위키 구독하기

Share wiki

Bookmark

Hyperliquid

0%

Hyperliquid

Hyperliquid는 자체 레이어 1 블록체인에 구축된 탈중앙화 거래소(DEX)입니다. 중앙 집중식 플랫폼의 효율성과 탈중앙화 시스템의 투명성을 결합했습니다. 이 플랫폼은 중개인에 의존하지 않고 빠른 거래, 낮은 수수료 및 영구 파생 상품을 포함한 고급 거래 도구를 제공합니다. [3]

개요

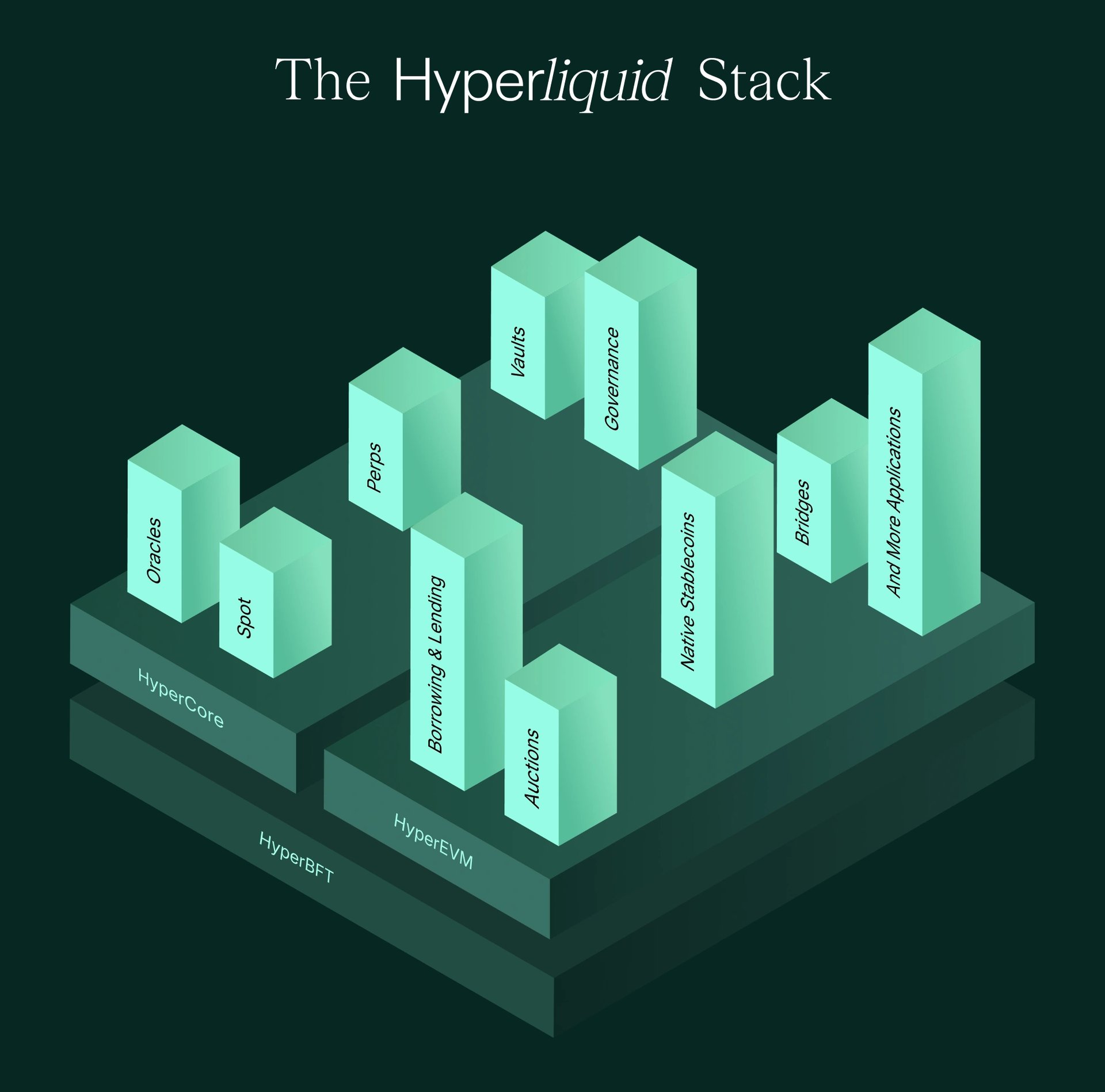

Hyperliquid는 온체인 금융 시스템을 위해 설계된 레이어 1 블록체인입니다. 유동성, 사용자 애플리케이션, 거래 활동을 단일 플랫폼에 통합합니다. 특정 요구 사항에 최적화된 Hotstuff 및 그 후속 기술을 기반으로 하는 맞춤형 합의 알고리즘인 HyperBFT를 사용합니다.

