Subscribe to wiki

Share wiki

Bookmark

MakerDAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

MakerDAO

MakerDAO is a decentralized global reserve bank that operates on the Ethereum blockchain. It is an open-source project and a Decentralized Autonomous Organization (DAO) that was established in 2014 by Rune Christensen. [15]

Overview

The Maker protocol leverages Ethereum smart contracts to provide a range of functionalities, including the collateralization and lending of its stablecoin, called DAI, as well as governance with the token, MKR. The Maker protocol automates these processes, allowing for an efficient financial system. [15][16]

The Maker Protocol operates by enabling individuals to obtain loans in DAI using various cryptocurrencies as collateral. Importantly, these loans are overcollateralized, requiring the deposit of a greater amount of cryptocurrency than the loan amount. [17]

The need for over-collateralization is to safeguard against potential market crashes of ETH or the underlying coins supporting DAI, such as wrapped bitcoin (WBTC) and centralized U.S. dollar stablecoins USDC and USDP. [17]

The Maker Protocol

The Maker Protocol, or Multi-Collateral Dai (MCD) system, enables users to generate DAI by pledging collateral assets approved by the Maker Governance. This governance is a community-run and -operated process responsible for overseeing various aspects of the Maker Protocol. [16]

The Maker Protocol creates new DAI through smart contracts referred to as Maker Vaults. These smart contracts can be accessed through various web interfaces and applications, such as Oasis Borrow and Instadapp. To retrieve their collateralized cryptocurrency from the smart contract, users must repay the Dai they generated, along with a stability fee. [18]

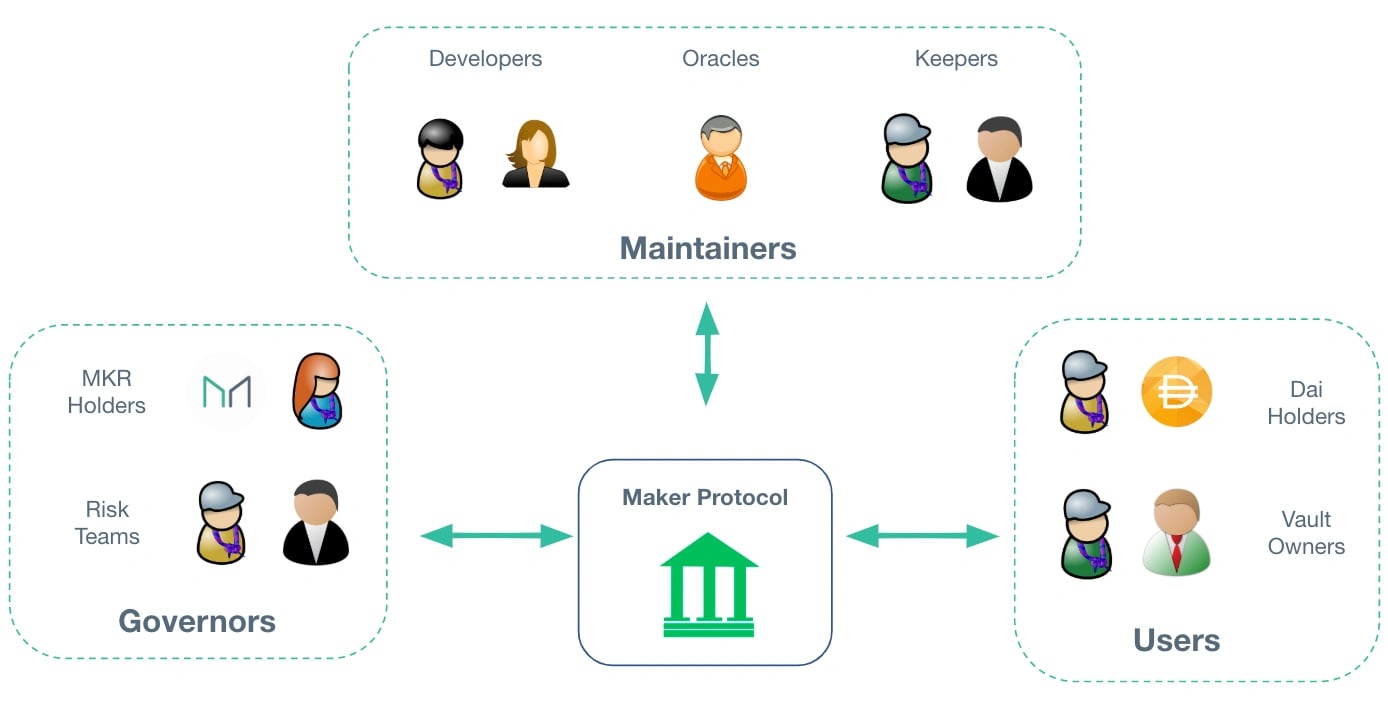

External Agents

The operations of the Maker Protocol rely on some external agents. [23]

