Subscribe to wiki

Share wiki

Bookmark

ALAI Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

ALAI Network

ALAI Network leverages artificial intelligence to optimize trading strategies and improve financial outcomes. Its platform employs multiple AI models to make consensus-driven trading decisions to balance profitability and risk. The network includes staking features for earning rewards and a referral program to support community expansion, integrating AI technology with blockchain transparency. [1]

Overview

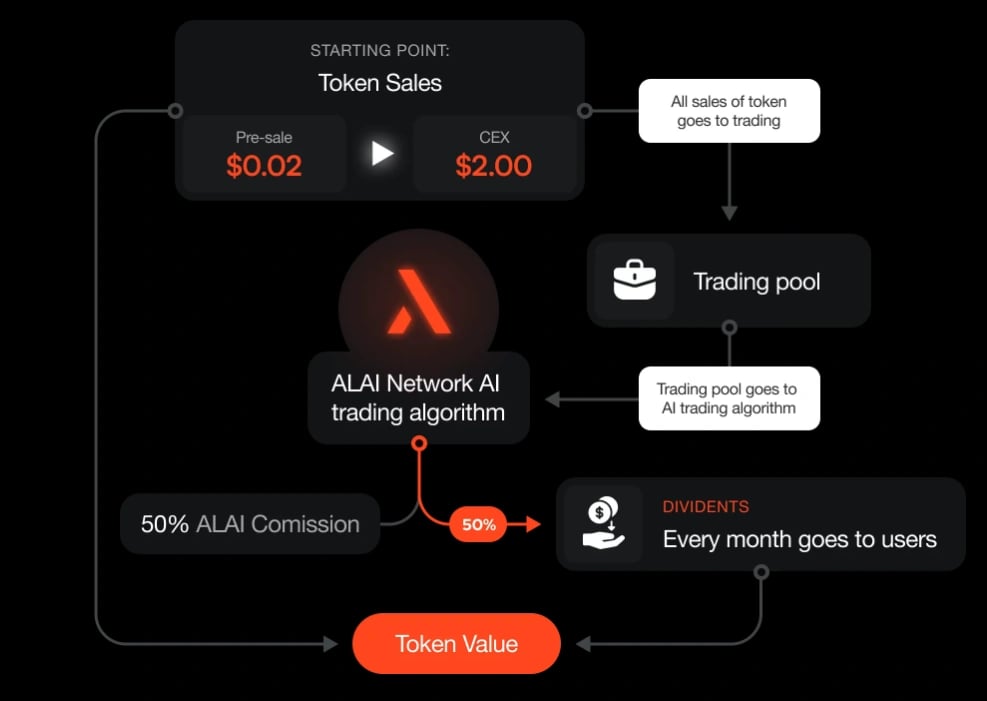

ALAI Network is a cryptocurrency platform that uses artificial intelligence (AI) to optimize trading strategies and improve financial outcomes. The platform employs multiple AI models that analyze historical data and real-time indicators to make consensus-based decisions about executing trades. It operates across spot and futures markets and leverages decentralized finance (DeFi) protocols to generate profit.

The project features staking options that allow users to lock tokens and earn rewards and a referral program to encourage network growth. ALAI Network directs token sales into an AI-managed trading pool, with profits allocated to maintaining token value and providing USDT dividends to token holders. Dividends are distributed monthly, and the platform emphasizes transparency by publicly sharing performance reports.

ALAI Network's decentralized ecosystem aims to integrate AI and blockchain to create an efficient and user-friendly investment environment. It focuses on democratizing cryptocurrency investing by offering accessible and automated trading solutions for novice and experienced users. [2] [3]

Features

AI Trading Algorithm

ALAI Network’s AI Trading Algorithm is a system that leverages artificial intelligence and machine learning to process vast amounts of market data, enabling precise and efficient trading decisions. It aims to optimize profitability, adapt to market conditions, and minimize risks. The algorithm uses advanced machine learning techniques to analyze historical and real-time data, identifying market patterns and trends. It incorporates Smart Money indicators to monitor institutional investment activity, providing insights that inform trading strategies. The system supports trading across assets such as Bitcoin and Ethereum futures, capitalizing on market volatility and growth potential.

