Subscribe to wiki

Share wiki

Bookmark

Ormolus

We've just announced IQ AI.

Ormolus

Ormolus is a Layer 2 solution aimed at improving Ethereum’s scalability and transaction efficiency using rollup technology. It enables faster, low-cost transactions while distributing Ethereum to holders on each transaction, focusing on building a sustainable, community-driven ecosystem within decentralized finance. [1]

Overview

Ormolus is a Layer 2 solution designed to enhance Ethereum’s scalability and transaction efficiency using zk-rollups, which bundle multiple transactions for processing on the Ethereum mainnet. This reduces gas fees and increases throughput while maintaining network security through cryptographic proofs. Ormolus's smart contract infrastructure automates rewards distribution, tax collection, and fund allocation, ensuring secure and transparent operations. The platform emphasizes strong security measures, integrating Ethereum’s security properties with additional protections like cryptographic and fraud proofs, supported by audits and a dedicated security team. [2][3]

Features

ETH Dividends System

Ormolus’s ETH dividends system rewards network participants with Ethereum (ETH), rather than the platform's native token. This strategy promotes long-term holding, as ETH is a stable and widely recognized asset, which reduces sell pressure and supports price stability. By incentivizing sustained engagement, the system aligns with Ethereum’s goals of maintaining a decentralized and secure network. Additionally, transaction taxes collected are distributed as ETH rewards to token holders based on their holdings, encouraging ongoing participation. The funds are allocated to development, marketing, and community projects, supporting platform enhancements, increasing visibility, and fostering community engagement to ensure the platform's growth. [2][4]

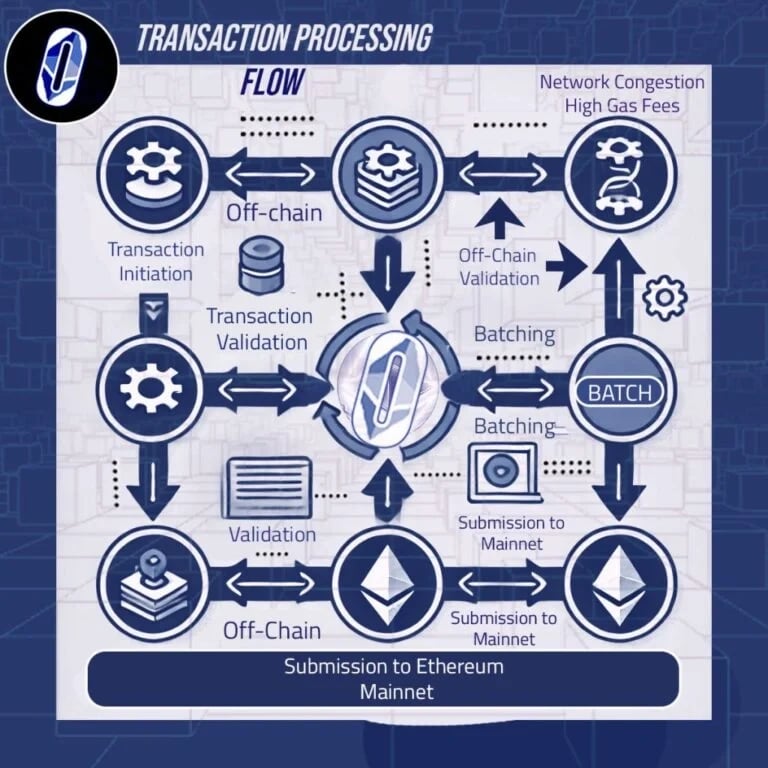

Transaction Processing

The transaction processing flow in the Ormolus platform enhances efficiency and security by processing transactions off-chain. Initiated transactions are validated and grouped into batches before being submitted to the Ethereum mainnet for finalization. This method allows Ormolus to manage a high volume of transactions without straining the Ethereum network, reducing latency and ensuring timely execution. Utilizing zk-rollups, each transaction within a batch is verified while keeping transaction details confidential, thus preserving user data security. Once finalized on the Ethereum mainnet, the batch becomes immutable, ensuring the integrity of the transaction history. [4]

