订阅 wiki

Share wiki

Bookmark

Limitless Exchange

0%

Limitless Exchange

Limitless Exchange 是一个建立在 Base 网络上的去中心化预测市场平台。它专为基于事件结果的交易而设计,专注于通过加密货币和股票价格的持续小时和每日市场进行短期资产价格波动。该平台采用中央限价订单簿 (CLOB) 模型进行交易,并支持基于自然语言表达式创建市场。它旨在提供快速、低成本的链上结算交易,并且已经处理了超过 4.97 亿美元的交易量。 [3] [7]

概述

Limitless Exchange 是一个建立在 Base 区块链 上的去中心化预测市场平台,通过其订单簿界面强调速度和降低交易成本。该平台支持市价单和限价单,促进链上结算,无需依赖 自动做市商 (AMM) 模型或复杂的定价曲线,例如基于对数市场评分规则 (LMSR) 的定价曲线。通过采用 混合 架构,Limitless 旨在降低 gas 费用,并简化用户体验,与一些替代预测市场设计相比。用户购买特定条件结果的份额,通常为“是”或“否”。例如,用户可能会以 0.15 美元的价格购买“BTC 将达到 6.5 万美元”结果的“是”份额,这意味着 15% 的概率。如果结果实现,获胜的份额以每个 1 美元的价格到期,而失败的份额在市场解决后变得一文不值。该平台的一个关键机制是,在解决之前,来自同一市场的“是”份额和“否”份额可以兑换为一单位 抵押 代币,通常为 USDC 或 Wrapped ETH。 [7]

该平台专为可访问性和资本效率而设计,允许基于自然语言条件创建市场,并最大限度地减少进入壁垒。用户可以直接从他们的 加密货币 钱包进行交易,而无需进行广泛的入门流程,并且该平台引入了移动优先的交易界面,以进一步增强全球用户 群 的可访问性。虽然主要采用 无需许可 的方式,但该平台包含可选功能,以在必要时支持法规遵从性。Limitless 还致力于通过跨链桥和 预言机 集成来聚合深度,从而提高各种市场类型的市场流动性和执行质量,从而实现更窄的买卖价差。 [7] [1] [2]

