INK Finance

Ink Finance is a scalable framework designed for collaborative finance, allowing organizations to establish efficient management structures and compliant on-chain financial operations with strong risk control and transparency. It supports a range of sectors, including influencer crowdfunding, real-world asset underwriting, DeFi liquidity pooling, and the transition from Web2 to Web3. [1]

Overview

Ink Finance seeks to transform DeFi by focusing on management competence and financial creditworthiness. It aims to help DAOs establish their on-chain reputation through transparent and effective financial operations tailored to their specific organizational needs at various stages. By utilizing blockchain's immutable features, Web3 organizations can demonstrate their capability in managing finances, thereby building their creditworthiness and that of their communities. This shift from cryptocurrency-based to credit-based DeFi could enhance the substance and value of crypto finance. Ink Finance is designed to support a wide range of decentralized organizations and traditional institutions, offering customizable on-chain tools to meet the needs of innovative and ambitious clients in the Web3 space. [2]

Modules

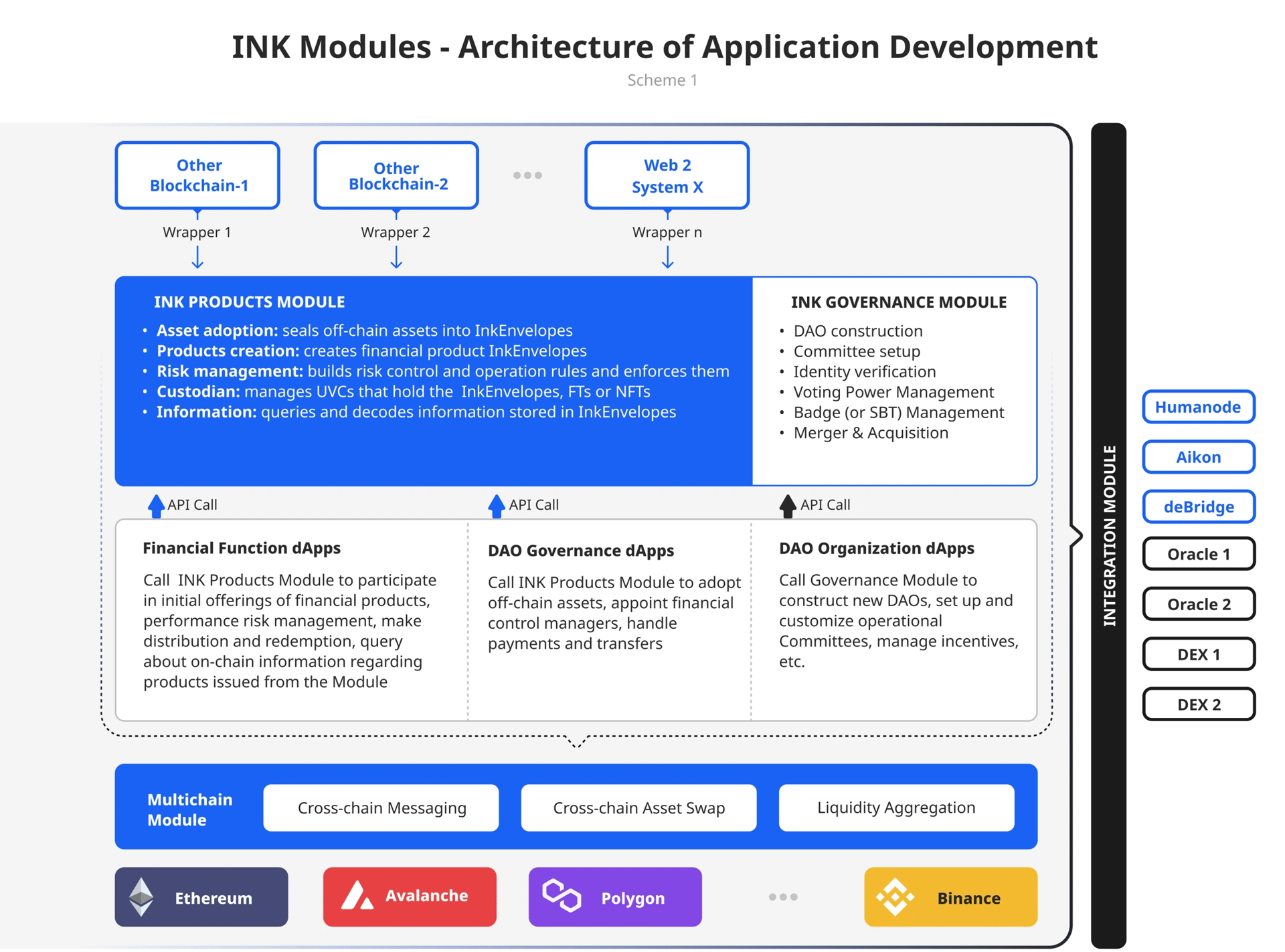

INK Modules are a set of code packages that support the development of Ink Finance applications, including the main web app created by the project team. The development framework comprises four key modules: INK Governance, INK Products, INK Multichain, and INK Integration. These modules form the INKSDK's foundation, enabling third-party dApps to be built within the Ink Finance ecosystem. [3][4]

Products

The INK Products Module provides code packages that support various fiscal and financial capabilities, including safe custody, product issuance, and risk management. It is designed to offer comprehensive, flexible, and user-friendly management tools. The module is built around two key components: the Unified Custodian Vault and InkEnvelope, which serve as the foundation for functionalities related to issuance, clearing, and risk management. [4][5]

Unified Custodian Vault

The Unified Custodian Vault (UCV) is a programmable multi-asset holding system designed to safeguard various assets with management rules. It allows DAOs to create multiple UCVs to separate assets or liabilities for different functions managed by other authorities. Transactions like DAO-to-DAO transfers and periodic or one-off payments are securely executed through contracts and multi-signature processes. UCV supports categorization, audit, and streamlined operations across treasury, investment, and funding activities. The system is managed by two constructs: UCVManager, which handles regular operations like payments, transfers, and audits, and UCVController, which oversees forced actions such as liquidation and repossession of collaterals. [6]

