订阅 wiki

Share wiki

Bookmark

Silo Finance

0%

Silo Finance

Silo Finance 是一个非托管借贷协议,旨在促进各种加密资产的借贷。它具有风险隔离的借贷市场,用户可以存入代币以赚取利息,或将其用作抵押品来借入其他加密货币。[1][2]

概述

Silo Finance 成立于 2021 年,是一个非托管借贷协议,旨在提供称为 Silos 的隔离借贷市场。每个 Silo 都设计为包含基础资产和桥接资产,例如 ETH 或 稳定币,旨在将风险隔离到各个市场,以防止系统性风险暴露。

Silo Finance 旨在支持所有代币的借贷,包括难以在其他借贷市场上架的小众代币,因为它不会在协议中分担风险。利率根据代币的利率模型和当前利用率以算法方式调整。治理由去中心化自治组织 (DAO) 管理,代币持有者参与决策过程。[1][2][3][4]

架构

Silos

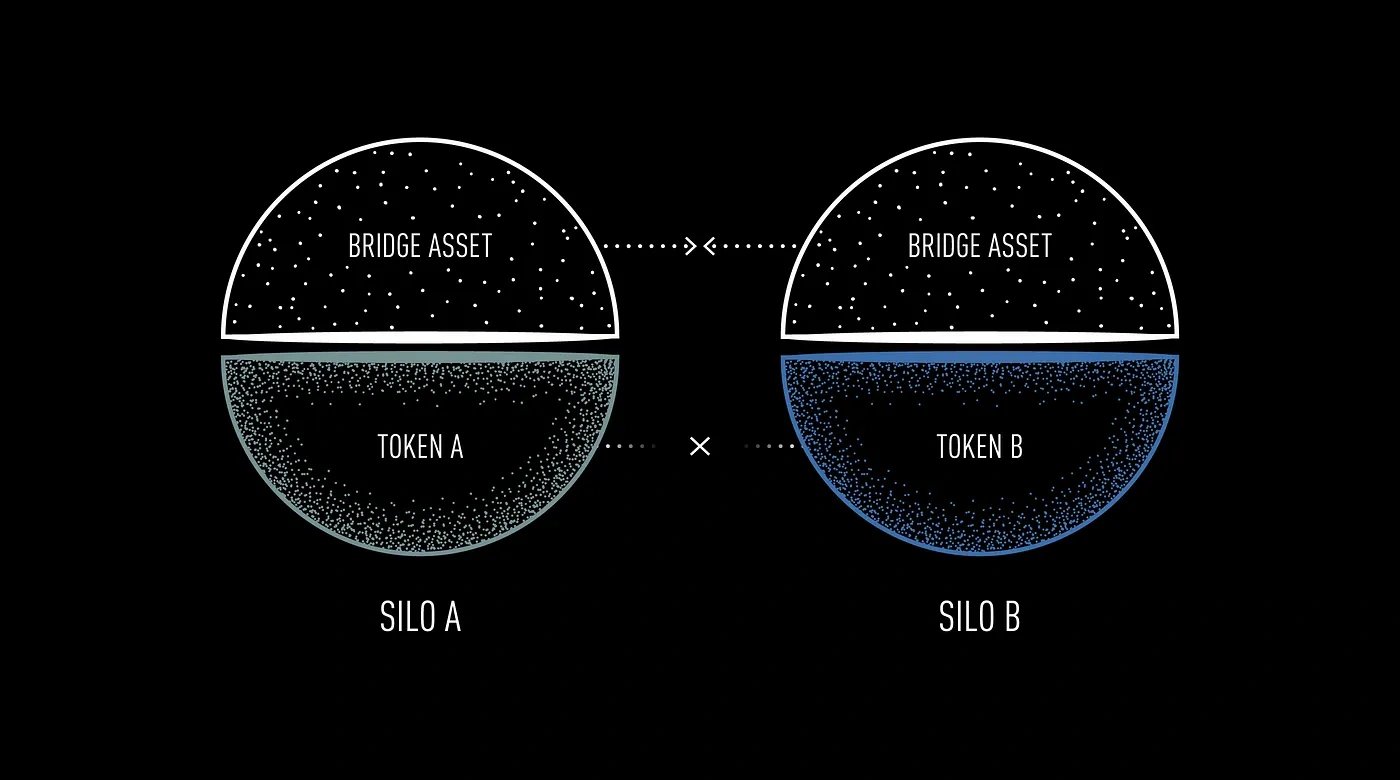

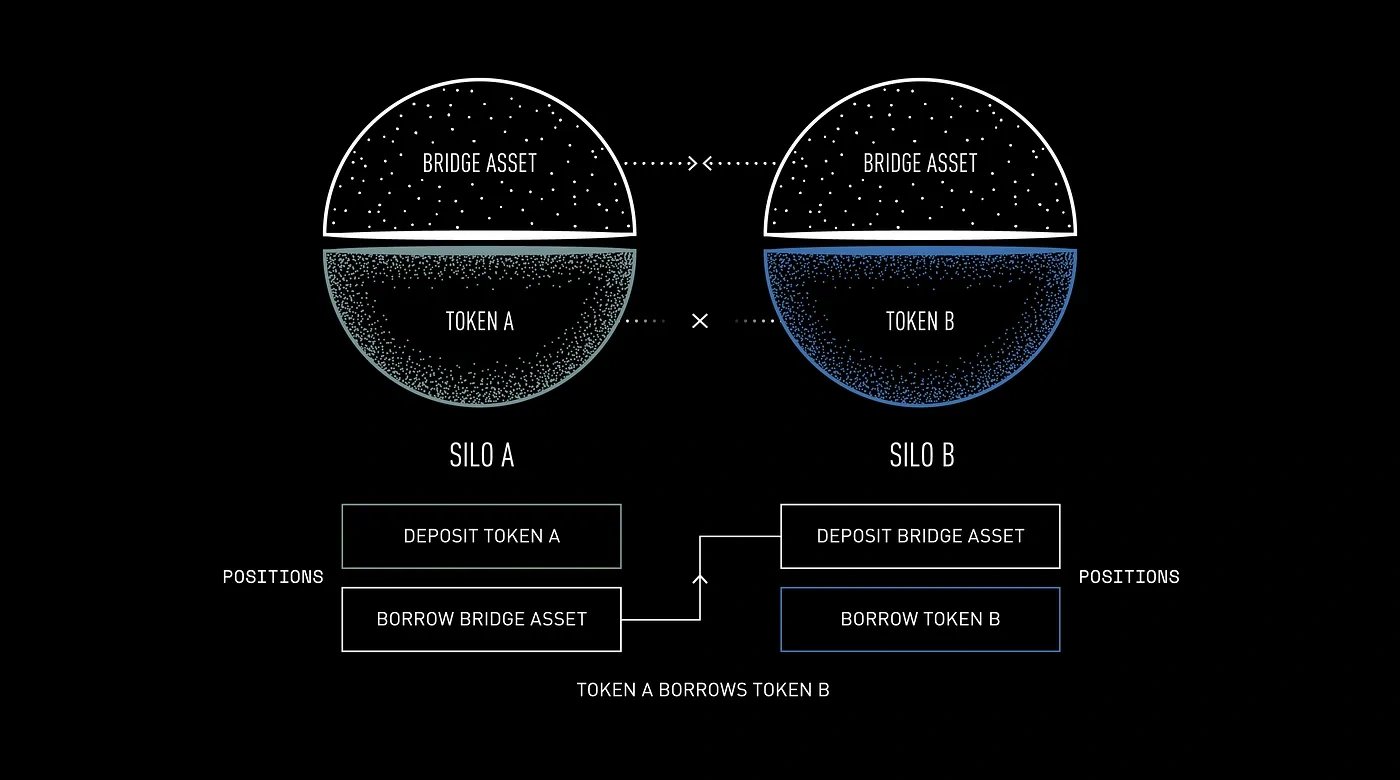

在 Silo Finance 中,Silo 是一个隔离的货币市场,由基础资产(例如 wstETH)和桥接资产(例如 ETH 和 USDC 等稳定币)组成。这种设置旨在将风险限制在各个 Silo 中,从而降低整个协议中系统性风险的可能性。[3][5]

基础资产

在 Silo Finance 中,每个 silo 都分配一个单独的代币资产,称为基础资产,它可以作为借入桥接资产的抵押品,反之亦然。由于每个 silo 仅接受一种基础资产,因此影响 Token XYZ 的问题不会影响 Silo ABC,后者仅接受 Token ABC 和桥接资产作为抵押品。这种风险隔离允许为各种代币创建新的 silo,而不会损害整体协议风险。

