Subscribe to wiki

Share wiki

Bookmark

MYSO Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

MYSO Finance

MYSO Finance is a trust-minimized, permissionless peer-to-peer (P2P) lending protocol implemented on the Ethereum Virtual Machine (EVM). The protocol enables the creation of fixed-term credit markets for any ERC-20 token as well as bespoke and fully customizable covered calls.[1]

Overview

MYSO Finance is a decentralized finance (DeFi) protocol specializing in fixed-term credit markets and trustless on-chain covered calls. MYSO is oracleless by nature, meaning that users can create custom loan offers and covered calls for nearly any token, regardless of the availability of reliable price feeds. The latter covered call offering allows token holders to lend otherwise idle tokens to generate upfront stablecoin revenue by writing call options. [1]

Covered Calls

MYSO enables the creation of customizable covered calls without counterparty risk for various tokens. This feature allows token holders to generate stablecoin revenue by writing call options on their idle tokens. Key benefits include the ability to utilize idle tokens without selling them, cost efficiency without incurring swap fees or market impact, instant revenue in stablecoins, trustless settlement, personalization according to user needs, and transparent on-chain settlement. [4]

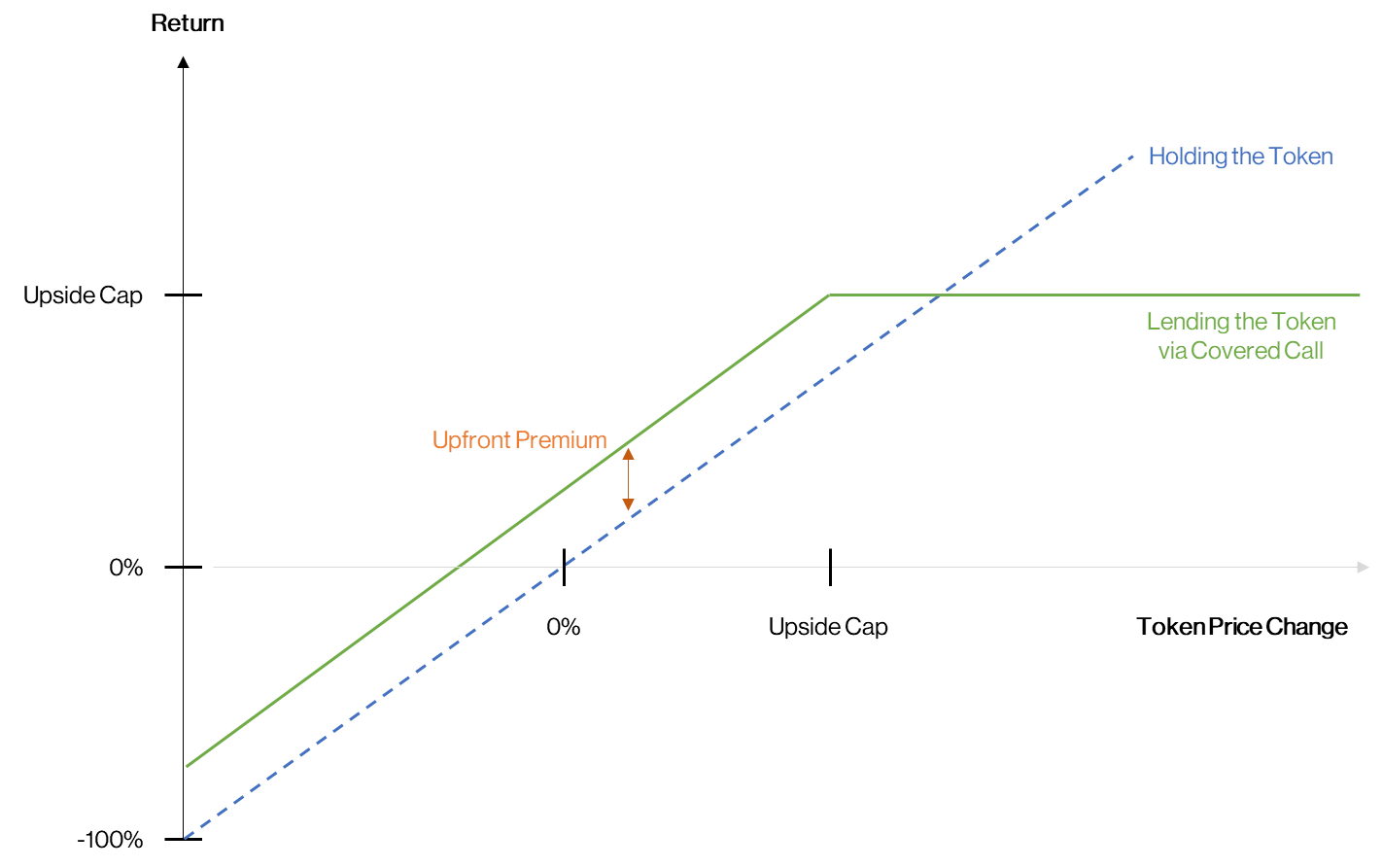

Through a covered call strategy, the token holder earns an initial premium by selling a call option, resulting in immediate revenue known as the Upfront Premium. The covered call payoff line follows a linear shape up to the upside cap, beyond which gains are capped. This means that if the token price remains below the upside cap, the covered call strategy tends to yield better outcomes. Holding the token becomes more advantageous only when the price exceeds the upside cap. [4]

Covered calls offer a range of advantages for users looking to optimize their crypto holdings. By engaging in covered calls, users can generate revenue from idle tokens without selling them, offering a practical solution for asset utilization. This strategy stands out for its cost efficiency, as it avoids swap fees and market impacts in the event of a conversion, making it an attractive option for treasuries diversifying into stablecoins. Revenue is generated instantly in stablecoins, providing immediate liquidity and financial benefit. Furthermore, the trustless nature of these transactions ensures that settlement occurs without counterparty risk, enhancing security. Covered calls also offer personalization, allowing users to tailor strategies to their specific needs, and operate with complete transparency, with all transactions being recorded on-chain. [2]

