위키 구독하기

Share wiki

Bookmark

Ethena

0%

Ethena

Ethena Labs는 이더리움 블록체인에서 개발된 분산형 프로토콜입니다. 그 목적은 기존 은행 시스템에 대한 암호화폐 기반 대안을 제공하는 것입니다. Guy Young이 설립한 이 프로토콜은 달러로 표시된 '인터넷 채권'(USDe)이라는 전 세계적으로 접근 가능하고 허가 없는 저축 수단을 도입합니다. [1][2][3]

개요

Ethena는 이더리움을 기존 은행 시스템과 독립적으로 최초의 암호화폐 네이티브 수익 창출 합성 달러로 전환하기 위해 파생 상품 인프라를 제공하는 DeFi 스타트업입니다. [1][3]

Ethena의 제품군에는 내장된 수익률을 특징으로 하는 델타 중립 합성 달러, USDe, 전 세계적으로 접근 가능한 변동 및 고정 금리 USD 표시 채권, 자본 효율적이고 구성 가능한 레버리지가 포함됩니다. 사용자는 USD, 이더리움 또는 유동성 스테이킹 토큰을 담보로 예치하여 USDe를 생성할 수 있습니다. 이는 이더리움 및 선물 시장의 경제 활동에서 수익을 얻는 최초의 분산형, 확장 가능하고 안정적인 자산입니다. [3]

보안, 투명성 및 프로그래밍 가능성을 보장하기 위해 Ethena는 담보를 다양한 온체인 MPC(Multi-Party Computation) 보관 계약에 배포하여 보관을 위해 중앙 집중식 서버에 대한 의존도를 없애고 상대방 위험을 완화합니다. [1]

USDe는 스테이킹된 이더리움 수익과 ETH 영구 자금 조달 비율의 기초를 포착하여 사용자에게 내장된 수익률을 생성합니다. [1]

“우리는 암호화폐에서 가장 중요한 수단인 스테이블코인을 은행 시스템에서 분리하고 싶습니다. 우리가 하려는 모든 것의 요점은 자급자족 시스템을 만드는 것이지만 가장 중요한 자산은 완전히 중앙 집중화되어 있습니다.” - Ethena 및 스테이블코인 USDe의 목표에 대한 [Guy Young] - (https://iq.wiki/wiki/guy-young)

2025 로드맵

Ethena의 2025 로드맵은 합성 달러 제품을 전통 금융(TradFi)에 통합하는 데 중점을 둡니다. 1분기의 주요 이니셔티브는 토큰 수준에서 전송 제한이 있는 래퍼 계약을 통합하여 sUSDe의 확장인 iUSDe를 출시하는 것입니다. Ethena는 TradFi 유통 파트너와 협력하여 iUSDe에 대한 액세스를 확대할 계획입니다.

대상 사용자는 자산 관리자, 사모 신용 펀드, 상장지수펀드, 사모 투자 신탁 및 주요 브로커를 포함합니다. 로드맵은 수익 창출 합성 달러가 190조 달러 규모의 고정 수입 시장에서 관심을 끌 수 있는 잠재력을 강조합니다. 스테이킹 보상과 이더 영구 선물 매도를 활용하여 Ethena는 암호화폐 및 전통 금융 부문 모두에서 자본 보존 및 수익 창출을 위한 실행 가능한 대안으로 합성 달러를 포지셔닝하려고 합니다. [9]

Converge 블록체인 출시

Ethena Labs는 Securitize와 협력하여 전통 금융(TradFi)과 분산형 금융(DeFi)을 통합하도록 설계된 이더리움 가상 머신 (EVM) 호환 블록체인인 Converge를 출시할 예정입니다. 2025년 2분기에 출시될 예정인 Converge는 DeFi 및 토큰화된 자산에 대한 소매 및 기관 액세스를 모두 용이하게 하는 것을 목표로 합니다. [10]

