订阅 wiki

Share wiki

Bookmark

INK Finance

0%

INK Finance

Ink Finance 是一个可扩展的框架,专为协作金融而设计,允许组织建立高效的管理结构和合规的链上金融运营,并具有强大的风险控制和透明度。它支持多个领域,包括网红众筹、现实世界资产承销、DeFi 流动性池以及从 Web2 到 Web3 的过渡。 [1]

概述

Ink Finance 旨在通过关注管理能力和财务信誉来改变 DeFi。它旨在帮助 DAO 通过透明有效的财务运营,根据其在各个阶段的特定组织需求,建立其链上声誉。通过利用 区块链 的不可变特性,Web3 组织可以展示其管理财务的能力,从而建立其自身及其社区的信誉。这种从基于 加密货币 到基于信用的 DeFi 的转变可以增强 加密 金融的实质和价值。Ink Finance 旨在支持广泛的去中心化组织和传统机构,提供可定制的链上工具,以满足 Web3 领域中创新和雄心勃勃的客户的需求。 [2]

Modules

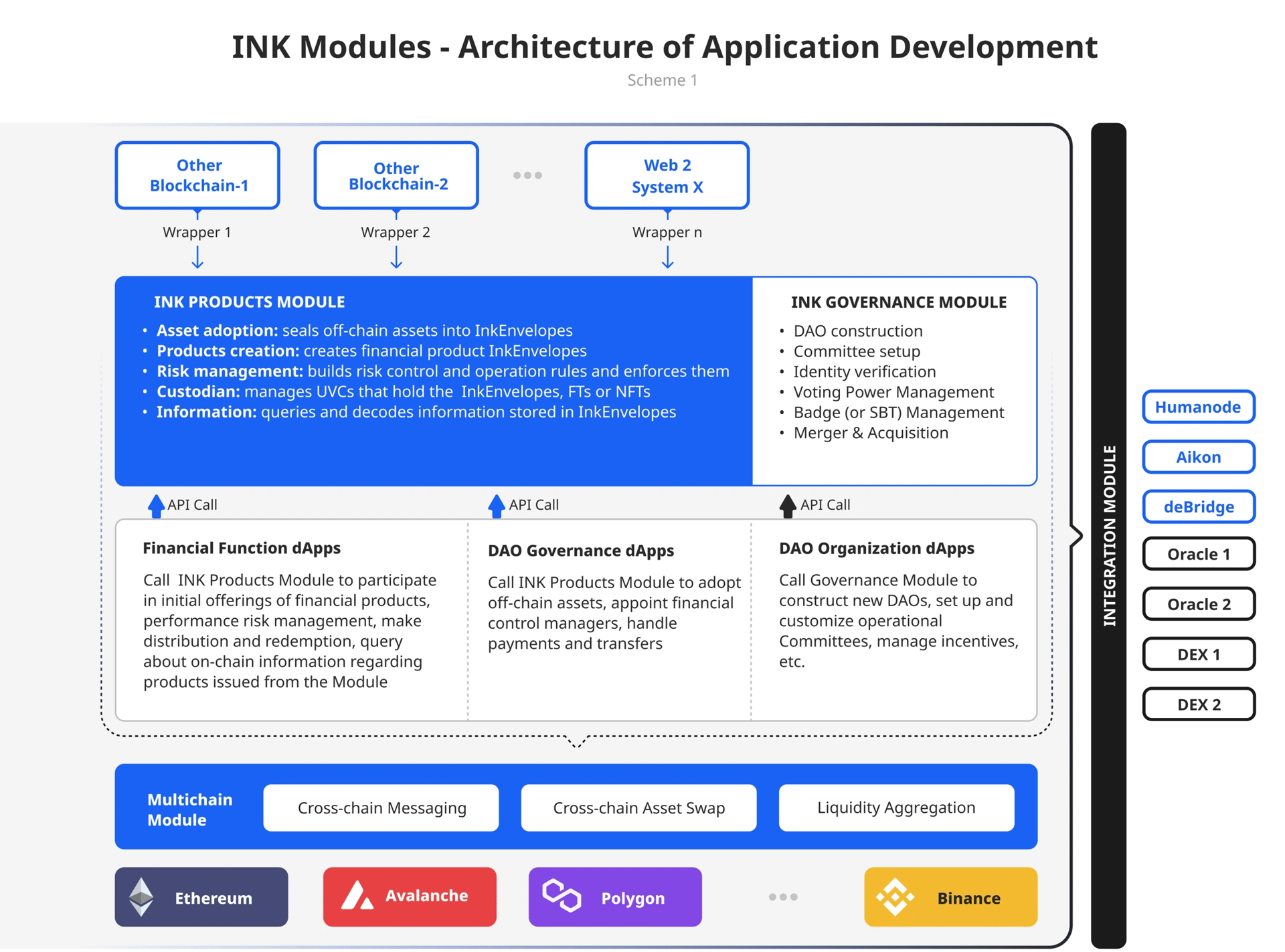

INK Modules are a set of code packages that support the development of Ink Finance applications, including the main web app created by the project team. The development framework comprises four key modules: INK Governance, INK Products, INK Multichain, and INK Integration. These modules form the INKSDK's foundation, enabling third-party dApps to be built within the Ink Finance ecosystem. [3][4]

Products

The INK Products Module provides code packages that support various fiscal and financial capabilities, including safe custody, product issuance, and risk management. It is designed to offer comprehensive, flexible, and user-friendly management tools. The module is built around two key components: the Unified Custodian Vault and InkEnvelope, which serve as the foundation for functionalities related to issuance, clearing, and risk management. [4][5]

统一托管金库

统一托管金库 (UCV) 是一种可编程的多资产持有系统,旨在通过管理规则保护各种资产。它允许 DAO 创建多个 UCV,以分离由其他机构管理的不同功能的资产或负债。诸如 DAO 到 DAO 的转账以及定期或一次性付款等交易,通过合约和多重签名流程安全地执行。UCV 支持跨财务、投资和融资活动的分类、审计和简化运营。该系统由两个构造管理:UCVManager,处理诸如付款、转账和审计等常规操作;UCVController,监督诸如清算和抵押品收回等强制操作。 [6]

