecoin like USDC ensures that the value of the money raised does not fluctuate over time.

- Blockchain interconnection: Using USDC can be a means to integrate payment systems and apps across blockchains because it is interoperable with a number of autonomous blockchains.[4]

Transparency and Regulations

USDC is an open-source project that works within U.S. money transmission laws and uses established banks and auditors. This is true financial and operational transparency. It is backed by Circle, a registered Money Transmitter, and regulated as a Money Services Business by the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of Treasury.[13]

Beyond the U.S., Circle is regulated as an Electronic Money Institution by the Financial Conduct Authority, held accountable to the treasury responsible for the UK's financial system and to the Parliament. So the issuance of USDC, the equivalent amount of USD is ascertained with one of the Circle’s trusted associates. All USDC tokens are regulated, transparent, and verifiable on the blockchain.[13]

Security

USDC is audited by well know accounting and auditing firm, Grant Thornton LLP. It issues attestations each month on the US dollar reserves that back the USDC tokens in circulation.[13]

USDC x Cosmos

Circle is collaborating with Strangelove Labs, a blockchain validation firm, with the support of Informal Systems, Iqlusion, and Osmosis Labs, to develop a generic asset issuance chain secured by Cosmos to launch its stablecoin, USDC. This will become available on the network in early 2023 and developers and users alike will have access to the asset via the IBC protocol. [15]

“It’s been a real challenge. We came up with this architecture of a chain for USDC — we’re not fully talking about how it’s going to be brought on, but we are talking about this idea of having it fire towards being part of interchain security.” - Zaki Manian, co-founder of Iqlusion

USDC payments on Visa

In March 2021, Visa revealed that it would use the US dollar-backed stablecoin, USDC, to settle transactions on the Ethereum network. [16][17]

“We’ve been testing how to actually accept settlement payments from issuers in USDC starting on Ethereum and paying out in USDC on Ethereum” - Cuy Sheffield, head of crypto at Visa

According to Sheffield, Visa is currently exploring ways to enable its clients to directly convert their digital assets to fiat currencies on its platform. [16][17]

“The same way that we can convert between dollars in euros on a cross-border transaction, we should be able to convert between digital tokenized dollars and traditional dollars” - Sheffield

Circle Assumes Control over USDC

On August 21, 2023, Coinbase announced that it would be investing in Circle, revealing that Circle will now take full control of USDC's governance and operations. This move aims to streamline operations, improve governance, and enhance Circle's accountability as the issuer. Coinbase will also acquire an equity stake in Circle. Both companies will continue to generate revenue from USDC reserves interest income, sharing it based on the amount of USDC held on their platforms. Furthermore, USDC plans to launch on six new blockchains, between September and October. The six listed were Base, Cosmos via the Noble network, NEAR, Optimism, Polkadot, and Polygon PoS, which would make USDC available on 15 different chains. [18][19][21]

"The new structure will streamline the operations and governance, and enhance the direct accountability of Circle as the issuer, including holding all the smart contract keys, complying with regulations on governance of reserves and enabling USDC on new blockchains." - ), Jeremy Allaire