该协议使用三种 ERC-20 代币:一种用于抵押品,一种用于受保护的抵押品,一种用于债务。用户可以确定他们的存款是否可以被借用或保留为受保护的抵押品。该系统使用铸造和销毁功能管理这些代币,并包括交易通知。[3][5]

桥接资产

在 Silo Finance 中,ETH 等桥接资产充当所有市场中的共享代币,旨在促进其用作任何 silo 中的抵押品或用于借贷。这使得可以通过利用桥接资产作为链接在多个 silo 中创建头寸。桥接资产的存款仅限于其特定的 silo,确保与其他 silo 隔离。

例如,如果 Token XYZ 遇到不利事件,则只有 Silo XYZ 中的桥接资产存款人可能会受到影响,而 Silo ABC 中的存款人则不受影响。与 ERC-20 兼容的桥接资产旨在连接 silo 并管理跨 silo 操作。它们在 Silo 存储库中受到监督,治理可以在其中调整其包含和运营角色。[3][6][7]

抵押品因子

在 Silo Finance 中,抵押品因子旨在管理每个 Silo 中的风险,采用贷款价值 (LTV)、清算阈值、清算罚款和 预言机 等参数。抵押品因子因代币和 silo 而异,以考虑市场波动和链上流动性。

风险较高的代币具有更保守的抵押品因子,以为贷方提供更大的安全边际。存款可以是可借用的或受保护的。可借用的存款旨在在借给借款人时赚取利息,而受保护的存款不借出且不赚取利息,但仍可用作抵押品。[3][8]

利率模型

Silo Finance 的利率模型旨在通过根据借入代币与存入代币的比率调整利率来维持最佳利用率。该系统力求动态响应,根据不同的利用率水平提高或降低利率及其变化率,以平衡流动性。

Silo Finance 采用各种利率模型,这些模型可以按每个代币每个 silo 应用,从而可以针对不同的代币类型进行详细的自定义。[3][9]

代币经济学

Silo Finance 代币 ($SILO)

$SILO 用作 SiloDAO 的 治理代币。它旨在通过投票促进参与协议决策。[12]

实用性

$SILO 代币用于 SiloDAO 内的治理。其功能包括:

- 部署新市场: 使用特定参数设置新市场。

- 调整市场参数: 修改现有市场的设置。

- 管理桥接资产: 添加或删除桥接资产。

- 修改费用机制: 更改 DAO 的费用结构。

- 增加代币供应: 提出对代币供应的调整。

- 部署协议拥有的流动性: 分配由协议控制的流动性。[12]