자금 조달

2023년 7월, Ethena는 암호화폐 중심 벤처 캐피털 회사인 Dragonfly가 주도하고 BitMEX 설립자 Arthur Hayes와 그의 가족 사무실인 Maelstrom이 참여한 시드 자금 조달 라운드에서 600만 달러를 모금했습니다. 또한 주요 암호화폐 파생 상품 거래소인 Deribit, Bybit, OKX, Gemini 및 Huobi와 여러 벤처 캐피털 및 거래 회사도 이 라운드에 투자했습니다. [4]

600만 달러의 시드 투자는 Ethena가 스테이블코인 및 채권 자산인 USDe 출시를 준비할 수 있도록 하기 위한 것이었습니다. 회사는 테스트넷 단계를 완료하고, 업계 리더와의 파트너십을 구축하고, 프로토콜의 보안 및 효율성을 보장하기 위해 스마트 계약 감사를 수행할 계획이었습니다. [4][5]

USDe 생성 메커니즘

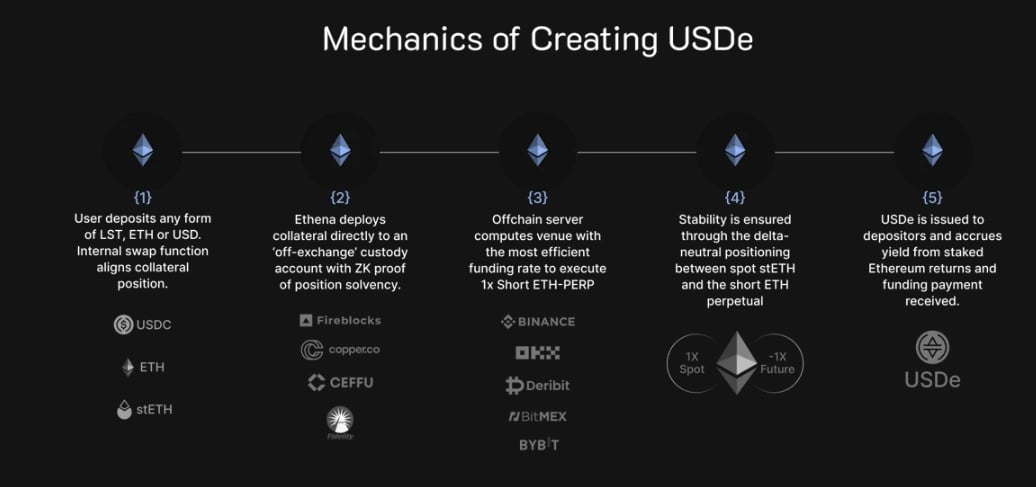

USDe는 사용자가 LST, ETH 또는 USD를 예치하여 생성됩니다. 내부 스왑 기능은 담보 포지션과 조화를 이룹니다. 그 후 Ethena는 담보를 장외 보관 계정으로 보내 위치 지급 능력에 대한 ZK 증명을 제공합니다. 장외 서버는 가장 효율적인 자금 조달 비율로 장소를 계산하여 1x 쇼트 ETH-PERP를 실행합니다. 안정성은 스팟 stETH와 쇼트 ETH 영구 간의 델타 중립 포지셔닝을 통해 보장됩니다. [3]

예금자는 스테이킹된 이더리움 수익과 수령한 자금 조달 지불금에서 수익을 축적하는 발행된 USDe를 받습니다. 이 프로세스는 Ethena 생태계 내에서 USDe를 생성하고 유지하기 위한 투명하고 안전한 메커니즘을 보장합니다. [1][3]

확장성은 파생 상품을 활용하여 달성되므로 스테이킹된 ETH 담보가 동일한 명목의 쇼트 포지션으로 완벽하게 헤지될 수 있으므로 USDe는 상당한 과잉 담보 없이 확장할 수 있으므로 스테이블코인은 1:1 담보만 필요합니다.

