Subscribe to wiki

Share wiki

Bookmark

DeGate

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

DeGate

DeGate is a decentralized exchange (DEX) protocol built on Ethereum using Zero Knowledge (ZK) technology. It features a DAO-centric design and supports limit orders for decentralized trading. [1]

Overview

Launched in March 2021, DeGate is a decentralized exchange (DEX) protocol using Zero Knowledge (ZK) technology as a ZK Rollup. It addresses a market gap by offering spot order book trading and grid trading within the Ethereum ecosystem, providing an experience similar to centralized exchanges (CEX). DeGate is DAO-centric, with its treasury fully controlled by the community. [1]

Features

Spot Trading

Spot trading on the Ethereum mainnet often incurs high gas fees, especially with conventional AMM DEXes that only provide market orders. DeGate, utilizing ZK Rollup technology, allows for spot trading through limit orders, similar to centralized exchanges. A "match node" matches orders between traders and periodically records the transactions on the mainnet, offering a faster and cheaper trading experience while maintaining Ethereum's security. Fees are low for taker orders and free for maker orders. [1]

DeGate has introduced gas-saving features to reduce users' costs further. The Gas Saving Deposit option, based on a "simple transfer" rather than a "contract call," can reduce the one-time gas deposit fee by up to 75%. Ultra-Efficient Gas Saving (UEGS) technology also ensures significant gas savings while maintaining a decentralized protocol. DeGate maintains Ethereum's security and trustlessness while providing functionality similar to centralized exchanges without their inherent security risks. [1]

Grid Strategy

Grid Strategy, or grid trading, automates buying and selling within a defined range. It places buy and sell orders within a designated price range. When a buy order is executed, it places another sell order at a higher grid level and vice versa. This strategy performs best in sideways markets when prices fluctuate within a defined range, enabling profits from small price changes. [2]

Grid Strategy is popular among traders who cannot constantly monitor the market. One of its key advantages is automation. After defining the upper and lower price limits, the grid buy/sell orders are placed and executed automatically according to the asset's price movements. The grid strategy operates 24/7, generating passive profit for traders by buying low and selling high. [2]

Another advantage is adaptability. Grid density can be optimized for various circumstances, with hundreds of grids set up to capture micro profit from daily price changes in the short term or selecting a larger range for long-term profit from an overall sideways trend. Profitability is also a significant benefit, as grid trading excels in sideways markets without needing to predict the asset's price direction. Once initiated, a grid strategy requires no further input outside monitoring the results. [2]

Grid trading employs three common strategies, which depend on market trends and the underlying asset's performance. [2]

Normal Grid Strategy

The Normal Grid Strategy is optimal for turbulent markets where the underlying asset consolidates or ranges. This strategy allows traders to set buy and sell orders within a predefined price range, enabling passive profits from the asset's price fluctuations. [2]

Buy Grid Strategy

The Buy Grid Strategy is ideal for markets experiencing a downtrend where the underlying token price may continue to decline. This strategy allows traders to place multiple buy orders below the current market price, enabling them to accumulate the asset at lower prices. If the price rebounds, the grid orders can be automatically flipped to sell orders within the defined grid range, allowing traders to profit from price fluctuations. [2]

The primary goal of the Buy Grid Strategy is to capitalize on the potential of the underlying token, which is considered suitable for long-term holding. This approach enables traders to effectively average the dollar cost into the token, even if its price falls below the initially set grid range. [2]

Sell Grid Strategy

The Sell Grid Strategy is employed in markets experiencing an uptrend where the underlying token price is anticipated to continue rising. This strategy allows traders to place multiple sell orders above the current market price, enabling them to profit from the asset's appreciation. If the price retraces, the grid orders can be automatically flipped to buy orders within the defined grid range, allowing traders to capitalize on price fluctuations. [2]

The key advantage of the Sell Grid Strategy is that it enables traders to take profits as the underlying token price increases gradually. By selling incrementally as the price breaks upwards, traders can maximize their profits while buying back at lower prices if the token price retraces within the grid range. [2]