블록체인의 상태 실행은 HyperCore와 HyperEVM으로 구성됩니다. HyperCore는 완전한 온체인 영구 선물 및 현물 주문장을 지원하며, 초당 최대 200,000개의 주문을 한 블록 완결성으로 처리합니다. HyperEVM은 이더리움 호환 스마트 계약 기능을 Hyperliquid로 확장하여 사용자가 금융 인프라를 기반으로 구축할 수 있도록 합니다. [2]

특징

HyperEVM

HyperEVM은 Hyperliquid의 레이어 1 내에 통합된 이더리움 가상 머신(EVM)으로, HyperCore와 동일한 HyperBFT 합의 메커니즘으로 보호됩니다. 이 설계를 통해 EVM과 HyperCore 간의 원활한 상호 작용이 가능하며, 현물 및 영구 주문장에서 자산을 사용할 수 있습니다. HyperEVM은 이중 블록 아키텍처를 활용하여 빠른 소형 블록과 느린 대형 블록 간에 처리량을 분할하여 트랜잭션 속도와 블록 크기의 균형을 맞춥니다. 빠른 블록은 2초마다 2M 가스 한도로 발생하고, 느린 블록은 1분마다 30M 가스 한도로 발생합니다. 시스템 처리량은 향후 업그레이드를 통해 증가할 것으로 예상됩니다.

HyperEVM의 스마트 계약은 온체인 현물 및 영구 선물 주문장을 포함하여 Hyperliquid의 핵심 기능과 직접 상호 작용할 수 있어 플랫폼의 거래 인프라와의 호환성을 향상시킵니다. Hyperliquid의 실행 모델은 L1과 HyperEVM이 순차적으로 작동하도록 하여 EVM이 이전 블록의 블록체인 상태에 액세스하고 다음 블록에 대한 작업을 제출할 수 있도록 하여 일관되고 예측 가능한 운영을 보장합니다. HyperEVM의 ERC-20 토큰은 Hyperliquid의 기본 토큰과 대체 가능하며, 탈중앙화 애플리케이션(dApp) 내에서 토큰 거래 및 사용에 대한 최소한의 수수료와 풍부한 유동성을 제공합니다. [4] [5] [6]

HyperBFT

HyperBFT는 Hyperliquid의 합의 알고리즘으로, 보안과 일관성을 보장하면서 고빈도 거래를 위해 설계되었습니다. HotStuff 프로토콜을 기반으로 하여 1초 이내에 블록 확인이 가능하며, 중간 대기 시간은 0.2초이고 초당 20만 건 이상의 트랜잭션을 처리할 수 있습니다. 최적화가 계속됨에 따라 처리량은 초당 100만 건 이상의 주문을 초과할 수 있습니다. HyperBFT는 비잔틴 장애 허용을 유지하여 검증자의 최대 1/3이 악의적으로 행동하더라도 네트워크가 작동할 수 있도록 합니다. 또한 Hyperliquid의 레이어 1과 HyperEVM 간에 공유 상태를 보장하여 원활한 데이터 가용성 및 동기화를 제공합니다. [6]

볼트

HyperCore 볼트를 통해 전략은 청산 및 고처리량 마켓 메이킹을 포함하여 DEX와 동일한 기능을 활용할 수 있습니다. 단순한 토큰 리밸런싱 볼트와 달리, 이러한 볼트는 더 복잡한 전략을 허용합니다.