안정성은 발행 시 담보에 대해 즉시 실행되는 레버리지 없는 쇼트 영구 포지션을 통해 제공되므로 포지션이 델타 중립이고 초기 명목 잔액이 완벽하게 헤지되지 않은 사용자는 USDe를 발행하지 않습니다. [3]

검열 저항은 담보를 은행 시스템에서 분리하고 중앙 집중식 유동성 장소 외부의 신뢰할 수 없는 암호화폐 담보를 온체인, 투명하고, 연중무휴 감사 가능하고, 프로그래밍 가능한 보관 계정 솔루션에 저장하여 달성됩니다. [3]

개발

Ethena Labs x WLFI

2024년 12월 18일, Ethena Labs는 Donald Trump가 지원하는 World Liberty Financial과의 전략적 파트너십을 발표하여 Ethena의 sUSDe 토큰(USDe “합성 달러”의 스테이킹된 버전)을 World Liberty Financial의 Aave 인스턴스와 통합하여 사용자가 USDe를 예치하고 sUSDe 및 World Liberty의 WLF 토큰 모두에서 보상을 받을 수 있도록 했습니다. [7]

"Ethena는 @worldlibertyfi와 전략적 파트너십을 체결했습니다. sUSDe를 WLFI의 곧 출시될 Aave 인스턴스에 핵심 담보 자산으로 추가하기 위한 거버넌스 제안이 제출되었습니다.

통과되면 이 제안은 @worldlibertyfi 사용자가 sUSDe 보상과 WLF 토큰 보상을 모두 받을 수 있도록 합니다. 이 통합은 프로토콜에서 스테이블코인 유동성과 활용률을 높일 것입니다. sUSDe의 통합이 Aave의 핵심 인스턴스에서 그랬던 것처럼" - Ethena Labs 팀이 트윗했습니다.

Ethena, 독일 시장에서 철수

2025년 4월 15일, Ethena는 독일에서 운영을 종료하기로 합의했습니다.

이 결정은 독일 금융 규제 기관인 BaFin이 Ethena의 USDe 토큰에서 "심각한 결함"을 확인하고 회사가 승인 없이 독일에서 증권을 제공하고 있다고 밝힌 지 3주 만에 나왔습니다.

"우리는 BaFin과 Ethena GMBH의 모든 활동을 종료하기로 합의했으며 더 이상 독일에서 MiCAR 승인을 추구하지 않을 것입니다."라고 Ethena는 트윗에서 밝혔습니다.

이전의 모든 사용자는 프로토콜의 영국령 버진 아일랜드 법인인 Ethena BVI에 온보딩될 것이라고 덧붙였습니다. [11]

Ethena x TON

2025년 5월 1일, Ethena는 The Open Network(TON)과 파트너십을 맺어 10억 명이 넘는 Telegram 사용자 기반에 스테이블코인을 제공한다고 발표했습니다.

이 파트너십은 두바이에서 열린 Token2049에서 발표되었으며, Ethena의 USDe와 Ethena Staked USDe(sUSDe)가 TON 블록체인 내에서 기본적으로 배포될 예정입니다.

sUSDe 변형은 tsUSDe라는 이름으로 통합되어 Telegram 사용자가 Telegram 내에서 직접 US 달러 표시 저축에 액세스할 수 있도록 합니다. [12]

배포에는 Telegram의 보관 지갑과 메신저에 통합된 자체 보관 지갑인 TON Space 지갑의 두 가지 주요 Ethena 통합이 포함됩니다.

"이는 Ethena의 가장 의미 있는 출시 중 하나입니다.

Telegram은 아시아, 아프리카 및 라틴 아메리카와 같은 지역의 신흥 경제에서 입지를 확보하여 10억 명의 사용자에게 진정으로 전 세계적인 배포를 제공합니다.

이제 이러한 국가의 사용자는 모두 Telegram 앱 내에서 Ethena의 USDe를 통해 전 세계적으로 액세스 가능한 달러 저축 수단을 활용할 수 있습니다." - Ethena가 트윗했습니다. [13]

잘못된 내용이 있나요?