Maverick Protocol

Maverick Protocol은 트레이더, 유동성 공급자, 탈중앙화 자율 조직(DAO) 재무, 개발자를 위해 시장 유동성을 향상시키도록 설계된 탈중앙화 금융(DeFi) 인프라를 제공합니다. 자본 효율성을 최적화하고 유동성 집중을 자동화하기 위해 Dynamic Distribution Automated Market Maker(AMM)를 활용합니다. [1]

개요

Maverick Protocol은 2023년 3월 8일에 Dynamic Distribution AMM을 도입하여 스마트 계약에서 유동성 관리에 효율성을 제공하는 것을 목표로 합니다. 이전에는 빈번한 유지 보수 또는 외부 프로토콜이 필요했던 유동성 전략을 자동화함으로써 Maverick Protocol은 트레이더에게 더 유동적인 시장과 개선된 가격을 제공합니다. 유동성 공급자(LP)는 특정 토큰에 대한 방향성 베팅을 선택하여 풀 내에서 노출을 집중시킬 수 있습니다. 이 접근 방식은 수동 조정의 필요성을 없애고 가스 수수료를 줄입니다. Ethereum 및 zkSync Era에서 사용할 수 있는 Maverick dApp을 통해 사용자는 사용자 친화적인 스왑 인터페이스 및 풀 인터페이스로 거래하고 유동성을 제공할 수 있습니다. [1][2][3]

Maverick AMM 기능

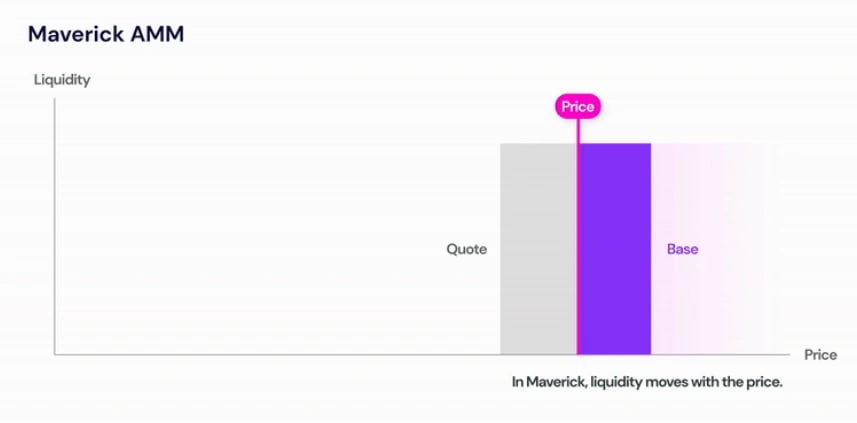

자동화된 집중 유동성

Maverick AMM은 가격 변화에 따라 유동성 집중 이동을 자동화하여 유동성 공급자의 자본 효율성을 극대화합니다. 이 기능은 수동 조정의 필요성을 없애고 가스 수수료를 줄여 거래자에게 더 유동적인 시장과 개선된 가격을 제공합니다. 유동성 공급자는 가격 변동에 따라 유동성을 모니터링하고 재집중시키는 다양한 유동성 이동 모드 중에서 선택하여 최적의 자본 활용을 보장할 수 있습니다. [2]

방향성 LPing

방향성 LPing

유동성 공급자는 특정 토큰의 가격을 한 방향으로 추종하도록 선택하여 자산 가격에 대한 방향성 베팅을 할 수 있습니다. 가격이 선택한 방향으로 움직일 때 유동성을 자동으로 재집중함으로써 유동성 공급자는 더 많은 수수료를 얻고 비영구적 손실을 피할 수 있습니다. 이 방향성 LPing 기능은 LP가 시장 신념에 따라 유동성 포지션을 조정하고 위험-보상 프로필을 최적화할 수 있도록 합니다. [2][4]

모드

Maverick은 방향성 LPing을 위한 네 가지 고유한 모드를 도입하여 유동성 공급자(LP)에게 가격 예측에 맞춰 유동성 포지션을 조정할 수 있는 다양한 옵션을 제공합니다. [5]

정적 모드

"정적" 모드에서는 LP들이 기존 범위 AMM LP와 유사하게 고정된 범위 내에서 유동성을 스테이킹할 수 있습니다. 이 모드는 안정성을 제공하며 가격 변동에 대응하여 적극적으로 포지션을 조정하지 않고 보수적인 접근 방식을 선호하는 LP에게 적합합니다. [5]