Liquidity Mining

DeGate’s liquidity mining initiative aims to reward users who provide effective liquidity within the order book, particularly through grid strategy orders placed near the highest buy or lowest sell prices. Liquidity mining activities are organized around specific trading pairs, each managed by a node operator who establishes and oversees mining pools. Users can access information about active mining pools via the platform’s mining page. [3]

Each mining pool undergoes multiple stages throughout its lifecycle, with varying durations and corresponding rewards for participants. A minimum duration requirement for these strategies has been implemented to discourage users from creating and canceling grid strategies solely for mining rewards. All allocated rewards are initially labeled as "temporarily unclaimable," transitioning to "claimable" status only after the strategy duration concludes. Should a user cancel a strategy prematurely, any temporarily unclaimable rewards associated with that strategy will revert to the mining pool. [3]

To engage in ongoing mining programs, users must initiate a grid strategy before the end of the mining period, typically at a specified cutoff time aligned with the strategy’s required duration. [3]

Batch Spot Trade

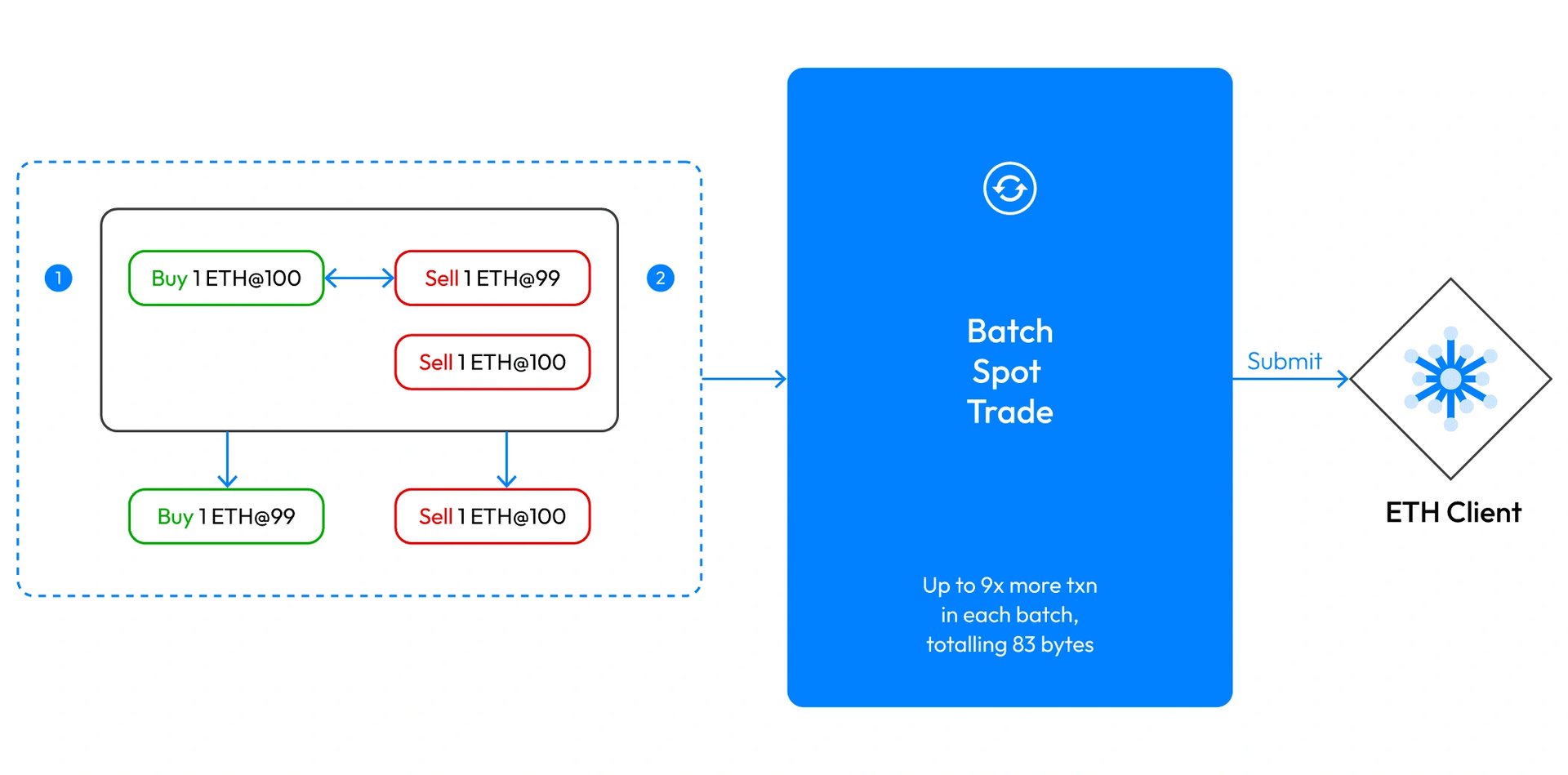

An order book exchange in its traditional setup faces many technical challenges to be suitable for the blockchain industry. Batch Spot Trade was designed to overcome these hurdles, enhancing the efficiency of the traditional matching model while adapting to the technical characteristics and cost model of ZK rollups. The goal is to find a cost-efficient way to bundle transactions before submitting them on-chain, now achievable with Zero-Knowledge Proof (ZKP) on Zero-Knowledge rollups (L2). [4]

Handling a large, high-frequency order book remains inefficient. Batch Spot Trade was created to bundle up to nine times more transactions, consuming only 83 bytes before being recorded on-chain. Research into traditional order book exchanges revealed that efficient exchanges often involve large "Makers" transacting with many "Takers." This behavior was considered in the design of Batch Spot Trade. [4]