InkEnvelope

InkEnvelope is a wrapper consolidating heterogeneous assets from networks or systems secured by governance integrity. It simplifies bundling various assets and their related information into a single token, adding programmability while integrating seamlessly into DeFi applications. Beyond token minting, InkEnvelope handles critical asset-related details such as insurance, appraisals, and licensing. It can incorporate privacy-protected asset verification using ZKP-based systems, especially for assets from enterprise blockchains or Web2 platforms requiring access permissions. InkEnvelope supports fungible and non-fungible tokens and is compatible with mainstream wallets and DeFi tools. It can serve as treasury assets, collateral, or components of investment portfolios, offering uniformity and liquidity. The InkEnvelope is used in the INK Products Module for executing DAO asset adoption, creating new financial products backed by other InkEnveloped assets, distributing returns, and managing asset-related information transparently, advancing the shift toward credit-based DeFi and reducing reliance on generic utility tokens for fundraising. [7]

治理

INK 治理模块提供代码包,支持DAO的组织结构、决策过程和运营执行。它旨在创建一个框架,将这些要素连贯地整合在一起,提供全面、灵活和用户友好的解决方案。该模块有助于在去中心化组织内实现高效的治理和运营工作流程。 [4][8][9]

分层 DAO 构建

Ink Finance 中的分层 DAO 构建允许在一个大型生态系统中直观地设置顶层和子 DAO。DAO 可以被建立为具有其治理代币的元级别实体,或者作为使用现有 治理代币 的子 DAO,成员可以质押到元 DAO 的 质押 引擎中。重要的是,“子 DAO”是一个技术术语,而不是一个商业术语,这意味着在发行 治理代币 的 DAO 和子 DAO 之间不需要直接的经济或行政联系。这种去中心化的方法允许用户在其社区内独立使用 治理代币。[10]

