Subscribe to wiki

Share wiki

Bookmark

COMP

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

COMP

COMP is an ERC-20 token that enables community governance of the Compound protocol. The protocol comprises decentralized interest rate markets that permit users to supply and borrow Ethereum tokens at fluctuating interest rates. Holders of COMP can debate, propose, and vote on changes to the protocol. [1][2]

Overview

COMP allows its holders to delegate voting rights to any address, including their own, and the delegate's voting rights are automatically updated upon changes in the owner's token balance. The Compound protocol consists of three components, namely, the COMP token, governance module, and Timelock, which work together to facilitate the proposal, voting, and implementation of changes via the administrative functions of a cToken. Such proposals can bring about modifications in system parameters, introduce new markets, or incorporate entirely new protocol functionalities. [2]

Distribution

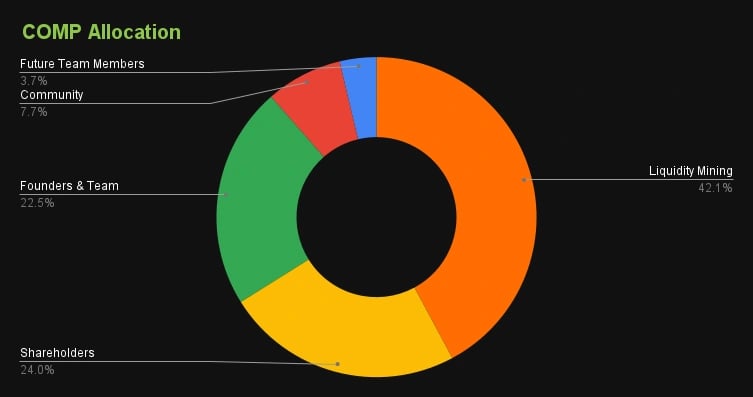

Compound's COMP token has a fixed supply of 10 million tokens. Of this, 42% is allocated to users through a daily allocation (for more information, check Emission section). [3]

The remaining tokens are distributed among various stakeholders in the following manner: Compound Labs, the company driving the lending platform and token, receives 24%. The Compound founders and staff members receive around 22%. Nearly 8% is allocated to participants in the project's governance, while approximately 4% is reserved for future Compound employees. [3]

Emission

On a daily basis, around 1,822 COMP tokens are allotted to the users of the protocol. The distribution of these tokens is assigned to different markets such as ETH, USDC, DAI, etc. The allocation of tokens is determined by COMP token-holders through the governance process. Within each market, the distribution is split equally between suppliers and borrowers. [1]

Use Cases

COMP token holders are able to participate in governance by voting on proposals and suggesting new ones. These proposals cover a range of topics such as setting interest rates, adding new assets, and selecting protocol administrators. The primary purpose of COMP is for governance. Holders can delegate their voting power, discuss proposals, and vote on them. The governance system is transparent and displays the amount of voting power held by each address. To propose a new governance idea, an individual must delegate at least 1% of COMP tokens to an address and provide executable code. These proposals are subject to a 3-day voting period, where COMP holders can vote for or against the proposal, or choose to abstain. Proposals receiving more than 400,000 votes in favor are then passed on to the Timelock, which is a smart contract that modifies the protocol and system parameters. The Timelock has a minimum delay of 2 days before executing the proposal's code. Once the delay has passed, the proposal is implemented. [4]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)