Subscribe to wiki

Share wiki

Bookmark

MUX Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

MUX Protocol

MUX is a protocol suite that offers the 1st decentralized perpetual trading aggregator and the P2Multi-Pool model; it provides traders with deep aggregated liquidity, optimized trading cost, up to 100x leverage, diverse market options and unique aggregator features like smart position routing, aggregated position, leverage boosting and liquidation price optimization. [1]

The MUX Perpetual Aggregator has integrated with leading perps liquidity sources like MUX V3 Trading Protocol, MUX V1 Trading Protocol, MUX V1 Degen Protocol, GMX V1, GMX V2, gTrade and will continue to integrate with more protocols. [1]

Overview

MUX Protocol, initially known as MCDEX and founded in 2019, has progressed through multiple versions, with the latest iteration, MUX Protocol, launched in August 2022. This version incorporates an oracle for price feeds and features a trading mechanism akin to GMX. Following a rebranding in December 2022, MUX has received backing from investors like Binance Labs and Multicoin Capital.

The protocol consists of several components: the MUX Perpetual Aggregator, which aims to optimize liquidity routes; the MUX Native Trading Protocol, designed for zero price impact trading and up to 100x leverage; and the MUX Degen Protocol, focused on long-tail asset trading. MUX Protocol continues to evolve and integrate with additional liquidity sources.[1][2][3]

Products

MUX Perpetual Aggregator

MUX Protocol includes the MUX Perpetual Aggregator, which aims to route positions to the most suitable liquidity sources and enhance leverage and liquidation prices by providing additional margin. It also supports the management of large orders by splitting them across multiple liquidity sources to reduce costs.

The protocol seeks to consolidate liquidity from various sources and utilizes smart contracts, known as position containers, to manage and isolate positions for improved risk management. Planned future updates include better integration with GMX, cross-chain aggregation, and advancements in position management.[4]

MUX Native Trading Protocol

The MUX Native Trading Protocol is a decentralized system designed for perpetual trading. It aims to offer zero price impact, up to 100x leverage, and integrate liquidity across multiple chains. The protocol supports leveraged trading with aggregated liquidity, providing benefits to both traders and liquidity providers.

The protocol operates through three mechanisms: Universal Liquidity, which seeks to consolidate liquidity across networks for improved efficiency; Multi-Asset Pool, which manages risk by supporting leveraged positions with a diversified asset portfolio; and Dark Oracle, which aggregates pricing data from various sources to ensure accurate pricing and minimize price impact.[5]

MUX Degen Protocol

MUX Degen Protocol is a decentralized trading system aimed at enhancing the trading experience for long-tail assets. It adjusts trading prices based on position size to reduce risks of price manipulation and promote stability.

The protocol includes the DegenLP pool, used for trading within the system. Access to this pool is limited to whitelisted, sophisticated traders and liquidity providers due to its high-risk nature.[6]