Right 모드

상승세 전망을 가진 LP를 위해 'Right' 모드를 사용하면 가격이 상승함에 따라 활성 bin의 왼쪽에 유동성을 스테이킹할 수 있습니다. 가격 변동을 따라 LP는 잠재적 이익을 얻고 상승 가격 추세의 이점을 누릴 수 있습니다. 이 모드는 자산 가치가 상승할 것이라고 믿고 상승 시장에서 수익을 최적화하려는 LP에 적합합니다. [5]

Left 모드

반대로, "Left" 모드는 약세 입장을 가진 LP를 대상으로 합니다. 이 모드를 사용하는 LP는 가격이 하락함에 따라 활성 빈의 오른쪽에 있는 빈에 유동성을 스테이킹합니다. 이 접근 방식을 통해 가격 하락을 활용하고 가격 하락 시 잠재적 손실을 완화할 수 있습니다. "Left" 모드는 자산 가치 하락을 예상하고 불리한 시장 상황으로부터 자본을 보호하려는 LP에게 이상적입니다. [5]

Both 모드

"Both" 모드에서 LP는 양방향으로 유동성을 스테이킹할 수 있는 유연성을 갖습니다. 이 모드를 통해 LP는 시장 역학에 적응하고 방향에 관계없이 가격 변동의 기회를 포착할 수 있습니다. "Both" 모드를 사용하는 LP는 활성 빈 양쪽에 유동성을 배치하는 다재다능성을 활용하여 다양한 시장 시나리오에서 수수료를 생성하고 수익을 최적화할 수 있습니다. [5]

맞춤형 유동성 포지션

맞춤형 유동성 포지션

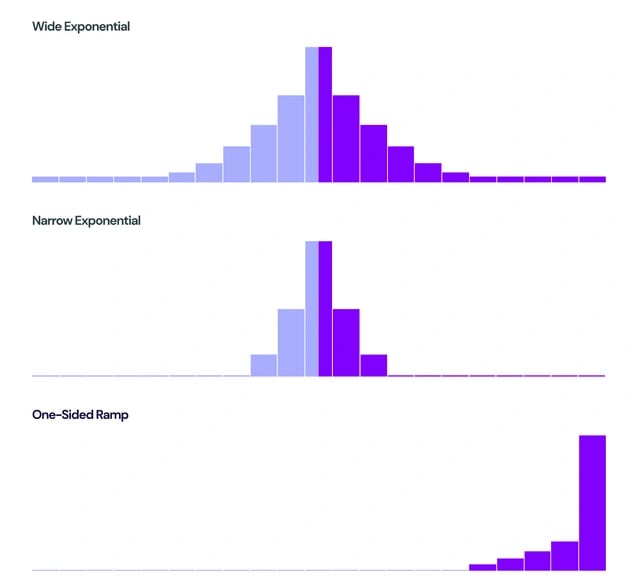

Maverick은 LP에게 풀의 가격 범위에 따라 유동성 분포를 구성할 수 있는 유연성을 제공합니다. 이러한 맞춤 설정을 통해 유동성 공급자는 위험 최적화 전략을 구현하고 특정 시장 상황에 맞게 유동성 포지션을 조정할 수 있습니다. 사용자 정의 분포를 설계함으로써 LP는 비영구적 손실 노출을 효과적으로 관리하면서 수수료 보상을 극대화할 수 있습니다. [2]

MAV 토큰

MAV는 Maverick 생태계 내에서 기본 유틸리티 토큰으로, 주로 스테이킹, 투표 및 부스팅 목적으로 사용됩니다. 이 ERC-20 토큰은 LayerZero의 Omnichain Fungible Token (OFT) 확장을 통합하여 다양한 체인 간의 MAV의 원활한 브리징을 가능하게 합니다 (향후 도입 예정). 현재 MAV는 이더리움 메인넷, zkSync Era 및 바이낸스 스마트 체인에서 운영됩니다. [6]

토큰 이코노미

MAV 토큰의 총 공급량은 2,000,000,000개로 설정되어 있으며, 이는 생성될 수 있는 최대량을 나타냅니다. MAV 토큰의 유통량은 250,000,000개이며, 이는 총 토큰 공급량의 약 12.5%를 구성합니다. [7]