In Batch Spot Trade, user token balances are critical to ensuring the accuracy of matched transactions. To maintain system accuracy, a token balance counter was added. The Batch Spot Trade mechanism can bundle and compress many transactions before adding them to the DeGate Layer 2 block, generating a validity proof through cryptographic means and submitting it to the Ethereum Mainnet. [4]

Exodus Mode

The Operator of the DeGate off-chain node plays a critical role in producing zkBlocks and submitting proofs. If the Operator ceases operations, any off-chain transactions not finalized on-chain will become invalid. To ensure the security of user funds, DeGate implements an Exodus Mode, enabling users to withdraw their assets even if the node becomes inactive. [5]

Once Exodus Mode is activated, the DeGate smart contract stops accepting new zkBlock data. The protocol remains frozen at the last valid block before initiating Exodus Mode. This suspension includes all off-chain transactions, withdrawals, and transfers within DeGate. Exodus Mode is a permanent state change and cannot be reversed. During this period, users can only withdraw their assets from the protocol. [5]

DG Token

DG is DeGate’s native token, with a total supply of 1 billion. Home DAO initially owned 100% of it. It has the following distribution: [6]

- Incentives: 44%

- Financing: 20%

- Founder Financing: 19.8%

- Business Development: 9%

- Reserves: 5.2%

- Liquidity Pool: 2%

DeGate DAO

DeGate operates as a DAO, with full control over its treasury by DG token holders who participate in governance and delegate decision-making. While Home DAO has the authority to alter almost any aspect of the DeGate protocol, certain foundational principles are maintained as a social contract that will not be easily changed. Home DAO will be responsible for any losses caused by the DeGate protocol’s negligence and will strive to minimize the dominance of the token majority. Home DAO operates and controls the DeGate protocol and, thus, is entitled to the revenue it generates. [7]

Through the governance process, Home DAO can decide how to use the generated revenue, such as converting a portion into DG and custodying it within the DAO treasury or burning it. DG token holders can initiate governance proposals, subject to a minimal DG ownership requirement. Major decisions are made by Home DAO, which helps ensure stability and consistency in decision-making, fostering trust. [7]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)