Taoshi (PTN)

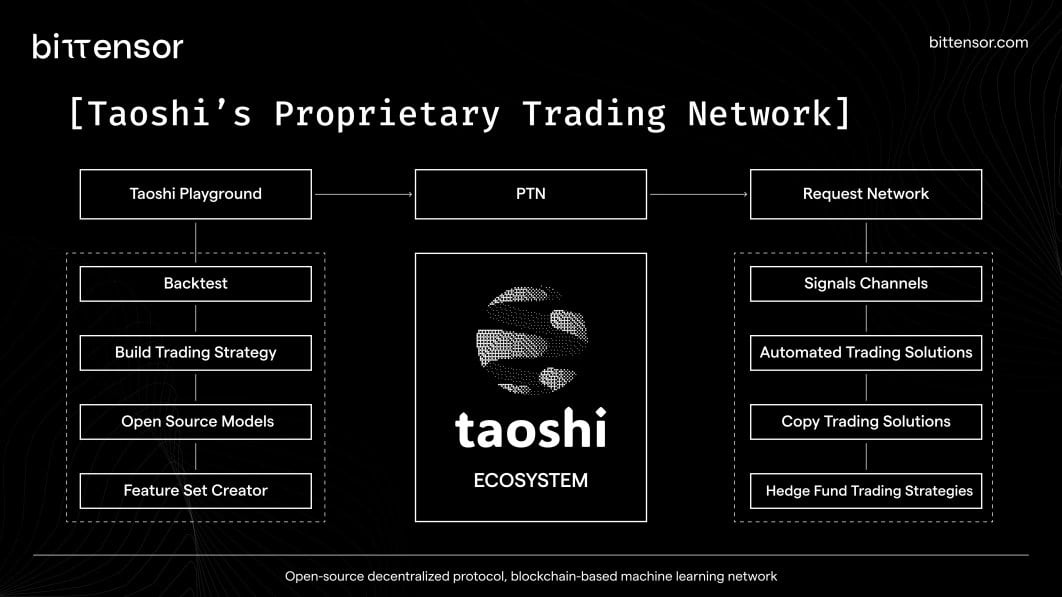

Taoshi is a software company that specializes in developing decentralized trading infrastructure on the Bittensor blockchain. The company's core product is the Proprietary Trading Network (PTN), a system that integrates artificial intelligence and machine learning to foster a competitive environment where traders are rewarded based on performance. [1]

Overview

Taoshi is a software company established in 2023 that develops decentralized trading infrastructure using Bittensor’s blockchain network. Its platform integrates AI and machine learning to analyze financial market data, aiming to make advanced trading strategies more accessible and transparent for both individuals and institutions. The company’s core innovation is the Proprietary Trading Network (PTN). This decentralized system enables traders to compete in a transparent environment and earn rewards based on their performance, rather than entry fees. Unlike traditional proprietary trading firms, which often rely on challenge fees, Taoshi’s model aligns incentives toward long-term trader success and data-driven insights. Through its blockchain-based framework, Taoshi focuses on combining decentralized AI with financial analytics to promote fair competition, credible evaluation, and improved decision-making across global markets. [2] [3]

Technology

PTN

The Proprietary Trading Network (PTN) is a decentralized trading system developed by Taoshi that evaluates traders and algorithms based on real-time performance across multiple markets, including forex, crypto, and equities. Participants, referred to as miners, submit trading signals—long, short, or flat—aimed at generating consistent returns while staying within defined drawdown and leverage limits. The network ranks miners according to portfolio efficiency and return metrics, rewarding those with the strongest and most stable performance.

PTN enforces strict operational rules to ensure fairness and credibility. Traders can only hold one directional position per trading pair, with leverage capped to prevent excessive risk-taking. Each position incurs spread and carry fees that scale with leverage, promoting responsible trading behavior. Orders outside market hours are ignored, and miners found plagiarizing others’ strategies face elimination. A registration fee and a short immunity period allow new participants to integrate into the competition before being evaluated against established traders.