功能特性

CLOB

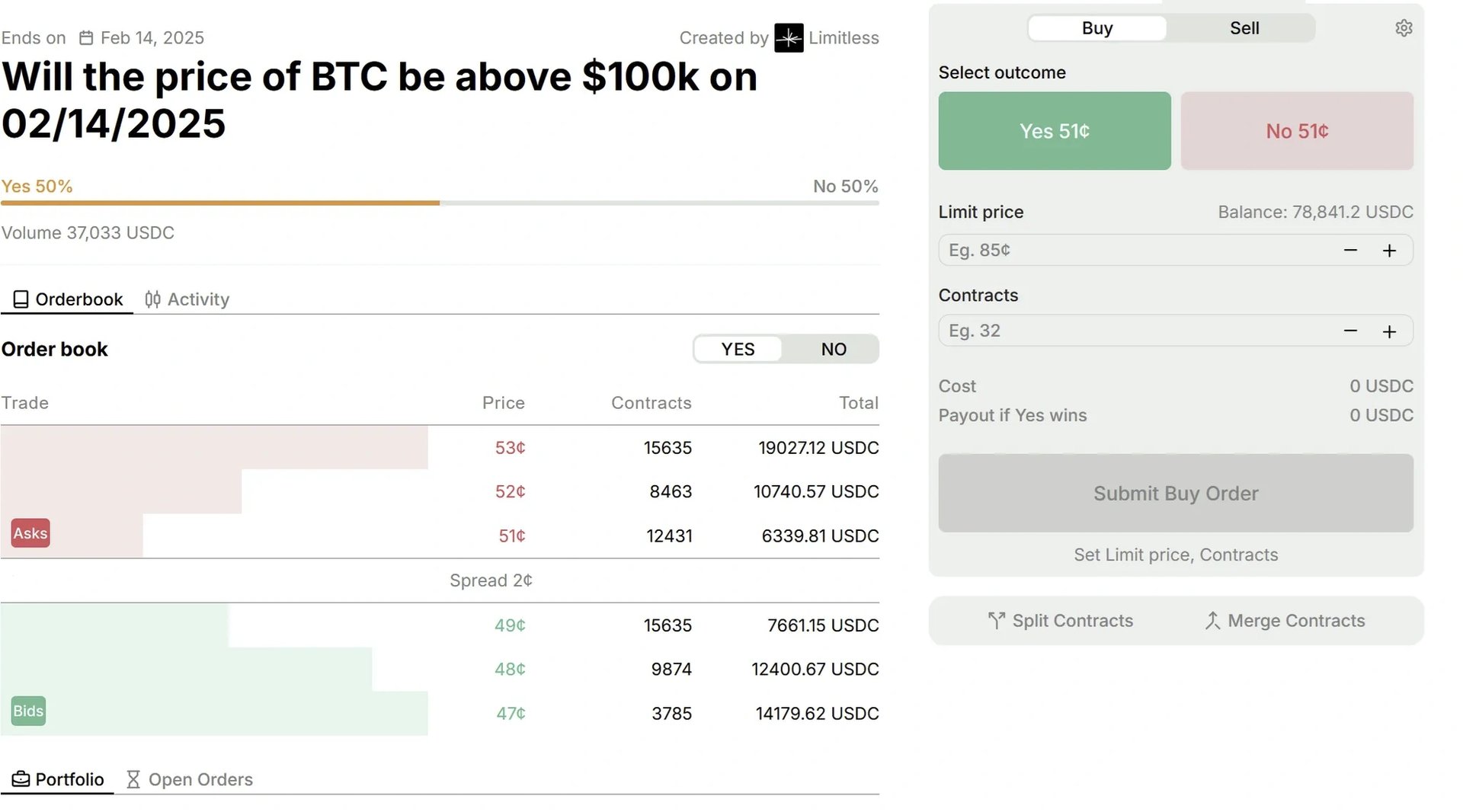

Limitless Exchange 实施中央限价订单簿 (CLOB) 系统来管理预测市场份额的交易。这种结构类似于传统金融市场中的结构。每个市场都有单独的“是”和“否”订单簿,其中列出了所有活跃的买入(买单)和卖出(卖单)。例如,如果交易者提供以 0.51 美元(卖价)出售“是”股票,并出价以 0.49 美元(买价)购买它们,则购买的市价单将以 0.51 美元执行。最高买价和最低卖价之间的差额称为价差,价差越低表示市场流动性越高。 [7]

交易者可以下市价单,以便以最佳可用价格立即执行,或者下限价单,以指定他们希望买入或卖出股票的确切价格。限价单会添加到订单簿中,并在找到匹配的订单时执行。更接近当前市场价格的订单通常具有更高的执行概率。通过下有竞争力的限价单来贡献流动性的用户可能有资格通过平台的流动性提供者 (LP)激励计划获得奖励。

Limitless 支持的预测市场中的一个独特功能是合并和拆分股票的能力。用户可以随时将 1 美元的抵押品转换为特定市场的一个“是”股票和一个“否”股票。相反,来自同一市场的一个“是”股票和一个“否”股票可以合并回 1 美元的抵押品。此机制旨在提高交易者的资本效率,并帮助整合市场内相反结果的流动性,从而有助于改善订单簿深度和匹配。 [7]

Negrisk

Negrisk,也称为 Limitless 上的类别市场,是一种预测市场,其中定义了多个可能的结果,但最终只有一个结果是正确的。这种结构类似于多项选择题。虽然 Negrisk 市场中的每个结果都有自己的“是”和“否”订单簿,但该市场中所有可能结果的“否”份额是相互关联的。

这种互连性实现了份额转换功能。持有某个结果的单个“否”份额(例如,“ETH 不是 2,000 美元”)的交易者可以将其转换为该市场中所有其他可能结果的一个“是”份额。这是基于这样的逻辑:如果一个结果是错误的,那么其他结果之一必须是正确的。如果交易者持有多个“否”份额,并且没有足够的相应“是”份额可用于完全转换,则多余的“否”份额可以直接转换为市场的抵押品货币,通常是 USDC。此过程充当内置的 套利 机制,有助于维持相关结果之间的价格一致性。

