위키 구독하기

Share wiki

Bookmark

Indexed Finance

Indexed Finance

**인덱스드 파이낸스(Indexed Finance)**는 이더리움(Ethereum) (https://iq.wiki/wiki/ethereum) 네트워크를 위한 수동적 포트폴리오 관리 전략 개발에 중점을 두고 있습니다. 인덱스드 파이낸스는 거버넌스 토큰 보유자에 의해 관리되며, 이 토큰은 프로토콜 업데이트 제안 및 시장 부문 정의, 새로운 관리 전략 생성과 같은 상위 수준의 인덱스 관리에 대한 투표에 사용됩니다.[7][8]

2021년 10월 14일, 인덱스드 파이낸스는 1600만 달러 규모의 익스플로잇 공격을 당했습니다. 공격자는 정교한 플래시론 공격을 실행하여 프로젝트의 스마트 계약(https://iq.wiki/wiki/smart-contract) 중 하나의 기능적 논리를 악용했습니다.[9]

개요

인덱스드 파이낸스는 이더리움 기반의 수동적 포트폴리오 관리를 위한 탈중앙화 프로토콜입니다. 인덱스드 파이낸스는 2020년 8월에 시작되어 2020년 12월에 이더리움(https://iq.wiki/wiki/ethereum) 메인넷에 출시되었습니다. 이 프로젝트는 Molly(HEGIC 제작자)와 창립자 중 한 명으로부터 총 12만 5천 달러의 초기 사모 투자를 받았습니다.[10]

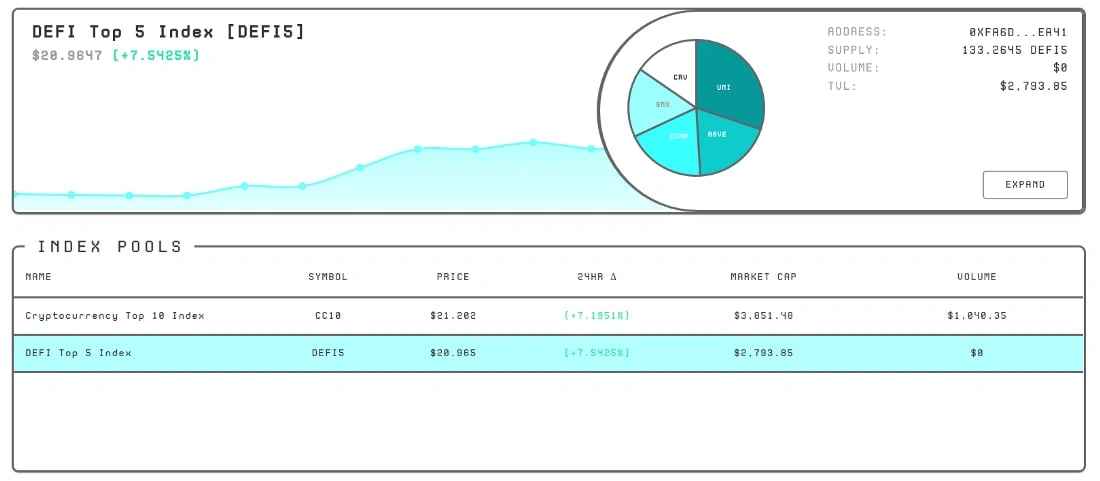

인덱스드 프로토콜은 상장지수펀드(ETF)와 유사한 포트폴리오 관리에 중점을 두고 있습니다. 운용 자산은 기초 자산의 성과를 추적합니다. 인덱스 풀은 풀을 나타내는 토큰으로 토큰화됩니다.

자동화된 시장 조성자(AMM)(https://iq.wiki/wiki/automated-market-maker) 메커니즘이 인덱스드 파이낸스 프로토콜에 통합되어 인덱스 풀의 균형을 재조정합니다. NDX 토큰 보유자는 거버넌스를 통해 관리 전략 및 시장 부문 정의를 포함한 풀을 수동적으로 관리합니다.

인덱스드 파이낸스는 Dillion Kellar와 PR0로 알려진 익명의 인물 두 명이 공동으로 설립했습니다. 현재 총 5명의 팀원이 프로젝트에 참여하고 있습니다.[11]

인덱스 풀

이는 인덱스드 파이낸스가 개발한 첫 번째 제품으로, 주식 시장에서 과거에 적극적으로 관리되는 펀드를 모방하도록 설계된 시가총액 가중 인덱스 풀 세트입니다.

인덱스 풀은 이더리움에서 자산 관리를 간소화합니다. 인덱스 펀드가 주식 시장에서 하는 방식과 마찬가지로, 인덱스가 나타내는 시장 부문을 추적하는 다양한 포트폴리오의 소유권을 나타내는 단일 자산을 생성합니다. 각 인덱스 풀에는 ERC-20(https://iq.wiki/wiki/erc-20) 인덱스 토큰이 있으며, 누구든 풀에 기초 자산을 제공하여 생성하거나, 소각하여 기초 자산을 청구하거나, 거래소와 스왑하여 특정 시장에 대한 노출을 쉽게 관리할 수 있습니다.

