订阅 wiki

Share wiki

Bookmark

Upton Finance

0%

Upton Finance

Upton Finance 是 Telegram 生态系统中的一个 CeDeFi 平台,旨在通过 TON 区块链上的第一个再质押协议提供安全、高收益的储蓄解决方案。[1][2]

概述

Upton Finance 是 Telegram 生态系统中的一个 去中心化金融 平台,它在 TON 区块链上运行。它作为 TON 上的第一个 CeDeFi 再质押协议,旨在解决生态系统中高收益储蓄产品的缺口。

该平台允许用户质押 USDT 和 TON 代币,提供 15% 的 年化百分比收益率 (APY)。通过将自己定位为 TON 的货币市场基金,Upton Finance 旨在为 Telegram 庞大的用户群提供安全、产生收益的金融服务。[1][2][3]

产品

质押机制

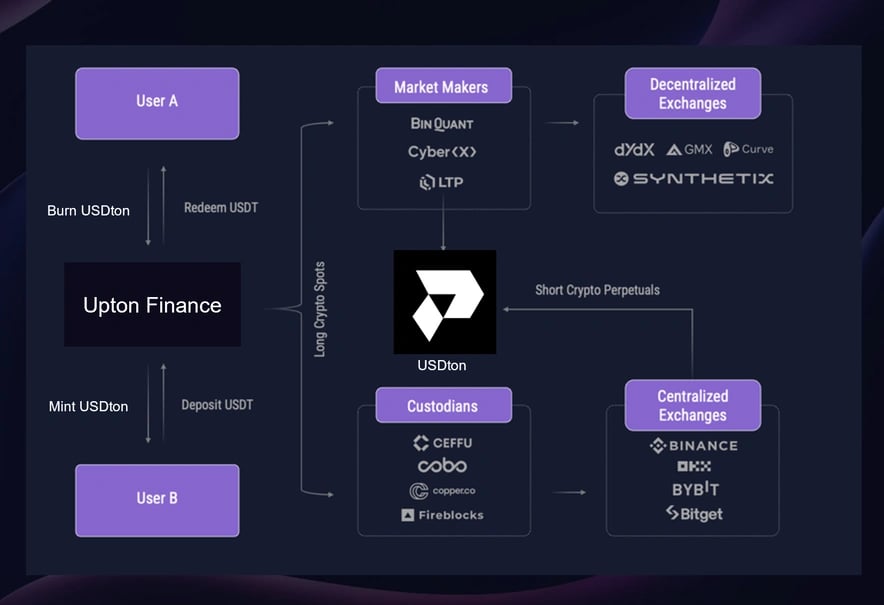

Upton Finance 提供了一种质押机制,用户可以存入 USDT 和 TON 代币以换取 USDton 代币,这些代币旨在产生 15% 的年回报率。该系统通过第三方托管人确保资产安全,并利用诸如基差套利和 AI 驱动的交易等策略来优化回报。用户可以选择将其 USDton 代币兑换为等值的原始资产,从而实现流动性和灵活性[3][4]

高回报

Upton Finance 提供了一种质押产品,旨在通过 USDton 代币为用户提供 15% 的 年化百分比收益率 (APY),主要使用低风险套利来赚取资金费率合约费用。该平台计划推出 $UPTON 治理代币,这可能会将回报率提高到高达 30% 的 APY。收益生成依赖于套利策略和 AI 驱动的交易来优化回报,同时管理风险。[3][5]

用户友好的体验

Upton Finance 旨在通过 Telegram 机器人和 Web 界面提供用户友好的体验。它力求通过直观的设计和游戏化元素来简化财务管理。用户可以存入 USDT 和 TON,接收产生利息的 USDton 代币,并通过实时更新管理他们的投资。该平台还提供教育资源和社区支持,以增强可访问性和用户参与度。[3][6]

代币经济学

Upton Finance 代币 ($UPTON)