사용자는 볼트에 예치하여 수익의 일부를 얻을 수 있으며, 볼트 소유자는 총 수익의 10%를 받습니다. 프로토콜 볼트에는 수수료 또는 수익 공유가 없습니다. 볼트는 수동으로 관리하거나 마켓 메이커가 자동화할 수 있습니다. 각 전략에는 위험이 따르므로 사용자는 예치 전에 성과를 평가해야 합니다. [7]

Hyperliquidity Provider

Hyperliquidity Provider (HLP) 프로토콜 볼트는 마켓 메이킹 및 청산을 위해 설계되었습니다. 거래 수수료의 일부를 얻습니다. HLP는 커뮤니티가 유동성을 제공하고 수익을 공유할 수 있도록 하여 특정 주체에게만 제공되던 전략을 더 쉽게 접근할 수 있도록 합니다. HLP는 완전히 커뮤니티 소유이며 수수료를 징수하지 않습니다. 수익은 예금자들에게 비례적으로 분배됩니다. 출금은 가장 최근 예금 후 4일 후에 가능합니다.

HLP는 초기 단계의 DeFi 프로젝트에서 유동성을 확보하기 위해 필요한 전통적인 마켓 메이킹 거래의 대안을 제공하여 수익이 사용자에게 돌아가도록 하는 것을 목표로 합니다. 마켓 메이킹 배경을 가진 Hyperliquid의 핵심 기여자들은 폐쇄형 알파 기간 동안 유동성을 초기 제공했습니다. 잠재적인 이점이나 비대칭 정보에 대한 우려를 해결하기 위해 팀의 전략은 공개적으로 접근 가능한 볼트에 보관됩니다.

HLP의 전략은 Hyperliquid 및 중앙화 거래소의 틱 데이터를 사용하여 공정한 가격을 결정합니다. 마켓 메이킹 및 테이킹 전략을 통해 주문을 실행하여 지속적인 유동성을 제공합니다. 전략은 오프체인에서 운영되지만, 모든 볼트 포지션, 미체결 주문, 거래 내역, 예금 및 출금은 투명성을 위해 온체인에서 확인할 수 있습니다.

시간이 지남에 따라 외부 마켓 메이커들이 Hyperliquid에 많은 양을 기여할 것으로 예상됩니다. API 및 SDK를 오픈 소싱하여 온보딩을 용이하게 하고, 참여 증가는 전략의 위험 관리 및 효율성을 향상시킬 것으로 예상됩니다. [8]

