Subscribe to wiki

Share wiki

Bookmark

Block Reward

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Block Reward

Block Reward is a reward given to a miner, staker, or validator for successful mining, minting, or validating a block on a blockchain network.[1] Each cryptocurrency sets its own block rewards, while some cryptocurrencies, such as Ripple and some stablecoins, don’t offer any block rewards at all.[6] The block reward is paid in the blockchain’s native token.[7]

Overview

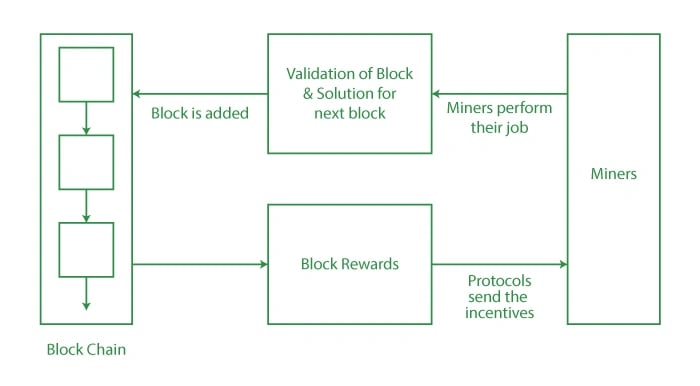

Block rewards are used to be provided as incentives by the blockchain protocols for the distributed volunteer users to discover new blocks in order to secure the network and keep it updated. In the absence of a centralized governing entity in cryptocurrency systems, block rewards function as the principal monetary incentive encouraging participation within the network. Block rewards also serve as the issuance system for releasing newly minted coins into circulation.

For instance, Tezos has its native token called Tez(XTZ), which is used for staking, governance, and transaction fees. Validators are rewarded with additional XTZ tokens for securing the network and participating in block validation.

Block rewards are not always denominated in the same tokens being transacted on its blockchain, as seen with stablecoins. To maintain a consistent exchange rate against fiat currency, these protocols regulate token supply. Therefore, these protocols often reward their miners with a different token. [5]

For instance, Reserve Rights' 'Reserve Rights Token(RSR)' is the native utility token of the Reserve ecosystem, which maintains the stability of the its stablecoin. Whereas, 'Reserve Stablecoin(RSV)' is the stablecoin of the Reserve ecosystem, which rewards users for holding RSV.

To manage coin supply and introduce deflationary features, block rewards in certain cryptocurrencies decrease over time. For instance, Bitcoin undergoes halving events roughly every four years, or 210,000 blocks, reducing the reward by 50%. Since the last halving in May 2020, successful miners have been receiving 6.25 BTC for each mined block. Bitcoin’s block rewards have halved three times since the protocol launched in 2009 and will continue to halve until the total number of coins in circulation reaches the maximum supply of 21 million coins. After that, no more block rewards and no more new coins will enter circulation.

Distribution

Different projects yield different rewards. Therefore, the calculation of block reward depends on factors like:[4]

Consensus Algorithm

Each consensus algorithm used, such as Proof of Work (PoW), Proof of Stake (PoS), Delegated Proof of Stake (DPoS), and more, has its own set of rules for block reward distribution.

Block Height

Some blockchain networks have block rewards that decrease or change at specific block heights, often referred to as 'halving events.'

Network Inflation Rate

The network's desired inflation rate or supply control mechanism can influence block rewards. Some networks aim for a fixed annual inflation rate, while others may have varying inflation rates over time.

Total Staked/Miner Participation

In PoS and DPoS networks, the amount of cryptocurrency staked or delegated by participants can affect their chances of earning block rewards. Higher stakes or more significant participation may increase the likelihood of being selected as a block validator or producer.

Validator Performance

In PoS and DPoS networks, validators' performance and behavior can impact their block rewards. Validators who follow the rules and validate transactions correctly may earn more rewards than those who behave maliciously.

Block Time

The time it takes to mine or produce a block can affect the block reward calculation. Some networks aim for a fixed block time, while others dynamically adjust block difficulty to maintain a consistent block time.

Community Governance

In some blockchain networks, changes to block reward parameters may be subject to community governance or decision-making processes. Network participants may vote on changes to block rewards or other economic parameters.

Economic and Monetary Policy

The blockchain's overall economic and monetary policy, including factors like the maximum supply of coins, issuance rate, and distribution mechanisms, can influence block reward calculations.

Network Upgrades and Forks

Block reward parameters can change through network upgrades or hard forks. The user must consider the version of the blockchain protocol in use when calculating block rewards.

Components

The block reward is made up of two components:

Block Subsidy

A block subsidy is a fixed number of new coins that are created and awarded to the miner who successfully adds a new block to the blockchain. This is a way for cryptocurrencies to introduce new coins into circulation. In many networks, the block subsidy decreases over time, a process known as "halving," which happens at predetermined intervals. For example, Bitcoin undergoes a halving approximately every four years, where the block subsidy is reduced by half.

Transaction fees

It is the fees paid by users to have their transactions included in the block. Transaction fees can fluctuate based on several factors, including the size of the transaction in bytes, the congestion level on the network at the time of the transaction, and the priority given to the transaction by the sender (some networks allow senders to pay higher fees for faster transaction confirmation).[4]

Together, the block subsidy and transaction fees create the total block reward, which serves as an incentive for miners to maintain the network's security and continue mining. This system ensures that miners are compensated for their efforts, even as the block subsidy decreases over time. Eventually, in many networks, the block subsidy will reach zero, and miners will be compensated solely through transaction fees. This transition is expected to be smooth, with transaction fees gradually taking a more prominent role as the subsidy decreases.[3]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)