By linking performance-based incentives with transparent blockchain tracking, PTN attracts quantitative and AI-driven trading systems capable of competing at a global level. The structure ensures that only high-performing strategies with proven efficiency and sound risk management rise to the top. [6]

Miners

In Taoshi’s Proprietary Trading Network (PTN), miners serve as traders who generate and execute trading signals across multiple asset classes, including forex, crypto, and equities. Each miner places orders based on leverage, which represents the proportion of their portfolio allocated to a trade. When a miner opens a position—either long or short—it reflects their directional view on the asset’s movement. Long positions anticipate price increases, while short positions anticipate declines. Miners can adjust leverage within an open position to manage exposure or take partial profits by issuing counter-signals.

To participate, miners must register on the Bittensor network and pay a small entry fee. Upon joining, they enter a challenge period lasting up to 90 days, during which they must demonstrate consistent performance. To pass, a miner must trade for at least 61 days, maintain a drawdown below 10%, and rank at or above the 15th position within their asset class. Miners who exceed the drawdown limit or fail to meet ranking requirements face elimination. Those who drop below the top tier after qualifying enter a probation period, with 30 days to recover before removal.

Operationally, PTN enforces clear trading constraints to maintain fairness and system integrity. Miners may hold only one open position per trade pair, cannot reverse direction without closing a position, and must operate within defined leverage limits. Orders placed outside market hours, sent too frequently, or made during cooldown periods are ignored. The system also discourages exploitative behavior such as excessive order submission or reusing deregistered hotkeys. These measures ensure that only disciplined, consistently performing traders remain active in the network. [7]

Validators

A validator receives trade signals from miners and maintains an individual portfolio for each miner in the validation directory. It tracks portfolio performance using live market data, eliminating miners whose portfolios exceed drawdown limits. Portfolio metrics, such as the omega score and return, are used to assign weights that reward top-performing miners, with updates occurring every five minutes. Validators also monitor the network for plagiarism by analyzing all incoming orders and removing miners who copy trades from others. Information on eliminated miners—whether for excessive drawdowns or plagiarism—is stored in designated validation files, and only active, non-eliminated miners can continue participating until they are deregistered and reapply.

Before operating on the mainnet, it is recommended to test validators on the testnet using the appropriate flags. The mainnet environment, which emits real TAO, requires a lock cost to create incentive mechanisms, making proper configuration essential. Users are advised to safeguard their private keys, use only testnet wallets for testing purposes, avoid reusing passwords across wallets, and ensure their mechanisms are resistant to potential abuse. [8]

Collateral

The collateral system enables miners to lock Theta tokens, allowing them to access and scale simulated trading capital within the network. This mechanism introduces accountability and aligns long-term incentives by requiring miners to commit a Theta deposit, with the amount of capital unlocked determined by a valuation model. Initially, each Theta provides access to $175 in capital, with valuations adjusted quarterly based on factors such as supply, liquidity, and miner activity.

The rollout occurs in stages. V1, the initial phase, serves as a risk-free test period on both mainnet and testnet. Participation is optional, deposits are capped at 50 Theta, and no collateral is subject to slashing. V2 introduces mandatory collateral and integrates profit and loss (PnL) metrics into miner scoring, with higher collateral limits—initially capped at 300 Theta. V2.1 introduces position sizing requirements, which require miners to hold sufficient collateral to cover the notional value of their open positions, calculated based on leverage and asset type.

Deposits and withdrawals are subject to strict rules to maintain network consistency. Miners must close all positions before adjusting collateral, and changes only take effect after midnight UTC. Withdrawals depend on performance: miners with positive returns can withdraw fully, while those with losses face proportional limits based on drawdown. Exceeding a 10% drawdown results in elimination, where half of the miner’s collateral is slashed and the remaining half returned. [9]

Horizon

Horizon serves as a unified platform for managing PTN miners and exchange connectivity, featuring both backend monitoring and a web-based control interface. It consists of two main components: Watcher, which oversees exchange activity and converts orders into actionable signals, and Easy Miner, a browser-based tool for managing miners and monitoring order flow. Together, these systems provide real-time visibility, automated signal processing, and modular integration for multiple exchanges.

