Subscribe to wiki

Share wiki

Bookmark

Liquidation

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Liquidation

Liquidation or Crypto liquidation is the process of forced closing a trader's positions in the cryptocurrency market. It occurs when a trader's margin account can no longer support their open positions due to significant losses or a lack of sufficient margin to meet the maintenance requirements.[5]

If the market moves against the leveraged position to a large degree, the user may lose the entire collateral (or initial margin) and their position could be liquidated. In other words, the initial capital input will be forfeited to the exchange. Closing the positions helps ensure that the trader does not accumulate more debt and that the exchange can recover any outstanding funds.[6]

Overview

To initiate crypto liquidation, the timeframe can differ substantially based on the type of exchange being used. On centralized exchanges (CEX), liquidation can happen almost instantly, taking anywhere from a few seconds to several minutes. This expedited process is possible due to strict margin requirements and the employment of advanced algorithms that incessantly monitor positions to instigate liquidation when necessary.

On the other hand, liquidations on decentralized exchanges (DEX) might experience a protracted duration. In DEX environments, traders retain the responsibility of managing their margins. Consequently, closing a position can necessitate a waiting period to find a matching buyer or seller to fulfill the order.

An essential concept in this realm is the 'liquidation price,' which refers to the asset price threshold at which the exchange automatically closes a trader's position due to the failure to satisfy margin prerequisites. This price is subject to fluctuations based on several factors, including the degree of leverage utilized, margin stipulations, and the current market climate.

Market volatility is a key determinant of how often the liquidation price changes. In volatile market conditions, the liquidation price is likely to adjust more frequently. In contrast, during more stable market times, the liquidation price tends to remain relatively steady.[10]

Types of Liquidations

Partial Liquidation

Partial liquidation involves closing out a portion of the users' position to reduce risk exposure. This type of liquidation is usually voluntary, and the trader does this not to lose his whole trading stake.[3] For instance, a trader needs to liquidate their Bitcoin to cover a short position, or to meet other financial obligations. When this happens, the trader will usually sell their Bitcoin at the current market price, regardless of whether it’s above or below the original purchase price. However, in some cases, a trader may be forced to sell their Bitcoin at a price below the market rate. This may end up being the liquidation price, and it’s usually determined by the exchange on which the Bitcoin is being sold.

When Bitcoin fell below 43k, over $812 million of crypto futures were liquidated, resulting in large losses for long crypto traders. This happened because of a partial or total loss of initial margin for traders.[12]

Forced Liquidation

A forced liquidation, also known as total liquidation happens when a trader does not or cannot meet the 'margin call' for a leveraged position. It involves the selling of the entire trading balance to cover losses. In other words, they don’t have enough funds to keep the position open. In such situations, the exchange will automatically close out the trader’s positions to cover the losses.

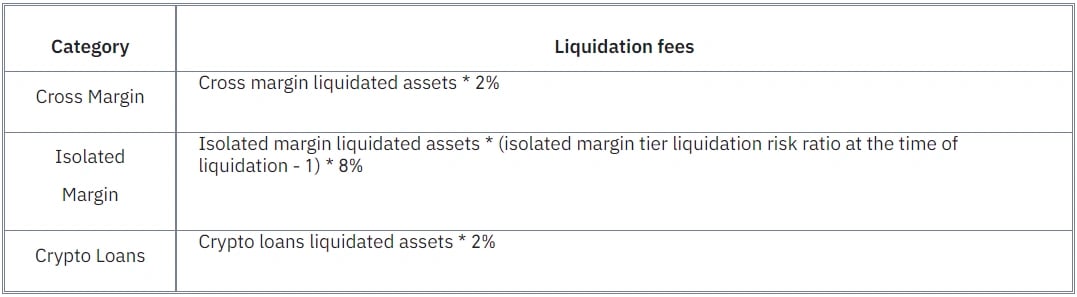

Forced liquidation usually prompts an additional liquidation fee, which has been put in place to encourage traders to manually close positions before they’re liquidated. In some severe cases, liquidation may lead to a negative balance. Some exchanges cover such losses by employing different methods, of which settling them with insurance funds is one of the methods.[7][9]