The algorithm analyzes real-time data, enabling quick decision-making in dynamic market environments. Risk management protocols are integrated to adjust strategies responding to market fluctuations, protecting investments while maintaining profitability. The technological framework includes machine learning tools like TensorFlow and PyTorch, which are used to build and train complex models. Blockchain integration ensures transparency and security by recording all trading activities on an immutable ledger. The system is designed with scalable infrastructure to manage high transaction volumes and support growth, utilizing cloud computing and decentralized architecture for reliability and availability. [4] [5]

Dividends

The ALAI token incorporates a dividend system that provides token holders with consistent income in USDT, derived from profits generated by the platform's AI trading algorithms. The system allocates a portion of profits from Bitcoin futures trading, conducted by AI algorithms using in-depth market analysis, to a dividend pool. Dividends are distributed proportionally based on the number of tokens held, with payouts occurring at regular intervals as determined by the network’s governance. This model incentivizes long-term holding, reducing circulating token supply, and enhances transparency by recording all transactions on the blockchain. It offers token holders a steady income while supporting the ecosystem’s stability and growth. [6] [7]

BTC Predict

BTC Predict is a feature within the ALAI Network's ecosystem, part of its extensive suite of over 120 machine-learning models. It gives users a transparent view of how algorithms analyze market data and execute trading decisions in real-time market conditions. Specifically, BTC Predict identifies opportunities in the Bitcoin (BTC) market, including optimal trade entry and exit points.

Accessible through the ALAI Network console, BTC Predict includes a real-time chart that highlights entry points for both long and short positions. This chart is continuously updated to provide users with the latest market insights. A key feature of BTC Predict is its dynamic signal processing. When an active signal is closed by an opposing signal, the model has secured a profit and recognized a shift in the local trend. However, the latest signal may adjust before it is finalized, as the model continuously processes new data, leading to potential revisions.

BTC Predict allows users to observe the real-time functionality of one of ALAI Network's machine-learning models. It provides access to live market data and insights into the methodologies underpinning the "zoo of models," enhancing users' understanding of the platform's technical sophistication and transparency. [8]