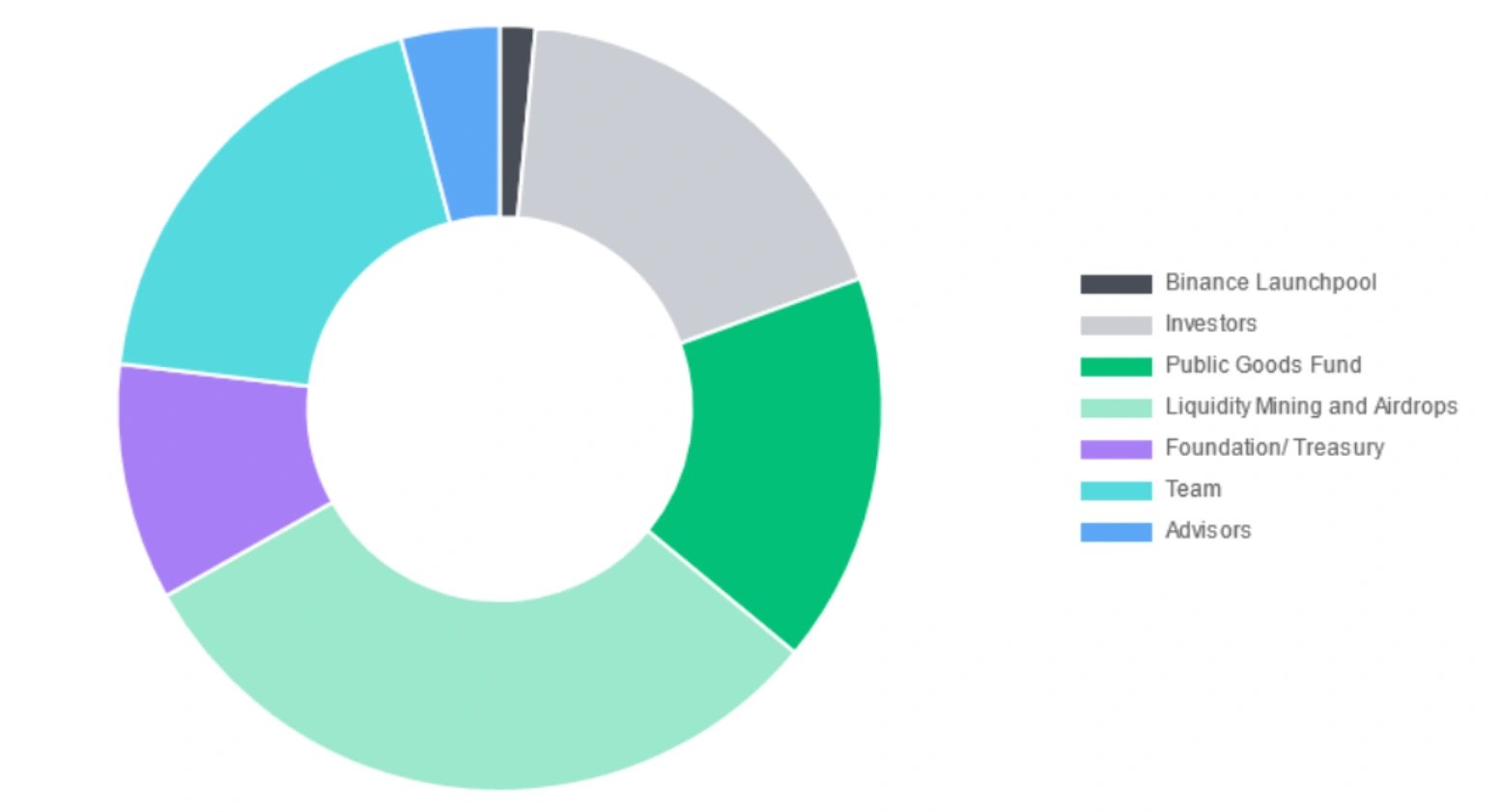

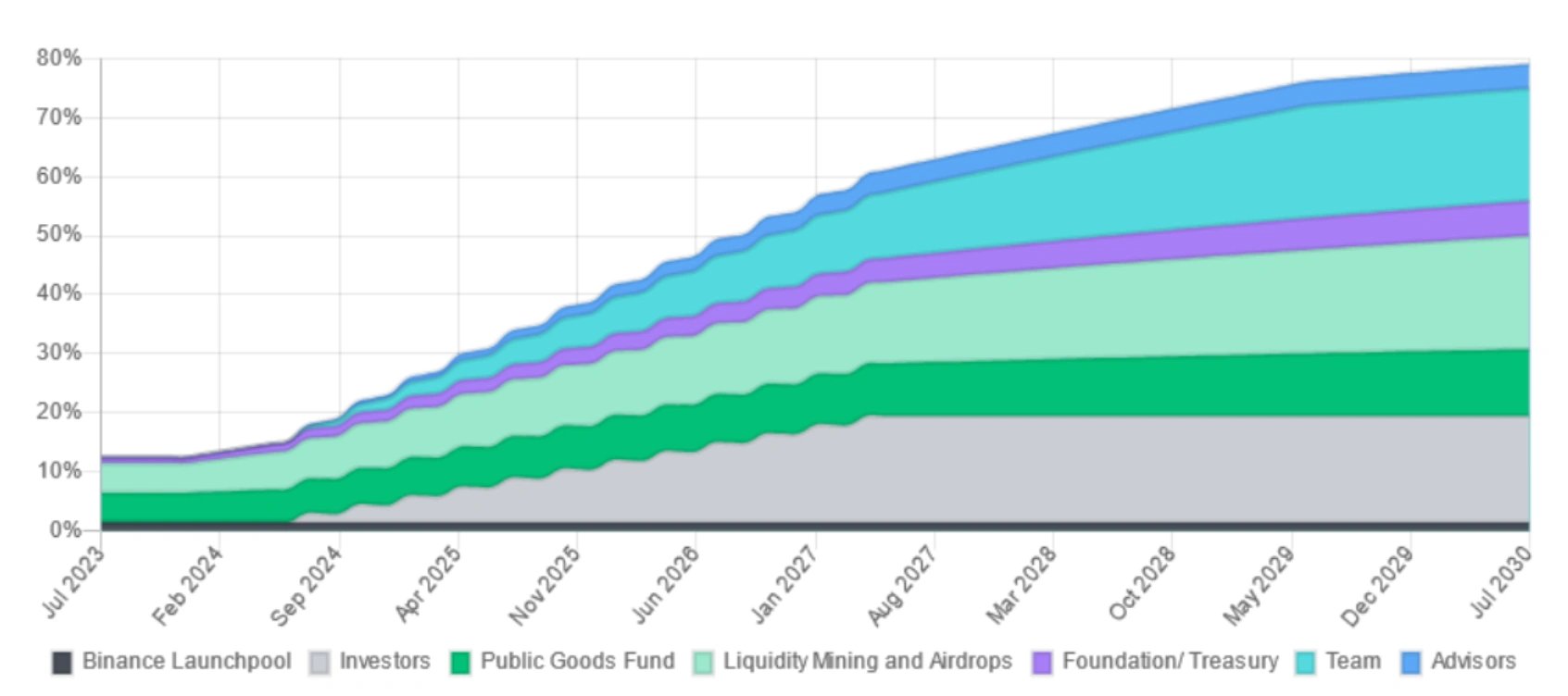

토큰 할당

MAV 토큰은 다음과 같이 다양한 범주에 할당됩니다: [8]

- 바이낸스 런치풀: 총 토큰 공급량의 1.50%

- 투자자: 총 토큰 공급량의 18.00%

- 공공재 기금: 총 토큰 공급량의 16.50%

- 유동성 마이닝 및 에어드랍: 총 토큰 공급량의 30.85%

- 재단/재무: 총 토큰 공급량의 10.00%

- 팀: 총 토큰 공급량의 19.00%

- 어드바이저: 총 토큰 공급량의 4.15%

토큰 출시 일정: 공공재 기금, 유동성 마이닝 및 에어드랍, 그리고 재단/재무부 카테고리에 할당된 나머지 물량은 2030년 7월 이후 점진적으로 베스팅되어 시간이 지남에 따라 MAV 토큰의 통제된 릴리스를 보장합니다. [8]

스테이킹

Maverick 생태계는 사용자에게 MAV 토큰을 스테이킹하고 투표 에스크로 MAV(veMAV)를 얻을 수 있는 기회를 제공합니다. veMAV는 양도할 수 없는 거버넌스 토큰으로, Maverick 투표 에스크로 계약에서 MAV 토큰을 스테이킹하여 얻을 수 있습니다. veMAV 잔액은 거버넌스 제안에 대한 사용자의 투표권을 결정하고 Maverick 프로토콜의 인센티브 방향에 영향을 미칩니다. [9]

veMAV 잔액은 스테이킹된 MAV 토큰의 양과 스테이킹 기간을 기준으로 계산됩니다. 더 많은 MAV 토큰을 더 오랜 기간 동안 스테이킹하면 더 큰 veMAV 잔액을 얻을 수 있습니다. 이를 통해 프로토콜의 장기적인 성공에 대한 강한 의지를 가진 사용자가 투표 과정에서 더 큰 영향력을 행사할 수 있습니다. [9]