Tokenomics

$MCB

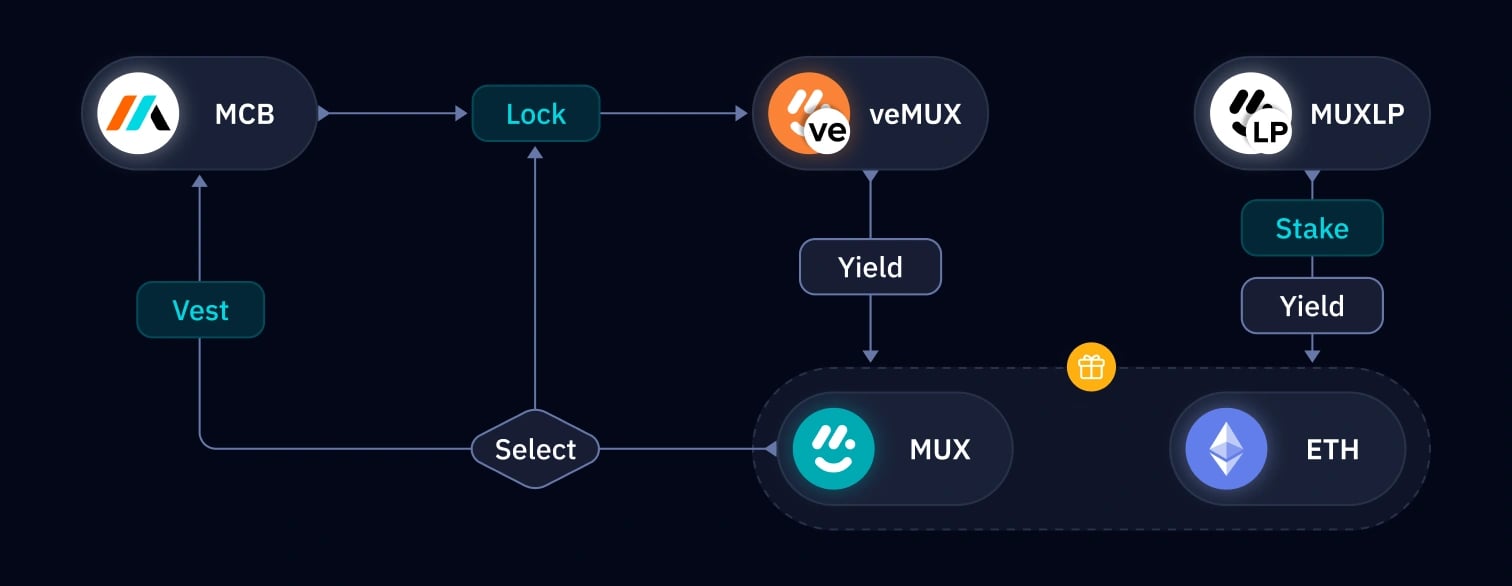

$MCB serves as the primary token within the MUX Protocol. Users can lock $MCB to obtain veMUX, which aims to provide access to protocol income and MUX rewards. The total supply of $MCB is capped at 4,803,144 tokens, with 1,000,000 reserved for future vesting. Locking $MCB or MUX tokens for varying periods yields veMUX, with longer lock durations resulting in greater allocations. Staking and rewards distribution are managed on Arbitrum, where users are encouraged to bridge tokens to participate.[7]

$MUX

$MUX serves as a non-transferable reward token within the MUX Protocol. Users can acquire $MUX by holding veMUX or staking MUXLP. The token has a supply cap of 1,000,000, with a daily emission rate of 1,000. The token supply is intended to decrease when $MUX is vested into $MCB over a year. Any potential increase in the supply cap would be subject to a governance proposal and a 14-day time lock if approved.[7]

Utility

The $MUX token has the following utilities:

- Staking: $MUX can be staked to earn veMUX, following similar rules as $MCB staking.

- Vesting: $MUX can be vested into $MCB over one year via:

- Quota Channel: Vesting is limited by veMUX-related quotas.

- Capacity Channel: Vesting depends on the amount of reserved MUXLP tokens.[7]

$veMUX

The $veMUX token serves as the governance token for MUX Protocol, aiming to provide voting power based on the quantity held. Users can obtain $veMUX by locking $MCB or $MUX, which in turn aims to grant access to protocol income and $MUX rewards.

$veMUX tokens are non-transferable and are available exclusively on Arbitrum. They are designed to receive a share of protocol income derived from trading fees.[7]

$MUXLP

$MUXLP is the liquidity provider token for the MUX Protocol. Users can obtain $MUXLP by contributing assets to the liquidity pool and may stake these tokens to potentially receive protocol income and $MUX rewards.

The token does not have a supply cap; $MUXLP tokens are created through purchases and removed through sales. Stakers are eligible to receive a share of the protocol's income derived from trading fees.[7]

Governance

The MUX Protocol’s governance process aims to involve community input through forum discussions and developer-led implementations. Proposed changes are openly debated, and a 48-hour timelock generally applies before they are enacted, with exceptions for urgent security interventions.

In the future, as the protocol matures, veMUX holders are expected to gain voting rights to participate in governance decisions. Currently, the MUX DAO multi-sig oversees the protocol’s smart contracts, handling operations, maintenance, and emergencies with varying time lock requirements based on the action.[8]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)