Subscribe to wiki

Share wiki

Bookmark

Maker (MKR)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Maker (MKR)

Maker (MKR) is the governance token for both MakerDAO and the Maker Protocol. MakerDAO is a decentralized global reserve bank while the Maker Protocol is a software platform and both are built on the Ethereum blockchain.[9]

Overview

MKR token is used to provide support and enhance the stability of DAI stablecoin. DAI is a digital currency designed to retain its purchasing power by being pegged to the value of the US dollar. Maker does this with the use of its smart contracts referred to as Collateralized Debt Positions (CDPs). [2]

Tokenomics

MKR was introduced in August 2015 without an initial coin offering (ICO). MakerDAO chose to gradually introduce the token into the market utilizing private sales before the Maker market was launched. [7]

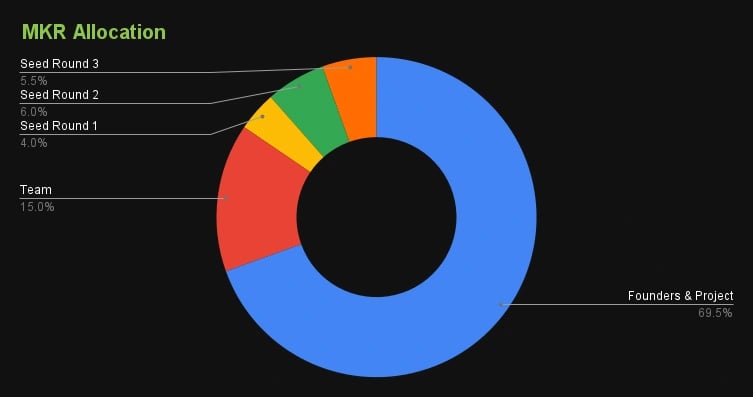

The initial token distribution of MKR shows that 69.50% of the total supply was allocated to founders and projects, 15.0% was allocated to Team, 4.0% to Seed Round 1, 6.0% to Seed Round 2, and 5.5% to Seed Round 3. [8]

Utility

MKR is a utility token within the Maker ecosystem used for settling fees incurred on CDPs to generate DAI. The payment of fees exclusively relies on MKR, and once paid, the MKR tokens are burned, effectively reducing the total supply. The demand and adoption of DAI and CDPs directly impact the demand for MKR, as users require it to cover the associated fees. As a result, the total supply of MKR decreases through the burning process. [3]

MKR also serves as a governance token whereby MKR holders utilize the token to participate in the decision-making process regarding the development and management of the Maker ecosystem. Through a voting process, MKR holders can determine the business logic and risk management parameters for each collateral asset and type of CDP. The governance voting process follows a continuous approval voting method, enabling MKR holders to cast votes for multiple proposals using their MKR holdings. They also have the flexibility to create new proposals or modify their existing votes at any time.[3]

MKR also serves as a recapitalization resource: if the MakerDAO system becomes undercollateralized (i.e., the value of the collateral falls below the value of the DAI it's supposed to back), new MKR tokens can be automatically created and sold on the open market to raise additional collateral. This is called a debt auction. This mechanism effectively means MKR holders have a vested interest in ensuring the system is managed properly.[10]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)