分配

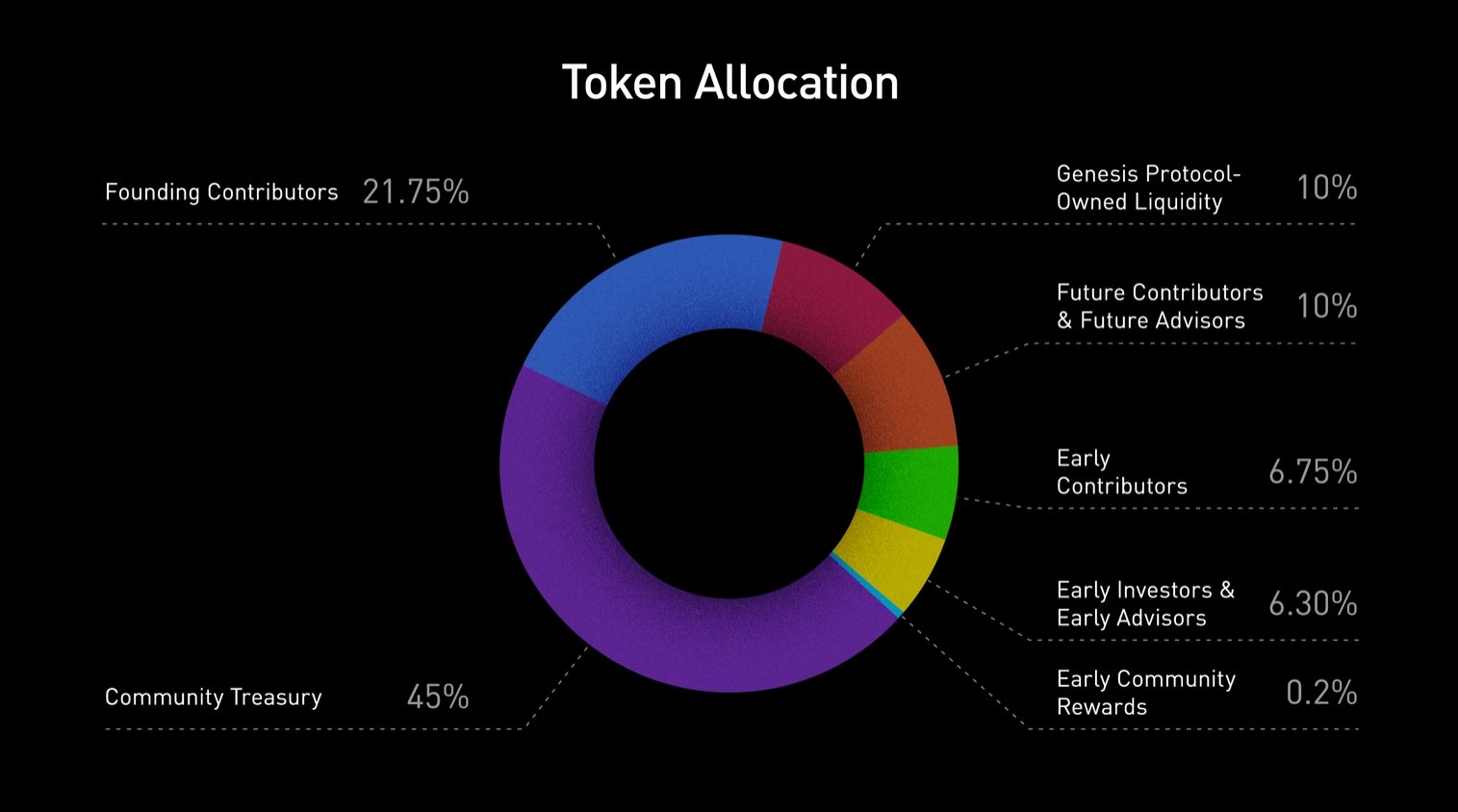

从 2021 年 12 月 1 日开始,该协议旨在在四年内总共铸造 10 亿个 $SILO 代币,未来通货膨胀的可能性取决于代币持有者的决定。分配和归属时间表如下:

- 创世协议拥有的流动性 (10%):代币在公开拍卖后分配,并且可以在拍卖后立即领取。

- 社区金库 (45%):代币受三年线性归属的约束,并由社区通过治理管理。

- 早期贡献者 (6.75%):代币在代币生成事件 (TGE) 后,经过六个月的悬崖期,线性归属四年。

- 创始贡献者 (21.75%):代币在 TGE 后,经过六个月的悬崖期,线性归属三年。

- 早期社区奖励 (0.2%):代币于 2022 年 1 月空投给社区成员。

- 早期投资者和顾问 (6.30%):代币在 TGE 后,经过六个月的锁定,线性归属两年。

- 未来贡献者和顾问 (10%):代币在加入 DAO 后,经过一年的悬崖期,线性归属四年。[13]

治理

Silo Finance 在由 Silo DAO 管理的去中心化治理结构下运作。代币持有者可以对各种提案进行投票或委托其投票权。最初,核心开发团队将监督协议管理和投票流程,但不会控制 DAO 的金库。

治理框架旨在纳入委托投票,类似于 Compound 等其他协议使用的模型。随着时间的推移,开发团队会将管理职能过渡到 Silo DAO。代币持有者将能够对协议资产、收入机制、抵押品因子和产品里程碑等方面进行投票。治理讨论和提案将通过专用论坛进行,有关治理程序和代币分配的更多详细信息将在未来提供。[3][14]

已弃用

Silo 协议使用一种称为 $XAI 的超额抵押 稳定币,它与美元软挂钩,并与 Silo Legacy 部署上的 $ETH 一起用作桥接资产。

$XAI 目前正在被弃用,这是一个涉及偿还和 销毁 未偿还 $XAI 债务的过程。[10][11]

团队

Silo Finance 的团队包括:

- Shadowy Edd,智能合约主管。

- Ihor,高级智能合约工程师。

- Neo Racer,高级智能合约工程师。

- Tyko,高级前端工程师。

- Siros Ena,前端主管。

- Andrew,产品设计主管。

- Augustus,运营主管。

- Aiham Jaabari,增长主管。

- Yoshua Urioste,业务发展经理。

- Nutoro D. Chutoro,营销主管。

- Alex,数学家。

- Anton,数学家。[2]

发现错误了吗?