Subscribe to wiki

Share wiki

Bookmark

TDX

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

TDX

TDX is a wealth management platform that utilizes artificial intelligence to provide users with curated investment opportunities across Real World Assets (RWA), Decentralized Finance (DeFi), and Traditional Finance (TradeFi). The platform is designed to simplify investing by consolidating diverse financial products into a single interface. [1] [2]

Overview

Based in Dubai, TDX aims to bridge various financial ecosystems to make wealth creation more accessible. The platform's core is an AI-driven system that assesses risk to present personalized investment options. TDX offers a range of financial products, from tokenized U.S. Treasury Bills to high-yield DeFi protocols, catering to a global investor base with varying risk appetites. Users can invest using either fiat currency or cryptocurrency. The blockchains explicitly supported by the platform include Ethereum, Base, Oasis, and BNB Smart Chain (BSC). This multi-chain capability is fundamental to the function of its Yield Aggregator, which sources opportunities from different networks to optimize returns. [2] [3] [1]

TDX positions itself as a comprehensive ecosystem that includes not only investment products but also tools for project growth and community engagement. Its offerings are divided into several key areas: passive income generation through its yield aggregator, early-stage investment access via its Crowdfunding platform, and marketing support for new projects through its Social Boost service. The platform also emphasizes education, providing users with research reports, guides, and masterclasses to help them make informed financial decisions. This dual focus on providing both investment tools and educational resources is central to the project's goal of empowering users in the digital asset space. [2]

4-in-1 Platform

TDX operates as a multi-feature ecosystem integrating four primary components each designed to support different aspects of digital asset engagement.

Trade Signals

This feature provides users with curated cryptocurrency trading insights produced by TDX’s research team. It is intended to streamline decision-making by offering market data, performance reports, and trading options within a unified interface.

Social Boost

Social Boost facilitates user engagement through interactive campaigns across major social platforms. Participants can earn points or rewards by completing promotional tasks, while project owners gain a structured channel to increase visibility and community participation.

Decentralized Crowdfunding

TDX’s crowdfunding system offers a transparent mechanism for startups and blockchain projects to raise capital from a decentralized investor base. The platform incorporates a vetting process to evaluate projects for credibility and alignment with investor expectations, aiming to minimize risk and broaden access to early-stage opportunities.

Non-Custodial Management

The non-custodial model enables users to maintain control of their digital assets and private keys, reducing reliance on centralized intermediaries. This structure seeks to enhance both autonomy and security within the TDX ecosystem. [11]

Key Features

- Security and Trust Framework: TDX emphasizes user protection through a structured framework that includes Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures, non-custodial management, and advanced security protocols.

- Regulatory Compliance: The platform applies automated KYC and AML verification processes to facilitate smooth onboarding while maintaining user data integrity and promoting transparent transactions.

- User Empowerment: By allowing individuals to manage their own funds, TDX seeks to strengthen user confidence and foster a trust-based decentralized environment [11]

Use Cases

For Investors

- Passive Income Generation: The primary use case for investors is generating passive income through the Yield Aggregator. Users can deposit funds and allow the platform's AI to manage their portfolio across various yield-bearing assets.

- Portfolio Diversification: The platform enables investors to diversify their holdings across different asset classes (DeFi, RWA, TradeFi) and risk profiles from a single interface.

- Early-Stage Investing: Through the Crowdfunding platform, investors can gain access to private and seed-stage investment deals in new crypto projects, which are typically difficult for retail investors to access.

For Crypto Projects

- Capital Raising: The Crowdfunding platform provides a venue for new and emerging projects to raise capital from a community of engaged investors.

- Community Building and Marketing: The Social Boost tool allows projects to launch marketing campaigns that incentivize community engagement. This helps projects build a user base and increase their social media presence in a structured, gamified manner. [2]