InkEnvelope

InkEnvelope is a wrapper consolidating heterogeneous assets from networks or systems secured by governance integrity. It simplifies bundling various assets and their related information into a single token, adding programmability while integrating seamlessly into DeFi applications. Beyond token minting, InkEnvelope handles critical asset-related details such as insurance, appraisals, and licensing. It can incorporate privacy-protected asset verification using ZKP-based systems, especially for assets from enterprise blockchains or Web2 platforms requiring access permissions. InkEnvelope supports fungible and non-fungible tokens and is compatible with mainstream wallets and DeFi tools. It can serve as treasury assets, collateral, or components of investment portfolios, offering uniformity and liquidity. The InkEnvelope is used in the INK Products Module for executing DAO asset adoption, creating new financial products backed by other InkEnveloped assets, distributing returns, and managing asset-related information transparently, advancing the shift toward credit-based DeFi and reducing reliance on generic utility tokens for fundraising. [7]

Governance

The INK Governance Module provides code packages that support a DAO’s organizational structure, decision-making processes, and operational execution. It aims to create a framework where these elements are coherently integrated, offering comprehensive, flexible, and user-friendly solutions. The module facilitates efficient governance and operational workflows within decentralized organizations. [4][8][9]

Hierarchical DAO Construction

Hierarchical DAO construction in Ink Finance allows for the intuitive setup of top-level and sub-DAOs within a large ecosystem. A DAO can be established as a meta-level entity with its governance tokens or as a sub-DAO using an existing governance token, where members stake into the meta DAO’s Staking Engine. Importantly, a "sub-DAO" is a technical, rather than a business, term, meaning no direct economic or administrative link is required between the governance token-issuing DAO and the sub-DAO. This decentralized approach allows users to utilize governance tokens independently within their communities. [10]