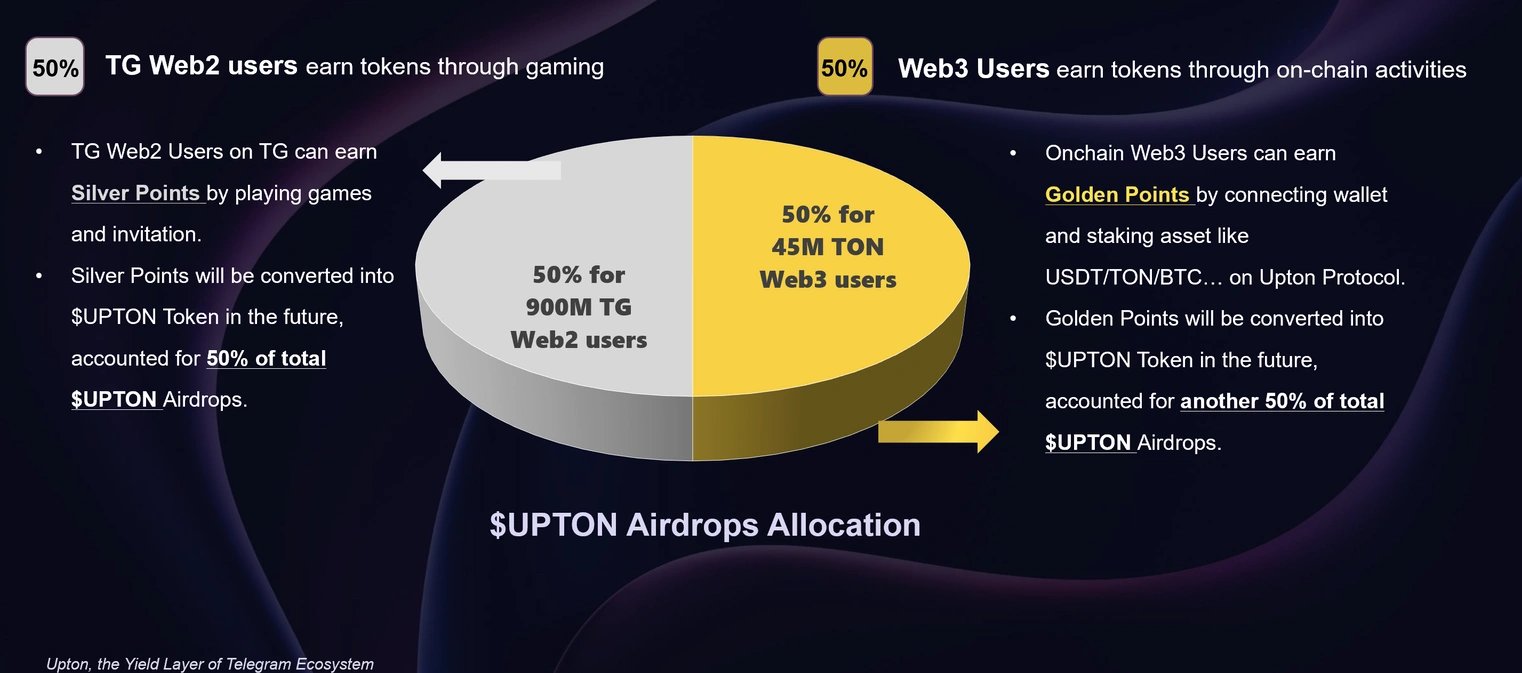

$UPTON 是 Upton Finance 的 治理代币,在 TON 区块链上的总供应量为 2100 万个代币。它旨在支持平台内的治理和决策过程。Upton Finance 旨在采用战略性的 空投 模型,以促进 Telegram 生态系统中 Web2 和 Web3 用户的采用和参与。[8]

分配

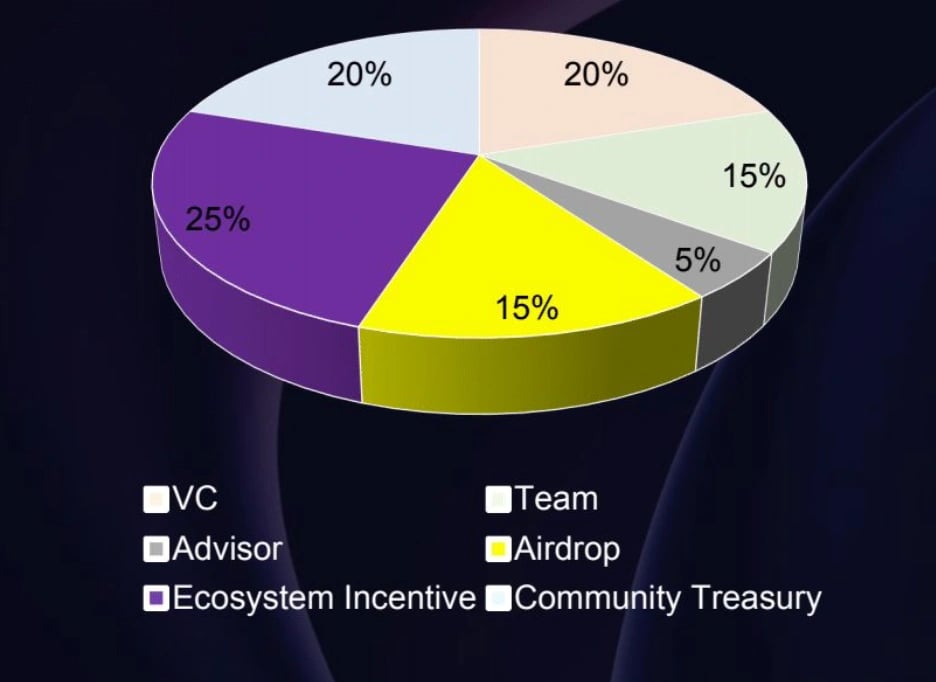

$UPTON 代币的分配如下:

- 风险投资 (VC):20%

- 团队:15%

- 顾问:5%

- 空投:15%

- 生态系统激励:25%

- 社区金库:20%

Upton 协议的收入将与 $UPTON 质押者分享 50%。[[9]](#cite-id-9y9z538h976]

合作伙伴

Upton Finance 的主要合作伙伴包括:

发现错误了吗?