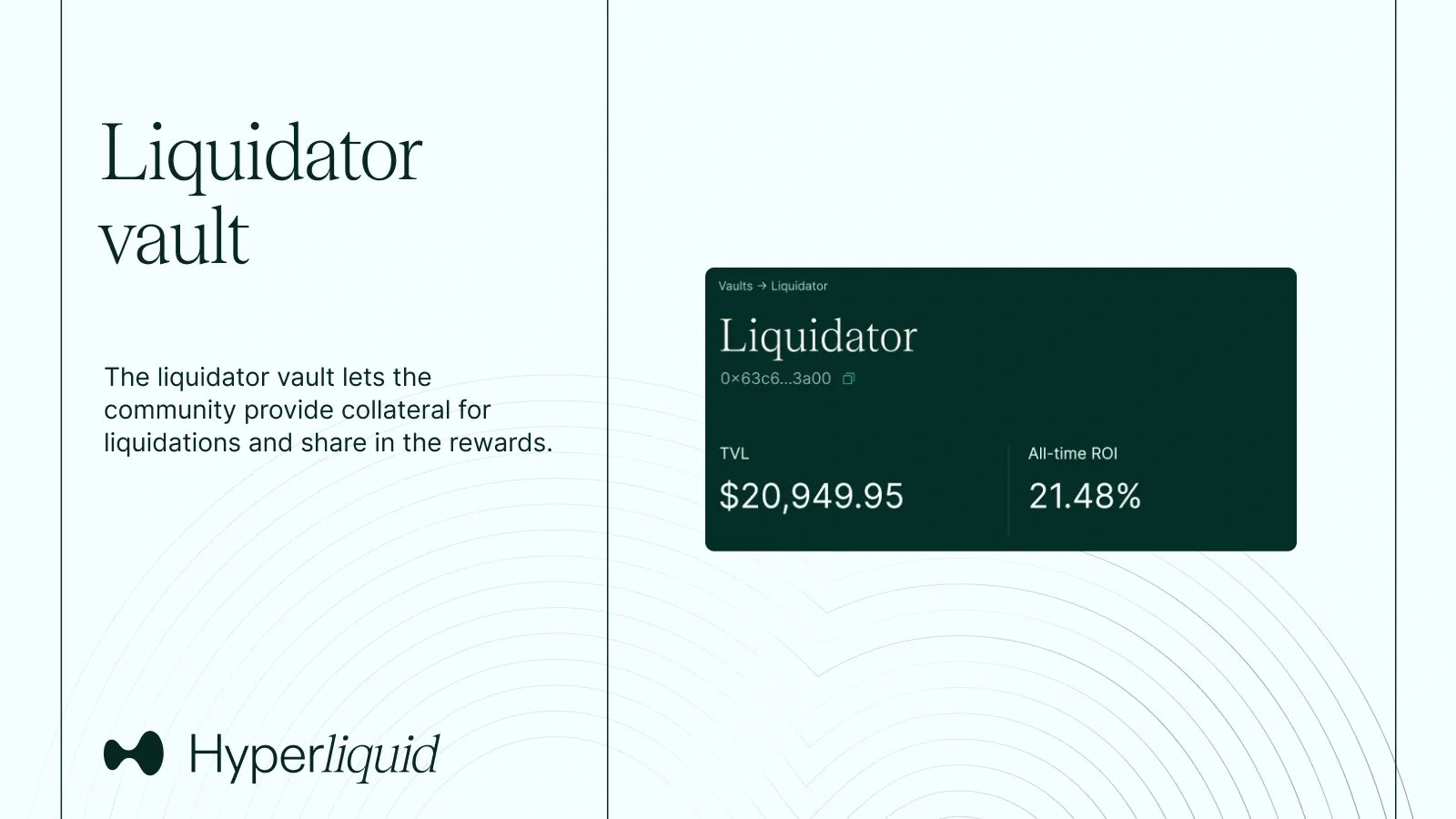

리퀴데이터 볼트

리퀴데이터 볼트를 통해 커뮤니티는 청산을 위한 담보를 제공하고 이익을 공유할 수 있습니다. 모든 청산은 온체인에서 발생하며 탐색기를 통해 추적할 수 있습니다. 현재 청산은 리퀴데이터 볼트를 통해 분산되어 있으며, 이익은 예금자들에게 분배됩니다.

청산은 나중에 API를 통해 접근할 수 있게 될 수도 있지만, 현재 리퀴데이터 볼트는 청산으로 이익을 얻을 수 있는 유일한 방법입니다. 이는 과도하게 레버리지를 사용한 트레이더의 청산을 활용하는 전략에 자금을 지원하여 변동성이 큰 기간 동안 안정성을 유지하는 데 도움이 됩니다. 예금은 누구에게나 개방되어 있으며, 짧은 락업 기간 후에는 인출이 허용됩니다. 볼트는 청산 가능한 포지션이 있을 때만 거래를 실행하고 청산 직후 종료합니다.

리퀴데이터 볼트는 분산화되어 있고 수익성이 높으며, 성과 지표는 공개적으로 이용할 수 있습니다. ROI 및 APY 계산은 과거 성과를 고려하여 볼트 수명을 조정하여 통계적 노이즈를 줄입니다. [9]

HYPE

HYPE는 보유자가 플랫폼 결정에 참여할 수 있도록 하는 거버넌스 토큰입니다. 또한 Hyperliquid 블록체인에서 가스 수수료로 사용할 수도 있습니다. 총 공급량은 10억 개의 토큰으로 제한됩니다.

2024년에 Hyperliquid는 에어드랍을 통해 HYPE를 도입했습니다. 배포는 현재 및 미래 사용자에게 토큰의 75%를 할당했으며, 상당 부분은 초기 참가자에게 돌아갔습니다. Hyperliquid는 벤처 캐피털 자금에 의존하지 않았기 때문에 대부분의 토큰이 커뮤니티에 배포되었습니다. HYPE 토큰의 20% 이상이 Hyperliquid Labs 개발자를 포함한 핵심 기여자에게 할당되었습니다. 이러한 토큰은 초기 매도를 완화하기 위해 2027년에서 2028년 사이에 베스팅되도록 설정되었습니다. [1]

개발

Hyperliquid, JELLYJELLY 상장 폐지

2025년 3월 27일 수요일, Hyperliquid는 잠재적인 고래 조작으로 인해 솔라나 기반 밈 코인 JELLYJELLY가 거의 500% 급등한 후 유동성 위기에 직면했습니다. 급등으로 인해 일시적으로 70만 달러의 이익이 발생했습니다. [10] [11]

