위키 구독하기

Share wiki

Bookmark

Renzo Protocol

0%

Renzo Protocol

렌조 프로토콜은 EigenLayer 생태계에 대한 접근을 제공하는 액체 재스테이킹 토큰(LRT)이자 EigenLayer용 전략 관리자입니다. 이는 AVS(Actively Validated Services)를 보호하고 사용자와 EigenLayer 노드 운영자 간의 협업을 간소화합니다. Lucas Kozinski, James Poole 및 Kratik Lodha는 Renzo의 창립자입니다. [1]

개요

2023년 12월에 출시된 액체 재스테이킹 토큰(LRT)이자 전략 관리자인 Renzo는 EigenLayer 생태계 내에서 운영됩니다. 이는 사용자 상호 작용을 간소화하고 EigenLayer 노드 운영자와의 원활한 협업을 촉진합니다. 이는 이더리움에서 허가 없는 혁신을 가능하게 하고 생태계 내에서 신뢰를 구축한다는 EigenLayer의 사명과 일치합니다. Renzo는 이더리움 재스테이킹을 위한 플랫폼으로, ETH 스테이킹보다 더 높은 수익률을 제공하고 EigenLayer의 채택을 촉진합니다. 이는 예치된 모든 LST 또는 ETH에 대해 해당하는 양의 ezETH를 민팅하여 달성합니다. 이는 최적의 위험/보상 재스테이킹 전략을 확보하기 위해 스마트 계약 및 운영자 노드를 사용합니다. [1]

REZ

2024년 4월 30일에 출시된 REZ는 프로토콜 내에서 기본 거버넌스 토큰 역할을 하며, 보유자는 다양한 문제를 포괄하는 거버넌스 제안에 투표할 수 있습니다. 이러한 제안은 운영자 화이트리스트, Actively Validated Services 화이트리스트, 전반적인 위험 관리를 위한 프레임워크, 커뮤니티 및 재무부 보조금, 농도 금액, 담보 자산 및 예금에 관한 사양을 포함할 수 있습니다. [1][2]

REZ 에어드롭

시즌 1 에어드롭은 사용자의 ezPoints 잔액을 기준으로 선형 분포를 따랐습니다. Renzo는 타사 데이터 분석 회사와 협력하여 시빌 지갑을 식별하고 토큰 배포 자격에 대한 스냅샷 날짜 기준으로 지갑당 최소 ezPoints 임계값을 설정했습니다. 50만 ezPoints가 넘는 지갑은 토큰 생성 이벤트(TGE)에서 50% 잠금 해제되고 3개월에 걸쳐 50% 선형 베스팅이 적용되었습니다. 시즌 1은 4월 26일에 종료되었습니다. 사용자 자격은 현재 ezETH 잔액에 관계없이 스냅샷 시점의 지갑에 있는 ezPoints 잔액을 기준으로 했습니다. [10]

4월 26일에 시작된 시즌 2 캠페인은 지속적인 성장을 지원하고, 초기 사용자에게 보상하고, 지원되는 모든 네트워크에서 ezETH의 유틸리티와 배포를 향상시키는 것을 목표로 했습니다. 시즌 2는 사용자 지갑의 ezETH 보유자를 위한 포인트 부스트와 지원되는 DeFi 통합을 특징으로 했습니다. 이는 7월 26일까지 3개월 동안 총 공급량의 5%(5억 $REZ)를 커뮤니티에 배포했습니다. 모든 시즌 1 사용자는 시즌 2 종료 시 총 ezPoint 잔액에 대해 10% 추가 부스트를 받았습니다. [11]

토큰노믹스

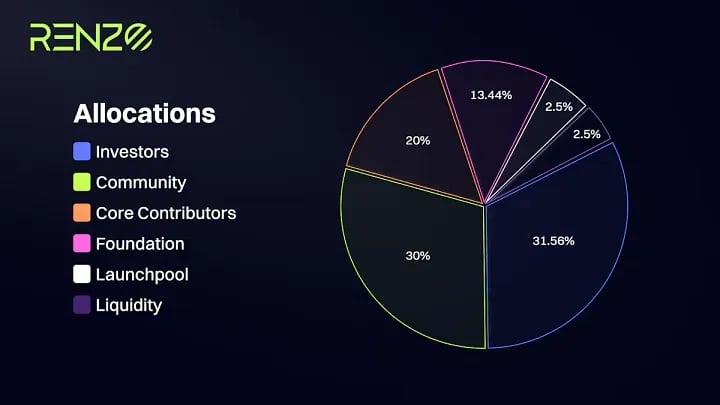

REZ 토큰의 최대 공급량은 100억 개로 제한되며 다음과 같이 할당됩니다. [1][2]

- 펀드레이징: 31.56%

- 프로젝트의 초기 투자자를 위한 것입니다.

