위키 구독하기

Share wiki

Bookmark

Convergent

Convergent

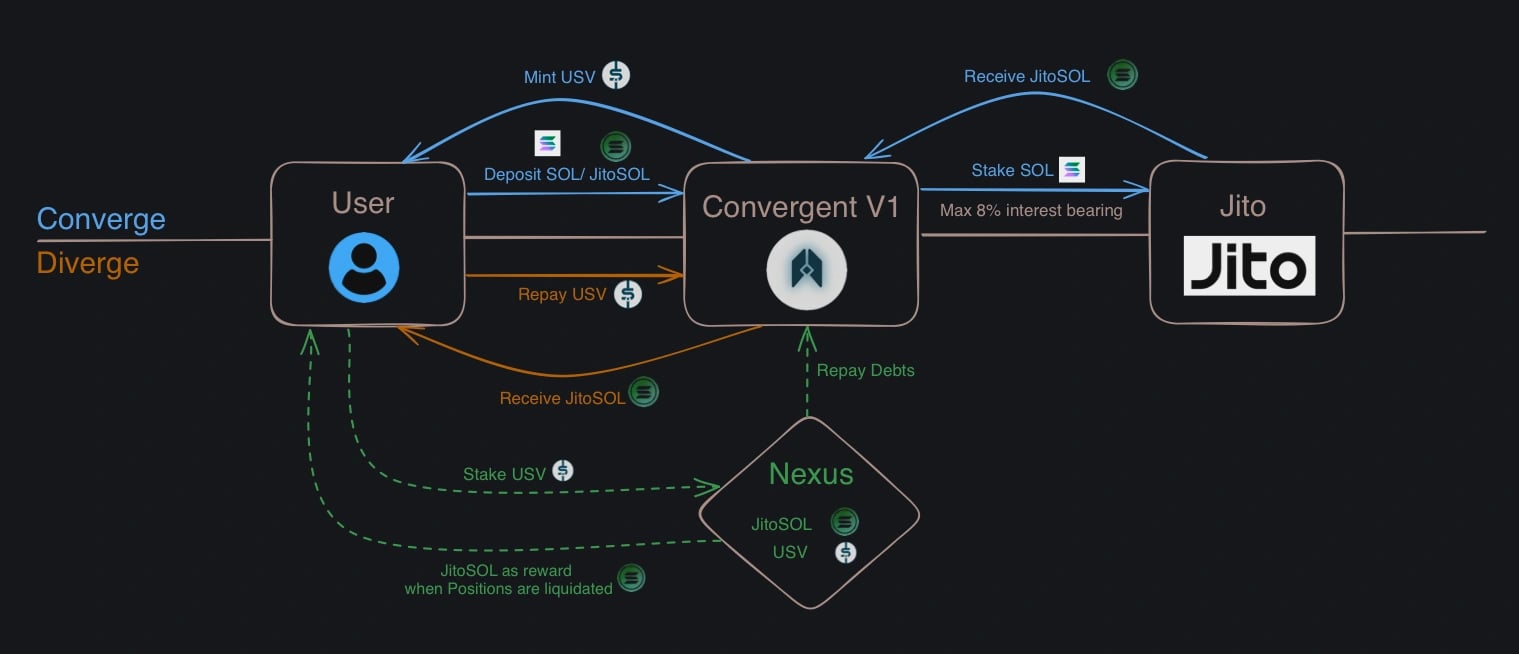

Convergent는 솔라나에서 작동하는 프로토콜로, SOL(솔라나)(SOL)을 초과 담보화하여 탈중앙화된 안정화 코인인 USV를 생성합니다. 이 프로토콜은 해당 SOL을 Jito에 자동으로 스테이킹하여 사용자가 USV를 보유하면서 스테이킹 보상과 MEV 수익률을 얻을 수 있도록 합니다. USV는 레버리지 또는 추가 수익률 창출에 적합한 유동적인 안정화 코인입니다. [1]

개요

Convergent는 다음과 같은 기능을 통해 1 USV의 가치를 1 USD와 1:1 비율로 유지하도록 설계되었습니다. [1]

- 0% 이자 대출: USV 차용자에게는 이자 수수료가 부과되지 않으므로 시간이 지남에 따라 부채가 증가하는 것에 대한 우려가 없습니다.