Ink 质押引擎

Ink Finance 的质押引擎是 DAO 治理的核心经济驱动力,需要质押 DAO 的元代币才能参与治理。管理者和投票者必须质押代币,这有助于防止女巫攻击,并通过抵消 gas 成本来奖励参与。DAO 还可以为治理发行徽章,但这些徽章必须与元代币结合使用。定期质押方案允许 DAO 自定义奖励和惩罚系统。创建 DAO 时,创建者设置质押引擎并将奖励代币提交到系统。此过程通过 Ink 的无代码界面进行管理,包括配置质押奖励、设置排放曲线和锁定期,以及定义提前提款的惩罚。 [11][12]

Multichain

INK Multichain Module provides code packages that enable a DAO to operate on its native blockchain while accessing financial liquidity across other blockchain networks. This module allows a DAO to maintain its operational competence and reputation, ensuring transparency and traceability in financial dealings. It facilitates the propagation of governance decisions to branch networks, similar to how a corporation manages its branch offices, allowing DAOs to establish cross-chain creditworthiness. [4][13]

The module supports various functionalities, including sending cross-chain messages to execute governance decisions, transferring raised funds back to the main Treasury or Investment UCV, accessing decentralized exchanges (DEXs) for automatic asset management, and aggregating liquidity data across multiple blockchains. It also creates an abstraction layer that simplifies interactions between Web3 protocols and Web2 infrastructure. The ultimate aim is to enable DAOs to manage assets across diverse systems, enhancing their operational capabilities and access to liquidity. [4][13]

集成

INK 集成模块由旨在与其他去中心化协议和 Web2 基础设施集成的代码包组成。它使 Ink Finance 能够在抽象和解耦层上运行。它强调可组合性,允许专注于金融的 DAO 专注于其核心目标,而无需管理集成复杂性。[4][14]

为了解决外部编程接口的不可预测性,该模块为各种外部功能提供了一个抽象层,确保集成细节不会给 Ink Finance 应用程序带来负担。这种抽象对于系统的长期可维护性至关重要,可以适应外部系统中不可避免的变化。该模块涵盖隐私保护的身份验证、跨链消息传递、预言机、去中心化交易所 (DEX)、存储、文档签名和用于链下托管的 Web2 基础设施。INK 集成模块将继续增强和优化这些集成,以保持无缝的用户体验。[4][14]

QUILL

QUILL是Ink Finance平台的原生代币,类似于用户DAO使用其元代币的方式,它在Ink Finance生态系统中充当治理代币。它也可以作为不发行代币的较小DAO的默认治理代币。与通用DAO代币不同,QUILL旨在提高代币持有者的价值,同时作为非安全实用代币发挥作用,这与Ink Finance作为区块链的SaaS平台的角色相一致。 [15]

代币经济学

- 顾问/团队: 20%

- 质押排放: 20%

- 生态系统: 13%

- 种子轮和基石轮: 10%

- 战略轮: 10%

- 社区激励: 10%

- 保险基金: 10%

- 公开发售: 5%

- 交易所流动性: 2%

融资

2021年8月20日,Ink Finance完成了种子轮和锚定轮融资,筹集了150万美元。Republic Capital领投了本轮融资,DHVC、Krypital Group、Axia8 Venture、BellaTech、GSR Markets、Legos Capital Group、LD Capital、RedlineDAO、LucidBlue和Blofin参与了投资。Republic Advisory Service还利用其生态系统连接,领导了顾问委员会。 [17]

合作伙伴

- deBridge

- Salus

- Humanode

- Astra

- OKX 钱包

- Vayana

- Alterverse

- Bitlayer

- Magic Square

- Polytrade

- Sign Protocol

- Orbital7

- Paragen

- Phoenix

- AlphaNet

- Ordify

- Script Network

- Crypto Stoics

- Sugar Kingdom Odyssey

- Vent Finance

- HyperGPT

发现错误了吗?