TOKI

TOKI 是一个跨链桥,旨在通过具有多重验证者安全性的 IBC 促进安全的代币转移。它致力于连接 Ethereum、BNB Chain 和 Cosmos 等网络,使用 TEE、ZKP 和统一的 流动性池 来提高效率和安全性。 [1][2]

概述

TOKI 由 Daiki Ishikawa 创立,旨在开发使用 IBC 和多重验证者安全性的安全跨链基础设施。自 2020 年以来,它一直与 Datachain 合作,以支持 IBC 的开发并探索与金融机构的用例。TOKI 于 2023 年推出,旨在建立“区块链互联网”。

该平台旨在实现无需封装代币的单次点击跨链转移,利用统一的 流动性池 来最大限度地降低风险并提高效率。它通过 TEE、ZKP 和轻客户端代理来关注安全性,同时促进与 去中心化应用程序 的兼容性,以实现支付、转账和其他功能。

TOKI 测试网 于 2024 年 9 月 2 日启动,旨在通过两个阶段提高平台稳定性:转移测试网和转移及池测试网。[1][2][3][4]

特点

多重验证者安全性

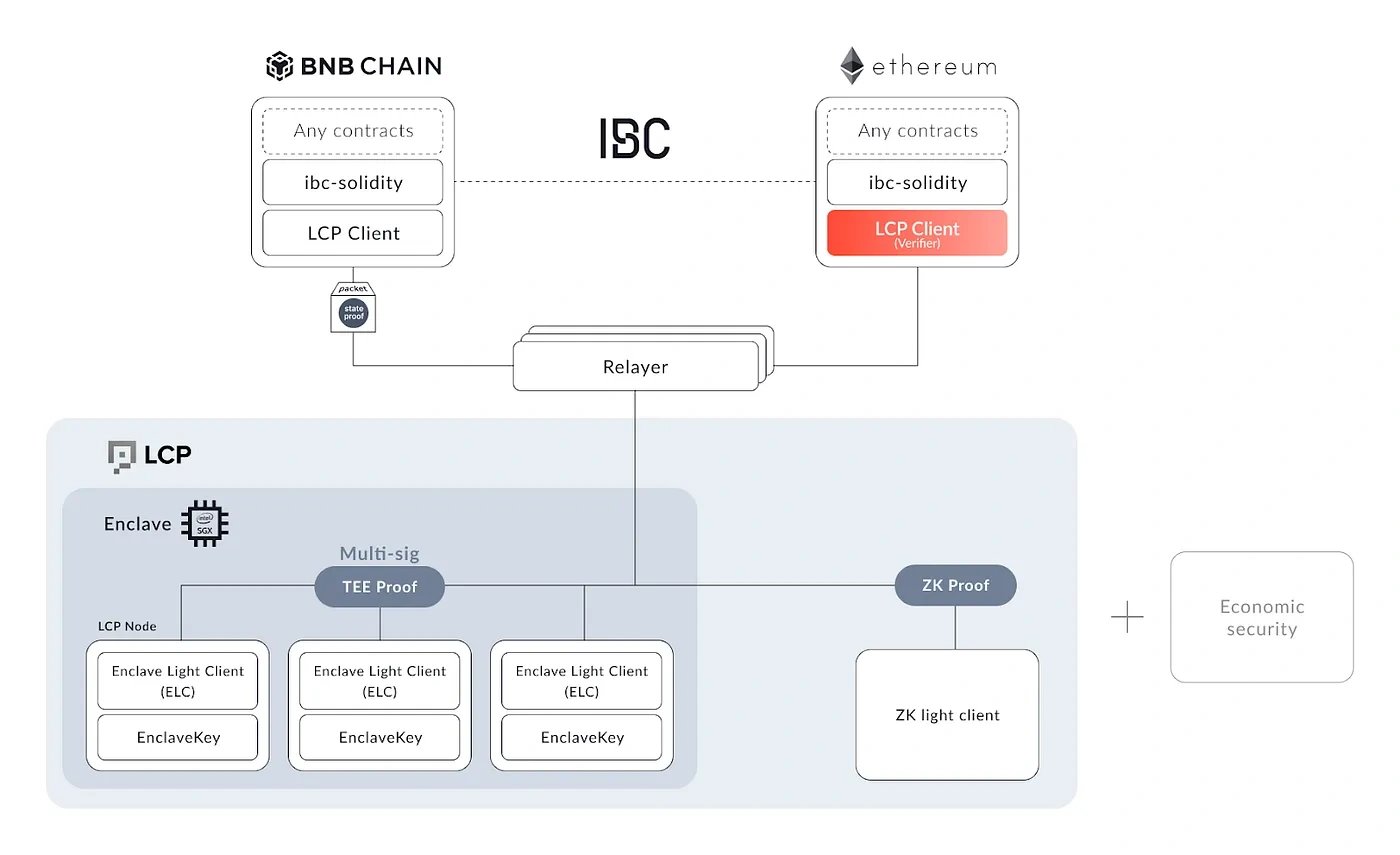

TOKI 将多重验证者安全性与 IBC 集成,旨在提供安全高效的跨链消息传递。IBC 是一个开放且无需许可的交易标准,受到广泛的开发者社区的支持,并具有可靠运行的记录。