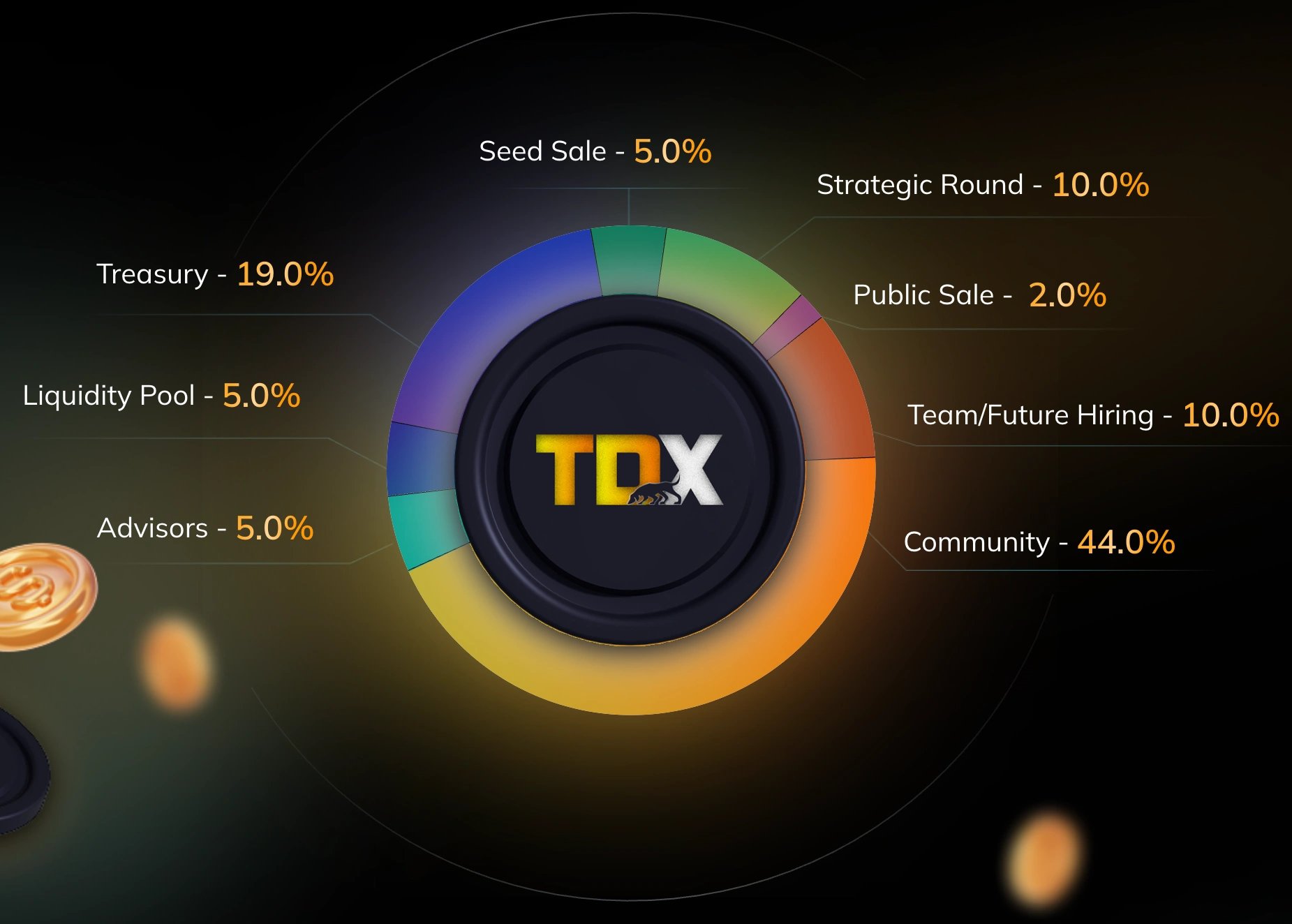

Tokenomics

TDX has a native utility token named TDX. It has a toatl supply of 1,000,000,000 token [2] [6]

Token Allocation

- Seed Sale: 5.00%

- Strategic Round: 10.00%

- Public Sale: 2.00%

- Team/ Future hiring: 10.00%

- Community: 44.00%

- Advisors: 5.00%

- Liquidity Pool: 5.00%

- Treasury: 19.00%

Project Leaders

TDX is led by a team with experience in blockchain development, investment, and technology management:

- Constantin Kogan: Co-founder of BullPerks and GamesPad, with previous experience managing over $1.5 billion in assets at Wave Financial and contributing to the incubation of more than 70 blockchain projects.

- Rishabh Gupta: A specialist in token economics who oversaw the growth of over 100 startups at TDeFi, including several that achieved valuations exceeding $1 billion, with a focus on Web3 strategy and operational development.

- Jyoti Prakash: A technology executive with over a decade of experience leading engineering teams and launching more than 15 large-scale projects, contributing to operational efficiency and revenue growth. [2]

Partnerships and Ecosystem

TDX has established several partnerships to integrate external products and is part of a larger group of affiliated companies.

Product and Integration Partners

- Midas

- Maple Finance

- Docen

- Kycaid

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)