- 수익률 생성: USV 보유자는 SOL을 예치하여 Jito를 통한 스테이킹 보상 및 MEV 수익률을 얻을 수 있습니다.

- 초과 담보화: 시스템은 발행된 USV 토큰의 가치보다 담보의 총 가치가 더 크도록 보장하여 안정성을 높입니다.

- 100% 탈중앙화: Convergent는 완전히 탈중앙화된 방식으로 운영되므로 검열에 대한 저항력을 갖추고 페그 안정성 및 시스템 지급 능력을 유지하기 위해 중앙화된 자산에 의존하지 않습니다.

이자 발생 담보

프로토콜 내 모든 SOL 예치금은 자동으로 Jito에 스테이킹되어 스테이킹 보상과 MEV 수익률을 얻습니다. JitoSOL이 기본 담보로 사용됩니다. 따라서 프로토콜은 Jito에서 얻은 수익률의 일부를 공제하지 않으므로 사용자는 부채를 상환하여 포지션을 청산할 때(이 과정을 "Diverging"이라고 함) 스테이킹 수익에 완전히 접근할 수 있습니다. Jito는 솔라나의 MEV 인프라 구축업체입니다. [2][3]

Nexus

사용자는 Nexus에 USV를 예치하여 청산 수익과 CVGT 토큰 배출을 얻을 수 있습니다. Nexus의 기능은 청산된 포지션으로 인한 부채를 해결하고 총 USV 공급에 대한 지속적인 지원을 보장하는 예비 자금 역할을 하는 것입니다. [4]

사용자는 Nexus에 USV를 예치하여 청산된 포지션에서 담보(JitoSOL)를 얻을 수 있습니다. 청산 중에 포지션의 남은 부채에 해당하는 USV가 Nexus의 잔액에서 공제되어 부채를 해결하고, 청산된 포지션의 총 담보는 Nexus로 이전됩니다. [4]

Converging

Converging은 담보로 SOL을 사용하여 USV를 차용하는 포지션을 개시하는 것을 포함하며, 담보는 이후 이자 발생 JitoSOL로 전환됩니다. 프로토콜은 일회성 차용 및 상환 수수료를 통해 0% 이자 차용을 가능하게 합니다. 이러한 수수료는 최근 상환 활동에 따라 알고리즘 방식으로 조정됩니다. 상환이 증가하여 USV 거래가 1 USD 미만이 될 가능성이 있는 경우 차용 수수료가 증가하여 차용을 억제합니다. [5]

Diverging

Diverging은 USV로 상환하여 포지션을 청산하고 대신 JitoSOL을 받는 것을 포함합니다. [6]

Liquidation

Convergent 프로토콜은 정확한 담보 평가를 위해 Pyth JITOSOL:USD 가격 피드를 사용하고 USV 차용 및 청산을 가능하게 합니다. 포지션의 담보화 비율이 110% 미만으로 떨어지면 과소 담보화된 것으로 간주되어 청산 대상이 됩니다. [7]

미결제 USV 공급에 대한 완전한 담보를 유지하기 위해 110% 담보화 비율 미만의 포지션은 청산됩니다. Nexus가 부채를 흡수하고, 그 담보는 Nexus 예치 사용자에게 비례적으로 배분됩니다. [7]

