订阅 wiki

Share wiki

Bookmark

Reserve Rights (RSR)

0%

Reserve Rights (RSR)

Reserve Rights (RSR) 是 Reserve 协议 生态系统中的 治理代币。它允许在任何 Reserve - 已部署的资产支持货币 (RToken) 上进行 质押,以参与治理、赚取 质押 费用,并为 超额抵押 做出贡献。 [1][2]

概述

RSR 作为 Reserve 协议 生态系统中的 治理代币 发挥作用,允许在任何 RToken 上进行 质押,以参与治理,赚取 质押 收入,以换取在 RToken 抵押品脱钩的情况下提供第一损失资本。 [3]

Reserve Rights (RSR) 的主要目的是提供一种 超额抵押 机制,以在 抵押品 代币违约的情况下保护 RToken 持有者。RSR 持有者可以 质押 一个或多个 RToken,或者完全避免 质押。质押者可以分享他们质押的特定 RToken 的收入,随着 RToken 市值的增加,预计会有更高的总收益传递给质押者 - 从而鼓励新的质押者。当 RSR 被质押到 RToken 上时,它会被存入一个专门的 质押 合约中,质押者会收到一个 ERC-20 代币,代表他们质押的 RSR 头寸,该代币是可转移和可替代的,允许交易或转移给可能选择取消质押的其他人。 [1]

代币经济学

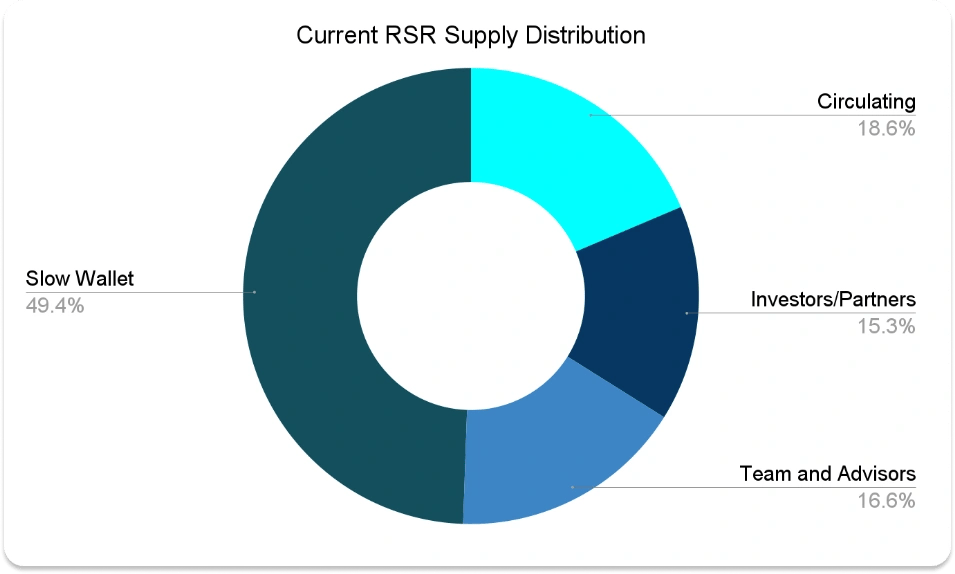

RSR 的总固定供应量为 1000 亿个代币,启动时流通量为 506 亿个。剩余的 494 亿个代币正在等待社区分配指令,这些指令保存在 Slow 和 Slower 钱包中。由 ABC Labs 控制的 Slow 钱包通过硬编码的 4 周提款交易延迟来支持 RToken 采用计划。 [1][2][3]

2024 年 1 月的组织结构调整引入了 Confusion Capital,协助为 Reserve 生态系统(包括 Best Friend Finance 和 ABC Labs)提供资金。Confusion Capital 管理 Slower 钱包,实施更严格的提款限制,保持 4 周的延迟,并将提款限制为每四周不超过 RSR 总供应量的 1%。此调整旨在最大限度地减少对 Confusion Capital 可信度的依赖。 [1][2][3]

发现错误了吗?