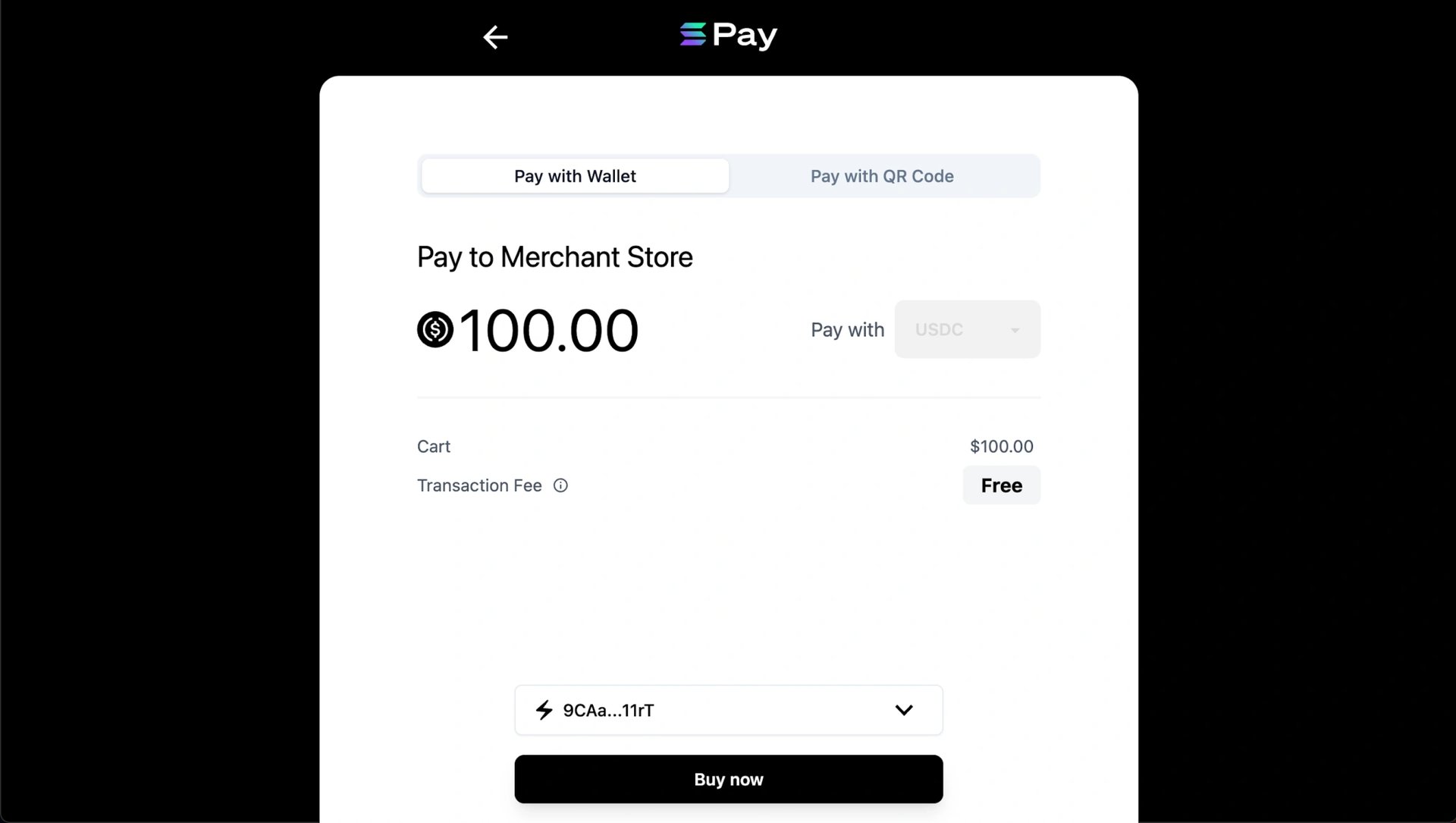

Solana Pay Enables USDC Payments Through Shopify

On August 23, 2023, Solana Pay, a decentralized payment protocol developed by Solana Labs, announced the integration of its plug-in with Shopify. USDC was chosen as the initial payment option due to its stability and regulatory compliance.

The integration aims to provide cost-saving benefits to businesses, as the Solana Pay option is virtually "fee-free", in contrast to the typical 1.5% to 3.5% credit card processing fees per transaction.

Additionally, this update facilitates the implementation of loyalty programs for merchants with minimal development effort. These reward systems can include NFT loyalty tokens, granting discounts to returning customers who use Solana Pay. [20]

USDC Launches on Optimism

On September 5, 2023, Optimism, an Ethereum-based Layer 2 protocol, partnered with Circle to introduce USDC to the Optimism ecosystem. This move aims to benefit both platforms by enhancing liquidity and offering a stablecoin that is fully reserved and redeemable for US dollars at a 1:1 ratio. Circle's USDC integration will also provide institutional on/off-ramps, expanding its role as a major currency for institutional investors. The Ethereum-bridged version of USDC on block explorers will be renamed as USDC.e in preparation for the integration. [22]

USDC Launches on Base

On September 5, 2023, USDC was made accessible directly on Base, an Ethereum Layer 2 platform, without the need for bridging. Circle Account and Circle APIs fully support Base USDC.

Native USDC is issued by Circle and is always redeemable 1:1 for US dollars. Base is working to migrate liquidity from bridged USDC (USDbC) to native USDC. This integration benefits payments, trading, borrowing, and lending, and allows users to save in digital dollars without a traditional bank account. [23]

Circle Payment Network Launch

In May 2025, the Circle Payment Network (CPN) went live. CPN is a blockchain powered payments coordination protocol that allows banks and payment providers to exchange payment instructions securely and settle in real time using USDC on public blockchains. [25]

CPN supports: B2B supplier payments, Cross border remittances, Treasury and cash consolidation, Recurring enterprise payments, Payroll and mass disbursements. [25]

"The launch of CPN represents a movement toward a new era in digital payments. Throughout 2025, we are exploring expanding access to more regions including Nigeria, the European Union, the United Kingdom, Colombia, India, the United Arab Emirates, China, Turkey, the Philippines, Vietnam, and Argentina." - Circle tweeted [25]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)