- 커뮤니티: 32%

- 획득한 ezPoints를 기준으로 시즌 1 에어드롭 보상에 7% 할당됩니다.

- 다양한 커뮤니티 캠페인에 할당됩니다.

- 인센티브의 두 번째 시즌에 5% 지정됩니다.

- 핵심 기여자: 20%

- Renzo Labs 팀 및 고문에게 배포됩니다.

- 재단: 12.44%

- 바이낸스: 2.5%

- 유동성: 1.5%

ezETH

ezETH는 Renzo 프로토콜 내에서 액체 재스테이킹 토큰(LRT)으로 기능하며 사용자의 재스테이킹된 위치를 상징합니다. 참가자는 기본 ETH 또는 액체 스테이킹 토큰(LST)(예: wBETH 및 stETH)을 스테이킹하고 그 대가로 ezETH를 획득할 수 있습니다. 특히 ezETH는 보상 지급 토큰으로, AVS(Actively Validated Services) 내에서 수익률 향상으로 인해 가치가 기본 토큰의 가치를 능가할 가능성이 있음을 의미합니다. [2]

pzETH

pzETH는 Symbiotic 생태계 내에서 사용자의 재스테이킹된 위치를 나타내는 액체 재스테이킹 토큰입니다. 사용자는 stETH, wstETH, wETH 또는 ETH와 같은 자산을 예치하여 AVS(Actively Validated Services)를 보호하고 스테이킹 및 재스테이킹 보상을 생성하는 pzETH를 받을 수 있습니다. 예치 시 pzETH는 사용자가 전략을 관리하거나 스마트 계약과 상호 작용할 필요 없이 AVS를 자동으로 지원합니다. 인출은 첫날부터 가능하며 기본 담보에 대한 완전한 상환이 가능합니다. Symbiotic을 통해 사용자는 자산을 재스테이킹하여 분산형 애플리케이션 및 서비스를 지원함으로써 보상을 얻습니다. [9]