Smart Contract Infrastructure

The smart contract infrastructure of Ormolus is essential to its functionality, governing operations such as rewards distribution, transaction tax collection, fund allocation, and governance. The platform relies on core contracts, including the token contract, which defines the Ormolus token's properties and functions, and the rewards contract, which manages reward distributions. These contracts are modular and upgradeable, allowing for the integration of new features as market conditions evolve. Security is a top priority, with all contracts undergoing rigorous testing and audits by both internal and third-party security experts to identify vulnerabilities. Ormolus also implements a bug bounty program to encourage the community to report security issues, ensuring the platform remains resilient against potential threats and protecting user assets. [2][4]

Security and Compliance

Ormolus incorporates a comprehensive security framework that addresses the challenges of blockchain technology, focusing on cryptographic security and decentralized validation to protect against vulnerabilities. It uses zk-rollups and fraud proofs to secure transactions, ensuring confidentiality and verification, while decentralizing validation to enhance platform reliability. Regular third-party security audits and a bug bounty program help identify and mitigate potential threats. Ormolus also prioritizes compliance with global regulations, including GDPR, and may implement KYC and AML procedures for specific activities. The platform's governance model allows it to adapt to evolving regulatory requirements, maintaining compliance without disrupting the user experience. [2][4]

Governance

Ormolus employs a decentralized governance model through a Decentralized Autonomous Organization (DAO), where token holders propose and vote on key issues, such as protocol upgrades, tax changes, and fund allocation. Token holders submit proposals by staking a minimum amount of ORM tokens, which are then reviewed and discussed by the community before voting. The DAO ensures transparency, with all proposals and decisions recorded on-chain, allowing for open participation and accountability. This inclusive system promotes active engagement from the community, ensuring that decisions reflect diverse perspectives and align with the platform's broader interests. [2][4]

ORM

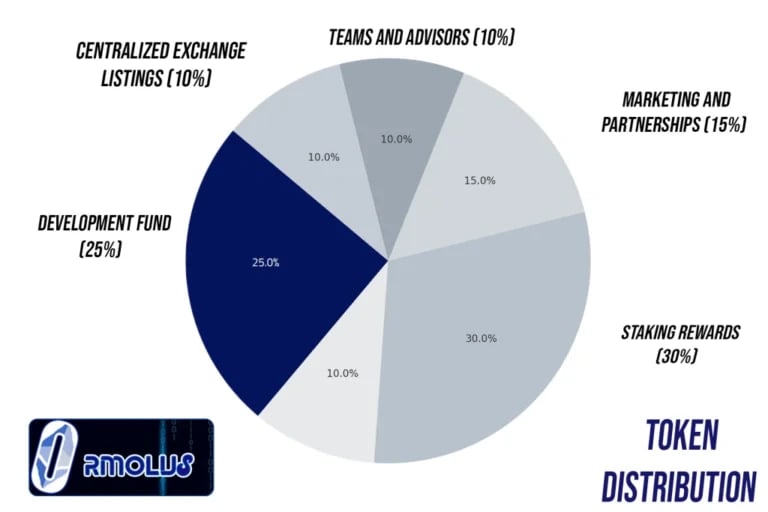

Ormolus features a sustainable economic model focused on long-term growth, with the Ormolus token (ORM) as the primary medium of exchange within the platform. The tokenomics are structured to maintain liquidity, stability, and align incentives, encouraging active participation and engagement within the ecosystem. [4]

Tokenomics

ORM has a total supply of 1B tokens and has the following distribution: [4]

- Staking Rewards: 30%

- Development Fund: 25%

- Marketing/Partnerships: 15%

- Liquidity Pool: 10%

- Team/Advisors: 10%

- Centralized Exchange Listings: 10%

Partnerships

- KangaMoon

- Defender Bot

- PAALMind

See something wrong?