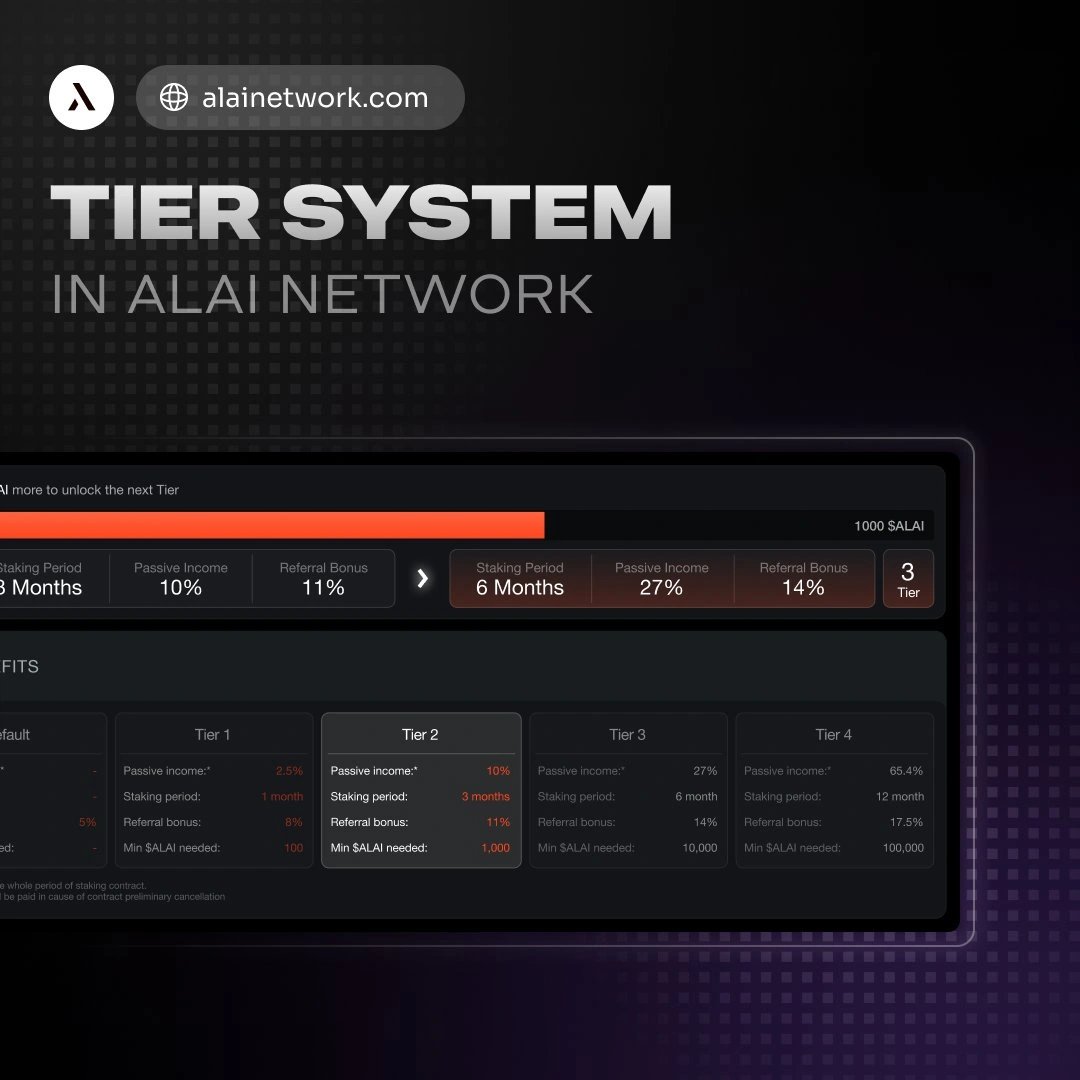

Tier System

The ALAI Network implements a tier system to organize participation in its staking and referral programs. Tiers are determined by the amount of $ALAI tokens held, which are solely indicators of the user's level. These tokens are not locked or utilized in staking or payouts, as all transactions are conducted exclusively in USDT. In addition to these features, holding $ALAI tokens grants access to the project’s dividend system, enabling users to earn passive income from profit distribution. This integration enhances the utility of the tier system, making it a key component of the ALAI ecosystem. [9]

Staking

The staking system offers fixed and guaranteed returns, with conditions determined by tier level. Tier 1 requires 100 $ALAI tokens and provides a 2.5% income over 30 days. Tier 2 requires 1,000 $ALAI tokens and offers a 10% income over 90 days. Tier 3, with a requirement of 10,000 $ALAI tokens, provides a 27% return over 180 days. The highest level, Tier 4, requires 100,000 $ALAI tokens and offers 65.4% income over 360 days. Staking funds are placed separately from the trading pool, ensuring fixed and independent income. [9]

Referral Program

The referral program is similarly tiered, with bonus percentages increasing alongside the user's tier. At the default level, users receive a 5% bonus. Tier 1 holders earn an 8% bonus, Tier 2 holders receive 11%, Tier 3 holders gain 14%, and Tier 4 participants are awarded a 17.5% bonus. All referral program payouts are made in USDT. [9]

ALAI

The ALAI token is the primary medium for transactions within the ecosystem, enabling payments for services such as AI trading tools and premium content. It offers access to exclusive features, including advanced trading strategies, early product launches, and specialized investment opportunities. Token holders can participate in governance by voting on platform decisions and benefit from discounts on services, such as reduced fees and special offers.

Incentive programs for ALAI holders include regular USDT dividends proportionate to holdings, providing a passive income stream. Exclusive access to premium services adds practical utility, while governance rights empower the community to influence the platform’s development. These features collectively drive demand and enhance the token’s value. [10] [11]

Deflationary Model

The ALAI token employs a deflationary model to promote long-term value appreciation by reducing the circulating supply and incentivizing holding. As demand increases and supply decreases, the token’s value has the potential to grow steadily over time.

