Subscribe to wiki

Share wiki

Bookmark

DefiEdge

We've just announced IQ AI.

DefiEdge

DefiEdge is a decentralized finance (DeFi) protocol that links liquidity providers with strategy managers to facilitate investments in UniswapV3 pools. The platform aims to provide broader access to advanced asset management services, enhancing user investment strategies through a decentralized approach.[1][2]

Overview

Founded in 2021, DefiEdge is a decentralized finance (DeFi) protocol that connects liquidity providers with strategy managers to facilitate investments in UniswapV3 pools. The permissionless protocol enables anyone to become a strategy manager through factory smart contracts, allowing users to invest and manage funds without restrictions.

Strategy managers aim to optimize user assets to enhance yields from UniswapV3, reducing the need for constant market monitoring. Funds are held in smart contracts, ensuring a non-custodial approach where managers can only rebalance positions to improve returns.

DefiEdge addresses high gas costs and impermanent loss risks on UniswapV3. By utilizing strategy pools, users can benefit from improved capital efficiency and price discovery without needing active management. The protocol's scalable layer supports collective management of positions to enhance returns.[1][2][3][4][5][6]

UniswapV3

UniSwapV3 marks a significant advancement in automated market makers (AMMs) by leveraging smart contracts to enhance liquidity provisioning and trading efficiency. It allows liquidity providers to allocate capital and earn returns through predefined algorithms, aiming to facilitate trades with minimal slippage and effective price discovery. UniSwapV3 introduces capital efficiency by enabling providers to specify price ranges and earn rewards on specific intervals defined by discrete ticks.

However, this approach carries risks such as impermanent loss if prices move beyond selected ranges, requiring active management of positions. While frequent rebalancing can result in high gas costs, DefiEdge proposes solutions by enabling providers to deploy assets into smart contracts for dynamic rebalancing, thus optimizing liquidity efficiency within the UniSwapV3 framework.[1][3]

