Subscribe to wiki

Share wiki

Bookmark

Leverage

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Leverage

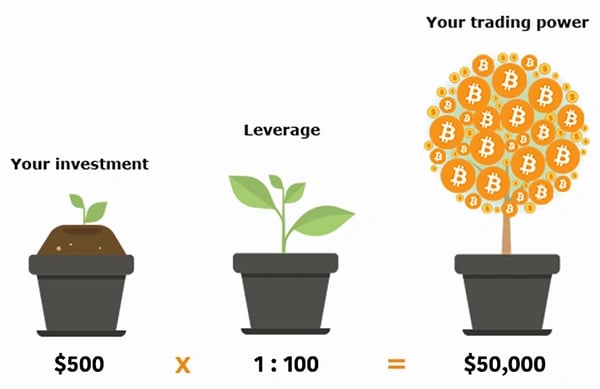

Leverage is the process of using borrowed capital to trade financial assets, like cryptocurrency. Leverage amplifies the buying or selling power of the traders.[1][3]

A ratio that represents the level of leverage, such as 1:5 (5x), 1:20 (20x), or 1:50 (50x), displays the multiplicity of the starting capital. Leverage can be used to trade various crypto derivatives, as well as margin trading, leveraged tokens, or futures contracts.[7]

A few of the exchanges that offer leverage trading are, Binance, ByBit, Kraken, Phemex. The options available can be compared based on several factors such as the trading fees, the maximum leverage on offer (it can range from 2X to 200X), how long a position can be held, etc.[5]

Overview

The initial capital deposited into the users trading account for making leveraged trades is known as Collateral. The collateral required depends on the leverage used and the total value of the position wanted to open, known as the margin.

For example, a user invests $1,000 in Ethereum (ETH) with 10x leverage. The margin required would be 1/10 of $1,000, i.e., $100 in the user's account as collateral is a must for the borrowed funds. If 20x leverage is being used, the required margin would be even lower (1/20 of $1,000 = $50). But, the higher the leverage is, the higher the risk of liquidation.

Apart from the initial margin deposit, maintaining a margin threshold for trades is also a must. If the market moves against the users' position, and the margin falls below the maintenance threshold, more funds must be invested into the account to avoid liquidation.

Leveraged Long Position

Opening a long position means expecting the price of an asset to rise.

If the user wants to open a long position of $10,000 worth of BTC with 10x leverage, $1,000 will be used as collateral. If the price of BTC rises 20%, a net profit of $2,000 (minus fees)will be earned, which is much higher than the $200 the user would have made if $1,000 capital is traded without leverage.

However, if the price of BTC drops 20%, the position would be down $2,000. Since the initial capital (collateral) is only $1,000, a 20% drop would trigger liquidation (balance drops to zero). The exact liquidation value depends on the exchange one uses.

To avoid liquidation, more funds must be added to the wallet to increase collateral. In most cases, the exchange sends a margin call before liquidation (e.g., an email telling to add more funds).

Leveraged Short Position

On the other hand, opening a short position expecting the price of an asset to fall.

If the user wants to open a $10,000 short position on BTC with 10x leverage, BTC must be borrowed from someone else and sold at the current market price. Although the collateral is $1,000, since the user is trading with 10x leverage, $10,000 worth of BTC can be sold.

Assuming the current BTC price is $40,000, 0.25 BTC is borrowed and sold. If the price drops 20% to $32,000, 0.25 BTC can be regained for $8,000. This would give a net profit of $2,000 (minus fees).

However, if the price of BTC rises 20% to $48,000, an extra $2,000 would be needed to buy back the 0.25 BTC. In this case, the users' position will be liquidated as they have only $1,000 in account balance. To avoid liquidation, more funds must be added to the wallet to increase collateral.[4]

Leverage Trading

Margin Trading and Crypto Leverage

Margin trading allows traders to borrow funds against their existing cryptocurrency holdings, essentially amplifying their purchasing power. This borrowed capital enables them to open larger positions than they would have been able to with just their own assets.

For instance, a trader with 1 Bitcoin can potentially open a position equivalent to 10 Bitcoins by utilizing 10x leverage.

However, this increased exposure comes with heightened risk. While the potential for amplified profits exists, a slight downturn in the market can result in substantial losses.

Leveraged Tokens

Leveraged tokens were introduced to make leveraging more accessible and user-friendly. These tokens track a multiple of the daily price movement of an underlying asset without requiring users to directly engage in margin trading.

For instance, a 3x leveraged Bitcoin token aims to move three times the percentage of Bitcoin's daily price change. This offers traders a simpler way to gain leveraged exposure without handling the complexities of margin positions.

DeFi and Decentralized Leverage

Decentralized Finance (DeFi) platforms have taken leverage a step further. Through smart contracts, users can lock up their cryptocurrency assets as collateral and borrow other assets, effectively trading on leverage within a decentralized ecosystem. This empowers users to access leverage without relying on centralized exchanges or traditional financial institutions.[6]

Leveraged vs. Unleveraged Trading

Leveraged trading involves an investor or trader borrowing funds to increase their trading position, which can amplify both potential gains and losses. In contrast, unleveraged trading occurs when an investor or trader utilizes only the capital they personally own, without taking on any additional borrowed funds.

For instance, if a user has $8,000, and the last traded price of BTC is $8,000.

If BTC's price increases to $8,050 the following day:

- Unlevered: 1 BTC contract at $8,000 is bought, and a $50 gained, by selling it at $8,050.

- Levered: $80,000 worth of contracts at $8,000 is bought, and sold at $8,050. Since trading with 10x leverage, amplifies the gain by 10 times, i.e., $500.

However, if BTC's price decreases to $7,950 the next day:

- Unlevered: 1 BTC contract for $8,000 is bought, and $50 is lost, by selling it at $7,950.

- Levered: $80,000 worth of contracts at $8,000 is bought, and sold at $7,950. Since trading with 10x leverage, amplifies the loss 10 times, i.e., $500.[2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)