订阅 wiki

Share wiki

Bookmark

Aryze

Aryze

Aryze 是一个旨在通过提供与稳定币、代币化和现实世界资产相关的服务来连接传统金融(TradFi)和 Web3 的平台。它将自己定位为提供稳定币即服务。 [2]

概述

Aryze 是一个成立于 2017 年的数字金融平台,它将传统银行与区块链技术相结合,以提供安全、完全抵押的数字资产和金融解决方案。其产品包括品牌稳定币、资金管理、跨境支付和外汇 API 集成,旨在提高企业、政府和机构的效率、合规性和全球流动性管理。

该平台强调强大的安全性和监管合规性,符合欧盟 MiCA 框架等国际标准。它使用智能合约和专有技术来实现快速、经济高效的交易。Aryze 支持与现有系统集成的可定制解决方案,促进无缝采用具有全球影响力的数字金融工具,并以斯堪的纳维亚的信任和运营精度为基础。 [3] [4]

服务

品牌稳定币(SaaS)

Aryze 的品牌稳定币是一项 SaaS 产品,使组织能够发行完全抵押的数字代币,这些代币与法定货币或现实世界资产挂钩。这些稳定币专为支付、资金管理和全球结算而设计。它们可以进行定制以反映企业的品牌,同时与 Aryze 的 API 集成,以实现安全透明的链上交易。

这些代币由法定储备完全支持,并符合 MiCA 等监管标准,通过链上审计跟踪提供可追溯性。部署过程包括代币定制、安全区块链启动、系统集成和实时监控工具,以管理交易和抵押品。 [5]

资金优化

Aryze 的资金优化解决方案使组织能够将闲置储备转换为由法定货币 1:1 完全抵押的稳定币,从而提供安全且现代的传统现金管理替代方案。它取代了传统的资金系统,降低了运营成本和外汇波动风险,同时通过灵活的收益分成模式创造了新的收入机会,回报率从 20% 到 50% 不等。

该系统通过 Aryze 的 API 和 ReForge FX Engine 与现有金融基础设施集成,支持实时交易和跨链流动性管理。符合 MiCA 等国际法规可确保安全、透明的运营,用户可以通过实时绩效和抵押品跟踪工具保留监督权。 [6]

外汇 API 集成

Aryze 的外汇 API 集成允许组织使用 ReForge FX Engine 在其金融系统中直接执行实时外汇兑换。API 支持跨区块链网络的链上、多币种交易,并采用固定费用模式,每次兑换都会自动进行收入分成。

集成包括嵌入标准化端点、配置交易和收入参数,以及使用监控工具实时了解交易量和绩效。此设置可实现高效的流动性管理,简化跨境支付,并从日常外汇活动中建立可预测的收入来源。 [7]

技术

稳定币架构

Aryze 的稳定币架构专为安全、完全抵押的数字资产发行而设计,支持 Wrapped 和品牌稳定币。它使用动态铸造和销毁机制来维持与法定货币或现实世界资产的 1:1 挂钩,确保供应与储备保持一致。

该架构通过 ReForge FX Engine 在多个区块链上实现互操作性,从而实现跨链资产转移。智能合约针对性能和 gas 效率进行了优化,该系统包括基于角色的访问控制、遵守国际合规标准(如 MiCA)以及通过不可变的审计跟踪实现链上透明度。此框架支持资金管理、支付和更广泛的数字金融应用中的用例。 [8]

reForge FX 引擎

reForge FX 引擎是 Aryze 的核心跨链基础设施,用于实时资产交换和流动性管理。它支持跨多个区块链网络的即时外汇兑换、资产交换和跨链转移,从而消除中介机构以降低成本和结算时间。此基础设施针对速度进行了优化,具有近乎即时的最终性,使其适用于高频交易。

安全性通过基于角色的访问控制、多重签名治理和动态铸造和销毁机制构建,所有这些都受到独立审计和完全监管一致性(例如,MiCA)的支持。该系统将所有交易记录在链上以实现完全可追溯性,并定期进行储备证明审计以确认 1:1 抵押。

reForge 支持跨各种区块链生态系统的部署,在保持资产价值和流动性的同时实现无缝互操作性。其开发者优先的 API 支持可定制的集成到金融系统中,帮助企业大规模嵌入外汇和稳定币功能。 [9] [10]

RYZE

$RYZE 是 Aryze 的原生 实用代币,通过促进流动性、激励稳定币采用以及将平台使用与代币持有者价值联系起来,来支持其金融生态系统。它在稳定币即服务 (SCaaS) 模型中发挥着核心作用,支持稳定币发行和运营,同时充当通过购买和销毁结构将平台增长分配回用户的机制。