The Watcher handles automated order tracking, converts exchange data into signals, calculates dynamic leverage, and maintains live updates via WebSocket connections. It supports both sandbox and testnet environments, offering flexibility for testing and deployment. Meanwhile, Easy Miner allows users to start or stop miners, view real-time logs, track live orders, and identify errors through a clear interface designed for operational oversight.

Horizon’s modular architecture separates core functions into dedicated directories for exchange monitoring, order management, miner control, and API routing. The system operates on Node.js and Python, requiring PTN configuration and valid exchange API credentials. Once configured, Horizon continuously monitors exchange activity, processes orders into signals, and maintains synchronized performance data between the backend and the user interface, supporting both development and production environments. [2] [3]

Request Network

The Request Network, developed by Taoshi, functions as a decentralized marketplace within the Bittensor ecosystem. It connects users with validators across subnets, allowing access to data, computational services, and analytical tools in a secure and transparent environment. The platform serves as an access point for decentralized innovation, enabling research and development across multiple domains while integrating payment through Stripe for reliability and ease of use.

Users engage with the network by registering on the marketplace, selecting a subnet that matches their needs, and choosing a validator to provide data or services. After agreeing to the service terms and completing payment, users receive an API key granting direct access to the validator’s offerings. The system reinforces collaboration within Bittensor’s ecosystem—miners provide data and computational power, consumers leverage these resources for innovation, and validators, who sustain network integrity, receive all transactional revenue from the Request Network. [5]

Theta

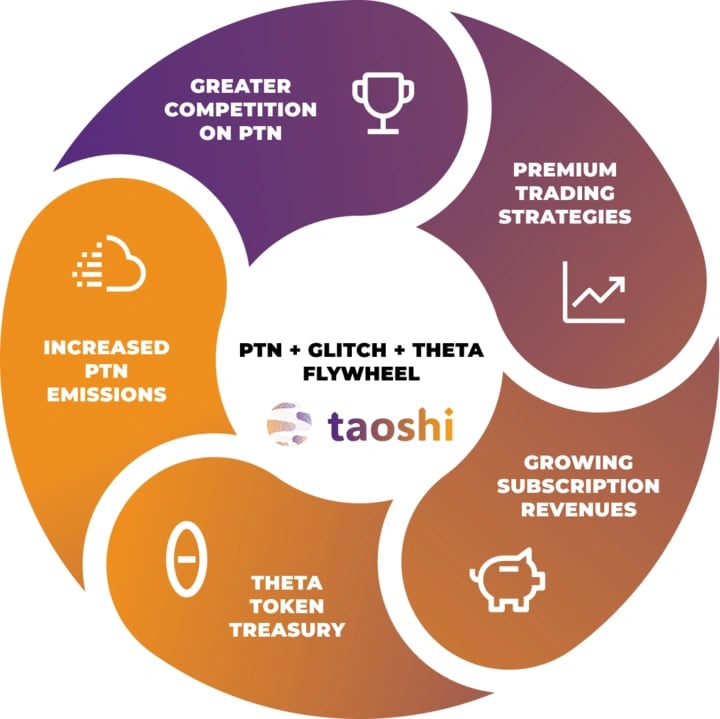

Theta is the native token powering Taoshi’s Proprietary Trading Network (PTN), a decentralized trading ecosystem built on the Bittensor blockchain. Integrated within Bittensor’s dynamic TAO framework (dTAO), Theta allows users to exchange TAO for Theta, directly investing in PTN and supporting its expansion. The token embodies the principles of dTAO—decentralization, transparency, and community-driven governance—by shifting value creation from centralized entities to subnet-specific ecosystems like PTN. Each subnet operates with its own token, enabling participants to invest in networks that align with their goals while contributing to a more open and inclusive financial model.

Theta’s design supports a self-sustaining growth mechanism known as the Theta Flywheel Effect. Competition among miners enhances the quality of trading signals and strategies within PTN, driving demand for Theta. Validators who hold Theta gain access to advanced, data-driven trading tools, while a portion of Glitch Financial’s revenue is used to buy back and allocate Theta tokens to a DAO for further ecosystem development. This continuous cycle of participation, innovation, and reinvestment reinforces the strength and longevity of the Taoshi ecosystem. [4]