Subscribe to wiki

Share wiki

Bookmark

Zodor

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Zodor

Zodor is a blockchain-based platform that provides real-world asset (RWA) tokenization infrastructure, offering tokenization as a service to institutional businesses and individuals. The platform aims to bridge the gap between traditional financial markets and blockchain technology by transforming tangible assets into secure, tradeable, and yield-generating tokens. [1]

Overview

Zodor is a decentralized platform focused on tokenizing real-world assets (RWAs), particularly from emerging markets. Converting them into blockchain-based security tokens allows users to co-own, trade, and earn from physical investments such as real estate, commodities, green energy infrastructure, and private equity. These tokenized assets offer fractional ownership, improved liquidity via secondary market trading, and broader access with lower capital requirements.

The platform is built around the $ZOD token and a decentralized Real-World Asset Protocol, ensuring transparency, compliance, and automation through smart contracts. Zodor emphasizes real-time settlement, reduced transaction costs, and strong regulatory alignment. It includes a loyalty rewards program, a referral system, KYC compliance, and an immersive AR/VR interface for community engagement and potential virtual governance. By blending traditional assets with blockchain efficiency, Zodor aims to modernize global investing while opening access to previously illiquid or inaccessible markets. [5] [6]

Technology

Maskade Blockchain

Maskade Blockchain is a custom Layer 1 chain built on Avalanche. It specifically supports Zodor’s regulated financial applications and real-world asset (RWA) tokenization. It is the backbone of Zodor’s ecosystem, offering enterprise-grade scalability, security, and compliance.

As an independent Avalanche L1, Maskade benefits from Avalanche’s speed and fault tolerance while maintaining sovereign governance. It supports EVM-compatible smart contracts, allowing for the secure execution of token issuance and financial operations. With sub-second finality and high throughput, Maskade is optimized for real-world applications that demand low latency and institutional reliability. Its permissioned validator system and compliance-ready framework make it a secure and tailored solution for regulated tokenized economies. [7]

Masque ID

Masque ID is a decentralized identity protocol that supports regulatory compliance for digital assets by linking on-chain identity proofs with off-chain data. It enables encrypted identity verification, real-time compliance checks, and dynamic risk scoring without publicly exposing personal information.

Users are assigned identity attributes (e.g., jurisdiction, risk scores), while sensitive documents remain with verified KYC providers. Compliance claims are managed through a registry, allowing validation and automatic updates or revocations based on activity and status. [15]