- Keepers: A keeper is an autonomous entity that provides liquidity and receives incentives through arbitrage opportunities.

- Price Oracles: the protocol utilizes a decentralized oracle infrastructure to acquire up-to-date information on market prices of collateral assets held in Maker Vaults. Price oracles are essential in identifying the appropriate timing for initiating liquidation.

- Emergency Oracles: they act as a final line of defense against any attempts to attack the platform's governance or other oracles.

- DAO Teams: DAO teams are groups of individuals and service providers who ensure the proper functioning of governance-related tasks

Governance

The Maker Protocol is governed by the MKR token. Proposals for changes take the form of smart contracts and can be submitted by any Ethereum address. The MKR holder community then votes on the proposals and the Ethereum address with the most MKR approval votes is granted the power to implement the proposed changes to the Maker Protocol. [18]

Off-chain Governance

Maker's off-chain governance relies on its online resources, which include the Maker DAO discussion forum and the Maker chat app. These channels allow any individual to propose and discuss ideas, specially at the forum. Ideas that achieve sufficient preliminary consensus through these channels may proceed to on-chain consideration. [24]

On-chain Governance

Maker utilizes two primary on-chain governance mechanisms: Governance Polls and Executive Votes. [24]

Governance Polls are conducted on a continuous weekly basis to measure the attitudes of MKR holders towards various topics, including those that have been extensively discussed off-chain and are being considered for further decision-making. The poll results, however, do not impact the protocol's state. [24]

Executive Votes are formal on-chain votes among the MKR holders to decide on changes to the protocol. They can be introduced at any time by any platform stakeholder, but only MKR holders have voting rights during an Executive Vote. While Executive Votes may be based on results from Governance Polls, they are not required to be. Maker has established an informal culture of orderly pipeline discussions from off-chain discussions to Governance Polls to Executive Votes. [24]

Tokenomics

MKR Token

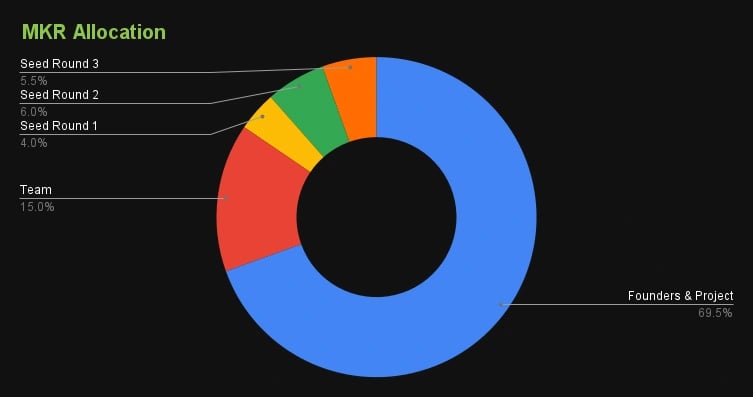

MakerDAO was launched with a total supply of 1 million MKR tokens. The total supply and value of Maker tokens are subject to change based on market conditions and prices. [18]

In the event of a sudden drop in the price of cryptocurrencies stored in a Maker Vault smart contract, they may no longer have sufficient value to support the generated stablecoin, resulting in a liquidation. If the DAI obtained through auctions is insufficient to fulfill the vault's obligations, new MKR tokens will be minted. Conversely, if more DAI is generated than required, it is used to purchase and burn Maker tokens, altering the total supply of MKR and affecting its price, while DAI remains pegged at USD 1. [18]

The MKR token enables its holders to vote on changes to the protocol. Approved modifications to the protocol's governance variables may not take effect immediately and can be delayed for up to 24 hours if the Governance Security Module (GSM) is activated. This delay provides MKR holders with the ability to trigger a Shutdown and protect the system against harmful governance proposals, such as those that alter collateral parameters or disable security measures. [16]