The model supports value growth through scarcity, encouraging long-term holding with regular USDT dividends that provide passive income. By decreasing the circulating supply and rewarding investors, the system enhances the token's appeal while fostering ecosystem growth.

The token’s integration into the ecosystem increases its utility and demand. Strategic planning and regular updates ensure transparency and alignment with broader growth goals, reinforcing its role as a critical asset within the ALAI Network. [12] [13]

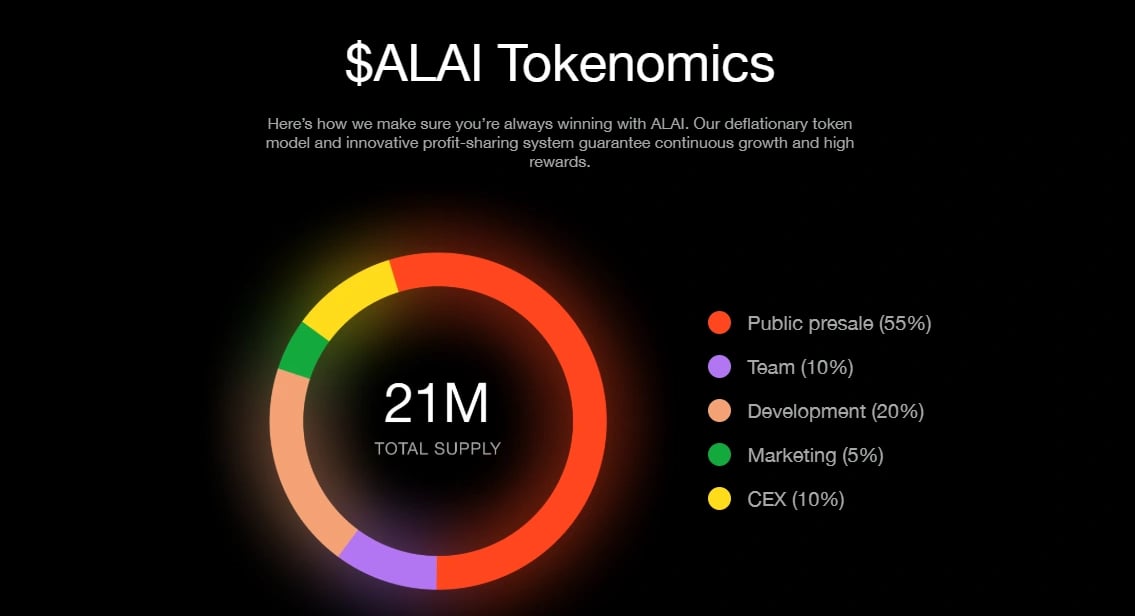

Tokenomics

ALAI has a fixed total supply of 2.1B tokens and has the following distribution: [14]

- Public Presale: 55%

- Development: 20%

- Team: 10%

- CEX: 10%

- Marketing: 5%

Regular Dividends

ALAI token holders receive regular USDT dividends generated from the profits of the platform’s AI trading algorithms. Dividends are distributed proportionally based on the number of tokens held, offering a consistent income stream while promoting long-term token retention. A portion of trading profits is allocated to a dedicated dividend pool, ensuring growth as trading activities become more profitable. Payouts are scheduled at regular intervals, such as monthly or quarterly, providing steady income for token holders.

This system incentivizes long-term holding, reduces token circulation, and enhances token value. Transactions and distributions are recorded on the blockchain, ensuring transparency and allowing holders to verify their earnings. The dividend structure supports both individual returns and the sustained success of the ALAI Network. [15]

Governance

ALAI Network employs a decentralized governance model that allows token holders to participate in shaping the network's development. Community members vote on proposals and decisions through this system, ensuring an inclusive and democratic approach to ecosystem management.

Governance activities are conducted transparently, with all voting records available for verification, enhancing trust and accountability. The network encourages broad community participation and incorporates diverse perspectives into its decision-making process, supporting informed and balanced outcomes. [16]

Partnerships

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)