多重验证者模型结合了 TEE 用于证明生成,ZKP 用于争议解决,并计划包括经济安全性以提高可靠性。轻客户端代理 (LCP) 促进配置,降低运营成本,并支持去中心化,符合 TOKI 增强链间连接的目标。[1][5]

统一流动性池

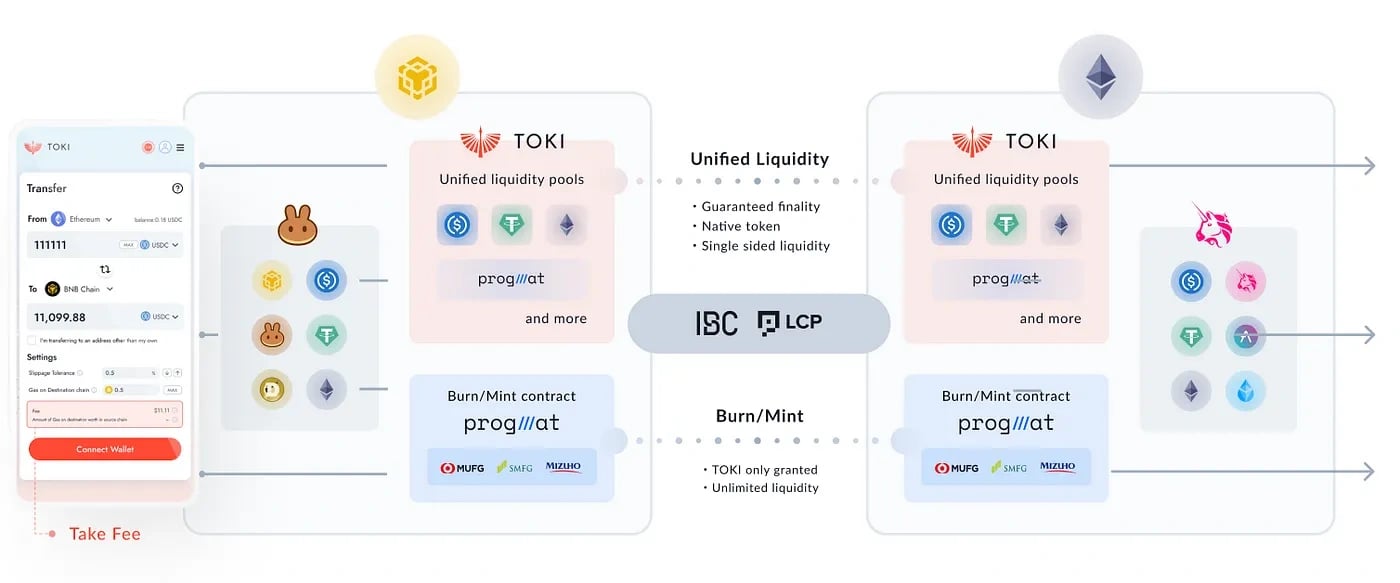

TOKI 旨在通过单边统一的 流动性池 简化跨 区块链 的原生代币转移。此功能消除了对封装代币的需求,从而可以一键转移并保证最终性。流动性提供者 旨在从最小化的风险中受益,例如不存在无常损失,以及提高的资本效率和安全性。

该系统连接不同 区块链 上的 流动性池,依靠 TOKI 的消息传递层来实现无缝操作。TOKI 代币用于鼓励流动性提供并支持生态系统的发展。[5]

第三方应用层

TOKI 的基础设施旨在在消息传递和流动性层中提供高可组合性,从而简化各种用例的跨链交易,例如交换、转账、NFT 购买和借贷。它还支持第三方应用程序集成,允许外部开发人员在该平台上构建。

例如,通过与 Progmat 集成,TOKI 促进了跨链 稳定币 转移。这种方法旨在促进创新并增加潜在收入。 [1][4]

用例

TOKI 旨在为跨链交易提供安全的基础设施,通过与去中心化应用程序 (DApp) 集成来促进各种用例:

- 跨链交换:用户可以使用稳定币作为代币对的桥梁货币,在不同链上交换代币。

- 跨链购买:用户可以使用来自另一条链的代币在一条链上购买 NFT。

- 跨链借贷:用户可以将来自一条链的代币存入另一条链上的借贷协议中。[6]

代币经济学

TOKI 采用三种代币类型:LP 代币、TOKI 代币和 veTOKI 代币,遵循其他 去中心化交易所 使用的模型。

- LP 代币:作为提供流动性的奖励发行,持有者获得一部分协议费用。

- TOKI 代币:根据 LP 代币存款分配,旨在为未来的交换提供费用折扣。

- veTOKI 代币:为质押 TOKI 代币而分配,投票权由 质押 期限的长短决定。[6]

合作伙伴

自推出以来,TOKI 建立了各种合作伙伴关系,旨在增强其生态系统:

- 金融机构:TOKI 与 Progmat 合作,以促进日本监管的稳定币发行。

- 基金会:与 Interchain Foundation 的合作侧重于扩展 Interchain Stack 并促进社区参与。

- IBC 技术提供商:TOKI 与 Union、Composable Finance、Confio、Landslide 和 Strangelove 合作,以加强其各自项目的互操作性和功能。

- L1 区块链:TOKI 与 Noble、XION、Oasys 等合作,以支持第三方集成并扩展区块链兼容性。[5]