One reason why institutional borrowers are willing to provide upfront cash for borrowing tokens is that these tokens enable them to seize arbitrage opportunities, such as price differences between different exchanges or between spot and perpetual contract prices. Additionally, market makers utilize a strategy called "gamma scalping" to take advantage of price fluctuations in the value of the call option. This strategy enables them to profit from the volatility of the underlying token without committing to a specific directional view.

MYSO supports covered calls for nearly any ERC-20 token, provided it is on an EVM-compatible chain and has a market cap exceeding $10 million. The minimum ticket size for covered call notional is $100,000. The protocol has onboarded several institutional borrowers who can provide stablecoin liquidity and quotes for these deals. [3]

Roadmap

As MYSO progresses along its innovative path, the team is keenly focused on scaling the accessibility and efficiency of covered calls. This strategic expansion is particularly significant as it heralds the introduction of covered calls to retail investors, effectively democratizing covered calls that were traditionally reserved for more experienced or institutional participants. [14]

Parallel to enhancing the covered calls offering, MYSO is poised to launch an innovative convertible debt vehicle aimed at supporting DAOs. This initiative is designed to provide DAOs with the necessary liquid capital to propel their growth and achieve strategic objectives, all while minimizing their token emissions, reducing sell pressure, and maintaining a high degree of alignment with community values. Additionally, this vehicle opens up new avenues for lenders, offering them the chance to participate in the upside potential of the collateral token, akin to equity-like benefits. [14]

Audits

MYSO has been committed to maintaining the highest possible code security standards, ensuring that user funds are secure and that the platform is protected from many different attack vectors. With this in mind, the MYSO v2 codebase has undergone 3 independent security audits with top teams from the code security space, including Trail of Bits, Omniscia, and Statemind. Each of these audits can be found here:

- Trail of Bits: https://github.com/trailofbits/publications/blob/master/reviews/2023-04-mysoloans-securityreview.pdf

- Statemind: https://github.com/statemindio/public-audits/blob/main/Myso%20Finance/2023-08-15\_Myso\_v2.pdf

- Omniscia: https://omniscia.io/reports/myso-finance-lending-protocol-644911cef1412d00142bf698/

Funding

MYSO Finance raised $2.4M in its seed round, announced in April 2022. Investors included Huobi, Nexo, Wintermute, GSR, Hashkey, CMT Digital, Nothing Research, Caballeros Capital, Advanced Blockchain, Ratio Ventures, Symbolic Capital Partners, Jabre Cap, and Mentha Partners. [13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)