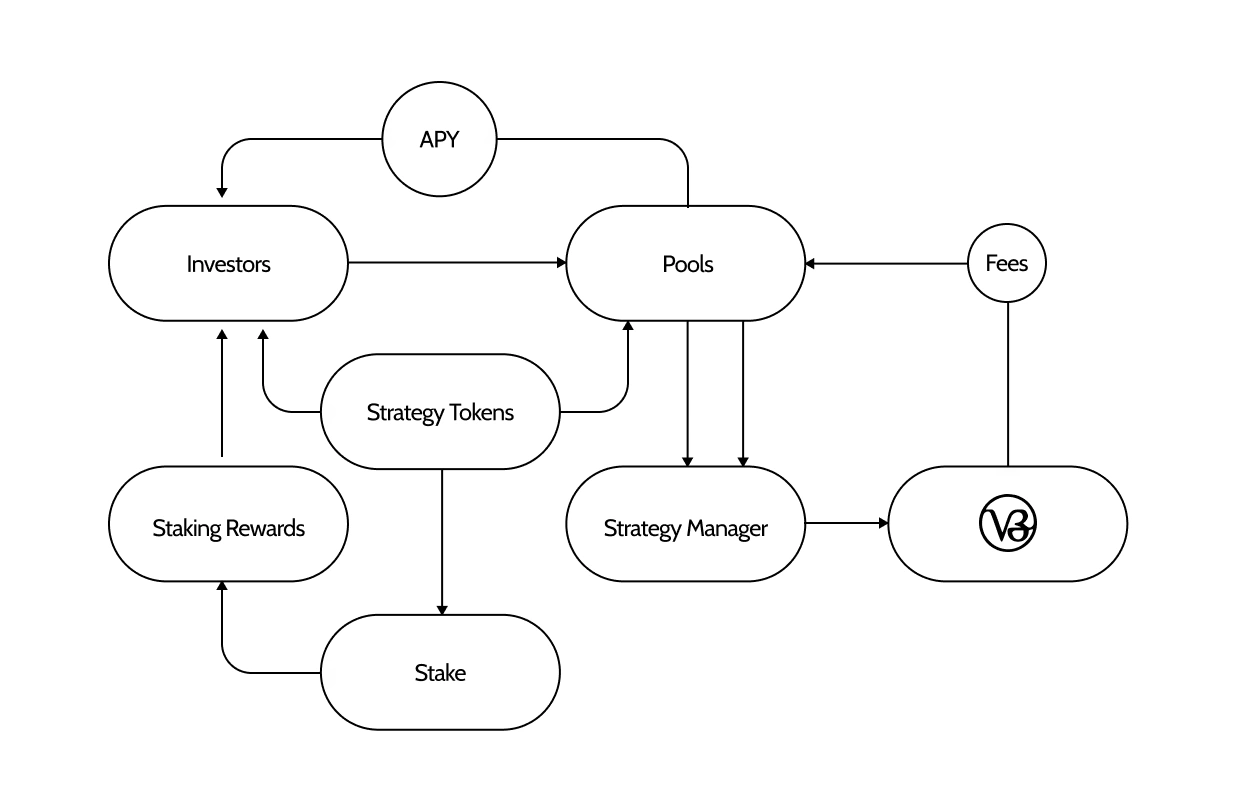

Architecture

Share Distribution

DefiEdge uses UniswapV3 and smart contracts for decentralized liquidity management between LPs and strategy managers. It aims to boost LPs' fee earnings through efficient management by strategy managers and explores options-like derivatives with UniswapV3 positions.

LPs set buy and sell prices based on their UniswapV3 position's geometric mean. Strategy managers execute profitable orders, beyond fee generation.

The protocol allows creating liquidity management contracts via the factory contract. LPs deposit assets for returns as strategy managers collectively optimize positions. Rebalancing on UniswapV3 is efficiently handled through DefiEdge's smart contracts, minimizing gas fees with batch processing. This scalable approach manages multiple positions within UniswapV3 pools.

Strategy managers on DefiEdge optimize user liquidity, adapting strategies to market dynamics for LPs' benefit. Protocol Shares (DEshares) reflect investor liquidity and returns, distributed based on invested amounts for fair allocation.[1][3]

