위키 구독하기

Share wiki

Bookmark

Maple Finance

0%

Maple Finance

Maple Finance는 허가된 대출 풀을 통해 디지털 자산 공간에서 기관 자본 배치를 용이하게 하는 탈중앙화 대출 플랫폼입니다. 2020년에 Sidney Powell과 Joe Flanagan에 의해 설립되었으며 2021년 5월에 출시되었습니다. [1] [6]

개요

Maple Finance는 전통 금융(TradFi)과 탈중앙화 금융(DeFi)를 연결하는 탈중앙화 신용 마켓플레이스로 운영됩니다. 이 프로토콜은 다른 DeFi 프로토콜에서 흔히 볼 수 있는 과도한 담보 대출 모델을 넘어 과소 담보 대출을 가능하게 함으로써 DeFi 생태계의 중요한 격차를 해소합니다. 이러한 접근 방식을 통해 기업은 과도한 담보를 묶어두지 않고도 운전 자본에 접근할 수 있어 기관 차입자에게 특히 매력적입니다. [1] [2]

주요 기능

Maple Finance에는 풀 위임 시스템과 스마트 계약 인프라가 포함되어 있습니다. 풀 위임자는 전문 신용 관리자 역할을 하며 차입자 실사, 풀 관리, 대출 조건 설정, 지속적인 모니터링 수행을 담당하고 풀 성공을 기반으로 성과 수수료를 받습니다. 스마트 계약 인프라는 대출 개시 및 서비스를 자동화하고, 블록체인에서 투명한 거래 기록을 보장하며, 프로그래밍 가능한 규정 준수 및 위험 매개변수와 다중 서명 보안 기능을 포함합니다.

Maple Finance는 또한 특정 대출 기준이 있는 허가된 대출 풀을 포함하여 기관 등급의 위험 평가 및 사용자 정의 가능한 대출 조건을 제공합니다. 이 플랫폼은 정기적인 차입자 모니터링, 채무 불이행 보호 메커니즘을 포함하는 다층적 위험 관리 프레임워크를 사용하며 풀 위임자가 게임에 참여하도록 요구합니다. [1] [2]

토큰노믹스

Maple 토큰($MPL)

Maple은 이더리움 및 솔라나 블록체인을 활용하는 기관 암호화폐 자본 네트워크로 기능합니다. 이 프로젝트는 이더리움의 ERC-20 및 ERC-2222 토큰 표준을 준수하는 유틸리티 및 거버넌스 토큰 역할을 하는 Maple 토큰(MPL)에 의해 주도됩니다. MPL 토큰은 거버넌스에 사용되어 보유자가 프로토콜 업그레이드 및 변경에 투표할 수 있도록 합니다. [1] [4]