DAI Token

DAI is an ERC-20 algorithmic stablecoin designed to maintain a one-to-one ratio with the US dollar. Its main purpose is to facilitate lending and borrowing of cryptocurrency assets without requiring a middleman. Users can generate and borrow DAI by opening a collateral vault through MakerDAO's Oasis Borrow dashboard and providing Ethereum-based assets as collateral. The deposited collateral must always have a higher value than the issued DAI tokens. In case the value of the collateral drops below the value of the DAI tokens issued, the collateral will be liquidated. [25]

In July 2023, A proposal seeking to temporarily increase the interest rate granted to holders of stablecoin Dai was approved by the MakerDAO community raising yields for tokenholders to as high as 8%. The proposal introduced the Enhanced Dai Savings Rate (EDSR), a mechanism that temporarily increases the effective Dai Savings Rate (DSR) available to users. The enhanced mechanism will be determined by the DSR utilization and will be reduced over time as the DSR utilization goes up. [35]

“The EDSR helps fix this by ensuring that Dai holders [...] get a more fair amount of value from the increased returns generated by the protocol. In turn this might help spur adoption," reads the proposal from MakerDAO co-founder Rune Christensen[35]

Maker Vaults

Accepted collateral assets can be used to generate DAI via smart contracts called Maker Vaults in the Maker Protocol. Users can access the Maker Protocol and establish Vaults through several user interfaces such as Oasis Borrow and those created by the community. Generating DAI results in an obligation to repay the DAI along with a Stability Fee to unlock the collateral placed and secured in a Vault. [26]

Vaults are non-custodial by nature. Users directly interact with the Maker Protocol and Vaults, and they have full control over their deposited collateral as long as the collateral's value remains above the required minimum level. [26]

Funding

During the MakerDAO Secondary Token Sale, the company raised funds from various investors. On December 16, 2017, a sum of $12 million was raised with investment from Andreessen Horowitz, Polychain Capital, and other firms such as Distributed Capital Partners, Scanate, FBG Capital, Wyre Capital, Walden Bridge Capital, and 1confirmation, at an average price of $300 per token. [20]

In April 2019, another sale took place, raising $15 million with a16z Crypto as the lead investor and an average price of $250 per token. In the same month, MakerDAO raised an additional $27.5 million with investment from Paradigm and Dragonfly Capital. [20]

Maker Foundation

The Maker Foundation, part of the worldwide Maker community, collaborates with various partners to build and launch the Maker Protocol. The Foundation is now working with the MakerDAO community to establish decentralized governance and strive for full decentralization of the Maker Protocol and Dai, a decentralized, collateral-backed stablecoin on the Ethereum blockchain that is governed by MakerDAO. [16][19]

Sustainability Efforts

MakerDAO has proposed a governance constitution that includes funding sustainability campaigns with 20,000 MKR tokens (approx. $14 million) until 2040. The constitution, written by founder Rune Christensen, prioritizes "scientific sustainability" as a core principle in Maker's politics and operations. [22]

“At the time of the Maker Constitution the world is headed off a cliff with runaway greenhouse gas pollution pushing the biosphere past critical climate tipping points that will cause disasters for centuries to come. Immediate action is required" -preliminary draft of the Maker constitution

The draft MakerDAO governance constitution is still in progress and will be continuously updated. The proposal needs to pass through the Request for Comments (RFC) phase, where the community is currently reviewing and providing feedback. The RFC phase lasts at least 4 months, after which Christensen can submit the proposal to the governance cycle for evaluation and voting by the community. [22]

MakerDAO x Chainlink

MakerDAO onboarded Chainlink’s smart contract automation into its Keeper system. Chainlink Automation executes functions such as updating prices, balancing liquidity for the DAI Direct Deposit Module (D3M), and increasing the debt ceiling for collateral assets. [27]

“This network of automated bots perform essential tasks to maintain the Maker protocol and will be greatly expanded through the integration with Chainlink’s renowned, hyper-reliable automation platform” - Nadia Álvarez, member of MakerDAO’s Growth Core Unit

MakerDAO x Spark Protocol

MakerDAO released a lending platform and liquidity market called Spark Protocol, a fork of Aave’s version 3. Spark Protocol is an application interface designed to enable users to borrow, lend, and stake DAI. To enhance security in the case of a possible exploit or outage, pricing oracles, which are sources of data, provided by Chronicle Labs and Chainlink, will support the new protocol. [28][29]