Products

Infra

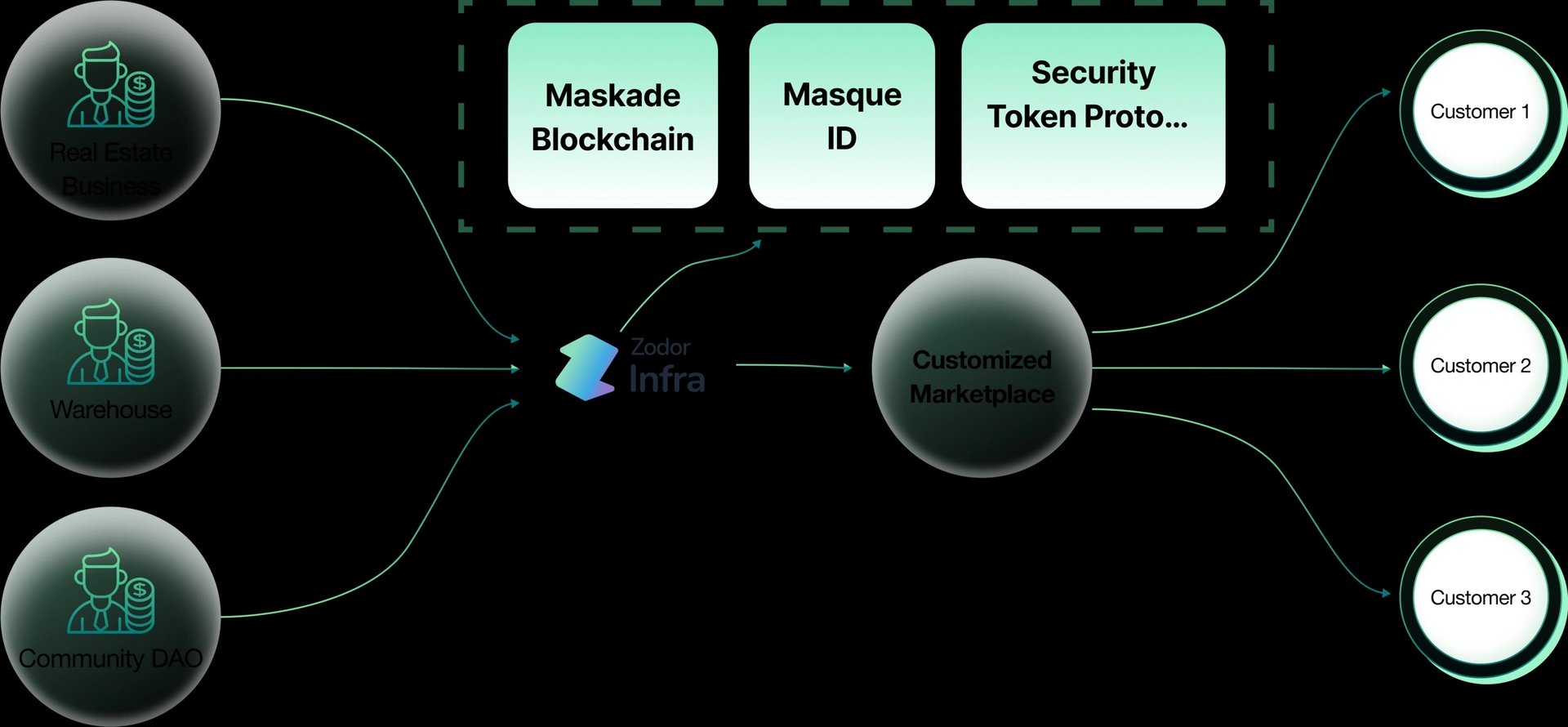

Zodor Infra is an enterprise-focused extension of the Zodor platform, providing customizable tokenization infrastructure for institutions and businesses aiming to digitize ownership and unlock liquidity from real-world assets (RWAs). Its Tokenization-as-a-Service model supports various asset classes, including real estate, industrial facilities, mining operations, corporate assets, and tradeable commodities.

The system leverages a proprietary, permissioned blockchain framework to enable secure, compliant, and transparent asset management. Zodor Infra facilitates fractional ownership, enhances liquidity, and reduces counterparty risk through on-chain automation. It also offers tailored tokenization strategies, regulatory alignment, interoperability with legacy systems, and full lifecycle support—from structuring to secondary trading. Designed for capital-intensive sectors, Zodor Infra helps organizations modernize asset handling, increase capital access, and bring real-world investments onto the blockchain. [8]

Capital

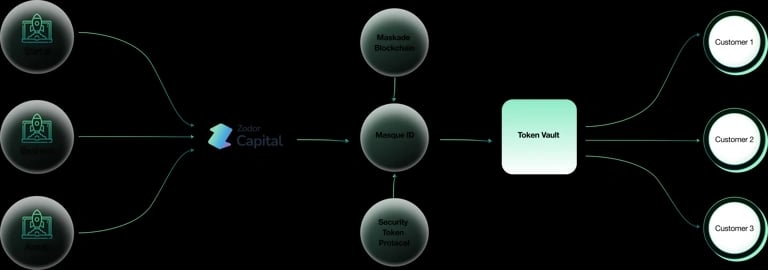

Zodor Capital is a platform focused on helping startups and businesses tokenize their operations to access capital and improve liquidity. Targeting the $6.5 billion token exchange market, it bridges traditional finance with decentralized systems through a blockchain-based tokenization process emphasizing security, transparency, and flexibility.