"의심스러운 시장 활동의 증거가 있은 후, 검증인 세트가 소집되어 JELLY 영구물을 상장 폐지하기로 투표했습니다. 플래그가 지정된 주소를 제외한 모든 사용자는 Hyper Foundation에서 전액 보상받게 됩니다. 이는 향후 며칠 내에 온체인 데이터를 기반으로 자동으로 수행됩니다. 티켓을 열 필요가 없습니다. 방법론은 나중에 자세히 발표될 예정입니다." - Hyperliquid 트윗

Hyerliquid는 영구 교환의 주요 유동성 풀인 HLP가 지난 24시간 동안 약 70만 달러의 순이익을 기록했다고 덧붙였습니다. [12]

Gracy Chen, 암호화폐 거래소 Bitget의 CEO는 Hyperliquid가 영구 교환에서 처리한 방식에 대해 비판하며 네트워크가 "FTX 2.0"이 될 위험에 처하게 되었다고 말했습니다. [13]

"#Hyperliquid는 #FTX 2.0이 될 궤도에 오를 수 있습니다. JELLY 시장을 처리하고 유리한 가격으로 포지션을 강제 청산하는 방식은 위험한 선례를 남깁니다. 자본이 아닌 신뢰가 모든 거래소(CEX 및 DEX 모두)의 기반이며, 일단 잃으면 회복하기가 거의 불가능합니다. 또한 플랫폼의 제품 설계는 사용자를 시스템 위험에 노출시키는 혼합 볼트와 조작의 문을 여는 무제한 포지션 크기와 같은 놀라운 결함을 드러냅니다. 이러한 문제가 해결되지 않으면 더 많은 알트코인이 Hyperliquid에 대한 무기로 사용되어 암호화폐에서 다음 재앙적인 실패가 될 위험에 처하게 될 수 있습니다." [14]

Hyperliquid, 최초의 온체인 10억 달러 비트코인 베팅 촉진

2025년 5월, 'moonpig'라는 가명으로 활동하는 트레이더 제임스 윈은 탈중앙화 거래소 Hyperliquid에서 고액 레버리지 거래를 실행했습니다. [15]

윈은 40배 레버리지를 활용하여 비트코인에 대한 롱 포지션을 개설하여 마진이 2,840만 달러 이상으로 확대되었고, 암호화폐 가치가 112,000달러에 육박하면서 상당한 미실현 이익을 얻었습니다. [17] [17]

이후 윈은 롱 포지션을 청산하고 전체 이익을 1,700만 달러 줄여 시장 입장을 바꿨습니다. 그러나 비트코인 가격이 110,000달러로 급반등하면서 숏 포지션이 청산되었습니다. 이러한 차질에도 불구하고 윈의 거래 활동은 규모와 시장 역학에 미치는 영향으로 주목을 받았습니다. [18]

이러한 거래 전략은 HyperEVM 블록체인에 구축된 탈중앙화 파생 상품 거래소인 Hyperliquid에 대한 상당한 관심을 불러일으켰습니다. 이 플랫폼은 KYC 규정 준수 없이 실시간 주문장 및 풍부한 유동성과 같은 기능을 제공합니다. 윈의 고액 거래는 플랫폼의 기능을 강조했을 뿐만 아니라 온체인 참여 증가와 플랫폼의 네이티브 토큰인 HYPE의 급등에서 알 수 있듯이 시장 심리와 활동에도 영향을 미쳤습니다. [17] [18]

예측 시장 및 옵션 (HIP 4)

Hyperliquid 개선 제안(HIP) 4가 통과된 후, 2026년 2월 2일에 플랫폼은 네이티브 예측 시장 및 옵션을 활성화했습니다. "결과 기반 거래"로 소개된 이 기능은 다른 예측 시장과의 경쟁을 목표로 합니다. 예측 시장은 메인넷 가스 가격 및 Blast 골드 배당률에 대한 초기 베팅과 함께 플랫폼에서 시작되었습니다. [19]

"결과는 현재 진행 중이며 현재 테스트넷에서만 테스트되고 있습니다. 객관적인 정산 소스를 기반으로 하는 표준 시장은 기술 개발이 완료되면 배포될 예정입니다. 표준 시장은 USDH로 표시됩니다. 사용자 피드백에 따라 인프라는 무허가 배포로 확장될 것입니다." - 트윗은 다음과 같이 결론지었습니다. [20]

잘못된 내용이 있나요?