스테이킹 기간 동안 스테이킹된 MAV 토큰은 상환할 수 없습니다. 스테이킹 기간이 끝나면 사용자가 MAV 토큰을 청구하면 해당 veMAV 잔액이 소각됩니다. 사용자는 언제든지 스테이킹 기간을 연장할 수 있는 유연성을 가집니다. Maverick은 이 목적을 위해 특별히 개발된 Origin 투표 에스크로 계약을 활용합니다. [9]

Curve의 성공에서 영감을 받은 Maverick의 모델은 전략적 우위를 제공하는 것을 목표로 합니다. 기존 ve 시스템과 달리 Maverick은 '부스트된 포지션'을 도입하여 풀 내에서 유동성 분배를 정확하게 타겟팅할 수 있습니다. 이 접근 방식은 인센티브 효율성을 최적화하여 프로토콜이 최소 자본으로 유동성 목표를 달성할 수 있도록 합니다. [16]

투표력 계산

veMAV 잔액은 프로토콜 내에서 사용자의 투표력과 직접적인 관련이 있습니다. 이는 스테이킹된 MAV 토큰의 양과 스테이킹 기간이라는 두 가지 요소에 의해 결정됩니다. 스테이킹된 MAV 토큰에는 승수가 적용되며, 이 승수는 스테이킹 기간이 길어질수록 증가합니다. 최대 스테이킹 기간은 4년이고 최소 기간은 1주일입니다. [10]

스테이킹 승수는 스테이킹 기간이 1년 추가될 때마다 기하급수적으로 증가합니다. 1.5배 성장 패턴을 따르므로 스테이킹 기간을 1년 연장하면 veMAV 잔액이 1.5배 증가합니다. 스테이킹 승수 곡선은 1.5^(스테이킹 기간 종료 - 계약 시작)으로 표현할 수 있으며, 스테이킹 기간 종료가 계약 시작에서 멀어질수록 스테이킹 승수가 높아집니다. [10]

시간이 지남에 따라 승수가 더 높은 새로운 스테이크가 도입됨에 따라 이전 스테이크의 투표력은 희석됩니다. 투표력을 극대화하려면 MAV를 최대 4년 동안 스테이킹하고 스테이킹 기간을 정기적으로 연장해야 합니다. [10]

에어드랍

Maverick Ecosystem Incentives Pre-Season 에어드랍은 사전 출시 및 초기 출시 단계에서 Maverick의 성장과 성공에 기여한 사용자와 커뮤니티 구성원에게 보상을 제공합니다. 에어드랍에는 이더리움 메인넷과 zkSync Era의 참가자가 포함되며, 6월 22일 10:00 UTC에 촬영된 스냅샷에서 총 26,155개의 이더리움 지갑 주소와 96,075개의 zkSync Era 지갑 주소가 있습니다. 에어드랍은 다양한 기준과 보상을 포함하며, 두 체인 모두에 걸쳐 특정 행동과 페르소나를 기반으로 할당됩니다. [11]

에어드랍을 청구하면 사용자는 Maverick Voting Escrow 계약에 MAV 토큰을 스테이킹하여 veMAV 토큰을 받을 수 있습니다. 에어드랍된 토큰을 스테이킹하면 사용자는 veMAV 보유자를 위한 후속 에어드랍에서 지분을 받을 수 있습니다. veMav 투표 인센티브에 대한 두 번째 스냅샷은 7월 27일에 촬영되며, 해당 날짜의 veMav 잔액을 기준으로 10,000,000 MAV가 비례 배분됩니다. [11]

할당

에어드랍은 다음과 같이 할당됩니다:[12]

- 유동성 공급자: 에어드랍의 60.7%, 총 18,210,000 MAV

- 이더리움 메인넷: 60% 할당

- zkSync Era: 40% 할당

- Maverick Warriors: 에어드랍의 1.3%, 총 390,000 MAV

- 이더리움 메인넷: 100% 할당

- 투표자: 에어드랍의 3%, 총 900,000 MAV

- zkSync Era: 100% 할당

- 트레이더: 에어드랍의 15%, 총 4,500,000 MAV

- 이더리움 메인넷: 70% 할당

- zkSync Era: 30% 할당

- MAVA 보유자: 에어드랍의 20%, 총 6,000,000 MAV

- 이더리움 메인넷: 37% 할당

- zkSync Era: 63% 할당

기준

각 범주에는 유동성 공급자에게 제공된 유동성의 달러 가치 및 유동성 제공 기간, Maverick Warriors가 획득한 Maverick Warrior Credits, 투표자를 위한 초기 거버넌스 참여, 트레이더를 위한 거래량과 같이 보상 결정을 위한 특정 기준이 있습니다. MAVA 보유자는 Maverick 개발의 다양한 단계에서 배포된 특정 MAVA NFT 소유 여부에 따라 보상을 받습니다. [13]

