订阅 wiki

Share wiki

Bookmark

Renzo Protocol

0%

Renzo Protocol

Renzo协议是EigenLayer的流动性再质押代币(LRT)和策略管理器,提供对EigenLayer生态系统的访问。它保护主动验证服务(AVS),并简化用户和EigenLayer节点运营商之间的协作。Lucas Kozinski、James Poole和Kratik Lodha是Renzo的创始人。[1]

概述

Renzo于2023年12月推出,是一个流动性再质押代币(LRT)和策略管理器,在EigenLayer生态系统中运行。它简化了用户交互,并促进与EigenLayer节点运营商的无缝协作。它符合EigenLayer在以太坊上实现无需许可创新的使命,并在生态系统中建立信任。Renzo是以太坊再质押的首选平台,提供比ETH质押更高的收益,并促进EigenLayer的采用。它通过为每笔存入的LST或ETH铸造等量的ezETH来实现这一点。它使用智能合约和运营商节点来确保最佳的风险/回报再质押策略。[1]

REZ

REZ于2024年4月30日推出,是协议中的原生治理代币,允许持有者对涵盖各种事项的治理提案进行投票。这些提案可能涵盖运营商白名单、主动验证服务白名单、整体风险管理框架、社区和财政拨款,以及关于集中金额、抵押品资产和存款的规范。[1][2]

REZ空投

第一季空投遵循基于用户ezPoints余额的线性分配。Renzo与第三方数据分析公司合作,识别女巫钱包,并为代币分配资格建立了每个钱包的最低ezPoints阈值(截至快照日期)。超过50万ezPoints的钱包在代币生成事件(TGE)时解锁50%,并在三个月内线性归属50%。第一季于4月26日结束。用户资格基于快照时其钱包中的ezPoints余额,无论其当前的ezETH余额如何。[10]

第二季活动于4月26日开始,旨在支持持续增长,奖励早期用户,并增强ezETH在所有支持网络上的效用和分配。across。第二季的特点是用户钱包中ezETH持有者的积分增加,并支持DeFi集成。它在三个月内(直到7月26日)向社区分配了总供应量的5%(5亿$REZ)。所有第一季用户在第二季结束时获得了其总ezPoint余额的10%额外提升。[11]

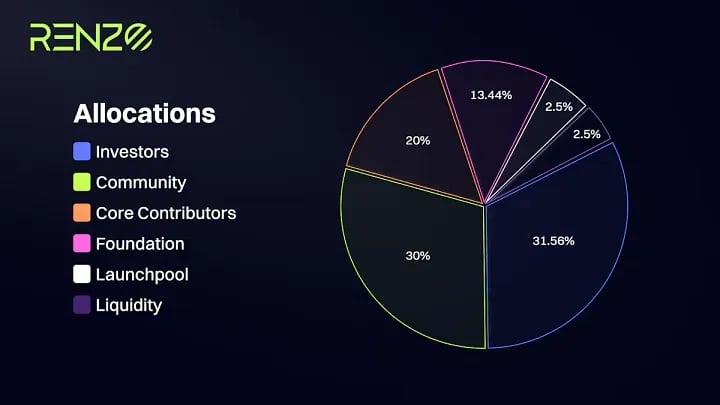

代币经济学

REZ代币的最大供应量限制为100亿,并具有以下分配:[1][2]

- 融资:31.56%

- 旨在用于该项目的早期投资者。

- 社区:32%

- 7%分配给基于获得的ezPoints的第一季空投奖励。

- 分配给各种社区活动。

- 5%指定用于第二季的激励。

- 核心贡献者:20%

- 分配给Renzo Labs的团队和顾问。

- 基金会:12.44%

- Binance:2.5%

- 流动性:1.5%

ezETH

ezETH在Renzo协议中充当流动性再质押代币(LRT),象征着用户的再质押头寸。参与者可以质押原生ETH或流动性质押代币(LST),如wBETH和stETH,并作为回报,获得ezETH。值得注意的是,ezETH是一种奖励代币,这意味着由于其在主动验证服务(AVS)中的收益增强,其价值有可能超过底层代币的价值。[2]

pzETH

pzETH是一种流动性再质押代币,代表用户在Symbiotic生态系统中的再质押头寸。用户可以存入stETH、wstETH、wETH或ETH等资产以接收pzETH,pzETH保护主动验证服务(AVS)并生成质押和再质押奖励。存款后,pzETH会自动支持AVS,而无需用户管理策略或与智能合约交互。从第一天起就可以提款,并且可以完全赎回底层抵押品。通过Symbiotic,用户通过再质押资产来支持去中心化应用程序和服务来赚取奖励。[9]