Negrisk 市场旨在通过使交易者能够轻松地在相关结果之间转移头寸或进行更广泛的押注(例如,预测特定事件不会发生,这意味着其他可能性之一将会发生)来提高交易者的资本效率。将多余的“否”份额转换为抵押品的能力也提供了一种释放资本的机制。此外,Negrisk 市场可以作为前瞻性数据来源,潜在地为金融仪表板提供支持,从而提供对各种事件的市场预期洞察,例如资产价格范围、利率变化或公司估值。这些数据流可用于为交易策略、投资组合管理或风险评估提供信息。 [7]

LP 奖励

Limitless 上的流动性提供者 (LP)奖励计划旨在激励用户通过下限价单为平台市场贡献流动性。奖励根据限价单与市场中间价的接近程度和订单大小等因素计算和分配。要获得奖励,订单必须达到或超过每个市场规定的最小规模阈值。该计划旨在鼓励下有竞争力的限价单,这有助于减少买卖价差并增加订单簿的深度,从而有助于建立更强大的交易环境。

Limitless 上的每个市场都有特定的参数来管理 LP 奖励的分配。这些参数通常包括市场的每日 USDC 奖励总额、订单可以获得奖励的与中间价的最大价差(例如,3 美分)以及获得资格所需的最小订单规模(例如,100 股)。奖金乘数适用于更接近中间价的订单,从而进一步激励更小的价差。为了促进平衡的流动性,单边流动性提供的奖励仅限于结果赔率在 5% 到 95% 之间的市场。该平台指出,这些参数是动态的,可能会进行调整以满足市场需求。 [7]

积分计划

为了迎接未来的代币生成活动 (TGE),Limitless 启动了一项积分计划,旨在激励用户参与和平台增长。该计划旨在奖励用户进行各种活动,包括交易、通过限价单提供流动性以及推荐新用户到平台。这些积分旨在跟踪用户在潜在代币发行之前对生态系统的贡献。 [2] [3]

团队

Limitless Labs由首席执行官CJ Hetherington、Roman Mogylnyi、Dima Horshkov和Rev Miller于2023年12月创立 [4]。

币安上市争议

2025年10月,首席执行官CJ Hetherington公开评论了加密货币交易所币安的代币上市流程。10月14日,Hetherington在社交媒体平台X上发布了他声称是币安的上市要约。所谓的条款包括要求项目方提供大量部分的代币供应量用于空投和营销,25万美元的保证金,以及价值200万美元的BNB代币作为现货上市的抵押品 [5] [6]。

币安公开反驳了这些说法,声明交易所“不会从其代币上市过程中获利”,并表示该公司倾销代币的指控是“不真实且未经证实的”。在一份声明中,币安将Hetherington的说法描述为“虚假和诽谤”,并批评了“非法和未经授权披露的机密通信”。交易所澄清说,它不收取上市费,并且保证金通常在一到两年内退还,以保护用户。币安保留采取法律行动以回应披露的权利 [6] [5]。

融资

截至2025年7月,Limitless Exchange 共筹集了总计 700 万美元的资金,分两轮进行。最初的 300 万美元种子轮融资由 1confirmation 领投,Paper Ventures、Collider、Public Works、Anagram、Figment Capital 以及来自 Polygon 和 Monad 的个人参与 [4]。2025年7月,随后的战略融资又筹集了 400 万美元。本轮融资包括 Arthur Hayes 通过其家族办公室 Maelstrom 进行的投资,Arthur Hayes 也加入了顾问团队。该项目的其他投资者包括 Coinbase Ventures、Node Capital、Punk DAO 和 WAGMI Ventures,个人投资者也通过 Echo 上的 Base Ecosystem Fund 团体进行了投资 [2]。

战略融资发生在平台因其短期预测市场而获得关注之后,该市场允许用户推测资产价格在短时间内的变动,包括每小时到期的变动。据报道,这些市场在推出后不久就积累了大量的交易量,总平台交易量后来超过了 4.97 亿美元。 [3] [2]

发现错误了吗?