Ink Staking Engine

Ink Finance’s Staking Engine is the core economic driver of DAO governance, requiring staked positions in the DAO’s meta token to participate in governance. Managers and voters must stake tokens, which helps prevent Sybil attacks and rewards participation by offsetting gas costs. DAOs can also issue badges for governance, but these must be combined with meta tokens. The Termed Staking scheme allows DAOs to customize reward and penalty systems. When creating a DAO, the creator sets up the Staking Engine and submits reward tokens to the system. This process is managed through Ink’s no-code interface and includes configuring staking rewards, setting emission curves and lockup terms, and defining penalties for early withdrawal. [11][12]

Multichain

The INK Multichain Module provides code packages that enable a DAO to operate on its native blockchain while accessing financial liquidity across other blockchain networks. This module allows a DAO to maintain its operational competence and reputation, ensuring transparency and traceability in financial dealings. It facilitates the propagation of governance decisions to branch networks, similar to how a corporation manages its branch offices, allowing DAOs to establish cross-chain creditworthiness. [4][13]

The module supports various functionalities, including sending cross-chain messages to execute governance decisions, transferring raised funds back to the main Treasury or Investment UCV, accessing decentralized exchanges (DEXs) for automatic asset management, and aggregating liquidity data across multiple blockchains. It also creates an abstraction layer that simplifies interactions between Web3 protocols and Web2 infrastructure. The ultimate aim is to enable DAOs to manage assets across diverse systems, enhancing their operational capabilities and access to liquidity. [4][13]

Integration

The INK Integration Module consists of code packages designed to integrate with other decentralized protocols and Web2 infrastructures. It enables Ink Finance to operate with a layer of abstraction and decoupling. It emphasizes composability, allowing financially focused DAOs to concentrate on their core objectives without needing to manage integration complexities. [4][14]

To address the unpredictability of external programming interfaces, the module provides an abstraction layer for various external functionalities, ensuring that integration details do not burden Ink Finance applications. This abstraction is crucial for the long-term maintainability of the system, accommodating inevitable changes in external systems. The module covers privacy-protected identity verification, cross-chain messaging, oracles, decentralized exchanges (DEXs), storage, document signing, and Web2 infrastructures for off-chain custody. The INK Integration Module will continue to enhance and optimize these integrations to maintain a seamless user experience. [4][14]

QUILL

QUILL is the native token of the Ink Finance platform and serves as the governance token within the Ink Finance ecosystem, similar to how user DAOs utilize their meta tokens. It can also act as the default governance token for smaller DAOs that do not issue tokens. Unlike generic DAO tokens, QUILL is designed to enhance token holder value while functioning as a non-security utility, aligning with Ink Finance’s role as a blockchain-based SaaS platform. [15]

Tokenomics

QUILL has a total supply of 100M tokens and has the following allocation: [16]

- Advisors/Team: 20%

- Staking Emissions: 20%

- Ecosystem: 13%

- Seed & Anchor Round: 10%

- Strategic Round: 10%

- Community Incentives: 10%

- Insurance Fund: 10%

- Public Sale: 5%

- Exchange Liquidity: 2%

Funding

On August 20, 2021, Ink Finance completed its seed and anchor round, raising $1.5M. Republic Capital led the round, with participation from DHVC, Krypital Group, Axia8 Venture, BellaTech, GSR Markets, Legos Capital Group, LD Capital, RedlineDAO, LucidBlue, and Blofin. Republic Advisory Service also led the Board of Advisors, leveraging its ecosystem connections. [17]

Partnerships

- deBridge

- Salus

- Humanode

- Astra

- OKX Wallet

- Vayana

- Alterverse

- Bitlayer

- Magic Square

- Polytrade

- Sign Protocol

- Orbital7

- Paragen

- Phoenix

- AlphaNet

- Ordify

- Script Network

- Crypto Stoics

- Sugar Kingdom Odyssey

- Vent Finance

- HyperGPT