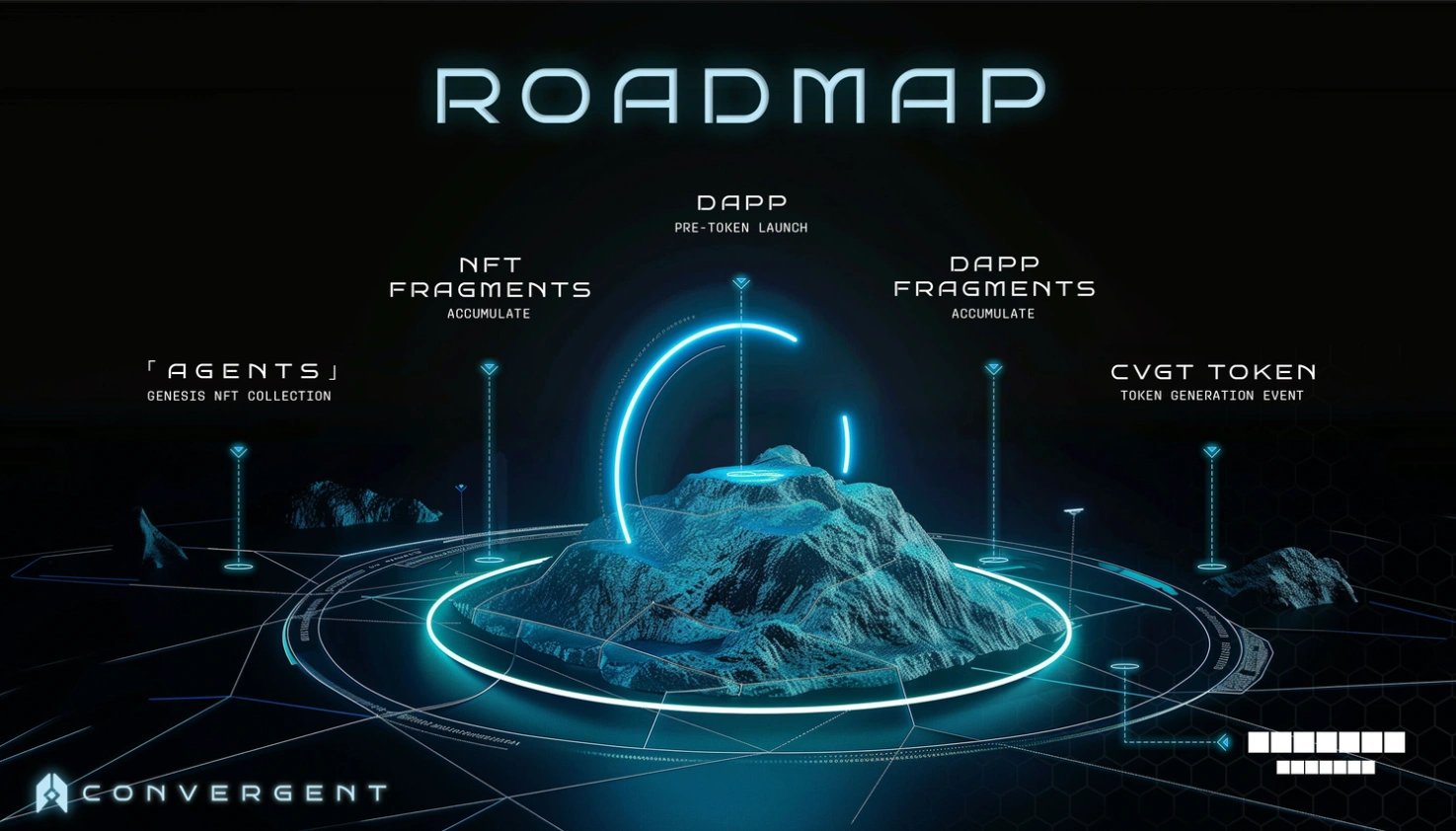

Genesis NFT 컬렉션

Genesis 컬렉션의 목적은 Convergent를 Solana NFT + DeFi 생태계에 소개함으로써 프로젝트의 초기 지지자들에게 감사를 표하는 것입니다. 시간이 지남에 따라 AGENTS 보유자는 FRAGMENTS 및 향후 제공되는 것들에 대한 접근 권한을 얻게 되며, 프로토콜 수수료 공유를 통한 스테이킹을 포함한 dApp과의 통합도 이루어집니다. [8]

USV

USV는 USD에 고정된 안정화 코인으로, Convergent 시스템 내에서 대출 상환에 사용됩니다. 필요할 때마다 기본 담보에 대해 명목 가치로 상환할 수 있습니다. [9]

CVGT

CVGT는 Convergent의 프로토콜 토큰입니다. 사용자는 CVGT를 스테이킹하여 발행 및 상환 수수료를 포함한 프로토콜에서 생성된 수수료의 일부를 비례적으로 얻을 수 있습니다. [9]

CVGT 토큰을 스테이킹하여 발행 및 상환 수수료를 포함한 프로토콜 수수료의 비례적인 지분을 얻을 수 있습니다. 프로토콜 수수료 공유 기능은 CVGT 토큰 생성 이벤트(TGE) 이후 활성화됩니다. 처음에는 재무부에 수수료가 발생하지 않습니다. 예를 들어, 1000개의 CVGT 토큰이 스테이킹되고 개인이 100개를 스테이킹하는 경우 프로토콜 수수료의 10%를 받게 됩니다. [8]

잘못된 내용이 있나요?