할당

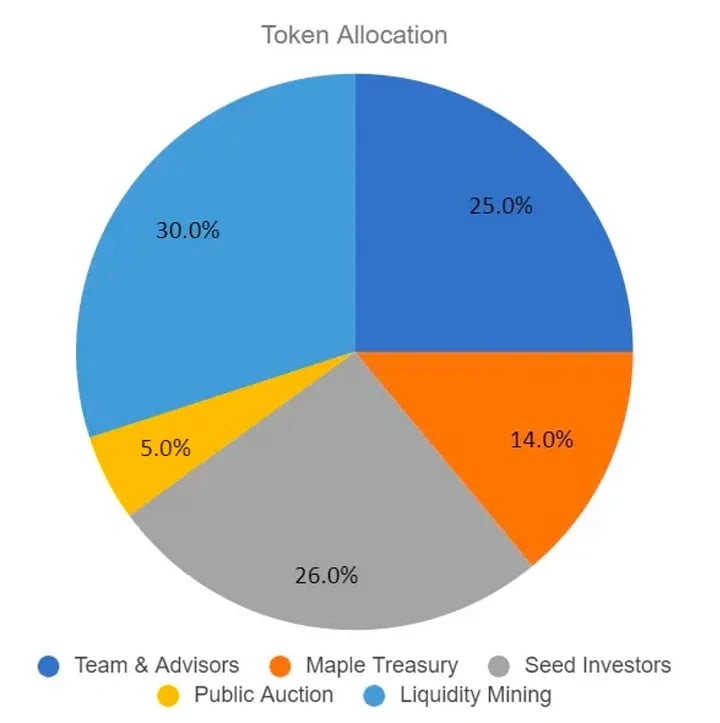

Maple의 총 공급량은 1,000만 MPL 토큰으로 제한되었으며 추가 토큰 생성 계획은 없습니다. 이 공급량 중 5%는 Balancer의 유동성 부트스트래핑 풀을 통해 배포되었습니다. 현재 783만 MPL 토큰이 유통되고 있으며 이는 총 공급량의 78.3%를 차지합니다. 토큰 생성 이벤트는 2021년 4월 28일에 열렸습니다. [2]

SYRUP 토큰노믹스

SYRUP 토큰노믹스는 Maple Finance 생태계 내에서 참여를 장려하고 이해 관계자의 이익을 일치시키도록 설계되었습니다. SYRUP 토큰은 거버넌스에 사용되어 보유자가 프로토콜 업그레이드 및 변경에 투표할 수 있도록 합니다. 또한 플랫폼 내에서 수수료 및 보상 분배에 중요한 역할을 하여 활성 참가자가 기여에 대해 보상을 받도록 합니다. [2]

MPL에서 SYRUP 토큰으로의 전환

MIP-010은 MPL 보유자가 1 MPL을 100 SYRUP으로 전환할 수 있도록 하는 SYRUP 토큰 출시를 제안합니다. 이 전환은 거버넌스 토큰을 새로운 커뮤니티 구성원이 더 쉽게 접근할 수 있도록 하는 것을 목표로 합니다. 이 제안에는 stSYRUP 보유자가 Maple 플랫폼에 적극적으로 참여할 수 있도록 하는 SYRUP 스테이킹 도입이 포함됩니다. 전환은 기존 보유자를 희석시키지 않고 SYRUP 토큰의 분배를 가속화할 것으로 예상됩니다. 기술적 전환에는 약 11억 5천만 개의 SYRUP 토큰을 발행하고 전환을 위해 Migrator 계약을 배포하는 것이 포함됩니다. MPL 보유자는 지정된 비율로 MPL을 SYRUP으로 교환하라는 메시지에 따라 Syrup 웹앱을 통해 토큰을 전환할 수 있습니다. [3] [5]

파트너십

Clearpool에서 개발한 실물 자산(RWA) 수익에 초점을 맞춘 블록체인인 Ozean은 기관이 DeFi 기반 수익 기회에 대한 접근성을 확대하기 위해 Maple Finance와 파트너십을 맺었습니다. 이 협력의 일환으로 Maple의 Syrup 프로토콜을 통해 발행된 수익 창출 스테이블코인인 SyrupUSDC가 Ozean의 사전 예치 캠페인과 Port로 알려진 첫 번째 거래소 거래 상품(ETP)에 통합됩니다. 이 이니셔티브는 Maple의 대출 인프라와 Ozean의 기관 온체인 볼트 프레임워크를 결합하여 다양하고 규정을 준수하는 수익 노출을 제공합니다. Ozean은 OP 스택을 기반으로 구축된 RWA 중심 레이어 2 네트워크로 운영되며 RWA 접근성을 간소화하고 규제에 부합하는 인프라를 통해 전통 금융과 DeFi를 연결하는 것을 목표로 합니다. [7] [8]

OAK Research는 Maple 프로토콜에 대한 지속적인 커버리지를 제공하기 위해 Maple Ambassador 프로그램에 합류했습니다. 이 협력을 통해 OAK Research는 Syrup을 포함하여 Maple 및 관련 플랫폼의 개발 및 성능에 초점을 맞춘 보고서, 분석 및 연구를 게시합니다. 이 이니셔티브는 투명성을 지원하고 더 넓은 DeFi 커뮤니티에 대한 프로토콜 진화에 대한 통찰력을 제공하는 것을 목표로 합니다. [9]

잘못된 내용이 있나요?