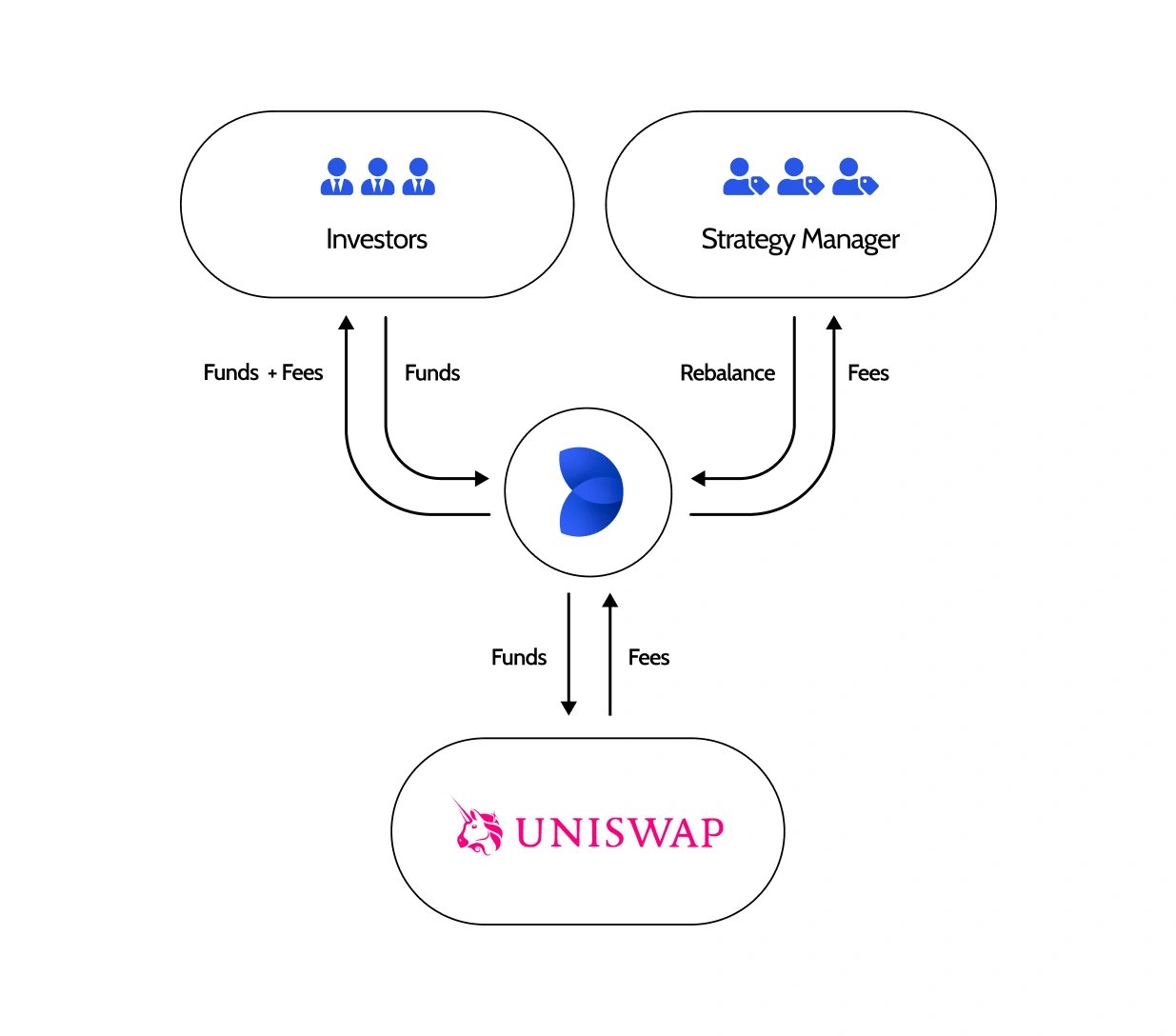

Strategy Manager

As strategy managers on DefiEdge, individuals aim to optimize investments in UniswapV3 pools by actively managing user assets to maximize yields. They predict optimal trading ranges and strategically deploy assets, facilitated through smart contracts accessible via the 'Create Strategy' button on the dashboard.

Managers are responsible for covering gas fees associated with rebalancing actions, temporarily removing liquidity and reinvesting accrued fees to potentially enhance returns. DefiEdge supports deploying liquidity across multiple ranges, adjusting based on market conditions and desired token ratios.

Managers also have the option to hold assets expected to appreciate, aiming to accumulate trading fees. For asset swaps, they utilize UniswapV3 pools or 1inch for optimized trades across exchanges, aiming to minimize slippage.[7][8][9][19]

Liquidity Provider

As a liquidity provider on DefiEdge, users can deposit assets into managed strategies that interact with UniswapV3 pools, designed to facilitate trading of volatile tokens efficiently. DE-Shares are allocated based on the deposited liquidity, initially valued at $100 (for illustration), adjusted by asset prices and fees accrued over time.

DE-Shares can be utilized as ERC20 tokens, potentially tradable on decentralized exchanges like Sushiswap or Uniswap. This feature enables liquidity providers to use their investments as collateral, facilitating liquidity mining and diversification within the platform. DefiEdge aims to provide a robust system for flexible and efficient liquidity management for its users.[10][11][12][18]

DefiEdge Participants

DefiEdge facilitates efficient asset deployment on UniswapV3 through managed strategies, allowing users to select strategies managed by experienced individuals from the platform's dashboard. DE-Shares are allocated proportionally based on deposited liquidity, functioning as ERC20 tokens tradable on decentralized exchanges. This setup enables liquidity providers to utilize shares as collateral for activities such as liquidity mining or diversification.

The platform integrates features like limit orders and automated rebalancing to optimize liquidity deployment across multiple ranges within UniswapV3 pools. DefiEdge aims to streamline the liquidity provision process compared to direct UniswapV3 participation, providing tools to enhance flexibility and potentially maximize yield for liquidity providers. [13][14][15]