The platform supports various industries and includes initiatives such as empowering women entrepreneurs by increasing global visibility and access to DeFi networks. Zodor Capital also uses tokenizing real estate, particularly in India, to offer global retail investors fractional access to high-value assets. Features include tier-based allocation through NFTs, an AI-enhanced user platform for informed investing, and a loyalty program that rewards community engagement. With a focus on compliance, privacy, and inclusivity, Zodor Capital aims to make decentralized investing more accessible and secure. [9]

Energy

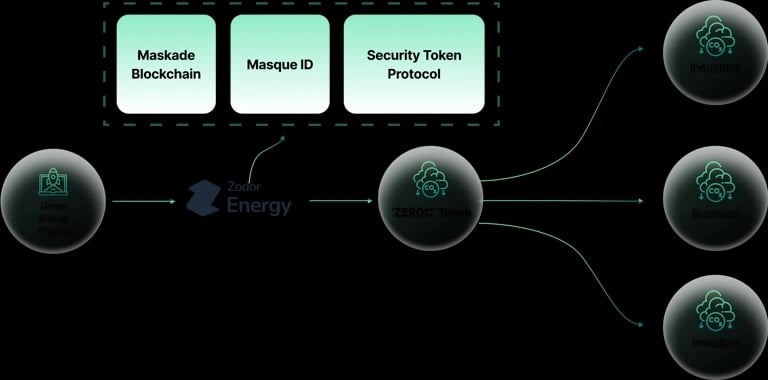

Zodor Energy is a blockchain-based platform that funds renewable energy projects by removing intermediaries and enabling global participation through tokenized investments. Using proprietary $ZEROC tokens, the platform supports greenfield and brownfield energy initiatives, allowing individuals and smaller investors to contribute directly to sustainability efforts.

The platform integrates Maskade Blockchain, Masque ID, and a Security Token Protocol to ensure transparency and decentralized governance. It emphasizes accessibility, community ownership, and measurable environmental impact. Zodor Energy aims to bridge blockchain and clean energy development, especially in regions like Africa, MENA, and the GCC, while promoting accountability in energy metrics. The long-term goal is to build a decentralized ecosystem that drives the global energy transition. [10]

Infinity

Zodor Infinity is a platform that enables businesses to tokenize their equity or revenue streams through a streamlined, blockchain-based process. Positioned as "The Shopify for Tokenized Economies," it offers a decentralized alternative to traditional IPOs and venture capital by reducing costs, increasing accessibility, and providing built-in liquidity.

The platform features AI-powered security token offerings, validator-driven governance, milestone-based fund disbursement, and smart contract-enabled liquidity. Zodor Token holders review and approve projects, earn validation rewards, and influence investment decisions. The system is designed to serve both startups and investors, offering compliance automation, community engagement, and transparent capital allocation. Zodor Infinity aims to democratize fundraising and improve investor access to high-potential businesses while ensuring accountability through automated, milestone-based fund releases. [11] [12]

ZOD

The ZOD Token ($ZOD) functions as the core utility token within the Zodor ecosystem, providing value to holders through revenue sharing, cost reductions, and access to exclusive investment opportunities. It supports ecosystem engagement by rewarding long-term participation and offering tier-based benefits.

Holders of $ZOD receive a portion of revenues from tokenized real-world assets (RWAs) and benefit from reduced transaction fees across the platform. The token grants early access to high-value deals and allows users to stake for additional yield. A tiered rewards structure incentivizes loyalty by unlocking enhanced perks as holdings increase. [13]

Tokenomics

ZOD has the following distribution: [14]

- Liquidity (DEX): 60%

- Team: 10%

- Treasury: 8%

- Marketing: 9%

- KOL: 7%

- Advisors: 2%

- Market Makers: 2%

- Liquidity (CEX): 2%

Partnerships

- Proof

- Poolify

- Assure DeFi

- STPI

- Liminal

- KycHub

- AvaCloud

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)