随着企业采用 Aryze 的 SCaaS,对 $RYZE 的需求增加。平台收入的一部分用于回购和销毁 $RYZE,从而产生通货紧缩压力,并将代币价值与生态系统扩张对齐。统一的流动性池将 $RYZE 与稳定币配对,以减少滑点、提高交易效率并加强系统稳定性。

除了流动性之外,$RYZE 对于稳定币发行者至关重要,可实现发行并支持企业级采用。它还可以解锁未来对高级功能和服务的访问。随着 Aryze 的发展,$RYZE 的实用性和稀缺性旨在扩大规模,从而加强其作为合规、稳定且全球可访问的金融基础设施引擎的功能。 [11]

代币经济学

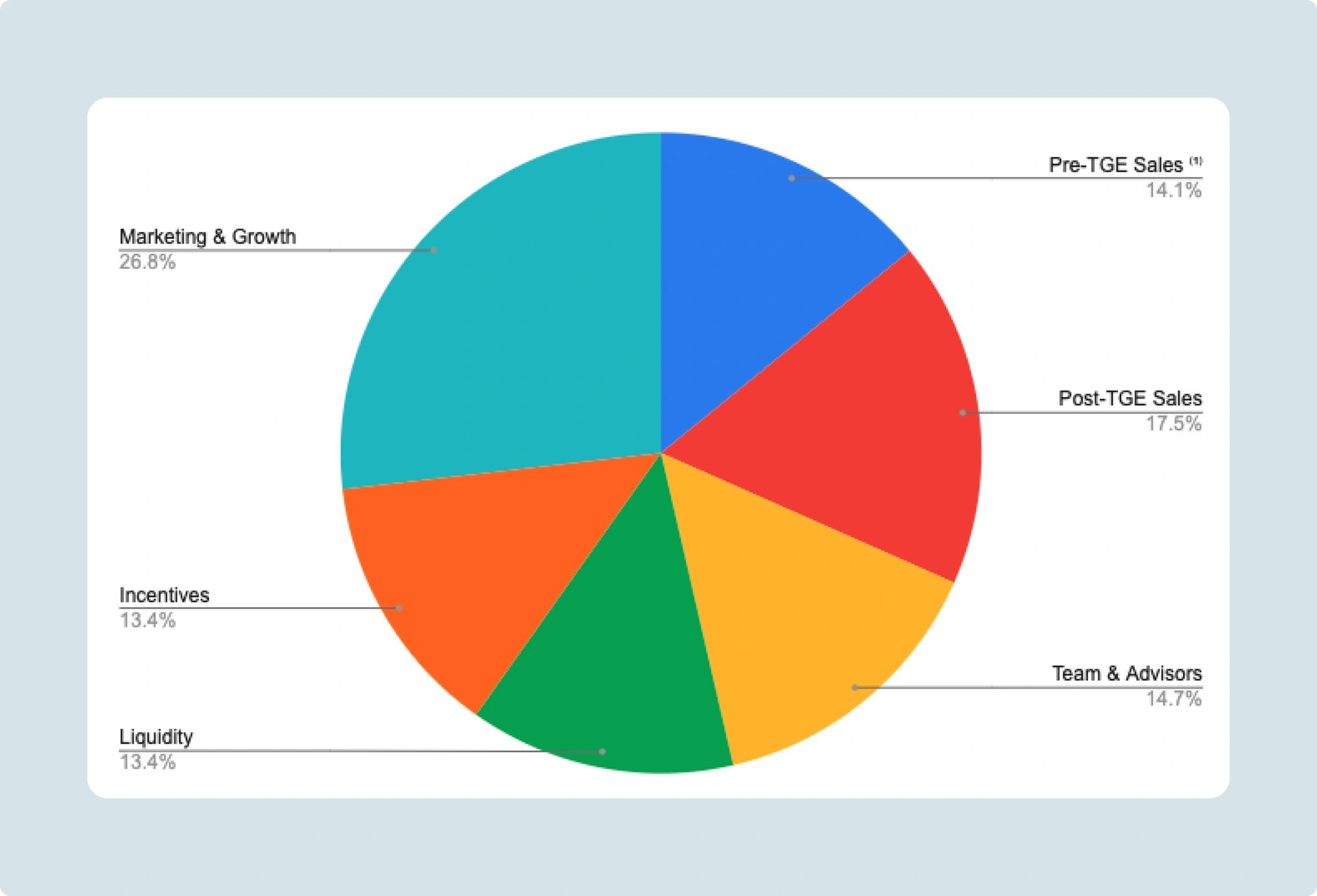

RYZE 的总供应量为 3.847 亿个代币,其分配如下: [12]

- 营销与增长:26.8%

- TGE 后销售:17.5%

- 团队与顾问:14.7%

- TGE 前销售:14.1%

- 流动性:13.4%

- 激励:13.4%

合作伙伴

发现错误了吗?