거버넌스

NDX 거버넌스 조직은 다음과 같은 책임을 맡고 있습니다.

- 필요에 따라 프록시 구현 업그레이드

- 새로운 인덱스 풀 배포

- 인덱스가 선택하는 토큰 범주 관리 및 새로운 범주 생성

- 새로운 관리 전략을 구현하는 풀 컨트롤러 승인

- 스왑 수수료와 같은 구성 값 설정

NDX 토큰 분배

NDX는 인덱스드의 거버넌스 토큰입니다. 10,000,000 NDX의 초기 공급량은 다음과 같이 분배됩니다.

- 20%는 창립자, 투자자 및 향후 팀원에게 귀속 기간이 적용되어 배분됩니다.

- 5%는 유니스왑(Uniswap)(https://iq.wiki/wiki/uniswap) 오라클을 업데이트하고 풀 컨트롤러에 대한 정기적인 업데이트를 트리거하는 키퍼에게 보상으로 사용됩니다.

- 25%는 인덱스 토큰 또는 유니스왑(https://iq.wiki/wiki/uniswap) 이더 페어 LP 토큰을 스테이킹하는 사용자에게 유동성 마이닝을 통해 분배됩니다.

- 20%는 2021년 1월 22일 이후 거버넌스에 의해 결정되는 방식으로 DeFi(https://iq.wiki/wiki/defi) 사용자에게 분배됩니다.

- 30%는 2021년 3월 1일부터 시작하여 9개월에 걸쳐 NDX 재무부에 제공됩니다.[12]

초기 거버넌스

분배가 진행되는 동안 프로젝트의 보안이 유지되며, 토큰이 귀속되는 동안 팀은 거버넌스 제안을 생성하고 투표할 수 있는 권한을 유지합니다. 또한, 거버너 계약에 대한 투표 기간은 임시로 블록으로 약 12시간에 해당하는 값으로 설정됩니다. 2021년 1월 7일 이후에는 누구든 거버너에 대한 함수를 호출하여 투표 기간을 약 3일에 가까운 영구적인 값으로 설정할 수 있습니다.

키퍼

키퍼를 위한 5% 할당은 현재 타임락 계약에 의해 보유되고 있으며, 키퍼 봇 및 계약의 개발 및 테스트가 완료되면 이전됩니다.

인덱스 컨트롤러

인덱스 풀 컨트롤러는 토큰 값을 추적하고 조정된 시가총액 가중 공식을 사용하여 포트폴리오 목표를 설정하는 계약입니다. NDX 거버넌스 DAO는 컨트롤러에서 토큰 범주를 생성하고 관리할 수 있으며, 이는 임의의 공통점을 가진 자산 바스켓입니다.

범주 토큰 선택

각 범주에 포함되기 위한 현재 규칙은 앱의 해당 페이지에서 확인할 수 있습니다.

- DeFi(탈중앙화 금융) 범주 [4]

- 암호화폐(https://iq.wiki/wiki/cryptocurrency) 범주 [5]

인덱스 해킹 공격

2021년 10월 14일, 인덱스드 파이낸스는 1600만 달러 규모의 익스플로잇 공격을 당했습니다. 공격자는 정교한 플래시론 공격을 실행하여 프로젝트의 스마트 계약(https://iq.wiki/wiki/smart-contract) 중 하나의 기능적 논리를 악용했습니다. 해커는 풀이 예치된 자산의 가치를 계산하는 방법을 관리하는 스마트 계약 코드를 공격하여 DEFI5 및 CC10 풀에서 자금을 가져갔습니다. 플래시론으로 빌린 자산을 풀에 투입하여 UNI 토큰을 교환함으로써, 해커는 알고리즘을 속여 풀의 가치를 실제보다 훨씬 낮게 계산하도록 만들었습니다.

이를 통해 해커는 풀의 인덱스 토큰을 대량으로 생성할 수 있었고, 이는 기초 자산을 청구하기 위해 소각되었습니다. 해커는 초기 플래시론을 상환한 후 DEFI5 풀에서 1100만 달러 상당의 자산과 CC10 풀에서 500만 달러 상당의 자산을 탈취했습니다.[13]

요약

인덱스 풀은 AMM을 겸하는 토큰화된 포트폴리오입니다. 풀 계약은 외부 유동성에 접근할 필요 없이 포트폴리오 구성을 근본적으로 변경할 수 있도록 설계되었습니다.

인덱스 풀 계약은 [6]의 포크입니다. 계약에 대한 주요 변경 사항은 자산을 점진적으로 바인딩, 리바인딩 및 가중치를 재조정할 수 있도록 더욱 역동적인 풀 관리를 가능하게 하여 외부 유동성에 접근할 필요가 없도록 하는 것이었습니다.

잘못된 내용이 있나요?