ezPoints

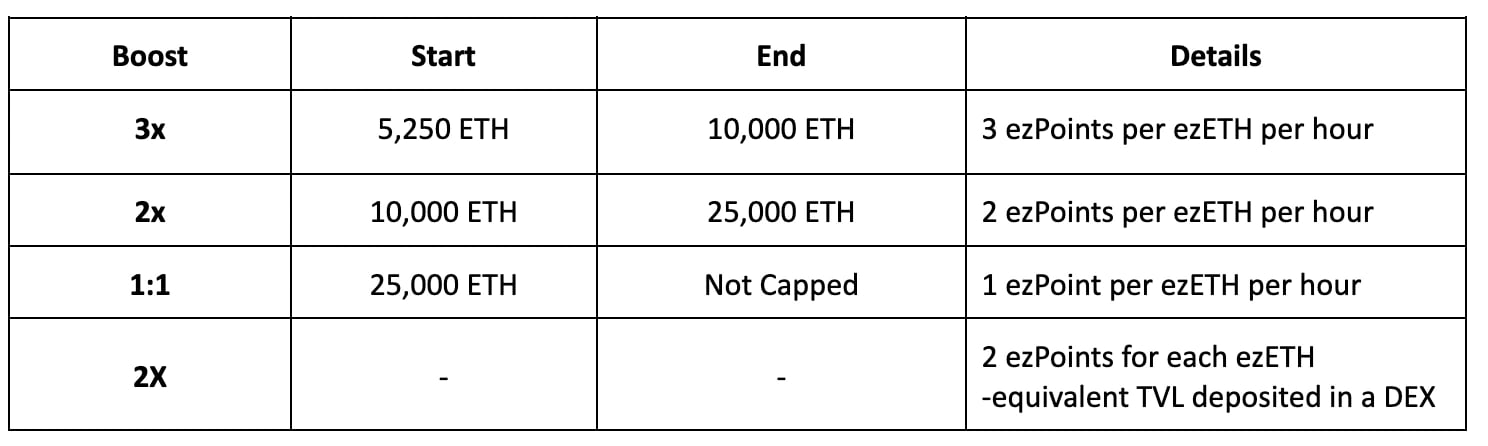

Renzo의 ezPoints 시스템은 프로토콜의 성공에 대한 적극적인 참여와 기여를 장려하는 것을 목표로 합니다. 참가자는 참여를 기반으로 포인트로 보상을 받으며, 수량은 참여 기간과 성격에 따라 다릅니다. ezETH를 보유하는 것은 ezPoints를 얻는 한 가지 방법이며, 보유자는 보유한 각 ezETH에 대해 시간당 1 Renzo ezPoint를 받습니다. 초기 참가자와 더 많은 ezETH 보유자는 추가 포인트를 받습니다. [1]

ezEIGEN

ezEIGEN은 EIGEN 재스테이킹 프로세스를 간소화하도록 설계된 토큰입니다. EigenDA를 포함한 여러 AVS에서 보상 청구를 자동화하고 효율성을 높이기 위해 해당 보상을 자동 복리화합니다. 자동화는 가스 수수료를 줄이고 Renzo의 ezETH 제품과 동일한 보안 기술을 기반으로 구축되었습니다. 주요 프로세스를 간소화함으로써 ezEIGEN은 재스테이킹에 대한 접근성을 높여 더 광범위한 채택을 장려할 수 있습니다. [7][8]

파트너십

Connext Network

Renzo Protocol은 Connext Network와 협력하여 레이어 2 네트워크에 크로스 체인 기본 재스테이킹을 도입했습니다. 이 협력을 통해 ETH/wETH 보유자는 Renzo에서 지원하는 주요 레이어 2 체인에서 재스테이킹할 수 있어 유동성과 접근성이 향상되는 동시에 기존 재스테이킹 프로세스의 복잡성이 간소화됩니다. 또한 Renzo는 레이어 2 네트워크에서 LST 재스테이킹에 대한 지원을 확대할 계획입니다. Renzo를 Connext 및 Chainlink의 CCIP(Cross-Chain Interoperability Protocol)와 통합하면 사용자에게 원활하고 매끄러운 크로스 체인 기본 재스테이킹 경험을 보장할 수 있습니다. [1]

Pendle

2024년 1월 31일, Renzo는 DeFi 수익률 프로토콜 Pendle Finance와의 통합을 발표했습니다. 이 통합은 1:1 비율로 ezETH를 나타내는 단일 계약인 EIP5115 SY 토큰을 통해 운영되었습니다. SY 토큰은 원금 토큰(PT)과 수익률 토큰(YT)으로 토큰화될 수 있습니다. [3]

Chainlink

2024년 3월 20일, Renzo는 이더리움 메인넷, Arbitrum 및 Linea에서 Chainlink 가격 피드와의 통합을 발표했습니다. 이 통합을 통해 Renzo의 ezETH는 신뢰할 수 있고 변조 방지 가격 피드에 액세스할 수 있어 고급 액체 재스테이킹 전략에 대한 안전하고 확장된 액세스를 촉진하고 사용자에게 Renzo DeFi 통합을 위한 업계 표준 가격 데이터를 제공할 수 있습니다. [4]

투자자

- Binance Labs

- Maven 11 Capital

- OKX Ventures

- IOSG Ventures

- Bitscale Capital

- SevenX Ventures

- Robot Ventures

- Figment Capital

- Mantle

시드 펀딩 라운드

2024년 1월 15일, Renzo는 시드 펀딩에서 320만 달러를 모금했습니다. Maven11 Capital이 라운드를 주도했으며 Figment Capital, SevenX Ventures, IOSG Ventures 및 기타 투자자도 참여했습니다. [5]

6월 펀딩 라운드

2024년 6월 18일, Renzo는 CoinDesk와 공유된 보도 자료에 따르면 펀딩 라운드에서 1,700만 달러를 모금했다고 발표했습니다. 두 라운드에 걸쳐 진행된 펀딩은 1라운드에서 Galaxy Ventures가, 2라운드에서 Brevan Howard Digital Nova Fund가 주도했습니다. 자본은 ERC-20 토큰에 대한 지원을 추가하는 것을 포함하여 프로젝트의 재스테이킹 서비스를 확장하는 데 사용될 것입니다. [6]

잘못된 내용이 있나요?