For instance, $190 million has been liquidated on the BitMex. Even though the exchange offers as much as 100 times leverage on futures contracts, users are at risk of facing margin calls on what’s borrowed, which can end up leading to the liquidation of their position.[14]

Long and Short Liquidations

The terms 'long' and 'short' simply refer to what type of trade an investor is making. Short trades are bets against price rises, and so short liquidations refer to liquidations that happen on these types of trades. For instance, Deribit had a dominant short liquidation rate of 56.32%. Long trades are those that expect price levels to rise, and long liquidations are those that occur on such trades. For instance, OKX saw the highest percentage of long liquidations at 98.2%.[7][13]

Liquidation Ratio

A liquidation ratio is the level of collateral ratio at which a partial liquidation of collateral is triggered. It represents the situation in which the collateral ratio drops to 125% and DAG executes a partial liquidation of the user’s collateral.[6]

Collateralization in DeFi

In DeFi, users can lock up a certain amount of cryptocurrency as collateral to borrow other assets, typically stablecoins like DAI or USDC. Collateralization ratio (or, Collateral %) = Value of collateral/Value of borrowed assets.

Liquidation Threshold

DeFi protocols set a liquidation threshold, also known as the liquidation ratio, which represents the minimum collateralization level a user's position must maintain.

If the value of the collateral falls below this threshold due to market price fluctuations, the user's position becomes vulnerable to liquidation.

Liquidation in Margin & Future Tradings

Margin Trading/Margin Call

Before the actual liquidation occurs, there is often a margin call mechanism in place. When a user's position approaches the liquidation threshold, they receive a warning or margin call notification. The margin call allows users to add more collateral to their position to bring it back above the liquidation threshold and avoid liquidation.

The specific liquidation ratio can vary from one DeFi protocol to another. Lower liquidation ratios provide less room for price fluctuations, which can be riskier for borrowers. Higher liquidation ratios offer more flexibility but come with the trade-off of requiring users to lock up more collateral.[7]

Futures Trading

The significance of liquidation in futures trading helps maintain the stability and integrity of the market by mitigating the risk of default. By enforcing timely liquidation, exchanges ensure that traders meet their obligations and prevent potential cascading liquidations that could impact the entire market.[7]

Features

Risk Mitigation

Liquidation serves as a risk management tool, reducing the potential for defaults and losses for lenders. When the value of collateral falls, liquidation helps in recouping the borrowed assets to prevent insolvency.

Market Efficiency

By liquidating undercollateralized positions, DeFi platforms maintain a balance between supply and demand for assets, which contributes to market efficiency.

Liquidity Provision

Liquidation events provide opportunities for users to acquire assets at discounted prices, increasing market liquidity.

Liquidation Risk Management

Coverage

To cover losses from bankrupt positions, certain cryptocurrency exchanges utilize various methods, one of which involves using insurance funds. These funds act as a form of protection for exchanges, allowing them to cover losses and allocate enough resources to compensate profitable traders.

In the event of bankruptcy, when the liquidation price surpasses the initial margin, the insurance fund will be used to absorb the loss, safeguarding crypto traders from acquiring a negative balance.[7]

Stop Order

Stop Order aka, 'stop loss' or 'stop-market order,' is an order that you can place through a crypto exchange, telling the exchange to sell an asset when its price hits a certain point. It’s an essential piece of risk management for leveraged trading.

Initially, the user must know the stop price

- the price at which the order will go into effect; the selling price

- the price at which they'd be willing to sell the asset, and the size

- how much of the asset the user wants to sell.

If the asset hits the stop price, the exchange will automatically execute the order and sell the amount stated at the price stated. Stop losses are designed to limit potential losses. It’s generally set between 2% and 5% of the users' trade size. Additionally, per-trade losses should be kept below 1.5% of the entire account size.[11]

Manual Margin Ratio Monitoring

The user can also keep track of losses manually by knowing the percentage the market needs to move against the position for it to be liquidated.

Liquidation % = 100 / Leverage

For instance, say that the user is opening a position with an initial margin of $100 and leverage of 4x, to create a position of $400. Using the above formula,

Liquidation % = 100 / 4 = 25%

From the above result, the user may face liquidation if the price of the asset moves 25% against the user's position. So, liquidation would occur in this scenario if $400 position moves down to a value of $300.[11]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)