Maverick Warriors 프로그램

2022년 11월 24일, Maverick Protocol은 Maverick Warrior Program을 시작했습니다. 이 프로그램은 60일간 진행되는 커뮤니티 주도 인센티브 프로그램으로, Maverick Warrior로 알려진 커뮤니티 리더와 기여자들을 인정하고 보상하기 위해 설계되었습니다. 이 프로그램은 협업을 촉진하고 커뮤니티 구성원들이 Maverick 커뮤니티의 성장과 교육에 재능과 노력을 기여할 수 있도록 지원하는 것을 목표로 합니다. [14]

“다음에 해야 할 일은 커뮤니티 자체에서 나오는 아이디어와 이니셔티브를 육성하는 강력하고 사려 깊은 프레임워크를 구축하는 것입니다.”

프로그램 구조

매버릭 워리어 프로그램은 매버릭 워리어 크레딧(MWC) 시스템과 워크플로우라는 두 가지 주요 구성 요소로 이루어져 있습니다.[14]

Maverick Warrior Credit (MWC) 시스템

Maverick Warrior Credit (MWC) 시스템은 Maverick 커뮤니티 내에서 리더와 기여자를 인정하고 장려하기 위해 설계된 평판 기반 프레임워크입니다. 커뮤니티 구성원, 투표자, Maverick Warrior - 기여자, Maverick Warrior - 핵심 기여자 및 Maverick 위원회를 포함한 다양한 역할로 구성됩니다. 각 역할은 아이디어를 검토하고, 제안서를 제출하고, 실행 프로세스에 참여하고, 커뮤니티 투표를 관리하는 능력과 같은 특정 자격과 권한을 가집니다.[14]

워크플로우

Maverick Warrior 프로그램은 아이디어와 제안의 효과적인 실행을 보장하기 위해 구조화된 워크플로우를 따릅니다. 커뮤니티 구성원은 Maverick Discord 플랫폼에서 아이디어나 제안을 검토, 논평 및 토론할 수 있습니다. Mava NFT를 보유한 투표자는 수행자로서 제안 실행 프로세스에 참여할 수 있으며, 그들의 작업은 자격 있는 결과물에 대해 평가됩니다. 기여자는 Maverick 위원회에 제안서를 제출하고 실행 프로세스에 적극적으로 참여할 수 있습니다. 핵심 기여자는 사전 위원회 승인 없이 커뮤니티에 직접 제안서를 제출할 권한이 있습니다. Maverick 위원회는 제안서 심사, 커뮤니티 투표, 결과물 검증 및 보상 분배를 관리합니다. 이 워크플로우는 Maverick Warrior 프로그램의 투명성과 책임성을 보장합니다.[14]

자금 조달

2023년 6월 21일, Maverick Protocol은 9백만 달러 규모의 전략적 자금 조달 라운드를 완료했다고 발표했습니다. 이 라운드는 벤처 캐피털 회사인 Founders Fund가 주도했으며, Pantera Capital, Binance Labs, Coinbase Ventures, Apollo Crypto 등 주목할 만한 블록체인 중심 벤처 기업이 참여했습니다. 자금은 보다 효율적인 LST(Liquid Staking Token) 인프라 개발을 확장하고 크로스 체인 유동성 비효율성을 해결하는 데 사용될 예정입니다. 또한 이 자본은 프로토콜의 새로운 체인으로의 확장, 인프라를 기반으로 구축하는 개발자에 대한 지원 제공, 성장하는 생태계에 더 많은 프로젝트를 유치하는 데 사용될 것입니다. [15]

“Maverick은 유동성 공급자를 위한 더 큰 자본 효율성을 가지면서 액체 스테이킹 토큰 거래의 허브로 빠르게 자리 잡았습니다. 회사의 탈중앙화 금융에 대한 외과적 접근 방식은 전체 산업을 발전시킬 것입니다.” - Joey Krug, Founders Fund 파트너.