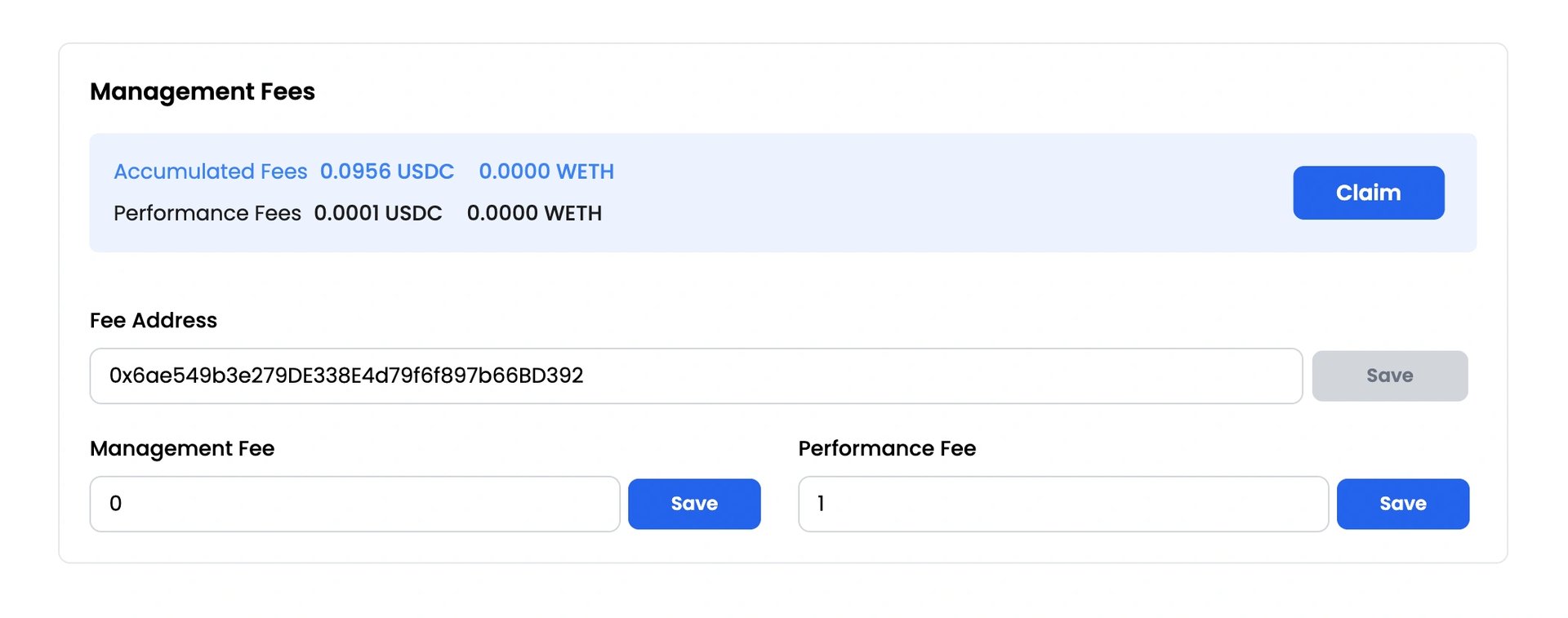

Fee Structure

DefiEdge employs a fee structure that includes liquidity management fees and performance fees. Liquidity management fees are levied by strategy managers when assets are deposited into a strategy, intended to cover gas costs related to UniswapV3 rebalancing. For example, a 10% fee means managers receive $10 for every $100 deposited, applied once per deposit.

Performance fees, also set by managers, represent a percentage of UniswapV3 fee earnings, typically capped at 20%. These fees compensate managers for optimizing strategies and can be adjusted as required.

Protocol fees, currently set to zero, are potential future additions through governance mechanisms. These fees would be calculated as a percentage of management and performance fees to support platform operations.

It is essential for prospective liquidity providers and strategy managers to carefully review these fees before engaging with DefiEdge to ensure they align with their investment strategies and goals.[3][17]

Products

Automated Liquidity Optimization (ALO)

DefiEdge's Automated Liquidity Optimization (ALO) presents a methodical approach for liquidity providers (LPs) operating within concentrated DEXs. ALO employs predefined price ranges, adjusting regularly based on historical data to uphold optimal liquidity positions. During periods of market volatility, ALO strategically shifts to lower-risk positions temporarily to mitigate potential losses, returning to standard operations when market conditions stabilize. ALO aims to automate liquidity management, thereby reducing the impact of impermanent loss and enabling LPs to optimize returns efficiently and autonomously.[16][20]

See something wrong?