ezPoints

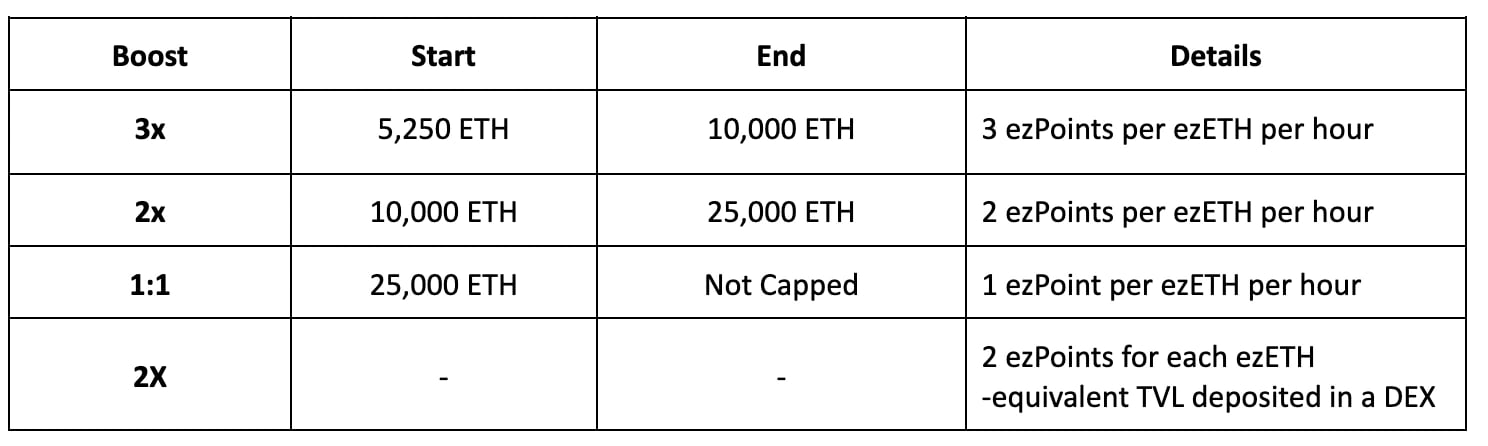

Renzo的ezPoints系统旨在激励积极参与并为协议的成功做出贡献。参与者根据他们的参与获得积分奖励,数量根据他们参与的持续时间和性质而变化。持有ezETH是赚取ezPoints的一种方式,持有者每持有ezETH每小时可获得1个Renzo ezPoint。早期参与者和那些拥有较大ezETH持有量的人会获得额外的积分。[1]

ezEIGEN

ezEIGEN是一种旨在简化EIGEN再质押过程的代币。它可以自动从多个AVS(包括EigenDA)声明奖励,并自动复利这些奖励以提高效率。该自动化减少了gas费用,并且建立在与Renzo的ezETH产品相同的安全技术之上。通过简化关键流程,ezEIGEN使再质押更容易访问,从而可能鼓励更广泛的采用。[7][8]

合作伙伴关系

Connext网络

Renzo协议已与Connext网络合作,将跨链原生再质押引入Layer 2网络。此合作使ETH/wETH持有者能够在Renzo支持的著名Layer 2链上进行再质押,从而提高流动性和可访问性,同时简化传统再质押过程的复杂性。此外,Renzo计划扩展对Layer 2网络上LST再质押的支持。将Renzo与Connext和Chainlink的跨链互操作性协议(CCIP)集成,可确保为用户提供流畅无缝的跨链原生再质押体验。[1]

Pendle

2024年1月31日,Renzo推出了与DeFi收益协议Pendle Finance的集成。此集成通过单个合约(EIP5115 SY代币)运行,以1:1的比例表示ezETH。SY代币可以被代币化为本金代币(PT)和收益代币(YT)。[3]

Chainlink

2024年3月20日,Renzo宣布其与以太坊主网、Arbitrum和Linea上的Chainlink价格信息集成。此集成允许Renzo的ezETH访问可靠且防篡改的价格信息,从而促进安全且扩展的对高级流动性再质押策略的访问,并为用户提供Renzo DeFi集成的行业标准价格数据。[4]

投资者

- Binance Labs

- Maven 11 Capital

- OKX Ventures

- IOSG Ventures

- Bitscale Capital

- SevenX Ventures

- Robot Ventures

- Figment Capital

- Mantle

种子轮融资

2024年1月15日,Renzo筹集了320万美元的种子资金。Maven11 Capital领投了该轮融资,Figment Capital、SevenX Ventures、IOSG Ventures和其他投资者也参与了该轮融资。[5]

6月融资轮

根据与CoinDesk分享的新闻稿,Renzo于2024年6月18日宣布已在一轮融资中筹集了1700万美元。该资金分两轮进行,第一轮由Galaxy Ventures领投,第二轮由Brevan Howard Digital Nova Fund领投。这笔资金将用于扩展该项目的再质押服务,包括增加对ERC-20代币的支持。[6]

发现错误了吗?