Spark Lend is the primary product offering of the platform. It enables users to borrow DAI at the existing DAI Savings Rate of 1%. Spark Lend will accept decentralized assets with high liquidity, including ETH, DAI, wstETH (wrapped derivative of staked ETH), and wBTC (wrapped BTC), as collateral. The platform is expected to introduce additional features, including fixed-term yield products and the integration of Maker's synthetic liquid staking derivative, EtherDAI, in the future. [28][29]

MakerDAO 5-Phase Endgame Update

The Endgame Plan is a proposal to overhaul and improve the governance and tokenomics of the Maker Ecosystem. As outlined in one of the May 2023 forum posts by Christensen, the immediate objective of the Endgame update is to facilitate the widespread adoption of MakerDAO's stable token, DAI, over the next three years, all while maintaining a balanced governance structure.[30]

To accomplish this, he suggested that MakerDAO should proceed with the implementation of Endgame's detailed five-phase roadmap.

Phase 1: Beta Launch

According to Christensen, the initial stage of Endgame involved the establishment of a fresh unified brand. This brand would have its own stablecoin and governance token, distinct from DAI and MKR. Maker and Dai are well-known and reputable brands within the cryptocurrency industry. Regrettably, there are certain drawbacks associated with this approach, such as the presence of two distinct brands instead of a unified and coherent concept," he stated.

The ongoing efforts of the Accessibility Governance Process involve the redesign of MakerDAO, aiming to address fragmentation by establishing a cohesive and unified brand. According to Christensen, individuals who hold DAI and MKR tokens will be given the option to either retain their tokens or transition to the new stablecoin and governance token.[31]

Phase 2: SubDAO Launch

After the Beta Launch, there were plans to establish six Maker SubDAOs, each equipped with its respective governance tokens. SubDAOs are developed to operate autonomously from Maker while maintaining a connection to the protocol through its mission. [31]

On September 12, 2023, 4 SubDAOs were launched to the Korean community at the SubDAO Genesis Event in Seoul.

SakuraDAO — was presented as a SubDAO to earn DeFi yields, SparkDAO — the community to govern Spark Protocol through the SPK token, QuantitativeDAO — pioneers the tokenization of billions of dollars in public-credit RWAs and lastly, QualitativeDAO — a decentralized community aiming to bring public and private credit on-chain through the tokenization of tangible assets, like real estate. [32]

Phase 3: Governance AI Tools Launch

Creating and launching AI-powered tools for governance will be the third phase of the Endgame's roadmap. This engine is crafted to guarantee that holders of the new governance token are strongly motivated to engage in the governance process actively. [31]

Phase 4: Governance Participation Incentive Launch

The introduction of the Sagittarius Lockstake Engine (SLE) represents the fourth stage of the Endgame roadmap. This engine is crafted to guarantee that holders of the new governance token are strongly motivated to engage in the governance process actively. [31]

Phase 5: NewChain Launch and Final Endgame State

The final phase of the Endgame roadmap is launching a rebranded new chain. Christensen highlights that this state will establish enduring balance, decentralization, and sustainability within MakerDAO's fundamental operations. This new blockchain is intended to serve as the central hub for all backend tools facilitating MakerDAO's functionalities. [31]

Team

The MakerDAO Team is composed of: [21]

- Rune Christensen – Founder

- Derek Flossman – Head of Protocol Engineering

- Phil Inje Chang – Product Leader

- Andrew Chorlian – Blockchain Developer

- Michael Elliot – Blockchain Engineer

- Krzysztof Kaczor – Senior Software Engineer

- Matthew C. – Business Development Man

Controversy

In August 2023, MakerDAO blocked virtual private network (VPN) users from accessing its lending platform, Spark Protocol which sparked criticism from the community. [33]

Blec, a decentralization and privacy advocate, took to X (formerly known as Twitter) and criticized MakerDAO’s creator Rune Christensen, and the developers in a response tweet, stating that they have prioritized profits over user privacy:

“The root of the problem here is that these developers are putting profit over principle. They’re putting their bank account balance ahead of your privacy and your rights.” Blec tweeted[33]

SPK farming and SakuraDAO's DeFi yield are not available for US or VPN users. [34]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)